Africa Diesel Generator Market

Source: The Report Cube

Understand The Key Trends Shaping This Market

Download Free SampleAfrica Diesel Generator Market Insights & Analysis

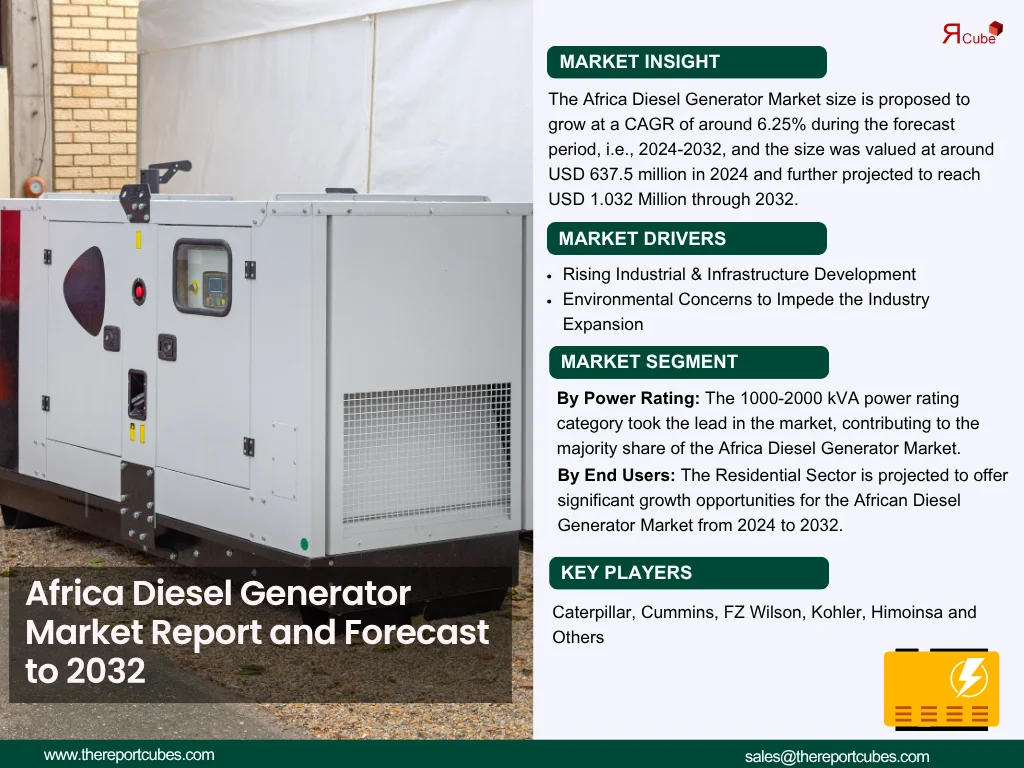

The Africa Diesel Generator Market size is proposed to grow at a CAGR of around 6.25% during the forecast period, i.e., 2024-2032, and the size was valued at around USD 637.5 million in 2024 and further projected to reach USD 1.032 Million through 2032. The market growth is primarily attributed to increased demand for continuous and reliable power supply, especially in the industrial sector. This demand has been on the rise owing to the high reliability of small-capacity generators to sustain regular electricity needs, which is not provided by the utility grids.

Various significant infrastructure and housing projects are underway in the regional countries, such as the Mesob Tower, with a budget of USD 681 million in Ethiopia, the Sangomar Field Development Phase 1 in Senegal, the Banana Port in the Congo, and many others contributing to structure growth and growing diesel generator usage. Leading vendors like Mitsubishi Heavy Industries Ltd. and Caterpillar offer diesel generators in this power rating range, capable of providing emergency and continuous power supply during unexpected outages.

Diesel generators find widespread usage in the tourism or hospitality sector, primarily in hotels and resorts. These generators serve as backup power sources for short or prolonged power outages. Additionally, diesel generators play a crucial role in providing continuous power in tourist destinations with limited access to grid power. Hotel owners often choose diesel generators due to their cost-effectiveness and easy availability of diesel fuel. Also, several industries require sources of electricity, becoming a large base for diesel generators.

Furthermore, the augmented demand for medical equipment, including ventilators and essential medicines, has driven greater demand from the pharmaceutical and medical equipment manufacturing industries, further contributing to the growth of the Africa Diesel Generator Market in the coming years.

Africa Diesel Generator Market Dynamics

-

Rising Industrial & Infrastructure Development

The rise in infrastructure projects & thriving industrial sector are expected to be significant drivers of the increasing demand for diesel generators in Africa. Diesel generators, being one of the crucial aspects for supplying uninterrupted power supply, help ensure uninterrupted operations in numerous industries, such as manufacturing, mining, agriculture, and telecommunications, where a continuous supply of power is essential.

Furthermore, the growing number of infrastructure development projects, such as the construction or building of roads, bridges, airports, and housing, is a prominent trend across the continent. Consequently, as these infrastructure projects continue to expand, the demand for diesel generators is estimated to grow substantially, further driving the growth of the Africa Diesel Generator Market.

-

Environmental Concerns to Impede the Industry Expansion

Growing environmental awareness & strict emissions regulations are factors of concern hindering the Africa Diesel Generator Market. Diesel generators are recognized for their emissions of several harmful gases like nitrogen oxide, hydrocarbons, and carbon monoxide, and the imposition of more rigorous environmental standards may encourage their utilization, necessitating further investments in emission control technologies, which could become one of the most prominent eco-friendly alternative solutions in the market. Also, the introduction of various eco-friendly alternatives replacing the usage of diesel generators by providing similar facilities is contributing to limiting their demand and negatively affecting the Africa Diesel Generators Market growth in the following years.

Africa Diesel Generator Market Segment-wise Analysis

By Power Rating:

- Up to 30 kVA

- 30.1 to 60 kVA

- 60.1 to 150 kVA

- 150.1 to 300 kVA

- 300.1 to 500 kVA

- 500.1 to 1,000 kVA

- Above 1,000 kVA

The 1000-2000 kVA power rating category took the lead in the market, contributing to the majority share of the Africa Diesel Generator Market. This range of diesel generator sets is predominantly utilized by data centers & mining, industrial, and construction sectors. Prominent manufacturers like Cummins, Kohler, Mitsubishi Heavy Industries, Ltd., and Caterpillar offer diesel generators within this power range, skilled in supplying uninterrupted power supply for extended durations.

Moreover, end-users across African countries such as Ethiopia, Ghana, Uganda, and Mali opt for diesel generators to ensure operational continuity in the face of occasional power outages. Furthermore, the banking sector has a critical operating process that demands constant baseload power. Hence, there is a higher need for deploying power backup solutions, like diesel generators, thus elevating the market expansion.

By End Users:

- Residential

- Mining & Quarrying

- Industrial & Construction

- Oil & Gas

- Telecom

The Residential Sector is projected to offer significant growth opportunities for the African Diesel Generator Market from 2024 to 2032. This progress can be attributed to the rapid economic development in numerous countries, resulting in increased adoption of household appliances in the residential sector and a growing requirement for diesel generators to ensure a consistent and stable energy supply.

Additionally, the heightened government emphasis on smart city initiatives, fostering the adoption of energy-efficient solutions, represents another factor boosting the demand for diesel generators as a primary power generation source, thereby propelling the market through 2032.

Regional Projection of the Africa Diesel Generator Industry

The Africa Diesel Generator Market is geographically diversified, covering:

- Nigeria

- Algeria

- Kenya

- South Africa

- Tanzania

- Ethiopia

- Sudan

- Moambique

- Uganda

- Rest of Africa

South Africa has dominated the Diesel Generator Market in recent years, primarily driven by substantial government investments and favorable regulations. The nation is observed to have a highly progressing economy across the region, owing to the presence of advanced economic infrastructure. The establishment of numerous international corporations and start-ups in the country are some of the factors elevating the South Africa Diesel Generators Market. Consequently, there is a growing demand for diesel generators to meet the rising electrical needs of these organizations for their business operations. This, in turn, is contributing to advancing the growth graph of the Diesel Generators Market in Africa.

What Does Our Africa Diesel Generator Market Research Study Entail?

- The Africa Diesel Generator Market Research Report highlights the forecast growth rate or CAGR by anticipating the market size & share.

- The market analysis puts light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The Africa Diesel Generator Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Import Export Statistics

- List of Major Dealers and Distributors, By Country

- Nigeria

- Algeria

- Kenya

- South Africa

- Tanzania

- Ethiopia

- Sudan

- Mozambique

- Uganda

- Rest of Africa

- Policy and Regulations, By Country

- Nigeria

- Algeria

- Kenya

- South Africa

- Tanzania

- Ethiopia

- Sudan

- Mozambique

- Uganda

- Rest of Africa

- Africa Diesel Generators Market Overview (2020-2032)

- Market Size, By Value (in USD Millions)

- Market Size, By Volume (Units Sold)

- Market Share, By KVA Rating

- Up to 30 kVA

- 30.1 to 60 kVA

- 60.1 to 150 kVA

- 150.1 to 300 kVA

- 300.1 to 500 kVA

- 500.1 to 1,000 kVA

- Above 1,000 kVA

- Market Share, By End User

- Residential

- Mining & Quarrying

- Industrial & Construction

- Oil & Gas

- Telecom

- Others

- Market Share, By Type

- Peak Shaving

- Stand By

- Prime Power

- Market Share, By Country

- Nigeria

- Algeria

- Kenya

- South Africa

- Tanzania

- Ethiopia

- Sudan

- Mozambique

- Uganda

- Rest of Africa

- Market Share, By Company

- Competition Characteristics

- Revenue Shares & Analysis

- Nigeria Diesel Generator Market Overview (2020-2032)

- Market Size (in USD Millions)

- Market Size, in Volume (Units Sold)

- Market Share, By KVA Rating

- Market Share, By End User

- Market Share, By Type

- Algeria Diesel Generator Market Overview (2020-2032)

- Market Size (in USD Millions)

- Market Size, in Volume (Units Sold)

- Market Share, By KVA Rating

- Market Share, By End User

- Market Share, By Type

- Kenya Diesel Generator Market Overview (2020-2032)

- Market Size (in USD Millions)

- Market Size, in Volume (Units Sold)

- Market Share, By KVA Rating

- Market Share, By End User

- Market Share, By Type

- South Africa Diesel Generator Market Overview (2020-2032)

- Market Size (in USD Millions)

- Market Size, in Volume (Units Sold)

- Market Share, By KVA Rating

- Market Share, By End User

- Market Share, By Type

- Tanzania Diesel Generator Market Overview (2020-2032)

- Market Size (in USD Millions)

- Market Size, in Volume (Units Sold)

- Market Share, By KVA Rating

- Market Share, By End User

- Market Share, By Type

- Ethiopia Diesel Generator Market Overview (2020-2032)

- Market Size (in USD Millions)

- Market Size, in Volume (Units Sold)

- Market Share, By KVA Rating

- Market Share, By End User

- Market Share, By Type

- Sudan Diesel Generator Market Overview (2020-2032)

- Market Size (in USD Millions)

- Market Size, in Volume (Units Sold)

- Market Share, By KVA Rating

- Market Share, By End User

- Market Share, By Type

- Mozambique Diesel Generator Market Overview (2020-2032)

- Market Size (in USD Millions)

- Market Size, in Volume (Units Sold)

- Market Share, By KVA Rating

- Market Share, By End User

- Market Share, By Type

- Uganda Diesel Generator Market Overview (2020-2032)

- Market Size (in USD Millions)

- Market Size, in Volume (Units Sold)

- Market Share, By KVA Rating

- Market Share, By End User

- Market Share, By Type

- Rest of Africa Diesel Generator Market Overview (2020-2032)

- Market Size (in USD Millions)

- Market Size, in Volume (Units Sold)

- Market Share, By KVA Rating

- Market Share, By End User

- Market Share, By Type

- Competitive Outlook (Company Profiles – Partial List)

- Caterpillar

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- Cummins

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- FZ Wilson

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- Kohler

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- Himoinsa

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- Atlas Copco

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- Others

- Caterpillar

- Contact Us & Disclaimer

List of Figure

-

Figure 1: Market Segmentation Framework

-

Figure 2: Research Methodology Flowchart

-

Figure 3: Distribution of Primary Interviews (By Designation, Region, and Company Type)

-

Figure 4: Africa Diesel Generators Market Size, By Value (USD Million), 2020–2032

-

Figure 5: Africa Diesel Generators Market Size, By Volume (Units Sold), 2020–2032

-

Figure 6: Africa Diesel Generators Market Share, By KVA Rating (%)

-

Figure 7: Africa Diesel Generators Market Share, By End User (%)

-

Figure 8: Africa Diesel Generators Market Share, By Type (%)

-

Figure 9: Africa Diesel Generators Market Share, By Country (%)

-

Figure 10: Africa Diesel Generators Market Share, By Company (%)

-

Figure 11: Competitive Landscape – Revenue Share of Major Companies (%)

-

Figure 12: Nigeria Diesel Generators Market Size, By Value (USD Million), 2020–2032

-

Figure 13: Nigeria Diesel Generators Market Size, By Volume (Units Sold), 2020–2032

-

Figure 14: Nigeria Market Share, By KVA Rating (%)

-

Figure 15: Nigeria Market Share, By End User (%)

-

Figure 16: Nigeria Market Share, By Type (%)

-

Figure 17–84: [Repeat similar structure for each country – Algeria, Kenya, South Africa, Tanzania, Ethiopia, Sudan, Mozambique, Uganda, Rest of Africa]

-

Market Size by Value (USD Million)

-

Market Size by Volume (Units Sold)

-

Market Share by KVA Rating

-

Market Share by End User

-

Market Share by Type

(Each country has 5 figures × 9 countries = 45 figures, numbered sequentially)

-

Figure 85: Import and Export Statistics of Diesel Generators in Africa

-

Figure 86: List of Major Dealers and Distributors, by Country (Table/Map Format)

-

Figure 87: Regulatory Landscape, by Country – Summary of Key Policies

-

Figure 88: Strategic Alliances and Partnerships of Key Players

-

Figure 89: Recent Developments in the Diesel Generator Market

-

Figure 90: Company Positioning Matrix (Caterpillar, Cummins, etc.)

List of Table

-

Table 1: Market Segmentation – By KVA Rating, End User, Type, and Country

-

Table 2: Study Variables and Definitions

-

Table 3: List of Secondary Data Sources

-

Table 4: Companies Interviewed for Primary Research

-

Table 5: Primary Interview Respondent Breakdown (By Role, Geography, and Company Type)

-

Table 6: Key Drivers Impacting the Diesel Generators Market in Africa

-

Table 7: Major Challenges in the Africa Diesel Generator Market

-

Table 8: Opportunity Assessment Matrix – Market Attractiveness by Region & Segment

-

Table 9: Recent Trends and Developments in the Africa Diesel Generators Market

-

Table 10: Import Statistics – Africa Diesel Generators (by Country, Value & Volume)

-

Table 11: Export Statistics – Africa Diesel Generators (by Country, Value & Volume)

-

Table 12: Major Dealers and Distributors – Nigeria

-

Table 13: Major Dealers and Distributors – Algeria

-

Table 14: Major Dealers and Distributors – Kenya

-

Table 15: Major Dealers and Distributors – South Africa

-

Table 16: Major Dealers and Distributors – Tanzania

-

Table 17: Major Dealers and Distributors – Ethiopia

-

Table 18: Major Dealers and Distributors – Sudan

-

Table 19: Major Dealers and Distributors – Mozambique

-

Table 20: Major Dealers and Distributors – Uganda

-

Table 21: Major Dealers and Distributors – Rest of Africa

-

Table 22: Key Policy and Regulatory Overview – Nigeria

-

Table 23: Key Policy and Regulatory Overview – Algeria

-

Table 24: Key Policy and Regulatory Overview – Kenya

-

Table 25: Key Policy and Regulatory Overview – South Africa

-

Table 26: Key Policy and Regulatory Overview – Tanzania

-

Table 27: Key Policy and Regulatory Overview – Ethiopia

-

Table 28: Key Policy and Regulatory Overview – Sudan

-

Table 29: Key Policy and Regulatory Overview – Mozambique

-

Table 30: Key Policy and Regulatory Overview – Uganda

-

Table 31: Key Policy and Regulatory Overview – Rest of Africa

-

Table 32: Africa Diesel Generators Market Size, By Value (USD Million), 2020–2032

-

Table 33: Africa Diesel Generators Market Size, By Volume (Units Sold), 2020–2032

-

Table 34: Africa Market Share, By KVA Rating (%)

-

Table 35: Africa Market Share, By End User (%)

-

Table 36: Africa Market Share, By Type (%)

-

Table 37: Africa Market Share, By Country (%)

-

Table 38: Market Share of Leading Companies in Africa (%)

-

Table 39–129: Country-wise Market Data Tables (for Nigeria, Algeria, Kenya, South Africa, Tanzania, Ethiopia, Sudan, Mozambique, Uganda, Rest of Africa)

-

Market Size by Value (USD Million), 2020–2032

-

Market Size by Volume (Units Sold), 2020–2032

-

Market Share by KVA Rating (%)

-

Market Share by End User (%)

-

Market Share by Type (%)

→ 9 countries × 5 tables each = 45 tables

-

Table 130: Company Overview – Caterpillar

-

Table 131: Business Segments – Caterpillar

-

Table 132: Strategic Partnerships – Caterpillar

-

Table 133: Recent Developments – Caterpillar

-

Table 134–149: Similar tables for Cummins, FZ Wilson, Kohler, Himoinsa, Atlas Copco, and Others

→ (Each with 4 tables × 6 companies = 24 tables)

Top Key Players & Market Share Outlook

- Caterpillar

- Cummins

- FZ Wilson

- Kohler

- Himoinsa

- Atlas Copco

Frequently Asked Questions