Understand The Key Trends Shaping This Market

Download Free SampleAfrica IVD Market Overview: Market Size & Forecast (2026–2034)

What is the anticipated CAGR & size of the Africa IVD Market?

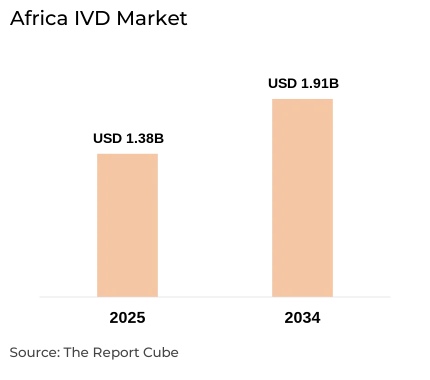

The Africa IVD Market is anticipated to register a CAGR of around 3.7% during the forecast period, 2026-34. Additionally, the market size was valued at nearly USD 1.38 billion in 2025 and is projected to reach almost USD 1.91 billion by 2034.

Market Analysis & Insights

The Africa IVD (In-Vitro Diagnostics) Market is presumed to expand tremendously, compelled largely by an increasing demand for infectious diseases testing, specifically for HIV & malaria diagnostics, enhancements in healthcare infrastructure, and surging acceptance of POCT (point-of-care testing). Also, recent years have observed substantial innovation & advancements in molecular diagnostics & immunoassay platforms, with key investments in new diagnostic laboratories & the distribution of IVD reagents & kits across Sub-Saharan Africa and North Africa.

Furthermore, the influence of the COVID-19 pandemic augmented molecular & POCT acceptance, while large-scale government initiatives across Nigeria & South Africa promoted guideline and admittance to affordable healthcare & medical device rules improvements. To improve sample access & clinical chemistry services, numerous leading companies in the Africa IVD Market, such as Abbott, Roche, and bioMérieux, have launched innovative products & established public-private partnerships. Further, instances include the range of digital telemedicine, which is very supportive in rural areas, and lab networks for decentralized testing.

Additionally, in order to enhance the African industry for infectious disease diagnostics & manage booming healthcare costs, distribution networks are developing via associations with regional providers. Besides, efforts to enhance regulatory harmonization & local assembly of IVD components, together with government-subsidized screening campaigns & the innovation of diagnostic laboratories, continue to be substantial. Also, the IVD Industry in Sub-Saharan Africa is foreseen to expand swiftly in the projected years owing to new developments, regional associations, and elevated investment in the Clinical Chemistry & IVD Reagents and Kits Market in Africa.

What is the Impact of AI in the Africa IVD Market?

The embracing of AI is altering the IVD business in Africa by enabling real-time disease surveillance & remote diagnosis, specifically in molecular diagnostics & infectious diseases. Also, POCT & the size of the in-vitro diagnostics market are clearly impacted by a number of advancements that surges diagnostic accuracy & facilitate the expansion of telemedicine & decentralized healthcare throughout Africa.

A few projects undertaken by companies in terms of AI, that benefits Africa IVD Market are:

- Cepheid's GeneXpert (2024) employed AI-driven interpretation for COVID-19 & TB,

- Abbott's m-PIMA platform (2025) utilized AI-integrated POCT to support HIV testing.

Africa IVD Market Dynamics

What driving factor acts as a positive influencer for the Africa IVD Market?

- Pervasive Government Screening Initiatives: The application of national screening programs for infectious diseases such as HIV & tuberculosis is a major positive driver in the Africa IVD Market. Also, the demand for sophisticated molecular diagnostics & immunoassay solutions is instigated by the fact that governments in Nigeria, South Africa, and Kenya devote a sizeable share of their healthcare budget to free or heavily discounted HIV testing & malaria diagnostics. Further, in addition to speeding up early diagnosis, these intensive public health initiatives enhance the size of the IVD Market in Africa as a whole & support diagnostic labs & point-of-care diagnostics.

What are the challenges that affect the Africa IVD Market?

- Intricate Regulatory Environment: A primary challenge for the Africa IVD Industry comes from an emerging & often inconsistent medical device regulation & local regulatory landscape. Moreover, fluctuating approval processes, narrow harmonization, and lack of regulatory clarity, specifically in the import of IVD Reagents & Kits Market in the country, delay new technology launches & hamper the entry of global market players in Africa IVD Market. Thus, this hampers standardization in diagnostic laboratories & could limit Sub-Saharan Africa IVD sector expansion, specifically in less developed markets.

How are the future opportunities transforming the market during 2026-34?

- Digital Health & Telemedicine Incorporation: Increasing investments in telemedicine & digital health solutions are opening up ground-breaking opportunities for the expansion of the Africa In-Vitro Diagnostics Market. Also, access is being elevated in rural areas via the amalgamation of POCT & molecular diagnostics with cloud & mobile health platforms. Furthermore, instances include app-based test interpretation for malaria diagnostics & distributed diagnostics for COVID-19 influence IVD Africa, which expand market reach, while enhancing disease surveillance & healthcare infrastructure.

What market trends are affecting the Africa IVD Market Outlook?

- Decentralization of Diagnostic Testing: An evolving trend across the Africa IVD Market is the transition towards decentralized testing assisted by POCT & mobile clinics, influenced by increasing demand during & after the COVID-19 impact. Also, this enables quicker results & access in rural areas, growing adoption of immunoassay, clinical chemistry, and other diagnostic platforms. Further, it pushes Sub-Saharan Africa IVD sector expansion, specifically where healthcare infrastructure is limited & traditional diagnostic laboratories are meagre.

How is the Africa IVD Market Defined as per Segments?

The Africa IVD Market Research Reports provide detailed market data & insights in accordance with market segmentation. Some of the segments are:

- Technology: Immunoassay/Immunochemistry, Molecular Diagnostics, Point-of-Care Testing, Whole Blood Glucose Monitoring, Clinical Chemistry, Microbiology, Hematology, Coagulation & Hemostasis, Others

- Product/Offering: Reagents & Kits, Instruments, Software & Services

By Technology:

The Immunoassay/Immunochemistry technology remains the most noticeable segment, seizing nearly 30% of the Africa IVD Market share.

The supremacy is reflected owing to the high acceptance for infectious diseases, malaria diagnostics, and HIV testing, supported by reasonable reagents & prevalent availability, even in decentralized settings. Also, this emphasis is essential for IVD industry & enhancing diagnostic reach in resource-constrained environments.

By Product/Offering:

The Reagents & Kits segment governs the Africa IVD Market, capturing about 60% of the overall market share.

The segment’s prevalence is owing to their recurring demand & vital utilization in all forms of clinical chemistry, immunoassay, and molecular diagnostics applications point-of-care, diagnostic laboratories, and field health campaigns. Also, this is anticipated to continue owing to ongoing public health initiatives & frequent usage in infectious Disease Diagnostics Market in Africa.

Africa IVD Industry: Country Insights

The Africa IVD Market is geographically diversified, covering:

- South Africa

- Egypt

- Nigeria

- Kenya

- Morocco

- Algeria

- Rest of Africa

The South Africa IVD Market is one of the leading national market, generating around 32% of the market share by 2025.

Strong government HIV testing programs, progressive diagnostic labs, and early adoption of POCT & digital health technologies are all credited with its dominance. Also, this country's refined healthcare system & medical device laws enhances IVD Market trends for Africa, enabling leading companies to launch innovations more quickly than in other Sub-Saharan & North African nations.

Africa IVD Market: What Recent Innovations Are Affecting the Industry?

- 2025: Abbott Laboratories introduced a rapid point-of-care HIV testing kit with integrated digital result reporting for remote clinics, assisting to expand access to HIV testing & supporting Africa In-Vitro Diagnostics Market size & POCT capacity.

- 2025: bioMérieux SA declared a next-generation molecular diagnostics platform for tuberculosis & malaria diagnostics, such as AI-powered analytics for rural diagnostic laboratories, responding to infectious diseases and Sub-Saharan Africa IVD sector growth needs.

What are the Key Highlights of the Africa IVD Market (2026–34)?

- The Africa IVD Market is foreseen to record a CAGR of about 3.7% during 2026-34 and attain a market value of around USD 1.91 billion by 2034.

- Immunoassay/Immunochemistry dominates technology, capturing nearly30% of Africa In-Vitro Diagnostics Market share.

- The Reagents & kits segment leads product offerings, accounting over 60% of market value across the region.

- Infectious diseases, is considered to be one of the prominent application, commanding around 50% market.

- Hospitals & clinics represent the biggest end-user segment, with approximately 55% market share.

- The South Africa IVD Market governs geographically, accountable for roughly 32% market share in 2025.

- AI, molecular diagnostics, and POCT instigate innovation & rural healthcare infrastructure upgrades.

How does the Future Outlook of the Africa IVD Market (2034) Appear?

- Sustained Growth: The Africa In-Vitro Diagnostics Market size is envisioned to be recorded as nearly USD 1.91 billion by 2034, and attain about 3.7% CAGR during 2026-34, further maintain steady market growth.

- Technological Upgrade: Advancements in molecular diagnostics, immunoassay, and AI-enabled POCT would enhance diagnostic accuracy, expand rural coverage, and increase disease surveillance, supported by emerging medical device regulation & investment in healthcare sector.

- Future Opportunities: The IVD reagents & kits market in Africa is predicted to expand further as public-private partnerships increase. Also, access & supply chain resilience are enhanced by assimilating digital platforms, telemedicine, and local reagent manufacture.

Through the projected years, the Africa IVD Market expansion & advancement would be impelled by AI, digital health, and regulatory evolution, supporting long-term growth across immunoassay, molecular diagnostics, clinical chemistry, and infectious disease diagnostics in the African market.

What Does Our Africa IVD Market Research Study Entail?

- The Africa IVD Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis & market scope sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The Africa IVD Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the Study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Breakdown of Secondary Sources

- Primary Data Points

- Breakdown of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- Africa Generator Sets Market Overview (2020–2034)

- Market Size, By Value (USD Billion)

- Market Share, By Technology

- Immunoassay/Immunochemistry

- Molecular Diagnostics

- Point-of-Care Testing

- Whole Blood Glucose Monitoring

- Clinical Chemistry

- Microbiology

- Hematology

- Coagulation & Hemostasis

- Others

- Market Share, By Product/Offering

- Reagents & Kits

- Instruments

- Software & Services

- Market Share, By Application

- Infectious Diseases

- Diabetes

- Oncology

- Cardiology

- Nephrology

- Autoimmune Diseases

- Other

- Market Share, By End User

- Diagnostic Laboratories

- Hospitals & Clinics

- Home Healthcare

- Other

- Market Share, By Country

- South Africa

- Egypt

- Nigeria

- Kenya

- Morocco

- Algeria

- Rest of Africa

- Market Share, By Company

- Revenue Shares

- Competition Characteristics

- Segment-wise / Industry-wise Market Overview (Forecast 2026–2034)

- By Technology Market Overview (2026–2034)

- By Product/Offering Market Overview (2026–2034)

- By Application Market Overview (2026–2034)

- By End User Market Overview (2026–2034)

- Forecast Year Tables (2026–2034)

- Competitive Outlook (Company Profiles)

- Abbott Laboratories

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Becton, Dickinson and Company

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- bioMérieux SA

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Danaher Corporation

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- F. Hoffmann-La Roche Ltd

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- QIAGEN N.V.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Siemens Healthineers AG

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Thermo Fisher Scientific Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Others

- Abbott Laboratories

- Contact Us & Disclaimer

List of Figure

Figure 1: Research Methodology Framework

Figure 2: Breakdown of Secondary Sources

Figure 3: Breakdown of Primary Interviews by Respondent Type

Figure 4: Africa Generator Sets Market Value (USD Billion)

Figure 5: Africa Generator Sets Market Share, By Technology

Figure 6: Africa Generator Sets Market Share, By Product/Offering

Figure 7: Africa Generator Sets Market Share, By Application

Figure 8: Africa Generator Sets Market Share, By End User

Figure 9: Africa Generator Sets Market Share, By Country

Figure 10: Market Share of Key Companies

Figure 11: Competition Characteristics – Africa Generator Sets Market

Figure 12: Market Forecast by Technology, 2026–2034 (USD Billion)

Figure 13: Market Forecast by Product/Offering, 2026–2034 (USD Billion)

Figure 14: Market Forecast by Application, 2026–2034 (USD Billion)

Figure 15: Market Forecast by End User, 2026–2034 (USD Billion)

Figure 16: Country-Wise Forecast (Top 5 Markets), 2026–2034 (USD Billion)

Figure 17: Company Revenue Comparison of Major Players

Figure 18: Key Strategic Partnerships and Alliances

Figure 19: Recent Product Launches and Innovations

Figure 20: Competitive Landscape Matrix – Market Positioning of Leading Players

List of Table

Table 1: Objective and Scope of the Study

Table 2: Product Definition and Classification

Table 3: Market Segmentation Overview

Table 4: Key Study Variables and Parameters

Table 5: Sources of Secondary Data

Table 6: Breakdown of Primary Interviews by Company Type and Region

Table 7: Summary of Market Drivers

Table 8: Summary of Market Challenges

Table 9: Key Opportunities Identified in the Africa Generator Sets Market

Table 10: Recent Trends and Developments (2020–2024)

Table 11: Regulatory Policies Impacting the Generator Sets Market in Africa

Table 12: Africa Generator Sets Market Size, By Value (USD Billion), 2020–2034

Table 13: Africa Generator Sets Market Share, By Technology

Table 14: Africa Generator Sets Market Share, By Product/Offering

Table 15: Africa Generator Sets Market Share, By Application

Table 16: Africa Generator Sets Market Share, By End User

Table 17: Africa Generator Sets Market Share, By Country

Table 18: Market Share Analysis of Key Companies

Table 19: Forecast by Technology, 2026–2034 (USD Billion)

Table 20: Forecast by Product/Offering, 2026–2034 (USD Billion)

Table 21: Forecast by Application, 2026–2034 (USD Billion)

Table 22: Forecast by End User, 2026–2034 (USD Billion)

Table 23: Country-wise Market Forecast, 2026–2034 (USD Billion)

Table 24: Company Overview – Abbott Laboratories

Table 25: Company Overview – Becton, Dickinson and Company

Table 26: Company Overview – bioMérieux SA

Table 27: Company Overview – Danaher Corporation

Table 28: Company Overview – F. Hoffmann-La Roche Ltd

Table 29: Company Overview – QIAGEN N.V.

Table 30: Company Overview – Siemens Healthineers AG

Table 31: Company Overview – Thermo Fisher Scientific Inc.

Table 32: Summary of Strategic Alliances/Partnerships by Key Players

Table 33: Summary of Recent Developments by Key Players

Table 34: Contact Details and Disclaimer

Top Key Players & Market Share Outlook

- Abbott Laboratories

- Becton

- Dickinson and Company

- bioMérieux SA

- Danaher Corporation

- F. Hoffmann-La Roche Ltd

- QIAGEN N.V.

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

- Others

Frequently Asked Questions