Understand The Key Trends Shaping This Market

Download Free SampleAustralia Industrial Coating Market Insights & Analysis

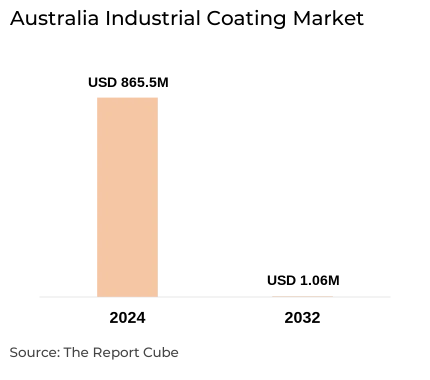

The Australia Industrial Coating Market is anticipated to register a CAGR of around 2.6% during the forecast period, i.e., 2025-32. Also, the market size was valued at nearly USD 865.5 Million in 2024. The mounting automotive, construction, marine, and manufacturing industries are driving the constant upsurge of the Australia Industrial Coating Market. Due to stringent environmental limitations, there is a booming trend for low-VOC (volatile organic compound) & water-based coatings, which is encouraging the market for environmentally friendly coatings.

The industry is also influenced by varied key aspects that contribute to its growth:

- To shield machinery, pipelines, and infrastructure from corrosion & adversative environmental conditions, country’s widespread mining and oil & gas industries require long-lasting coatings.

- The Australia Industrial Coating Industry is foreseen to upscale due to the rising need for protective coatings for transportation vehicles & automobile refurbishing.

- Self-healing coatings, anti-microbial coatings, and coatings based on nanotechnology are becoming more predominant as they provide enhanced durability & performance. Also, industrial coatings are vital for lengthening the machinery life, storage tanks, and marine vessels, primarily in coastal & industrial areas that are prone to corrosion.

- The requirement for anti-fouling & anti-corrosion coatings for ships, offshore structures, and port infrastructure is driven by Australia's long coastline & increasing marine activity.

- The market companies are being pushed to find sustainable solutions by growing awareness of & government incentives for environmental-friendly & recyclable coatings. Along with this, the demand for industrial coatings is solid owing to the requirement for machinery, equipment, and infrastructure to be maintained & recoated.

Moreover, all things considered, the Australia Industrial Coating Market is being shaped by advances in technology, sustainability trends, and intensifying end-use sectors, guaranteeing sustained growth in spite of complications like the cost of raw materials & complying with regulations.

Australia Industrial Coating Market Dynamics

- Shift Toward Sustainable Coatings to Elevate the Growth Graph of Australia Industrial Coating Market

To meet strict environmental laws, companies are prioritizing eco-friendly & low-VOC coatings, which is a key development driver for the Australia Industrial Coating Market. Further, to decrease hazardous emissions & enhance worker safety, there is an upsurging need for water-based, powder-based, and bio-based coatings. Moreover, progressions in self-healing coatings & nanotechnology are enlightening proficiency & durability, which further supports sustainability. Furthermore, enterprises that spend on sustainable coatings could have a competitive advantage owing to government incentives & consumers' augmented demand for eco-friendly solutions, which would accelerate Australia Industrial Coating Industry expansion in the forthcoming years.

- Inconsistent Raw Material Prices to Limit the Australia Industrial Coating Market Growth

The expansion of the Industrial Coatings Market in Australia is substantially hindered by shifting raw material prices as the sector generally depends on imported resins, pigments, and additives. Prices are raised by variables, such as inflation, supply chain interruptions, and geopolitical unrest, which makes it challenging for producers to keep cost steady.

Additionally, the industry's dependence on chemicals derived from petroleum leaves it vulnerable to variations in the price of crude oil. Thus, owing to these increasing costs, businesses are enforced to either absorb losses or pass costs on to consumers, which might lower demand. In addition to hindering long-term planning & innovation investment, the volatility of raw material prices also hampers Australia Industrial Coating Market expansion.

Australia Industrial Coating Market Segment-wise Analysis

By Technology:

- Solvent-borne

- Waterborne

- Powder-based

- Others

Waterborne segment holds the largest share of the Australia Industrial Coating Market. Waterborne technology is a surface treatment technique that deploy water as a solvent to breakdown resin & produce paints or coatings. Also, the non-reactive & eco-friendly properties of waterborne coatings make them a prevalent technology. Unlike water-borne coatings, solvent-borne coatings need an organic solvent to spread the resin, which is costly & environmentally damaging. Hence, in the construction & automotive sectors, water-borne coatings are increasingly taking the place of solvent-borne coatings.

Also, these days, water-borne coatings are extensively utilized in the construction industry for numerous purposes, like swimming pools, metal bodies, walls, roofing, and floor paints. Furthermore, the automobile market makes widespread usage of waterborne technology, thus making this segment more prevalent.

By Occupants:

- General Industrial

- Protective Coatings

- Automotive

- Electronics

- Aerospace

- Oil & Gas

- Power Generation

- Others

Owing to the nation 's strong emphasis on the mining, maritime, and infrastructure construction sectors, the Protective Coatings category dominates the Australia Industrial Coating Market. To stop corrosion, enhance durability, and lengthen asset life, protective coatings are frequently employed in heavy machinery, construction, oil & gas, and power production. Additionally, significant-performance coatings for steel structures, pipelines, and industrial equipment are given priority by enterprises due to Australia's hard-hitting climate, which includes substantial UV exposure, humidity, and coastal settings. Also, this segment's ascendency is further paved by government laws & sustainability programs that surge demand for low-VOC, fire-resistant, and anti-corrosion coatings.

What Does Our Australia Industrial Coating Market Research Study Entail?

- Australia Industrial Coating Market Research Report highlights the forecast growth rate or CAGR by anticipating the market size & share.

- The market analysis puts light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- Australia Industrial Coating Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- Australia Industrial Coating Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- Market Share, By Technology

- Solvent-borne

- Waterborne

- Powder-based

- Others

- Market Share, By Occupants

- General Industrial

- Protective Coatings

- Market Share, By Resin Type

- Epoxy

- Polyurethane

- Acrylic

- Polyester

- Other Resin

- Market Share, By Competitors

- 7.6.1. Competition Characteristics

- 7.6.2. Revenue Shares

- Australia Solvent-borne Industrial Coating Market Overview, 2020-2032F

- By Value (USD Million)

- By Occupants- Market Size & Forecast 2019-2030, USD Million

- By Resin Type- Market Size & Forecast 2019-2030, USD Million

- Australia Waterborne Industrial Coating Market Overview, 2020-2032F

- By Value (USD Million)

- By Occupants- Market Size & Forecast 2019-2030, USD Million

- By Resin Type- Market Size & Forecast 2019-2030, USD Million

- Australia Powder-based Industrial Coating Market Overview, 2020-2032F

- By Value (USD Million)

- By Occupants- Market Size & Forecast 2019-2030, USD Million

- By Resin Type- Market Size & Forecast 2019-2030, USD Million

- Australia Others Industrial Coating Market Overview, 2020-2032F

- By Value (USD Million)

- By Occupants- Market Size & Forecast 2019-2030, USD Million

- By Resin Type- Market Size & Forecast 2019-2030, USD Million

- Competitive Outlook (Company Profile - Partila List)

- Axalta Coating Systems, LLC

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- BASF SE

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Jotun A/S

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- PPG Industries, Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Wagon Paints Australia Pty Ltd.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- AkzoNobel N.V.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Sherwin-Williams Company

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Wacker Chemie AG

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Hempel A/S

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- DuluxGroup Limited

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Axalta Coating Systems, LLC

- Contact Us & Disclaimer

List of Figure

Figure 1: Australia Industrial Coating Market Value (USD Billion), 2020–2032

Figure 2: Market Share by Technology, Australia Industrial Coating Market, 2024

Figure 3: Market Share of Solvent-borne Coatings, 2020–2032

Figure 4: Market Share of Waterborne Coatings, 2020–2032

Figure 5: Market Share of Powder-based Coatings, 2020–2032

Figure 6: Market Share of Other Coating Technologies, 2020–2032

Figure 7: Market Share by Occupants – General Industrial vs. Protective Coatings, 2024

Figure 8: Market Share by Resin Type – Epoxy, Polyurethane, Acrylic, Polyester, Others, 2024

Figure 9: Competitive Landscape – Revenue Shares by Major Players, 2024

Figure 10: Solvent-borne Coating Market Size (USD Million), Australia, 2020–2032

Figure 11: Solvent-borne Coating Market by Occupants, 2019–2030

Figure 12: Solvent-borne Coating Market by Resin Type, 2019–2030

Figure 13: Waterborne Coating Market Size (USD Million), Australia, 2020–2032

Figure 14: Waterborne Coating Market by Occupants, 2019–2030

Figure 15: Waterborne Coating Market by Resin Type, 2019–2030

Figure 16: Powder-based Coating Market Size (USD Million), Australia, 2020–2032

Figure 17: Powder-based Coating Market by Occupants, 2019–2030

Figure 18: Powder-based Coating Market by Resin Type, 2019–2030

Figure 19: Other Coating Technologies Market Size (USD Million), Australia, 2020–2032

Figure 20: Other Coating Technologies Market by Occupants, 2019–2030

Figure 21: Other Coating Technologies Market by Resin Type, 2019–2030

Figure 22: Strategic Alliances and Partnerships Among Key Market Players, 2020–2024

Figure 23: Key Developments by Major Competitors, 2020–2024

List of Table

Table 1: Study Variables and Definitions

Table 2: Research Methodology Overview

Table 3: Secondary Data Sources Used in the Study

Table 4: List of Companies Interviewed

Table 5: Primary Interview Breakdown – By Designation, Region, and Industry

Table 6: Australia Industrial Coating Market Size (USD Billion), 2020–2032

Table 7: Australia Industrial Coating Market Share, by Technology, 2024

Table 8: Australia Industrial Coating Market Share, by Occupants (General Industrial, Protective Coatings), 2024

Table 9: Australia Industrial Coating Market Share, by Resin Type, 2024

Table 10: Competitive Characteristics – Market Concentration and Key Strategies

Table 11: Revenue Shares of Leading Competitors, Australia, 2024

Table 12: Solvent-borne Coating Market Size (USD Million), 2020–2032

Table 13: Solvent-borne Coating Market Size by Occupants, 2019–2030 (USD Million)

Table 14: Solvent-borne Coating Market Size by Resin Type, 2019–2030 (USD Million)

Table 15: Waterborne Coating Market Size (USD Million), 2020–2032

Table 16: Waterborne Coating Market Size by Occupants, 2019–2030 (USD Million)

Table 17: Waterborne Coating Market Size by Resin Type, 2019–2030 (USD Million)

Table 18: Powder-based Coating Market Size (USD Million), 2020–2032

Table 19: Powder-based Coating Market Size by Occupants, 2019–2030 (USD Million)

Table 20: Powder-based Coating Market Size by Resin Type, 2019–2030 (USD Million)

Table 21: Other Coating Technologies Market Size (USD Million), 2020–2032

Table 22: Other Coating Technologies Market Size by Occupants, 2019–2030 (USD Million)

Table 23: Other Coating Technologies Market Size by Resin Type, 2019–2030 (USD Million)

Table 24: Company Profiles – Summary of Key Metrics and Strategies (Axalta, BASF, Jotun, etc.)

Table 25: Strategic Alliances and Partnerships by Company, 2020–2024

Table 26: Recent Developments by Leading Market Players, 2020–2024

Top Key Players & Market Share Outlook

- Axalta Coating Systems, LLC

- BASF SE

- Jotun A/S

- PPG Industries, Inc.

- Wagon Paints Australia Pty Ltd.

- AkzoNobel N.V.

- Sherwin-Williams Company

- Wacker Chemie AG

- Hempel A/S

- DuluxGroup Limited

Frequently Asked Questions