Understand The Key Trends Shaping This Market

Download Free SampleUK Caustic Soda Market Overview: Market Size & Forecast (2026–2034)

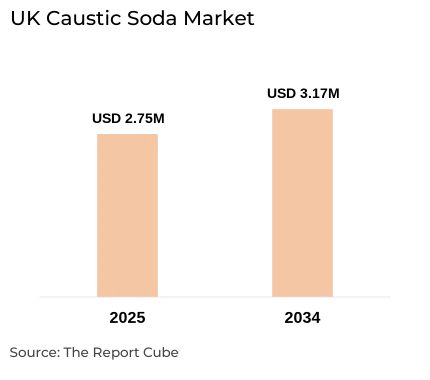

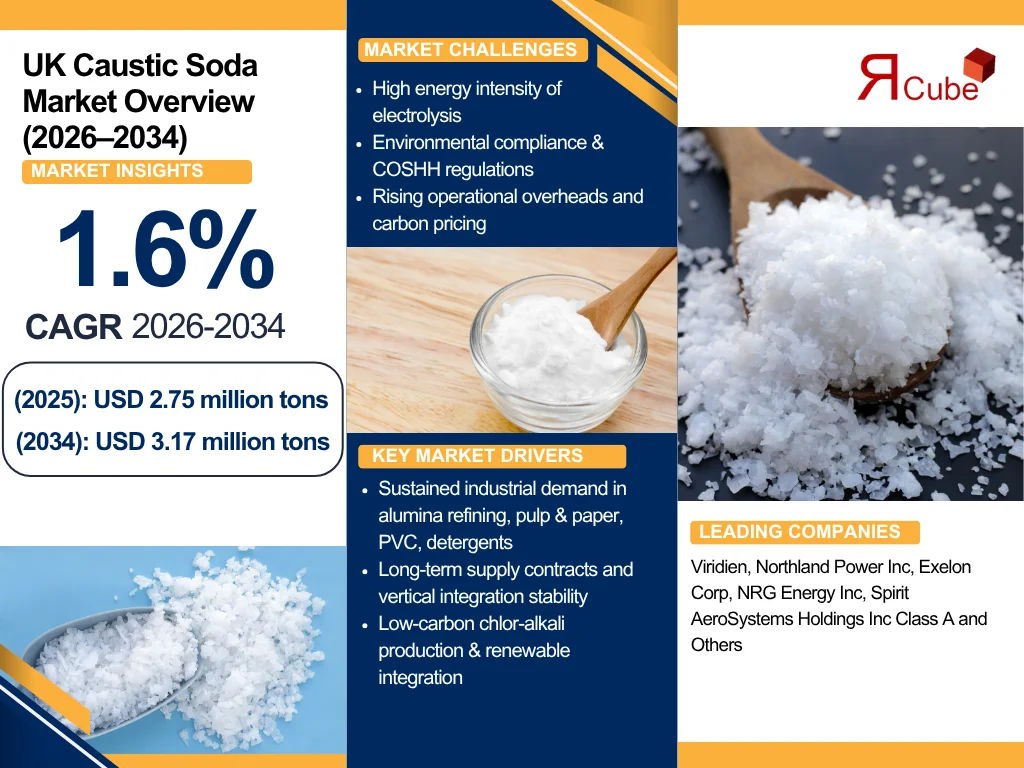

What is the anticipated CAGR & size of the UK Caustic Soda Market?

The UK Caustic Soda Market is anticipated to register a CAGR of around 1.6% during the forecast period, 2026-34. Additionally, the market size was valued at nearly USD 2.75 million tons in 2025 and is projected to reach nearly USD 3.17 million tons by 2034.

Market Analysis & Insights

The UK Caustic Soda Market is closely tangled to the nation’s chemical sector & downstream industries like alumina refining, pulp & paper, water treatment & specialty chemicals. The UK’s production remained to about 464 kt in 2024, with periodic supply rigidity from outages affecting caustic soda price & market revenue. Also, major domestic market players (INOVYN/Vynova Runcorn, Tata Chemicals (UK)) & international suppliers effect trade flows & bulk chemical supply chain decisions. The recent 2024–25 events, such as the INOVYN production constraints and Tata’s 2025 restructuring, is restricting regional availability & changed procurement strategies.

Moreover, high energy usage, stringent COSHH guidelines for caustic soda, and environmental rules are encouraging companies to upgrade to membrane cell technology & electrify their chlor-alkali plants. Further, new innovations are enhancing process control, energy efficacy, and recycling of raw materials to lower emissions. Additionally, in the UK Caustic Soda Market, products are generally sold via direct industrial contracts, distributors for smaller buyers, and traders handling import-export between the UK & EU. Thus, the changing trade policies & local decarbonization incentives are reforming sourcing & investment strategies.

Furthermore, looking ahead, the UK Caustic Soda Market would be instigated by low-carbon chlor-alkali production, limited European capacity, and stringent UK safety standards, helping producers provide high-quality, environmentally responsible sodium hydroxide supply across the UK through 2034.

Impact of AI in the UK Caustic Soda Market

AI enhances process control, predictive maintenance, and energy optimization in chlor-alkali plants, reducing electricity consumption & downtime. Further, it also refines demand forecasting & chemical procurement, refining inventory turns & aligning production with unstable demand outlook across the UK Caustic Soda Market in the future years as well.

UK Caustic Soda Market Dynamics

What driving factor acts as a positive influencer for the UK Caustic Soda Market?

- Sustained Industrial Demand in Core Production Sectors to Drive Market Growth: The Caustic Soda Market demand outlook in the UK remains sturdy, driven by alumina refining, paper, detergents, and PVC production. Also, integrated producers influence vertical linkages to maintain production continuity, which too influence growth. Further, even amid unstable European prices, the UK downstream industries sustain contract stability. For instance, in 2025, domestic prices augmented by around 8% QoQ, emphasizing strong consumption resilience despite limited imports.

What are the challenges that affect the UK Caustic Soda Market?

- Energy Intensity & Environmental Compliance Expenses to Hamper Market: The electrolysis process utilized to make sodium hydroxide in the UK uses a lot of electricity, interpreting operations susceptible to fluctuations in energy prices. Also, strict safety, emission, and waste management needs are mandated by the government's decarbonization objectives & COSHH laws for caustic soda. Further, production overheads are amplified by these compliance costs, which inexplicably impact smaller chlor-alkali companies. Along with this, through 2034, carbon pricing & energy efficiency retrofits would also continue to be challenging for the UK Caustic Soda Market.

How are the future opportunities transforming the market during 2026-34?

- Green Chlor-Alkali Expansion & Renewable Integration: Evolving investments in low-carbon chlor-alkali process facilities present a major growth opportunity for market. By incorporating renewable power sources & membrane-based electrolysis, the UK producers could decrease operating emissions by up to 25%. Also, the 2025 energy-transition initiatives at Runcorn & Cheshire industrial zones signal a change toward green sodium hydroxide & export-oriented sustainability branding.

What market trends are affecting the UK Caustic Soda Market Outlook?

- Alliance, Long-term Contracting, and Digital Transformation: An emerging trend toward supplier consolidation & long-term supply contracting defines the current UK chemical trade data landscape. Leading producers are launching digital procurement models, predictive maintenance AI, and blockchain-based logistics tracking. Further, price volatility has also motivated buyers to sign multi-year agreements, forming pricing stability & stronger collaboration between distributors & industrial end-users.

How is the UK Caustic Soda Market Defined as per Segments?

The UK Caustic Soda Market Research Reports provide detailed market data & insights in accordance with market segmentation. Some of the segments are:

- Manufacturing Process: Membrane Cell, Diaphragm Cell, and Others

- Product Type: Lye, Flake, and Others

By Manufacturing Process:

The Membrane Cell Process to capture the largest share of the UK Caustic Soda Market, and is anticipated to follow the same trend in the forecast years as well. This is owing to superior energy efficiency & lower effluent management versus diaphragm cells. Also, membrane technology decreases specific electricity consumption per ton of sodium hydroxide in the UK, easing compliance with power-intensive decarbonization targets & making it the favored route for new investments & retrofits.

By Product Type:

Lye (liquid caustic soda) is the dominant product form across the Caustic Soda Market in the UK by accounting for a substantial market share. As constant industrial processes favor pumpable liquid supply, the segment is destined to flourish in the following years as well. Owing to its ease of handling, pipeline logistics, and continuous industrial users, the liquid/lye segment frequently demands about 65% of deliveries both globally & regionally. Also, the segment’s ledership in the UK Caustic Soda Industry is further supported by the fact that numerous industrial customers (alumina, pulp, chemicals) prefer lye (sodium hydroxide UK) over flakes or solids as they demand continuous operations.

UK Caustic Soda Market: What Recent Innovations Are Affecting the Industry?

- 2025: INOVYN / Vynova Runcorn registered production limitations in 2025 that stiffened regional supply & contributed to short-term price surges across the UK & northwest Europe, affecting contract negotiations & distributor inventories.

- 2025: Tata Chemicals (UK) declared an operational restructuring that consisted closure of certain soda-ash capacity & a strategic pivot toward specialty salts, affecting upstream feedstock flows for caustic producers & provoking buyers to adjust procurement plans.

What are the Key Highlights of the UK Caustic Soda Market (2026–34)?

- The UK Caustic Soda Market is anticipated to expand at a CAGR of around 1.6% from 2026 to 2034, reaching nearly USD 3.17 billion by 2034.

- The industry progression is driven by the expanding chemical sector in the UK & increasing industrial demand.

- The membrane cell chlor-alkali process leads owing to energy efficiency & compliance with COSHH regulations caustic soda.

- Sodium hydroxide UK (lye form) dominates production across the UK Caustic Soda Industry.

- AI & digital control systems to improve process efficiency & safety.

- Enhanced chemical procurement & evolving UK chemical trade data reinforce the UK Caustic Soda Market analysis outlook.

How does the Future Outlook of the UK Caustic Soda Market (2034) Appears?

The UK Caustic Soda Market is projected to prioritize better supply chains & low-carbon, membrane-based chlor-alkali processes by the expected year, 2034. Also, with the assistance of high-end, renewable-energy-powered green sodium hydroxide UK products, revenue growth is observed to be consistent. Moreover, AI-driven process control & plant electrification would reduce energy usage, while European capacity limits & shifting chemical procurement strategies would shape the UK Caustic Soda Market, forecast 2034, ensuring sustainable progress in the Industrial Chemicals Market.

What Does Our UK Caustic Soda Market Research Study Entail?

- The UK Caustic Soda Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis & market scope sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The UK Caustic Soda Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the Study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Breakdown of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- UK Caustic Soda Market Overview

- Market Size, By Value (Million Tons)

- Market Share, By Manufacturing Process

- Membrane Cell

- Diaphragm Cell

- Others

- Market Share, By Product Type

- Lye

- Flake

- Others

- Market Share, By End-Use Industry

- Chemical Manufacturing

- Pulp and Paper

- Water Treatment

- Soap and Detergents

- Aluminum

- Textile

- Pharmaceutical

- Market Share, By Distribution Channel

- Direct Sales

- Distributors

- Online Sales

- Market Share, By Packaging Type

- Bulk Packaging

- Drums

- Bags

- Market Share, By Application

- Pulp and Paper

- Organic Chemical

- Inorganic Chemical

- Soap and Detergent

- Alumina

- Water Treatment

- Textile Processing

- Oil and Gas

- Food Processing

- Pharmaceuticals

- Market Share, By Company

- Revenue Shares

- Competition Characteristics

- UK Caustic Soda Market By Manufacturing Process Overview, 2026-2034

- Membrane Cell Market Overview, 2026-2034

- By Value (Million Tons)

- Diaphragm Cell Market Overview, 2026-2034

- By Value (Million Tons)

- Others Market Overview, 2026-2034

- By Value (Million Tons)

- Membrane Cell Market Overview, 2026-2034

- UK Caustic Soda Market By Product Type Overview, 2026-2034

- Lye Market Overview, 2026-2034

- By Value (Million Tons)

- Flake Market Overview, 2026-2034

- By Value (Million Tons)

- Others Market Overview, 2026-2034

- By Value (Million Tons)

- Lye Market Overview, 2026-2034

- UK Caustic Soda Market By End-Use Industry Overview, 2026-2034

- Chemical Manufacturing Market Overview, 2026-2034

- By Value (Million Tons)

- Pulp and Paper Market Overview, 2026-2034

- By Value (Million Tons)

- Water Treatment Market Overview, 2026-2034

- By Value (Million Tons)

- Soap and Detergents Market Overview, 2026-2034

- By Value (Million Tons)

- Aluminum Market Overview, 2026-2034

- By Value (Million Tons)

- Textile Market Overview, 2026-2034

- By Value (Million Tons)

- Pharmaceutical Market Overview, 2026-2034

- By Value (Million Tons)

- Chemical Manufacturing Market Overview, 2026-2034

- Competitive Outlook (Company Profiles)

- Viridien

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Northland Power Inc

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Exelon Corp

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- NRG Energy Inc

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Spirit AeroSystems Holdings Inc Class A

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Eaton Corp PLC

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Honeywell International Inc

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- GE Aerospace

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Siemens AG

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- ABB Ltd

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Viridien

- Contact Us & Disclaimer

List of Figure

Figure 1: Objective of the Study

Figure 2: Product Definition

Figure 3: Market Segmentation

Figure 4: Study Variables

Figure 5: Research Methodology

Figure 6: Secondary Data Points

Figure 7: Companies Interviewed

Figure 8: Primary Data Points

Figure 9: Breakdown of Primary Interviews

Figure 10: Executive Summary

Figure 11: Market Dynamics

Figure 12: Key Market Drivers

Figure 13: Market Challenges

Figure 14: Opportunity Assessment

Figure 15: Recent Trends and Developments

Figure 16: Policy and Regulatory Landscape

Figure 17: UK Caustic Soda Market Overview

Figure 18: UK Caustic Soda Market Size, By Value (Million Tons)

Figure 19: Market Share, By Manufacturing Process

Figure 20: Membrane Cell Market Share

Figure 21: Diaphragm Cell Market Share

Figure 22: Others Manufacturing Process Share

Figure 23: Market Share, By Product Type

Figure 24: Lye Market Share

Figure 25: Flake Market Share

Figure 26: Others Product Type Share

Figure 27: Market Share, By End-Use Industry

Figure 28: Chemical Manufacturing Market Share

Figure 29: Pulp and Paper Market Share

Figure 30: Water Treatment Market Share

Figure 31: Soap and Detergents Market Share

Figure 32: Aluminum Market Share

Figure 33: Textile Market Share

Figure 34: Pharmaceutical Market Share

Figure 35: Market Share, By Distribution Channel

Figure 36: Direct Sales Share

Figure 37: Distributor Sales Share

Figure 38: Online Sales Share

Figure 39: Market Share, By Packaging Type

Figure 40: Bulk Packaging Share

Figure 41: Drums Packaging Share

Figure 42: Bags Packaging Share

Figure 43: Market Share, By Application

Figure 44: Pulp and Paper Application Share

Figure 45: Organic Chemical Application Share

Figure 46: Inorganic Chemical Application Share

Figure 47: Soap and Detergent Application Share

Figure 48: Alumina Application Share

Figure 49: Water Treatment Application Share

Figure 50: Textile Processing Application Share

Figure 51: Oil and Gas Application Share

Figure 52: Food Processing Application Share

Figure 53: Pharmaceutical Application Share

Figure 54: Market Share, By Company – Revenue Shares

Figure 55: Competition Characteristics

Figure 56: UK Caustic Soda Market by Manufacturing Process Overview (2026–2034)

Figure 57: Membrane Cell Market Overview, By Value (2026–2034)

Figure 58: Diaphragm Cell Market Overview, By Value (2026–2034)

Figure 59: Others Manufacturing Process Market Overview, By Value (2026–2034)

Figure 60: UK Caustic Soda Market by Product Type Overview (2026–2034)

Figure 61: Lye Market Overview, By Value (2026–2034)

Figure 62: Flake Market Overview, By Value (2026–2034)

Figure 63: Others Product Type Overview, By Value (2026–2034)

Figure 64: UK Caustic Soda Market by End-Use Industry Overview (2026–2034)

Figure 65: Chemical Manufacturing Market Overview, By Value (2026–2034)

Figure 66: Pulp and Paper Market Overview, By Value (2026–2034)

Figure 67: Water Treatment Market Overview, By Value (2026–2034)

Figure 68: Soap and Detergents Market Overview, By Value (2026–2034)

Figure 69: Aluminum Market Overview, By Value (2026–2034)

Figure 70: Textile Market Overview, By Value (2026–2034)

Figure 71: Pharmaceutical Market Overview, By Value (2026–2034)

Figure 72: Competitive Outlook – Viridien: Company Overview

Figure 73: Viridien: Business Segments

Figure 74: Viridien: Strategic Alliances/Partnerships

Figure 75: Viridien: Recent Developments

Figure 76: Competitive Outlook – Northland Power Inc: Company Overview

Figure 77: Northland Power Inc: Business Segments

Figure 78: Northland Power Inc: Strategic Alliances/Partnerships

Figure 79: Northland Power Inc: Recent Developments

Figure 80: Competitive Outlook – Exelon Corp: Company Overview

Figure 81: Exelon Corp: Business Segments

Figure 82: Exelon Corp: Strategic Alliances/Partnerships

Figure 83: Exelon Corp: Recent Developments

Figure 84: Competitive Outlook – NRG Energy Inc: Company Overview

Figure 85: NRG Energy Inc: Business Segments

Figure 86: NRG Energy Inc: Strategic Alliances/Partnerships

Figure 87: NRG Energy Inc: Recent Developments

Figure 88: Competitive Outlook – Spirit AeroSystems Holdings Inc Class A: Company Overview

Figure 89: Spirit AeroSystems Holdings Inc: Business Segments

Figure 90: Spirit AeroSystems Holdings Inc: Strategic Alliances/Partnerships

Figure 91: Spirit AeroSystems Holdings Inc: Recent Developments

Figure 92: Competitive Outlook – Eaton Corp PLC: Company Overview

Figure 93: Eaton Corp PLC: Business Segments

Figure 94: Eaton Corp PLC: Strategic Alliances/Partnerships

Figure 95: Eaton Corp PLC: Recent Developments

Figure 96: Competitive Outlook – Honeywell International Inc: Company Overview

Figure 97: Honeywell International Inc: Business Segments

Figure 98: Honeywell International Inc: Strategic Alliances/Partnerships

Figure 99: Honeywell International Inc: Recent Developments

Figure 100: Competitive Outlook – GE Aerospace: Company Overview

Figure 101: GE Aerospace: Business Segments

Figure 102: GE Aerospace: Strategic Alliances/Partnerships

Figure 103: GE Aerospace: Recent Developments

Figure 104: Competitive Outlook – Siemens AG: Company Overview

Figure 105: Siemens AG: Business Segments

Figure 106: Siemens AG: Strategic Alliances/Partnerships

Figure 107: Siemens AG: Recent Developments

Figure 108: Competitive Outlook – ABB Ltd: Company Overview

Figure 109: ABB Ltd: Business Segments

Figure 110: ABB Ltd: Strategic Alliances/Partnerships

Figure 111: ABB Ltd: Recent Developments

List of Table

Table 1: Objective of the Study

Table 2: Product Definition

Table 3: Market Segmentation

Table 4: Study Variables

Table 5: Research Methodology

Table 6: Secondary Data Points

Table 7: Companies Interviewed

Table 8: Primary Data Points

Table 9: Breakdown of Primary Interviews

Table 10: Executive Summary – Key Market Metrics

Table 11: Market Dynamics Overview

Table 12: Key Market Drivers

Table 13: Market Challenges

Table 14: Opportunity Assessment

Table 15: Recent Trends and Developments

Table 16: Policy and Regulatory Landscape

Table 17: UK Caustic Soda Market Overview

Table 18: UK Caustic Soda Market Size, By Value (Million Tons)

Table 19: Market Share, By Manufacturing Process

Table 20: Membrane Cell Market Share

Table 21: Diaphragm Cell Market Share

Table 22: Others Manufacturing Process Share

Table 23: Market Share, By Product Type

Table 24: Lye Market Share

Table 25: Flake Market Share

Table 26: Others Product Type Share

Table 27: Market Share, By End-Use Industry

Table 28: Chemical Manufacturing Market Share

Table 29: Pulp and Paper Market Share

Table 30: Water Treatment Market Share

Table 31: Soap and Detergents Market Share

Table 32: Aluminum Market Share

Table 33: Textile Market Share

Table 34: Pharmaceutical Market Share

Table 35: Market Share, By Distribution Channel

Table 36: Direct Sales Share

Table 37: Distributor Sales Share

Table 38: Online Sales Share

Table 39: Market Share, By Packaging Type

Table 40: Bulk Packaging Share

Table 41: Drums Packaging Share

Table 42: Bags Packaging Share

Table 43: Market Share, By Application

Table 44: Pulp and Paper Application Share

Table 45: Organic Chemical Application Share

Table 46: Inorganic Chemical Application Share

Table 47: Soap and Detergent Application Share

Table 48: Alumina Application Share

Table 49: Water Treatment Application Share

Table 50: Textile Processing Application Share

Table 51: Oil and Gas Application Share

Table 52: Food Processing Application Share

Table 53: Pharmaceutical Application Share

Table 54: Market Share, By Company – Revenue Shares

Table 55: Competition Characteristics

Table 56: UK Caustic Soda Market by Manufacturing Process Overview (2026–2034)

Table 57: Membrane Cell Market Overview, By Value (2026–2034)

Table 58: Diaphragm Cell Market Overview, By Value (2026–2034)

Table 59: Others Manufacturing Process Market Overview, By Value (2026–2034)

Table 60: UK Caustic Soda Market by Product Type Overview (2026–2034)

Table 61: Lye Market Overview, By Value (2026–2034)

Table 62: Flake Market Overview, By Value (2026–2034)

Table 63: Others Product Type Overview, By Value (2026–2034)

Table 64: UK Caustic Soda Market by End-Use Industry Overview (2026–2034)

Table 65: Chemical Manufacturing Market Overview, By Value (2026–2034)

Table 66: Pulp and Paper Market Overview, By Value (2026–2034)

Table 67: Water Treatment Market Overview, By Value (2026–2034)

Table 68: Soap and Detergents Market Overview, By Value (2026–2034)

Table 69: Aluminum Market Overview, By Value (2026–2034)

Table 70: Textile Market Overview, By Value (2026–2034)

Table 71: Pharmaceutical Market Overview, By Value (2026–2034)

Table 72: Competitive Outlook – Viridien: Company Overview

Table 73: Viridien: Business Segments

Table 74: Viridien: Strategic Alliances/Partnerships

Table 75: Viridien: Recent Developments

Table 76: Competitive Outlook – Northland Power Inc: Company Overview

Table 77: Northland Power Inc: Business Segments

Table 78: Northland Power Inc: Strategic Alliances/Partnerships

Table 79: Northland Power Inc: Recent Developments

Table 80: Competitive Outlook – Exelon Corp: Company Overview

Table 81: Exelon Corp: Business Segments

Table 82: Exelon Corp: Strategic Alliances/Partnerships

Table 83: Exelon Corp: Recent Developments

Table 84: Competitive Outlook – NRG Energy Inc: Company Overview

Table 85: NRG Energy Inc: Business Segments

Table 86: NRG Energy Inc: Strategic Alliances/Partnerships

Table 87: NRG Energy Inc: Recent Developments

Table 88: Competitive Outlook – Spirit AeroSystems Holdings Inc Class A: Company Overview

Table 89: Spirit AeroSystems Holdings Inc: Business Segments

Table 90: Spirit AeroSystems Holdings Inc: Strategic Alliances/Partnerships

Table 91: Spirit AeroSystems Holdings Inc: Recent Developments

Table 92: Competitive Outlook – Eaton Corp PLC: Company Overview

Table 93: Eaton Corp PLC: Business Segments

Table 94: Eaton Corp PLC: Strategic Alliances/Partnerships

Table 95: Eaton Corp PLC: Recent Developments

Table 96: Competitive Outlook – Honeywell International Inc: Company Overview

Table 97: Honeywell International Inc: Business Segments

Table 98: Honeywell International Inc: Strategic Alliances/Partnerships

Table 99: Honeywell International Inc: Recent Developments

Table 100: Competitive Outlook – GE Aerospace: Company Overview

Table 101: GE Aerospace: Business Segments

Table 102: GE Aerospace: Strategic Alliances/Partnerships

Table 103: GE Aerospace: Recent Developments

Table 104: Competitive Outlook – Siemens AG: Company Overview

Table 105: Siemens AG: Business Segments

Table 106: Siemens AG: Strategic Alliances/Partnerships

Table 107: Siemens AG: Recent Developments

Table 108: Competitive Outlook – ABB Ltd: Company Overview

Table 109: ABB Ltd: Business Segments

Table 110: ABB Ltd: Strategic Alliances/Partnerships

Table 111: ABB Ltd: Recent Developments

Top Key Players & Market Share Outlook

- Viridien

- Northland Power Inc

- Exelon Corp

- NRG Energy Inc

- Spirit AeroSystems Holdings Inc Class A

- Eaton Corp PLC

- Honeywell International Inc

- GE Aerospace

- Siemens AG

- ABB Ltd

- Others

Frequently Asked Questions