Understand The Key Trends Shaping This Market

Download Free SampleDigital Twin in Finance Market Overview: Market Size & Forecast (2026–2034)

What is the anticipated CAGR & size of the Digital Twin in Finance Market?

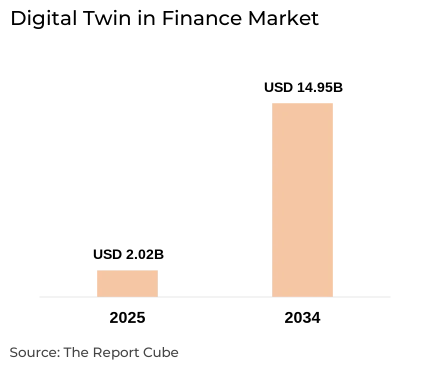

The Digital Twin in Finance Market is anticipated to register a CAGR of around 24.91% during the forecast period, 2026-34. Additionally, the market size was valued at nearly USD 2.02 billion in 2025 and is projected to reach nearly USD 14.95 billion by 2034.

Market Analysis & Insights

Digital twins of portfolios, consumer journeys, and complete balance-sheet dynamics are made promising by banks & FinTech companies looking for real-time analytics, scenario analysis, and stress testing without jeopardizing capital. To optimize capital allocation & operational resilience, financial institutions deploy digital twins for risk assessment & management, fraud detection, AML/compliance monitoring, and behavioral modeling.

Moreover, adoption is augmented by cloud deployments (like Azure Digital Twins) & advancement in AI/ML, data lakes, and low-latency feeds. Also, production rollouts are enhanced by collaborations between cloud vendors & financial incumbents. Further, platform producers (cloud + modeling stacks), analytics/SaaS providers, systems integrators, and consulting companies are all part of the Digital Twin in Finance Market structure. Both on-premises secure versions & cloud-native services are in great demand owing to crucial use cases (stress testing, operational risk modeling).

Additionally, stricter compliance regulations & sandbox programs from governments and authorities motivating investments in digital twins even more. As per the reliable industry trackers, Digital Twin in Finance Market values by the early 2030s would be in the low to mid billions, emphasizing the BFSI sector's recognition of FinTech innovations & tremendous market development drivers.

What is the Impact of AI in the Digital Twin in Finance Market?

AI drives the creation of predictive scenarios, automated behavioral modeling, and anomaly detection within financial digital twins. It also speeds up real-time analytics, enhances the precision of fraud detection & stress testing, and makes scalable FinTech innovations possible, all of which transform digital revolution finance in the BFSI industry.

Digital Twin in Finance Market Dynamics

What driving factor acts as a positive influencer for the Digital Twin in Finance Market?

- Financial institutions face surging regulatory scrutiny & complex market risks. Digital twins let banks simulate liquidity, credit, and market risk in several correlated variables.

- Enables enterprise-scale scenario analysis & automated stress testing that minimizes capital surprises & elevate regulatory reporting.

- Increasing investments by institutions on digital-simulation tooling & cloud analytics, to be a key market driver.

What are the challenges that affect the Digital Twin in Finance Market?

How are the future opportunities transforming the market during 2026-34?

- Banks can commercialize scenario engines (risk-as-a-service), provide personalized product simulators & embed digital twins into wealth/asset management workflows.

- Capital markets companies can employ twins for algorithmic portfolio optimization, while insurers could utilize constant modeling of risks to cost dynamically.

- Providing smaller institutions subscription services for behavioral modeling & real-time analytics.

What market trends are affecting the Digital Twin in Finance Market Outlook?

- Near-real-time twin execution is made possible by cloud platforms (Azure Digital Twins, specialist vendors) that are coupled with AI/ML pipelines & market data sources.

- Surge of hybrid deployments, secure on-prem instances for sensitive models together with cloud orchestration for compute bursts.

- This convergence speeds up the acceptance of digital twins in banking & financial services, letting for faster FinTech innovation prototyping & rollout.

How is the Digital Twin in Finance Market Defined as per Segments?

The Digital Twin in Finance Market Research Reports provide detailed market data & insights in accordance with market segmentation. Some of the segments are:

- Deployment Mode: Cloud-based & On-Premises

- Application: Risk Assessment & Management, Fraud Detection & Prevention, Customer Behavior Analysis, Asset & Liability Management, Compliance & Regulatory Reporting, and Process Optimization & Performance Monitoring

By Deployment Mode:

Cloud-based utilizations lead the Digital Twin in Finance Market, grabbing around 68% of total market share in 2024.

Their scalability, smooth AI/ML incorporation, and decreased initial prices are what inspires them. Constant data incorporation, real-time simulations, and widespread stress-test runs are made promising by cloud twins, most remarkably Microsoft Azure. Also, by providing pre-built financial digital twin templates that save deployment time, vendors, including AWS, IBM, and Oracle are promising banks to abandon their antiquated on-premises systems.

By Application:

The Risk Assessment & Management dominates the Digital Twin in Finance Market with nearly 32% market share in 2024.

The usage of digital twins for credit, liquidity, and operational risk imitations is expanding among banks & insurers. Also, stress testing, scenario analysis, and real-time exposure monitoring are all powered by these models. Further, this market is the biggest source of revenue owing to ongoing regulatory strictness & cultured AI-driven behavioral modeling, and Tier 1 banks & financial service providers are surging their investments in it.

Digital Twin in Finance Industry: Regional Insights

The Digital Twin in Finance Market is geographically diversified, covering:

- North America

- Europe,

- Asia-Pacific

- The Middle East & Africa

- Latin America

The North America Digital Twin in Finance Market grabs the potential market share of about XX%.

Early regulator-industry pilots, noteworthy cloud providers, and concentrated FinTech innovation are to blame for this. Also, the regional leadership is driven by considerable investments made by American banks, hedge funds, and insurers in scenario analysis, real-time analytics, and AI-enabled compliance solutions. Further, while FinTech centers guarantee the rapid generation of FinTech innovations intended for the BFSI industry, the presence of substantial platform vendors & consultancies speeds up deployments.

Digital Twin in Finance Market: What Recent Innovations Are Affecting the Industry?

- 2025: Microsoft expanded Azure Digital Twins incorporation & introduced AI-led content/digital twin workflows to assist enterprises scale digital twin content & simulation use cases.

- 2025: Ansys released Analysis 2025 R2 with improvements to digital twin analytics, model calibration & automation, features that speed twin creation & predictive simulations.

What are the Key Highlights of the Digital Twin in Finance Market (2026–34)?)

- The Digital Twin in Finance Market is predicted to expand at CAGR of about 24.91%, and expected to reach at a market size of about USD 14.95 billion through 2034.

- By Component: Software grabs the biggest share of the market, compelled by prevalent enterprise adoption & constant innovation in digital platforms.

- By Deployment Mode: Cloud-Based solutions lead the market share owing to scalability, cost-effectiveness, and ease of utilization.

- By Application: Risk Assessment & Management represents a dominant share, instigated by organizations’ emphasis on operational transparency.

- By End User: Banks & Financial Institutions captures the prominent market share, leveraging technology for process automation & compliance.

- AI enables real-time analytics, automated stress testing, and predictive scenario analysis, solidifying digital transformation finance in the BFSI sector.

How does the Future Outlook of the Digital Twin in Finance Market (2034) Appears?

Through 2034, the Digital Twin Finance Market is predicted to be multi-billion, instigated by broad acceptance of digital transformation finance, embedded real-time analytics, and scalable FinTech innovations. Moreover, banks & insurers would utilize twins for constant stress testing, AML/compliance monitoring & product personalization. Further, AI would be central, altering twins into autonomous decision-support engines in the BFSI sector during the forecast years.

What Does Our Digital Twin in Finance Market Research Study Entail?

- The Digital Twin in Finance Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis & market scope sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The Digital Twin in Finance Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

- High-fidelity twins need incorporated, trusted datasets (transactional, market, customer, macro). Data silos, latency, and governance gaps hamper model fidelity.

- Model-validation for regulatory compliance (e.g., model risk management frameworks) surge implementation intricacy & cost.

- Institutions must invest in MLOps, data lineage, and audit trails to gratify compliance monitoring & AML obligations.

How are the future opportunities transforming the market during 2026-34?

- Banks can commercialize scenario engines (risk-as-a-service), provide personalized product simulators & embed digital twins into wealth/asset management workflows.

- Capital markets companies can employ twins for algorithmic portfolio optimization, while insurers could utilize constant modeling of risks to cost dynamically.

- Providing smaller institutions subscription services for behavioral modeling & real-time analytics.

What market trends are affecting the Digital Twin in Finance Market Outlook?

- Near-real-time twin execution is made possible by cloud platforms (Azure Digital Twins, specialist vendors) that are coupled with AI/ML pipelines & market data sources.

- Surge of hybrid deployments, secure on-prem instances for sensitive models together with cloud orchestration for compute bursts.

- This convergence speeds up the acceptance of digital twins in banking & financial services, letting for faster FinTech innovation prototyping & rollout.

How is the Digital Twin in Finance Market Defined as per Segments?

The Digital Twin in Finance Market Research Reports provide detailed market data & insights in accordance with market segmentation. Some of the segments are:

- Deployment Mode: Cloud-based & On-Premises

- Application: Risk Assessment & Management, Fraud Detection & Prevention, Customer Behavior Analysis, Asset & Liability Management, Compliance & Regulatory Reporting, and Process Optimization & Performance Monitoring

By Deployment Mode:

Cloud-based utilizations lead the Digital Twin in Finance Market, grabbing around 68% of total market share in 2024.

Their scalability, smooth AI/ML incorporation, and decreased initial prices are what inspires them. Constant data incorporation, real-time simulations, and widespread stress-test runs are made promising by cloud twins, most remarkably Microsoft Azure. Also, by providing pre-built financial digital twin templates that save deployment time, vendors, including AWS, IBM, and Oracle are promising banks to abandon their antiquated on-premises systems.

By Application:

The Risk Assessment & Management dominates the Digital Twin in Finance Market with nearly 32% market share in 2024.

The usage of digital twins for credit, liquidity, and operational risk imitations is expanding among banks & insurers. Also, stress testing, scenario analysis, and real-time exposure monitoring are all powered by these models. Further, this market is the biggest source of revenue owing to ongoing regulatory strictness & cultured AI-driven behavioral modeling, and Tier 1 banks & financial service providers are surging their investments in it.

Digital Twin in Finance Industry: Regional Insights

The Digital Twin in Finance Market is geographically diversified, covering:

- North America

- Europe,

- Asia-Pacific

- The Middle East & Africa

- Latin America

Early regulator-industry pilots, noteworthy cloud providers, and concentrated FinTech innovation are to blame for this. Also, the regional leadership is driven by considerable investments made by American banks, hedge funds, and insurers in scenario analysis, real-time analytics, and AI-enabled compliance solutions. Further, while FinTech centers guarantee the rapid generation of FinTech innovations intended for the BFSI industry, the presence of substantial platform vendors & consultancies speeds up deployments.

Digital Twin in Finance Market: What Recent Innovations Are Affecting the Industry?

- 2025: Microsoft expanded Azure Digital Twins incorporation & introduced AI-led content/digital twin workflows to assist enterprises scale digital twin content & simulation use cases.

- 2025: Ansys released Analysis 2025 R2 with improvements to digital twin analytics, model calibration & automation, features that speed twin creation & predictive simulations.

What are the Key Highlights of the Digital Twin in Finance Market (2026–34)?)

- The Digital Twin in Finance Market is predicted to expand at CAGR of about 24.91%, and expected to reach at a market size of about USD 14.95 billion through 2034.

- By Component: Software grabs the biggest share of the market, compelled by prevalent enterprise adoption & constant innovation in digital platforms.

- By Deployment Mode: Cloud-Based solutions lead the market share owing to scalability, cost-effectiveness, and ease of utilization.

- By Application: Risk Assessment & Management represents a dominant share, instigated by organizations’ emphasis on operational transparency.

- By End User: Banks & Financial Institutions captures the prominent market share, leveraging technology for process automation & compliance.

- AI enables real-time analytics, automated stress testing, and predictive scenario analysis, solidifying digital transformation finance in the BFSI sector.

How does the Future Outlook of the Digital Twin in Finance Market (2034) Appears?

Through 2034, the Digital Twin Finance Market is predicted to be multi-billion, instigated by broad acceptance of digital transformation finance, embedded real-time analytics, and scalable FinTech innovations. Moreover, banks & insurers would utilize twins for constant stress testing, AML/compliance monitoring & product personalization. Further, AI would be central, altering twins into autonomous decision-support engines in the BFSI sector during the forecast years.

What Does Our Digital Twin in Finance Market Research Study Entail?

- The Digital Twin in Finance Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis & market scope sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The Digital Twin in Finance Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the Study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Breakdown of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- Global Digital Twin in Finance Market Overview

- Market Size, By Value (USD Billion)

- Market Share, By Deployment Mode

- Cloud-based

- On-Premises

- Market Share, By Application

- Risk Assessment & Management

- Fraud Detection & Prevention

- Customer Behavior Analysis

- Asset & Liability Management

- Compliance & Regulatory Reporting

- Process Optimization

- Performance Monitoring

- Insurance Claims Management

- Testing & Simulation

- Other Applications

- Market Share, By End User

- BFSI

- Manufacturing

- Transportation & Logistics

- Healthcare

- Other End-Use Industries

- Market Share, By Region

- North America

- Europe

- Asia-Pacific

- The Middle East & Africa

- Latin America

- Market Share, By Company

- Revenue Shares

- Competition Characteristics

- Segment-wise / Industry-wise Market Overview

- By Value (USD Billion)

- By Deployment Mode

- By Application

- By End User

- Forecast 2026–2034 Tables

- Competitive Outlook (Company Profiles)

- Microsoft

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- BIMobject

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- PTC

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Honeywell

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Siemens

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- General Electric

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Altair

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- IBM

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- ESI Group

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Ansys

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Oracle

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Schneider Electric

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Simul8 Corporation

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Tendril

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Others

- Microsoft

- Contact Us & Disclaimer

List of Figure

Figure 1.1: Objective of the Study

Figure 1.2: Product Definition

Figure 1.3: Market Segmentation Overview

Figure 1.4: Study Variables

Figure 2.1: Research Methodology Flowchart

Figure 2.2: Secondary Data Sources

Figure 2.3: Companies Interviewed

Figure 2.4: Primary Data Collection Process

Figure 2.5: Breakdown of Primary Interviews

Figure 3.1: Executive Summary – Market Highlights

Figure 4.1: Key Market Drivers

Figure 4.2: Market Challenges

Figure 4.3: Opportunity Assessment

Figure 5.1: Recent Trends and Developments

Figure 6.1: Policy and Regulatory Landscape

Figure 7.1: Global Digital Twin in Finance Market Size (USD Billion)

Figure 7.2: Market Share by Deployment Mode

Figure 7.2.1: Cloud-based vs. On-Premises Deployment

Figure 7.3: Market Share by Application

Figure 7.3.1: Risk Assessment & Management

Figure 7.3.2: Fraud Detection & Prevention

Figure 7.3.3: Customer Behavior Analysis

Figure 7.3.4: Asset & Liability Management

Figure 7.3.5: Compliance & Regulatory Reporting

Figure 7.3.6: Process Optimization

Figure 7.3.7: Performance Monitoring

Figure 7.3.8: Insurance Claims Management

Figure 7.3.9: Testing & Simulation

Figure 7.3.10: Other Applications

Figure 7.4: Market Share by End User

Figure 7.4.1: BFSI

Figure 7.4.2: Manufacturing

Figure 7.4.3: Transportation & Logistics

Figure 7.4.4: Healthcare

Figure 7.4.5: Other End-Use Industries

Figure 7.5: Market Share by Region

Figure 7.5.1: North America

Figure 7.5.2: Europe

Figure 7.5.3: Asia-Pacific

Figure 7.5.4: Middle East & Africa

Figure 7.5.5: Latin America

Figure 7.6: Market Share by Company

Figure 7.6.1: Revenue Shares

Figure 7.6.2: Competition Characteristics

Figure 8.1: Segment-wise Market Overview by Value (USD Billion)

Figure 8.2: Segment-wise Market Overview by Deployment Mode

Figure 8.3: Segment-wise Market Overview by Application

Figure 8.4: Segment-wise Market Overview by End User

Figure 8.5: Forecast 2026–2034 Tables

Figure 9.1: Microsoft – Company Overview & Strategic Highlights

Figure 9.2: BIMobject – Company Overview & Strategic Highlights

Figure 9.3: PTC – Company Overview & Strategic Highlights

Figure 9.4: Honeywell – Company Overview & Strategic Highlights

Figure 9.5: Siemens – Company Overview & Strategic Highlights

Figure 9.6: General Electric – Company Overview & Strategic Highlights

Figure 9.7: Altair – Company Overview & Strategic Highlights

Figure 9.8: IBM – Company Overview & Strategic Highlights

Figure 9.9: ESI Group – Company Overview & Strategic Highlights

Figure 9.10: Ansys – Company Overview & Strategic Highlights

Figure 9.11: Oracle – Company Overview & Strategic Highlights

Figure 9.12: Schneider Electric – Company Overview & Strategic Highlights

Figure 9.13: Simul8 Corporation – Company Overview & Strategic Highlights

Figure 9.14: Tendril – Company Overview & Strategic Highlights

Figure 9.15: Other Companies – Overview

Figure 10.1: Contact & Disclaimer Information

List of Table

Table 1.1: Study Objectives and Scope

Table 1.2: Product Definition Details

Table 1.3: Market Segmentation by Criteria

Table 1.4: Study Variables and Metrics

Table 2.1: Secondary Data Sources

Table 2.2: List of Companies Interviewed

Table 2.3: Primary Data Collection Summary

Table 2.4: Breakdown of Primary Interviews by Stakeholder

Table 4.1: Key Market Drivers

Table 4.2: Market Challenges

Table 4.3: Opportunity Assessment

Table 5.1: Recent Trends and Developments

Table 6.1: Policy and Regulatory Overview

Table 7.1: Global Digital Twin in Finance Market Size (USD Billion)

Table 7.2: Market Share by Deployment Mode

Table 7.3: Market Share by Application

Table 7.4: Market Share by End User

Table 7.5: Market Share by Region

Table 7.6: Market Share by Company

Table 8.1: Segment-wise Market Overview by Value (USD Billion)

Table 8.2: Segment-wise Market Overview by Deployment Mode

Table 8.3: Segment-wise Market Overview by Application

Table 8.4: Segment-wise Market Overview by End User

Table 8.5: Forecast 2026–2034

Table 9.1: Microsoft – Company Profile & Financials

Table 9.2: BIMobject – Company Profile & Financials

Table 9.3: PTC – Company Profile & Financials

Table 9.4: Honeywell – Company Profile & Financials

Table 9.5: Siemens – Company Profile & Financials

Table 9.6: General Electric – Company Profile & Financials

Table 9.7: Altair – Company Profile & Financials

Table 9.8: IBM – Company Profile & Financials

Table 9.9: ESI Group – Company Profile & Financials

Table 9.10: Ansys – Company Profile & Financials

Table 9.11: Oracle – Company Profile & Financials

Table 9.12: Schneider Electric – Company Profile & Financials

Table 9.13: Simul8 Corporation – Company Profile & Financials

Table 9.14: Tendril – Company Profile & Financials

Table 9.15: Other Companies Overview

Table 10.1: Contact & Disclaimer

Top Key Players & Market Share Outlook

- Microsoft

- BIMobject

- PTC

- Honeywell

- Siemens

- General Electric

- Altair

- IBM

- ESI Group

- Ansys

- Oracle

- Schneider Electric

- Simul8 Corporation

- Tendril

- Others

Frequently Asked Questions