Understand The Key Trends Shaping This Market

Download Free SampleGCC Car Rental Market Insights & Analysis

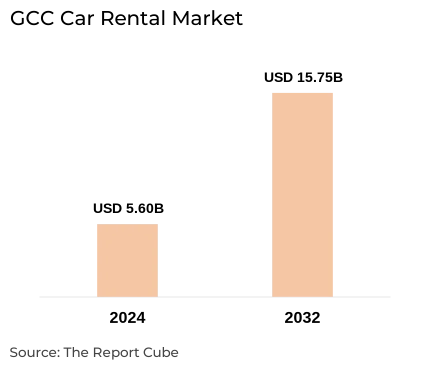

The GCC Car Rental Market was USD 5.6 Billion in 2024 and further is projected grow at a CAGR of around 13.8% during the forecast period, i.e., 2024-32, and the market size is further forecast at USD 15.75 billion through 2032. The market growth is attributable to the growing influx of tourists across the regional nations and an upsurge in the demand for rental cars to travel places.

Car rental organizations provide vehicles for a convenient fee, usually for a specified duration, which can range from a few hours to several days or even weeks. Hence, renting cars has gained popularity in the GCC markets owing to its hassle-free nature, low maintenance requirements, and affordability. The market in the regional nations, particularly in countries like the United Arab Emirates (UAE) & Oman, has seen noteworthy expansion driven by their expanding economies.

Furthermore, the market is benefiting from a heightened public awareness of a wide range of rental options, including luxury & eco-friendly vehicles, which is escalating the customer base & supporting industry growth. The expansion of urban infrastructure, the rising need for transportation in business hubs, and local car rental platforms that offer personalized rental solutions tailored to individual needs are contributing to enhancing the market size.

Government initiatives focused at promoting tourism and business travel, along with regulations that ensure quality & safety in rental practices, are reinforcing the market. Moreover, the growing preference for flexible commuting options, along with the strategic placement of car rental services at key locations like airports, hotels, and commercial centers, is accelerating market growth. Also, customized rental packages, long-term leasing options, and significant investments in customer service excellence create a positive outlook for the GCC Car Rental Market in the forthcoming years.

GCC Car Rental Market Dynamics

-

Increasing Tourist Inflow to Drive the Market Growth

The GCC region boasts numerous tourist attractions, including iconic landmarks, cultural sites, and natural wonders. Tourists often favor the suitability and flexibility provided by car rentals, enabling them to explore these attractions at their preferred pace. Renting a car grants tourists the liberty to travel independently, visit less-traveled destinations, and enjoy a hassel-free travel experience.

Furthermore, the proximity of GCC nations facilitates multi-country exploration during tourists' visits, and car rental services facilitate border crossings, permitting them to immerse themselves in the region's diverse cultures and landscapes. As a result, the surge in the number of tourists looking to explore various GCC countries and engage in business activities stands as a significant driving force behind the growth of the GCC Car Rental Market.

-

Mounting Investments in Public Transport to Hinder the Industry Expansion

The governments of the countries across the GCC region have been making substantial investments in augmenting the public transportation infrastructure, intended to improving the lifestyle in urban areas, and establishing a global logistics hub. The government's infrastructure projects include the construction of trains, metro lines, and public transport buses, all of which contribute to better road connectivity in several countries like the UAE, Saudi Arabia, Qatar, etc.

Thus, the advancement of robust public transportation infrastructure has led a significant portion of consumers, especially those seeking affordable transportation options, to shift from car rental to public transportation services, thereby hindering the growth of the GCC Car Rental Market.

GCC Car Rental Market Segment-wise Analysis

By Booking Channel:

- Online

- Offline

The Online Booking Channel is estimated to grow at a substantial pace, holding the potential share of the GCC Car Rental Industry during the forecast period. The trend of renting cars online via numerous apps due to its one-click process is prompting the adoption of car rental services.

App developers have been creating mobile rental applications that incorporate advanced booking features, offering users with increased vehicle options and the ability to compare rental prices within a single platform. For instance, Ejaro launched a licensed car-sharing application in Saudi Arabia in August 2020. This app serves as a platform connecting car owners with individuals seeking to rent vehicles online.

By Application:

- Leisure

- Commercial

In recent years, the Commercial sector captured a significant share of the GCC Car Rental Market and is presumed to follow the similar trend in the forthcoming years as well. This dominance can be attributed to the rapid expansion of the service industry in the region, coupled with proactive initiatives by the governments of the countries to encourage foreign direct investment (FDI). These factors have significantly contributed to the augmented demand for rental cars for business-related transportation requirements.

Furthermore, the presence of domestic & international organizations in the region has grown steadily, engrossed by favorable macroeconomic conditions, such as a skilled workforce, ease of establishing & terminating operations, and business-friendly policies. Consequently, this has further fueled the demand for rental cars to facilitate mobility services for their employees.

Country Projection of the GCC Catering Services Industry

The GCC Car Rental Market is geographically diversified, covering:

- Saudi Arabia

- The UAE

- Kuwait

- Qatar

- Bahrain

- Oman

The UAE is anticipated to be the dominant country in the GCC Car Rental Market in the coming years. The UAE Car Rental Market is significantly influenced by both tourists & corporate clients. The government's initiatives to promote technology-based platforms and customer-oriented services have played a pivotal role in driving the market forward. In the UAE, airports are typically situated outside city limits, making car rental services highly profitable, especially in cities like Dubai & Abu Dhabi. The nation's growing economy, coupled with the convenience of on-demand car rentals has made car rental services more accessible and sustainable.

Moreover, the mounting population, particularly in major cities, has led to a shortage of space, rising fuel prices, and taxes. These factors have encouraged individuals to seek more sustainable transportation options. Hence, there is a growing trend towards environmentally friendly vehicles, including electric vehicles (EVs), as the UAE Car Rental Market shifts towards eco-friendly solutions.

What Does Our GCC Car Rental Market Research Study Entail?

- GCC Car Rental Market Research Report highlights the forecast growth rate or CAGR by anticipating the market size & share.

- The market analysis puts light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- GCC Car Rental Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Key Factors Considered by Consumers While Selecting a Rental Car Company

- Smart Measures Takes by Car Rental Companies

- GCC Car Rental Market Overview (2020-2032)

- Market Size

- By Value (in USD Billion)

- By Volume (Total Fleet Available)

- Market Share, By Type of Car

- Economy

- Premium

- Ultra Luxury & Sports

- Market Share, By Application

- Leisure

- Commercial

- Market Share, By Drive Type

- Self-Driving

- Chauffer Driven

- Market Share, By Booking Type

- Online

- Offline

- Market Share, By Usage

- Up to 500 KM/day

- More than 500 KM/day

- Market Size, By Country

- UAE

- Qatar

- Kuwait

- Oman

- Bahrain

- Saudi Arabia

- Market Share, By Company

- Competition Characteristics

- Revenue Shares & Analysis

- Market Size

- GCC Economy Car Rental Solutions Market Overview (2020-2032)

- Market Size

- By Value (in USD Million)

- By Volume (Total Fleet Available)

- Market Share, By Application

- Market Share By Drive Type

- Market Share By Booking Type

- Market Share By Usage

- Market Share By Country

- Market Size

- GCC Premium Car Rental Solutions Market Overview (2020-2032)

- Market Size

- By Value (in USD Million)

- By Volume (Total Fleet Available)

- Market Share, By Application

- Market Share By Drive Type

- Market Share By Booking Type

- Market Share By Usage

- Market Share By Country

- Market Size

- GCC Ultra Luxury & Sports Car Rental Solutions Market Overview (2020-2032)

- Market Size

- By Value (in USD Million)

- By Volume (Total Fleet Available)

- Market Share, By Application

- Market Share By Drive Type

- Market Share By Booking Type

- Market Share By Usage

- Market Share By Country

- Market Size

- Competitive Outlook (Company Profiles – Partial List)

- Thrifty

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- Financials

- The Hertz Corporation

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- Financials

- Enterprise Holdings Inc.

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- Financials

- Auto Rent

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- Financials

- Sixt Rent a Car

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- Financials

- FasteR Rent a Car

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- Financials

- Kayak

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- Financials

- Key Car Rental

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- Financials

- Avis Budget Group

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- Financials

- National Rent a Car

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- Financials

- Others

- Thrifty

- Contact Us & Disclaimer

List of Figure

-

Figure 1: Market Segmentation Overview

-

Figure 2: Study Variables Framework

-

Figure 3: Research Methodology Flowchart

-

Figure 4: Breakdown of Primary Interviews by Stakeholder Type

-

Figure 5: Market Drivers and Challenges Overview

-

Figure 6: Opportunity Assessment Matrix

-

Figure 7: Recent Trends and Developments Timeline

-

Figure 8: Consumer Key Factors in Selecting Rental Car Companies

-

Figure 9: Smart Measures Adopted by Car Rental Companies

-

Figure 10: GCC Car Rental Market Size by Value (2020-2032)

-

Figure 11: GCC Car Rental Market Size by Volume (Total Fleet Available)

-

Figure 12: Market Share by Type of Car (Economy, Premium, Ultra Luxury & Sports)

-

Figure 13: Market Share by Application (Leisure vs Commercial)

-

Figure 14: Market Share by Drive Type (Self-Driving vs Chauffer Driven)

-

Figure 15: Market Share by Booking Type (Online vs Offline)

-

Figure 16: Market Share by Usage (Up to 500 KM/day vs More than 500 KM/day)

-

Figure 17: GCC Market Size by Country (UAE, Qatar, Kuwait, Oman, Bahrain, Saudi Arabia)

-

Figure 18: Market Share by Leading Companies in GCC Car Rental Market

-

Figure 19: Revenue Shares & Analysis of GCC Car Rental Market

-

Figure 20: GCC Economy Car Rental Market Size by Value and Volume

-

Figure 21: Economy Car Rental Market Share by Application

-

Figure 22: Economy Car Rental Market Share by Drive Type

-

Figure 23: Economy Car Rental Market Share by Booking Type

-

Figure 24: Economy Car Rental Market Share by Usage

-

Figure 25: Economy Car Rental Market Share by Country

-

Figure 26: GCC Premium Car Rental Market Size by Value and Volume

-

Figure 27: Premium Car Rental Market Share by Application

-

Figure 28: Premium Car Rental Market Share by Drive Type

-

Figure 29: Premium Car Rental Market Share by Booking Type

-

Figure 30: Premium Car Rental Market Share by Usage

-

Figure 31: Premium Car Rental Market Share by Country

-

Figure 32: GCC Ultra Luxury & Sports Car Rental Market Size by Value and Volume

-

Figure 33: Ultra Luxury & Sports Car Rental Market Share by Application

-

Figure 34: Ultra Luxury & Sports Car Rental Market Share by Drive Type

-

Figure 35: Ultra Luxury & Sports Car Rental Market Share by Booking Type

-

Figure 36: Ultra Luxury & Sports Car Rental Market Share by Usage

-

Figure 37: Ultra Luxury & Sports Car Rental Market Share by Country

-

Figure 38: Competitive Landscape Overview (Company Profiles)

-

Figure 39: Thrifty – Business Segments & Strategic Alliances

-

Figure 40: The Hertz Corporation – Business Segments & Strategic Alliances

-

Figure 41: Enterprise Holdings Inc. – Business Segments & Strategic Alliances

-

Figure 42: Auto Rent – Business Segments & Strategic Alliances

-

Figure 43: Sixt Rent a Car – Business Segments & Strategic Alliances

-

Figure 44: FasteR Rent a Car – Business Segments & Strategic Alliances

-

Figure 45: Kayak – Business Segments & Strategic Alliances

-

Figure 46: Key Car Rental – Business Segments & Strategic Alliances

-

Figure 47: Avis Budget Group – Business Segments & Strategic Alliances

-

Figure 48: National Rent a Car – Business Segments & Strategic Alliances

List of Table

-

Table 1: Objective of the Study

-

Table 2: Product Definition and Specifications

-

Table 3: Market Segmentation Criteria

-

Table 4: Study Variables Description

-

Table 5: Secondary Data Sources

-

Table 6: Companies Interviewed for Primary Research

-

Table 7: Breakdown of Primary Interviews by Type

-

Table 8: Summary of Market Drivers and Challenges

-

Table 9: Opportunity Assessment Details

-

Table 10: Key Consumer Factors for Rental Car Selection

-

Table 11: Smart Measures Implemented by Rental Companies

-

Table 12: GCC Car Rental Market Size Forecast (2020-2032)

-

Table 13: Market Size by Value (USD Million) – GCC Car Rental Market

-

Table 14: Market Size by Volume (Total Fleet Available) – GCC

-

Table 15: Market Share by Type of Car (Economy, Premium, Ultra Luxury & Sports)

-

Table 16: Market Share by Application (Leisure, Commercial)

-

Table 17: Market Share by Drive Type (Self-Driving, Chauffer Driven)

-

Table 18: Market Share by Booking Type (Online, Offline)

-

Table 19: Market Share by Usage (Up to 500 KM/day, More than 500 KM/day)

-

Table 20: Market Size by Country (UAE, Qatar, Kuwait, Oman, Bahrain, Saudi Arabia)

-

Table 21: Market Share by Leading Companies in GCC Car Rental Market

-

Table 22: Revenue Shares & Analysis of GCC Car Rental Market

-

Table 23: GCC Economy Car Rental Market Size (Value & Volume)

-

Table 24: Economy Car Rental Market Share by Application

-

Table 25: Economy Car Rental Market Share by Drive Type

-

Table 26: Economy Car Rental Market Share by Booking Type

-

Table 27: Economy Car Rental Market Share by Usage

-

Table 28: Economy Car Rental Market Share by Country

-

Table 29: GCC Premium Car Rental Market Size (Value & Volume)

-

Table 30: Premium Car Rental Market Share by Application

-

Table 31: Premium Car Rental Market Share by Drive Type

-

Table 32: Premium Car Rental Market Share by Booking Type

-

Table 33: Premium Car Rental Market Share by Usage

-

Table 34: Premium Car Rental Market Share by Country

-

Table 35: GCC Ultra Luxury & Sports Car Rental Market Size (Value & Volume)

-

Table 36: Ultra Luxury & Sports Car Rental Market Share by Application

-

Table 37: Ultra Luxury & Sports Car Rental Market Share by Drive Type

-

Table 38: Ultra Luxury & Sports Car Rental Market Share by Booking Type

-

Table 39: Ultra Luxury & Sports Car Rental Market Share by Usage

-

Table 40: Ultra Luxury & Sports Car Rental Market Share by Country

-

Table 41: Competitive Outlook Summary – Company Profiles

-

Table 42: Thrifty – Financial Overview and Strategic Alliances

-

Table 43: The Hertz Corporation – Financial Overview and Strategic Alliances

-

Table 44: Enterprise Holdings Inc. – Financial Overview and Strategic Alliances

-

Table 45: Auto Rent – Financial Overview and Strategic Alliances

-

Table 46: Sixt Rent a Car – Financial Overview and Strategic Alliances

-

Table 47: FasteR Rent a Car – Financial Overview and Strategic Alliances

-

Table 48: Kayak – Financial Overview and Strategic Alliances

-

Table 49: Key Car Rental – Financial Overview and Strategic Alliances

-

Table 50: Avis Budget Group – Financial Overview and Strategic Alliances

-

Table 51: National Rent a Car – Financial Overview and Strategic Alliances

Top Key Players & Market Share Outlook

- Thrifty

- Hertz

- Enterprise Holdings Inc.

- Massar Solutions

- Auto Rent

- Sixt Rent a Car

- FasteR rent a car

- Kayak

- Key Car Rental

- Avis Budget Group

- National Rent a Car

- Others

Frequently Asked Questions