Bahrain Home Healthcare Equipment Market

Source: The Report Cube

Understand The Key Trends Shaping This Market

Download Free SampleBahrain Home Healthcare Equipment Market Overview: Market Size & Forecast (2026–2032)

What is the anticipated CAGR & size of the Bahrain Home Healthcare Equipment Market?

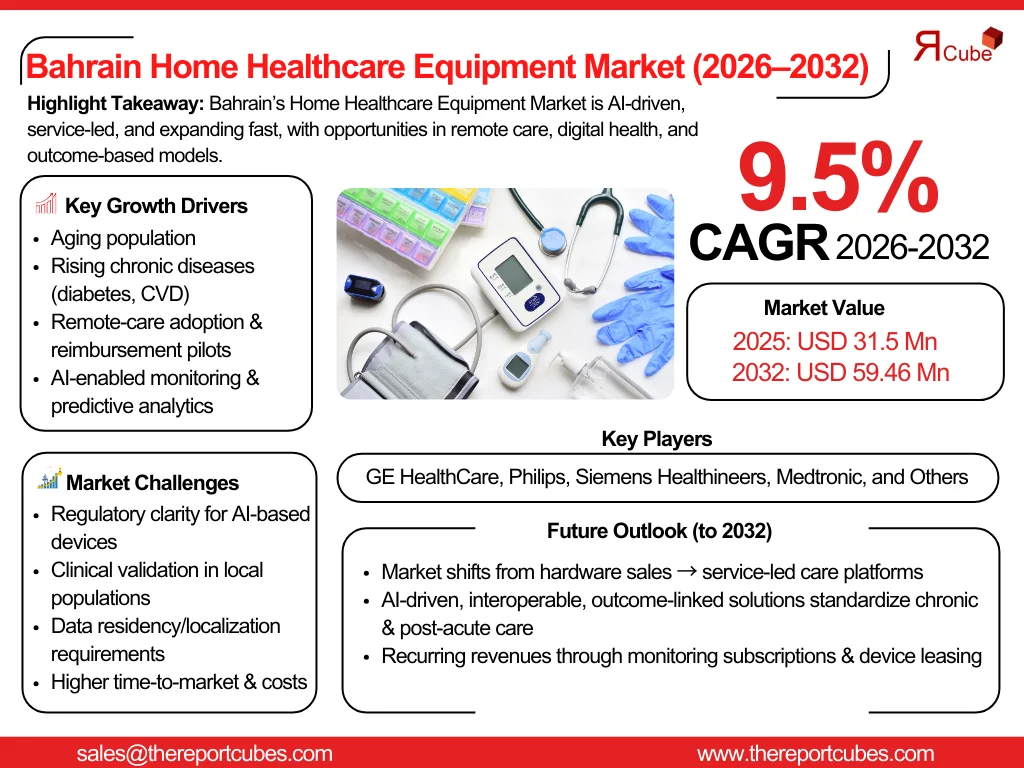

The Bahrain Home Healthcare Equipment Market is anticipated to register a CAGR of around 9.5% during the forecast period, 2026-32. Additionally, the market size was valued at nearly USD 31.5 million in 2025 and is projected to reach nearly USD 59.46 million by 2032.

Market Analysis & Insights

The Bahrain Home Healthcare Equipment Market would expand during 2026–2032, motivated by ageing demographics, increasing chronic disease frequency, and rising acceptance of remote care. Also, product offerings center on AI-enabled diagnostic & monitoring equipment (smart blood glucose & blood-pressure monitors with predictive analytics), therapeutic devices with rooted intelligence (adaptive oxygen concentrators & AI-assisted insulin-delivery algorithms), AI-enabled mobility-support systems, and consumables connected to tele-monitoring platforms.

Moreover, sales channels comprise hospital pharmacies, retail medical stores, direct-homecare agency amalgamation, and expanding e-commerce distribution. Also, leading market companies such as Siemens Healthineers, Philips, Medtronic, Stryker, Johnson & Johnson, BD, Abbott, GE HealthCare, and regional distributors, including Al Jishi Corporation & Gulf House Medical System WLL are incorporating AI capabilities into home devices or partnering with local providers to embed remote-monitoring services and cloud analytics augmenting deployments that link devices to national health registries & provider dashboards. This, in turn, is aiding in enhancing the Bahrain Home Healthcare Equipment Market share. For instance, global vendors showcased AI-driven monitoring & diagnostics at regional trade shows in 2025, underlining product directions toward cloud-connected, upgradable software stacks for home usage.

Furthermore, in the Bahrain Home Healthcare Equipment Market, AI chiefly adds predictive alerts, anomaly detection (for arrhythmias, glucose excursions, fall risk), adaptive therapy delivery, and automated triage workflows that minimize clinical burden & enable remote-case escalation. Thus, these features differentiate home equipment from commoditized devices & reinforced payer interest.

Additionally, looking ahead, public/private digital-health initiatives & attaining preferences for devices that support remote monitoring & interoperability would drive acceptance, specifically for AI-first solutions provided by Philips, GE HealthCare, and Medtronic in the following years.

Bahrain Home Healthcare Equipment Market Dynamics

What driving factor acts as a positive influencer for the Bahrain Home Healthcare Equipment Market?

- Increasing Chronic Disease Burden & Reimbursement Pilots for Remote Care to Instigate Growth Graph: Bahrain is observing elevated prevalence of non-communicable diseases (diabetes, cardiovascular disease), similar to regional trends. This drives demand for home devices that enable constant monitoring & early intervention. Significantly, early payer & employer pilots favor devices that feed AI analytics proficient in predicting deterioration & quantifying outcomes, making AI-enabled glucose monitors, intelligent oxygen concentrators, and remote cardiac telemetry attractive.

Moreover, vendors, like Abbott, Medtronic, and Philips, are positioning device-plus-analytics packages to meet these reimbursement pilots, as outcomes-linked procurement rewards equipment that evidently decreases admissions or clinical visits. Further, this incentive structure shortens sales cycles for AI-integrated home equipment & appeals to regional distributors such as Al Jishi Corporation & Gulf House Medical System WLL to invest in service-led offerings.

What are the challenges that affect the Bahrain Home Healthcare Equipment Market?

- Regulatory Clarity, Clinical Validation, and Data Localization: Home-health AI must meet both medical device & software-as-a-medical-device (SaMD) regulatory standards. Bahrain’s regulator & GCC neighbors progressively demand clinical validation & traceability for AI models utilized in diagnosis or therapy alterations. Further, vendors must exhibit real-world performance in Arabic-speaking populations & local care pathways.

Moreover, uneven procurement standards & the requirement for data residency or federated-learning approaches complicate deployments. Also, several global companies (e.g., Siemens Healthineers, GE HealthCare) adapt models & documentation to content both technical & legal necessities, which surges time-to-market & implementation price.

How are the future opportunities transforming the market during 2026-32?

- Service-Led Device Models & Remote-Monitoring Programs: Device-as-a-service & clinician-supported remote monitoring solutions that incorporate cloud AI analytics, nursing processes, and hardware have a certain economic opportunity. Turnkey packages that include gadgets (mobility aids, monitoring kits) with onboarding, round-the-clock alerts, and predictive dashboards are favored by hospitals & home care organizations.

Furthermore, businesses could distinguish themselves from vendors of pure hardware & generate recurring income by bundling devices with proven AI analytics & outcome-linked SLAs. Also, Philips & Medtronic, who have made monitoring platforms & received industry acclaim for their intelligent monitoring solutions in 2025, stand to gain from this trend.

What market trends are affecting the Bahrain Home Healthcare Equipment Market Outlook?

- Convergence of Global Medtech, Local Distributors, and Software Partners: Local distributors provide incorporation, language localization, and after-sales services, while multinational medtech giants supply hardware & core analytics in 2024–2025. Home equipment firmwares & cloud services include general-purpose AI functions, anomaly detection, predictive alarms, and remote triage.

Further, to demonstrate the product roadmap for home-care devices that would be delivered to Bahrain via approved partners, key vendors showcased AI-driven patient monitoring & cloud-based data management solutions at the Middle East's Arab Health 2025 health technology expo. Additionally, acceptance is augmented by this cooperation model, which simultaneously addresses cultural, legal, and technical issues.

How is the Bahrain Home Healthcare Equipment Market Defined as per Segments?

The Bahrain Home Healthcare Equipment Market Research Reports provide detailed market data & insights in accordance with market segmentation. Some of the segments are:

- Product Type: Therapeutic Equipment (oxygen therapy devices, insulin delivery systems, dialysis equipment, respiratory care devices), Diagnostic & Monitoring Equipment (blood glucose monitors, blood pressure monitors, heart rate monitors, sleep apnea devices, telehealth monitoring systems), Mobility Assist Devices (wheelchairs, walking aids, mobility scooters, patient transfer equipment), and Home Healthcare Consumables & Supplies (catheters, wound-care supplies, disposable gloves, feeding tubes)

- End-User: Retail Pharmacies & Medical Stores, Hospital Pharmacies, Online Platforms/E-commerce, and Direct Sales & Homecare Agencies

By Product Type:

The Diagnostic & Monitoring Equipment segment upholds the potential share of the Bahrain Home Healthcare Equipment Market as AI-enabled monitors provide immediate, measurable value. Continuous glucose monitors, wearable cardiac telemetry, smart BP monitors, and home sleep/respiratory monitors supply clinicians with actionable trends & alerts, helping them to get a timely update of the patient. These devices are essential to chronic disease management & post-discharge care pathways.

Further, the segment’s software-first architectures allow frequent model updates & remote calibration, making them easier to reimburse & support than heavy therapeutic hardware. Additionally, global vendors like Abbott, Philips, and Medtronic have prioritized monitoring portfolios that incorporate AI analytics, assisting distributors such as Al Jishi Corporation & Gulf House Medical System WLL in selling outcome-focused solutions.

By Distribution Channel:

Direct Sales & Homecare Agencies account for the dominant share of the Bahrain Home Healthcare Equipment Market as they bundle equipment, training, and clinical monitoring services, vital for AI-enabled devices that need clinical workflows & alert triage. Also, agencies acting as integrators buy devices from GE HealthCare, Siemens Healthineers, Abbott, and others, then layer on software, nursing support, and connectivity to provider systems. Thus, this channel minimizes adoption friction for patients & clinicians by offering installation, maintenance, and data-management services, which are essential for devices depending on constant AI-driven analytics. Further, the model also supports recurring revenue via device leasing & subscription to analytics dashboards.

Bahrain Home Healthcare Equipment Market: Recent Developments (2025)

- Philips unveiled improved AI-driven diagnostics & patient-monitoring innovations at Arab Health 2025, highlighting cloud-based data management & automation that elevates the acceptance of home-monitoring suites.

- Stryker’s strategic moves (declaration of Inari Medical acquisition) redesigned its device portfolio & distribution footprint. This motivated how distributors & providers prioritize device selection & post-acute care equipment for home settings.

What are the Key Highlights of the Bahrain Home Healthcare Equipment Market (2026–32)?

- The Bahrain Home Healthcare Equipment Market growth is driven by an ageing population, NCDs, and remote-care pilots, further making the market reach an estimated CAGR of about 9.5% during 2026-32.

- Therapeutic equipment (oxygen therapy, insulin delivery, dialysis devices) presumed to dominate market demand.

- Increasing acceptance of diagnostic & monitoring devices, specifically glucose monitors & telehealth-linked systems.

- Mobility assist devices are gaining traction with rehabilitation & elderly patients.

- Online sales channels & e-commerce are quickly developing alongside traditional pharmacies.

- End-users such as the elderly, post-operative, chronic disease, and rehabilitation patients, with geriatric care, are instigating the Bahrain Home Healthcare Equipment Market demand.

- Incorporation with telehealth, home nursing, and rehabilitation services improves industry potential.

- Global market companies (GE HealthCare, Philips, Medtronic) partnered with local distributors across Bahrain (Al Jishi Corporation, Gulf House Medical System WLL) to deliver service-led AI solutions.

How does the Future Outlook of the Bahrain Home Healthcare Equipment Market (2032) Appears?

Through 2032, Bahrain Home Healthcare Equipment Market would be service- & data-centric, with AI-enabled monitors & adaptive therapeutic devices standard for chronic-care & post-acute pathways. Further, larger adoption of device-as-a-service models & payer acceptance of outcome-linked reimbursements would expand recurring market revenues. Also, market companies that combine validated AI analytics, interoperability, and local-service capabilities, like Philips, GE HealthCare, and Medtronic, would play a significant role across the Bahrain Home Healthcare Equipment Industry. Moreover, AI would transform the market from episodic device sales to constant care platforms that enhance outcomes & decrease cost-per-patient, further generating profitable prospects during the forecast period.

What Does Our Bahrain Home Healthcare Equipment Market Research Study Entail?

- The Bahrain Home Healthcare Equipment Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The Bahrain Home Healthcare Equipment Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- Bahrain Home Healthcare Equipment Market Overview (2020-2032)

- Market Size, By Value (in USD Millions)

- Market Share, By Product Type

- Therapeutic Equipment

- Diagnostic & Monitoring Equipment

- Mobility Assist Devices

- Home Healthcare Consumables & Supplies

- Market Share, By End-User

- Retail Pharmacies & Medical Stores

- Hospital Pharmacies

- Online Platforms/E-commerce

- Direct Sales & Homecare Agencies

- Market Share, By Distribution

- Direct orders (OEM or authorized distributors)

- Retail/Pharmacy sales

- E-procurement and marketplace models

- Market Share, By Disease/Clinical Area

- Chronic Diseases

- Cardiac Care

- Orthopedics & Rehabilitation

- Neurology

- Palliative/Long-Term Care

- Market Share, By Competitors

- Competition Characteristics

- Revenue Shares

- Bahrain Therapeutic Equipment Home Healthcare Equipment Market Overview, 2020-2032F

- By Value (USD Million)

- By End-User- Market Size & Forecast 2019-2030, USD Million

- By Distribution- Market Size & Forecast 2019-2030, USD Million

- Bahrain Diagnostic & Monitoring Equipment Home Healthcare Equipment Market Overview, 2020-2032F

- By Value (USD Million)

- By End-User- Market Size & Forecast 2019-2030, USD Million

- By Distribution- Market Size & Forecast 2019-2030, USD Million

- Bahrain Mobility Assist Devices Home Healthcare Equipment Market Overview, 2020-2032F

- By Value (USD Million)

- By End-User- Market Size & Forecast 2019-2030, USD Million

- By Distribution- Market Size & Forecast 2019-2030, USD Million

- Bahrain Home Healthcare Consumables & Supplies Home Healthcare Equipment Market Overview, 2020-2032F

- By Value (USD Million)

- By End-User- Market Size & Forecast 2019-2030, USD Million

- By Distribution- Market Size & Forecast 2019-2030, USD Million

- Competitive Outlook (Company Profile - Partila List)

- GE HealthCare

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Siemens Healthineers

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Philips

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Medtronic

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Stryker

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Johnson & Johnson (Ethicon/DePuy Synthes)

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- BD (Becton

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Dickinson and Company)

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Abbott

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Others

- GE HealthCare

- Contact Us & Disclaimer

List of Figure

Figure 1.1 — Conceptual framework / Objectives of the study

Figure 1.2 — Product-definition schematic (home healthcare equipment categories)

Figure 1.3 — Market segmentation diagram (by product, end-user, distribution, disease area)

Figure 1.4 — Study variables and relationships (independent / dependent / control)

Figure 2.1 — Research design flowchart (secondary + primary data process)

Figure 2.2 — Secondary data sources map (types and examples)

Figure 2.3 — Companies interviewed — geographical & sectoral breakdown

Figure 2.4 — Primary data collection methodology (quant/qual mix)

Figure 2.5 — Breakdown of primary interviews (stakeholder types and sample sizes)

Figure 3.1 — Key takeaways snapshot (market at-a-glance infographic)

Figure 4.1 — Market drivers — impact vs. likelihood matrix

Figure 4.2 — Market challenges — heatmap of severity by stakeholder

Figure 4.3 — Opportunity assessment — TAM/SAM/SOM diagram

Figure 5.1 — Timeline of recent trends & major product/technology developments

Figure 6.1 — Regulatory map for home healthcare equipment in Bahrain (agencies, approvals)

Figure 6.2 — Policy impact matrix (regulation → market outcomes)

Figure 7.1 — Market size (USD million) — historical (2020–2024) and forecast (2025–2032)

Figure 7.2 — Annual CAGR (2020–2032) — overall market

Figure 7.3 — Market share by product type (pie chart)

Figure 7.4 — Product-type trend lines (Therapeutic, Diagnostic & Monitoring, Mobility, Consumables)

Figure 7.5 — Market share by end-user (stacked bar)

Figure 7.6 — End-user growth rates by segment (2019–2032)

Figure 7.7 — Market share by distribution channel (pie/stacked)

Figure 7.8 — Distribution channel revenue trend (direct, retail, e-procurement)

Figure 7.9 — Market share by disease/clinical area (pie chart)

Figure 7.10 — Disease-area demand growth (chronic, cardiac, ortho, neuro, palliative)

Figure 7.11 — Competitor landscape map (market positions)

Figure 7.12 — Revenue shares — top competitors (bar chart)

Figure 8.1 — Therapeutic equipment market value (USD million) — historical & forecast

Figure 8.2 — Therapeutic equipment by end-user — size & forecast

Figure 8.3 — Therapeutic equipment by distribution — size & forecast

Figure 9.1 — Diagnostic & monitoring market value (USD million) — historical & forecast

Figure 9.2 — Diagnostic & monitoring by end-user — size & forecast

Figure 9.3 — Diagnostic & monitoring by distribution — size & forecast

Figure 10.1 — Mobility assist devices market value (USD million) — historical & forecast

Figure 10.2 — Mobility devices by end-user — size & forecast

Figure 10.3 — Mobility devices by distribution — size & forecast

Figure 11.1 — Consumables & supplies market value (USD million) — historical & forecast

Figure 11.2 — Consumables by end-user — size & forecast

Figure 11.3 — Consumables by distribution — size & forecast

Figure 12.1 — Competitive positioning map (price vs. breadth of portfolio)

Figure 12.2 — Market share concentration (HHI or top-10 share)

Figure 12.3 — Revenue trend comparison — GE HealthCare, Siemens Healthineers, Philips, Medtronic (sample)

Figure 12.4 — Strategic alliances & partnership network (selected players)

Figure 12.5 — Recent developments timeline — major M&A / product launches (selected players)

Figure 13.1 — Report usage & data sources schematic (flow of data and disclaimers)

List of Table

Table 2.1 — Sources of secondary data (industry reports, government data, company filings)

Table 2.2 — Companies interviewed (sample list with sector classification)

Table 2.3 — Breakdown of primary interviews (stakeholder groups, % share)

Table 4.1 — Key market drivers and their relative impact

Table 4.2 — Market challenges and mitigation strategies

Table 4.3 — Opportunity assessment framework

Table 6.1 — Key policy and regulatory guidelines in Bahrain for home healthcare equipment

Table 6.2 — Regulatory approvals required by product type

Table 7.1 — Bahrain home healthcare equipment market size, by value (USD million), 2020–2032

Table 7.2 — Bahrain home healthcare equipment market share, by product type, 2020–2032

Table 7.3 — Bahrain home healthcare equipment market share, by end-user, 2020–2032

Table 7.4 — Bahrain home healthcare equipment market share, by distribution channel, 2020–2032

Table 7.5 — Bahrain home healthcare equipment market share, by disease/clinical area, 2020–2032

Table 7.6 — Market share, by competitors (revenue shares of leading players)

Table 8.1 — Therapeutic equipment market size & forecast, 2020–2032 (USD million)

Table 8.2 — Therapeutic equipment market, by end-user, 2019–2030 (USD million)

Table 8.3 — Therapeutic equipment market, by distribution channel, 2019–2030 (USD million)

Table 9.1 — Diagnostic & monitoring equipment market size & forecast, 2020–2032 (USD million)

Table 9.2 — Diagnostic & monitoring equipment market, by end-user, 2019–2030 (USD million)

Table 9.3 — Diagnostic & monitoring equipment market, by distribution channel, 2019–2030 (USD million)

Table 10.1 — Mobility assist devices market size & forecast, 2020–2032 (USD million)

Table 10.2 — Mobility assist devices market, by end-user, 2019–2030 (USD million)

Table 10.3 — Mobility assist devices market, by distribution channel, 2019–2030 (USD million)

Table 11.1 — Home healthcare consumables & supplies market size & forecast, 2020–2032 (USD million)

Table 11.2 — Home healthcare consumables & supplies market, by end-user, 2019–2030 (USD million)

Table 11.3 — Home healthcare consumables & supplies market, by distribution channel, 2019–2030 (USD million)

Table 12.1 — Company overview: GE HealthCare

Table 12.2 — Company overview: Siemens Healthineers

Table 12.3 — Company overview: Philips

Table 12.4 — Company overview: Medtronic

Table 12.5 — Company overview: Stryker

Table 12.6 — Company overview: Johnson & Johnson (Ethicon/DePuy Synthes)

Table 12.7 — Company overview: BD (Becton, Dickinson and Company)

Table 12.8 — Company overview: Abbott

Table 12.9 — Others — summary of selected players

Top Key Players & Market Share Outlook

- GE HealthCare

- Siemens Healthineers

- Philips

- Medtronic

- Stryker

- Johnson & Johnson (Ethicon/DePuy Synthes)

- BD (Becton

- Dickinson and Company)

- Abbott

- Others

Frequently Asked Questions