India Aluminum Wire Rod Market

Source: The Report Cube

Understand The Key Trends Shaping This Market

Download Free SampleIndia Aluminum Wire Rod Market Insights & Analysis

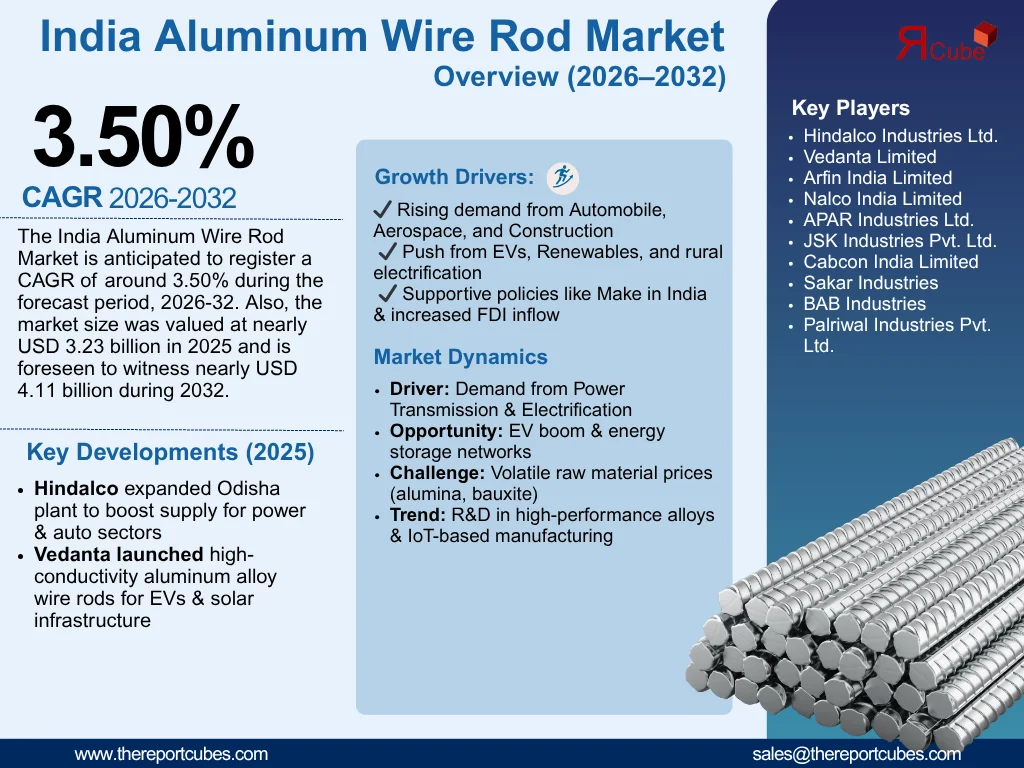

The India Aluminum Wire Rod Market is anticipated to register a CAGR of around 3.50% during the forecast period, 2026-32. Also, the market size is valued at nearly USD 3.23 billion in 2025 and is foreseen to witness nearly USD 4.11 billion during 2032. The market expansion is driven by increasing demand from the automobile, aerospace, and Construction industries.

Aluminum wire rods are major intermediate items utilized in cable production, power transmission, and welding electrodes, due to their outstanding conductivity, corrosion resistance, and lightweight properties, thus enhancing growth. Furthermore, the sturdy progression of infrastructure projects, together with growing electrification in rural & semi-urban India, is substantially driving the India Aluminum Wire Rod Market value.

Also, the impulse toward electric vehicles & renewable energy grids is infusing the ingestion of high-quality aluminum conductors, primarily across the automobile & power sectors. Moreover, the government’s "Make in India" initiative & elevated FDI inflow are also promoting production expansion, generating additional demand for aluminum wire rods in numerous sectors.

Additionally, new advances in technology & the expanding usage of lightweight materials in the automotive & aerospace sectors are generating new prospects for further market expansion. Also, with industries concentrating on recyclable & sustainable aluminum goods, the market is set for development driven by innovation.

Consequently, it is presumed that promising government policies, increasing downstream demand, and rising consciousness of lightweight, energy-efficient materials would all motivate the India Aluminum Wire Rod Market's cost & consumption throughout the forecast period.

India Aluminum Wire Rod Market Upgrades & Recent Developments

2025:

- Hindalco Industries Ltd. declared a capacity development of its aluminum wire rod facility in Odisha, targeting to meet increasing domestic demand in the power & automotive sectors with improved quality & output.

- Vedanta Limited introduced a new range of high-conductivity aluminum alloy wire rods, aiming at the electric vehicle (EV) & solar infrastructure markets with enhanced energy efficiency & performance.

India Aluminum Wire Rod Market Dynamics

-

Driver: Increasing Demand in Power Transmission & Distribution to Drive the Industry Growth

A major driver for the India Aluminum Wire Rod Market is the increasing demand from the power transmission & distribution sector. With expanding urbanization & the government's rural electrification initiatives, the requirement for effective, lightweight, and economical conductors has elevated. Also, aluminum wire rods, being highly conductive & corrosion-resistant, are favored for producing overhead & underground electrical cables. Moreover, the demand is further instigated by infrastructure advancement projects under schemes such as Saubhagya & Deendayal Upadhyaya Gram Jyoti Yojana (DDUGJY), which considerably impact the India Aluminum Wire Rod Market cost & volume progression.

-

Challenge: Instability in Raw Material Expenses to Hamper the Market Demand

A key challenge is the shifting cost of primary aluminum, which is driven by global supply-demand mismatches, energy costs, and geopolitical concerns. For producers of aluminum rod, the instability of raw material prices has a direct impact on valuing policies, manufacturing costs, and profitability. Also, the improbability is further elevated by India's partial reliance on imported alumina & bauxite, which affects manufacturing scheduling & limits the scalability of smaller companies with narrow profit margins.

-

Opportunity: Acceptance of Electric Vehicles (EVs) to Create Prospects

The swift transition to electric vehicles (EVs) provides considerable potential for manufacturers of aluminum wire rod. For augmented energy efficiency, EVs require lightweight materials, and aluminum is vital for battery systems & electrical harnesses. Also, aluminum wire rods would become ever more in demand in EV infrastructure, like charging stations, smart grids, and energy storage, as India strives for an around 30% EV acceptance rate by 2030. Moreover, for precise automotive applications, producers can utilize this trend to generate alloy grades that are custom-made to their needs.

-

Trend: Technical Innovations & Alloy Development to be Trending

High-performance aluminum alloys with enhanced strength, conductivity, and corrosion resistance are becoming more & more prevalent. Also, aiming sectors such as aerospace & electric vehicles, enterprises are investing in R&D to produce specialty aluminum wire rods with superior metallurgical qualities. Moreover, the sector is also shifting due to the acceptance of IoT-based quality monitoring systems & automation in manufacturing. Further, these advancements are probably going to assist in improving the quality of the products, maximizing production efficiency, and raising the rate of the India Aluminum Wire Rod Industry.

India Aluminum Wire Rod Market Segment-Wise Analysis

By Product Type:

- 1024 Type

- 2011 Type

- 6063 Type

- Others

The 6063 Type seizes the biggest share of the India Aluminum Wire Rod Market owing to its outstanding extrudability, corrosion resistance, and high conductivity. Architectural applications, automotive parts, and heat exchangers all make widespread usage of this alloy type. For both indoor & outdoor applications, its lightweight design & high surface finish make it impeccable. Moreover, 6063 aluminum wire rods' leading position in the Indian market is supported by the growing demand for heat-dissipating automobile components & energy-efficient building materials. Also, their recyclability further supports sustainable manufacturing trends, which enhances their appeal across a spectrum of industries.

By Application:

- Aerospace

- Automobile

- Architecture

- Others

The Automobile segment is the dominant application segment in the India Aluminum Wire Rod Market, accounting for the potential market share. The growing demand for automobiles that are lightweight & fuel-efficient is the aspect behind the dominance. The usage of aluminum wire rods in wiring harnesses, motors, connectors, and battery cables is increasing as India rises as a noteworthy center for automobile manufacture. Also, this requirement is further emphasized by the move to electric vehicles, as aluminum parts enhance performance & make vehicles weigh less. In addition, programs such as FAME India & PLI schemes in the automotive sector are encouraging this segment's growth & establishing it as a leading buyer of aluminum wire rods.

What Does Our India Aluminum Wire Rod Market Research Study Entail?

- The India Aluminum Wire Rod Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis puts light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The India Aluminum Wire Rod Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- India Aluminum Wire Rod Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- Market Share, By Product Type

- 1024 Type

- 2011 Type

- 6063 Type

- Others

- Market Share, By Application

- Aerospace

- Automobile

- Architecture

- Others

- Market Share, By Region

- North

- East

- West

- South

- Central

- Market Share, By Competitors

- Competition Characteristics

- Revenue Shares

- India 1024 Type Aluminum Wire Rod Market Overview, 2020-2032F

- By Value (USD Million)

- By Application - Market Size & Forecast 2019-2030, USD Million

- India 2011 Type Aluminum Wire Rod Market Overview, 2020-2032F

- By Value (USD Million)

- By Application - Market Size & Forecast 2019-2030, USD Million

- India 6063 Type Aluminum Wire Rod Market Overview, 2020-2032F

- By Value (USD Million)

- By Application - Market Size & Forecast 2019-2030, USD Million

- India Others Aluminum Wire Rod Market Overview, 2020-2032F

- By Value (USD Million)

- By Application - Market Size & Forecast 2019-2030, USD Million

- Competitive Outlook (Company Profile - Partila List)

- Arfin India Limited

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Cabcon India Limited

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- JSK Industries Pvt. Ltd.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Hindalco Industries Ltd.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Sakar Industries

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- BAB Industries

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Nalco India Limited

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Palriwal Industries Pvt. Ltd.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- APAR Industries Ltd.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Vedanta Limited

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Arfin India Limited

- Contact Us & Disclaimer

List of Figure

Figure 1: Market Segmentation Framework

Figure 2: Breakdown of Primary Interviews (by Designation, Region, and Company Type)

Figure 3: India Aluminum Wire Rod Market Value (USD Billion), 2020–2032

Figure 4: India Aluminum Wire Rod Market Share, by Product Type, 2020 & 2032

Figure 5: India Aluminum Wire Rod Market Share, by Application, 2020 & 2032

Figure 6: India Aluminum Wire Rod Market Share, by Region, 2020 & 2032

Figure 7: Regional Breakdown – North, East, West, South, Central

Figure 8: Market Share of Key Competitors, 2024 (Revenue Share %)

Figure 9: India 1024 Type Aluminum Wire Rod Market Value (USD Million), 2020–2032

Figure 10: India 1024 Type Aluminum Wire Rod Market by Application, 2019–2030

Figure 11: India 2011 Type Aluminum Wire Rod Market Value (USD Million), 2020–2032

Figure 12: India 2011 Type Aluminum Wire Rod Market by Application, 2019–2030

Figure 13: India 6063 Type Aluminum Wire Rod Market Value (USD Million), 2020–2032

Figure 14: India 6063 Type Aluminum Wire Rod Market by Application, 2019–2030

Figure 15: India 'Others' Type Aluminum Wire Rod Market Value (USD Million), 2020–2032

Figure 16: India 'Others' Type Aluminum Wire Rod Market by Application, 2019–2030

Figure 17: Competitive Landscape – Key Strategic Alliances/Partnerships of Major Players

Figure 18: Timeline of Recent Developments by Leading Companies (2022–2025)

List of Table

Table 1: Objectives of the Study

Table 2: Product Definitions & Classification of Aluminum Wire Rods

Table 3: Market Segmentation Overview

Table 4: Study Variables and Their Definitions

Table 5: Key Secondary Data Sources

Table 6: List of Companies Interviewed (Primary Research)

Table 7: Breakdown of Primary Interviews by Stakeholder, Region, and Role

Table 8: Market Drivers – Impact Assessment (2025–2032)

Table 9: Market Challenges – Impact Assessment (2025–2032)

Table 10: Opportunity Assessment Matrix

Table 11: Policy & Regulatory Framework – Key Guidelines & Impact

Table 12: India Aluminum Wire Rod Market Size (USD Billion), 2020–2032

Table 13: India Aluminum Wire Rod Market Share, by Product Type (%), 2020 vs 2032

Table 14: India Aluminum Wire Rod Market Share, by Application (%), 2020 vs 2032

Table 15: India Aluminum Wire Rod Market Share, by Region (%), 2020 vs 2032

Table 16: Competitive Landscape – Revenue Share of Major Players, 2024

Table 17: 1024 Type Aluminum Wire Rod Market Size, by Value (USD Million), 2020–2032

Table 18: 1024 Type Aluminum Wire Rod Market, by Application (USD Million), 2019–2030

Table 19: 2011 Type Aluminum Wire Rod Market Size, by Value (USD Million), 2020–2032

Table 20: 2011 Type Aluminum Wire Rod Market, by Application (USD Million), 2019–2030

Table 21: 6063 Type Aluminum Wire Rod Market Size, by Value (USD Million), 2020–2032

Table 22: 6063 Type Aluminum Wire Rod Market, by Application (USD Million), 2019–2030

Table 23: Others Aluminum Wire Rod Market Size, by Value (USD Million), 2020–2032

Table 24: Others Aluminum Wire Rod Market, by Application (USD Million), 2019–2030

Table 25: Company Profile Overview – Arfin India Limited

Table 26: Company Profile Overview – Cabcon India Limited

Table 27: Company Profile Overview – JSK Industries Pvt. Ltd.

Table 28: Company Profile Overview – Hindalco Industries Ltd.

Table 29: Company Profile Overview – Sakar Industries

Table 30: Company Profile Overview – BAB Industries

Table 31: Company Profile Overview – Nalco India Limited

Table 32: Company Profile Overview – Palriwal Industries Pvt. Ltd.

Table 33: Company Profile Overview – APAR Industries Ltd.

Table 34: Company Profile Overview – Vedanta Limited

Table 35: Strategic Alliances/Partnerships of Key Players (2022–2025)

Table 36: Summary of Recent Developments by Key Companies (2022–2025)

Top Key Players & Market Share Outlook

- Arfin India Limited

- Cabcon India Limited

- JSK Industries Pvt. Ltd.

- Hindalco Industries Ltd.

- Sakar Industries

- BAB Industries

- Nalco India Limited

- Palriwal Industries Pvt. Ltd.

- APAR Industries Ltd.

- Vedanta Limited

- Others

Frequently Asked Questions