Understand The Key Trends Shaping This Market

Download Free SampleIran Computational Fluid Dynamics Market Overview: Market Size & Forecast (2026–2034)

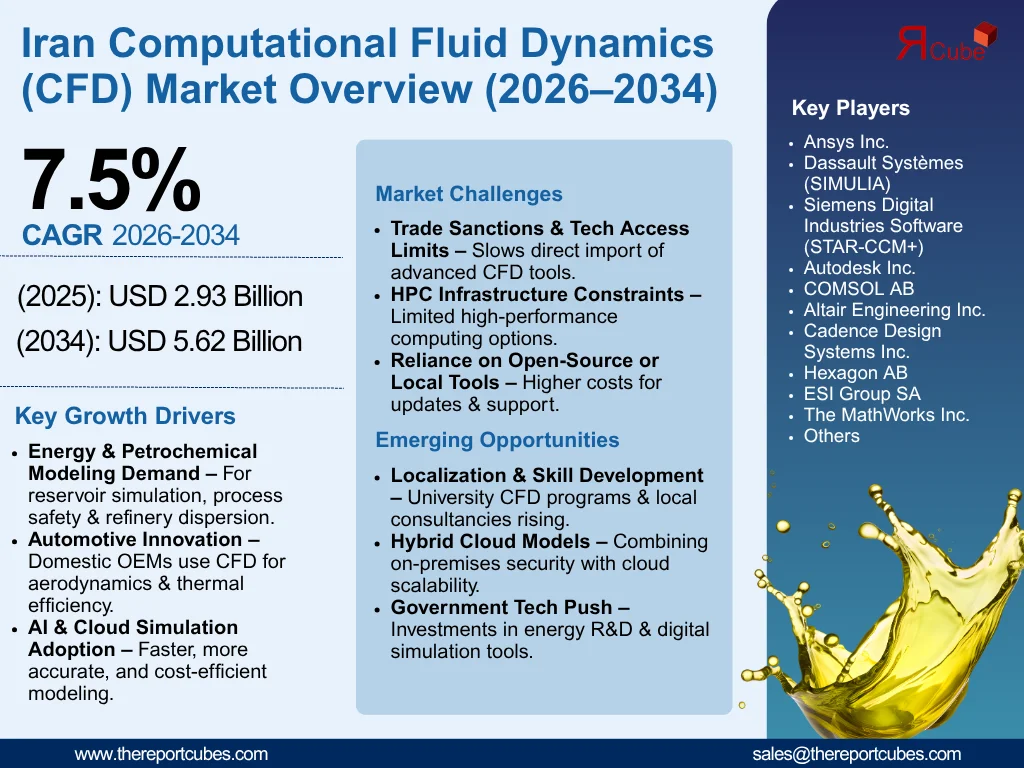

What is the anticipated CAGR & size of the Iran Computational Fluid Dynamics Market?

The Iran Computational Fluid Dynamics Market is anticipated to register a CAGR of around 7.5% during the forecast period, 2026-34. Additionally, the market size was valued at nearly USD 2.93 billion in 2025 and is projected to reach nearly USD 5.62 billion by 2034.

Market Analysis & Insights

The Iran Computational Fluid Dynamics Market is attaining traction from renewed investment in energy, petrochemicals, and vehicle engineering. Local engineering companies, national research institutes, and oil & gas operators progressively utilize CFD for reservoir flow modeling, refinery dispersion studies, and process optimization, minimizing cost & safety risks while complying with stricter environmental controls.

Moreover, global CFD vendors (Ansys, Dassault Systèmes, Siemens, Altair, COMSOL, MathWorks) impact the Iran Computational Fluid Dynamics Market via regional partnerships, training, and reseller networks. Furthermore, commercial licenses, cloud subscriptions, and project-based consultancy are common sales channels. Also, recent vendor releases & platform cloudification in 2025 have reduced obstacles to entry for SMEs & academic teams, augmenting adoption.

Additionally, government prominence in the indigenous tech & energy field development also supports demand. Further, looking ahead, the Iran Computational Fluid Dynamics Market is positioned for swift growth between 2026–2034, instigated by energy-sector modeling requirement & automotive R&D, where computational fluid dynamics would be central to efficacy & safety enhancements.

What is the Impact of AI on the Iran Computational Fluid Dynamics Market?

AI augments CFD workflows in Iran by automating mesh generation, enabling surrogate models for swift design iterations, enhancing turbulence modeling accuracy, and decreasing compute costs, enhancing engineering productivity in oil & gas, automotive, and academic research.

Iran Computational Fluid Dynamics Market Dynamics

What driving factor acts as a positive influencer for the Iran Computational Fluid Dynamics Market?

- Energy & Petrochemical Modeling Demand: The country’s sizeable oil, gas, and petrochemical sectors generate solid, industry-specific demand for Computational Fluid Dynamics. CFD is vital for reservoir flow simulation, multiphase pipeline transport, refinery dispersion, and process safety studies. Further, with ongoing field advancement & investments declared for gas-field development, operators need advanced multiphysics modeling to optimize production & minimize flaring. Thus, this real-world demand drives procurement of licenses, local consultancy projects, and collaboration with global vendors, augmenting industry expansion.

What are the challenges that affect the Iran Computational Fluid Dynamics Market?

- Sanctions, Imports, and Technology Access: International sanctions & trade limitations complicate direct access to several advanced simulation technologies & cloud services in Iran. This results in license procurement challenges, delayed vendor support, and restrictions on high-performance computing procurement. Further, as a consequence, several Iranian organizations depend on domestic software, academic associations, open-source tools, or indirect procurement channels, increasing costs for updates & enterprise support and decelerating seamless incorporation of the newest AI-enabled CFD structures.

How are the future opportunities transforming the market during 2026-34?

- Localization, Service Providers, and Skill Development: The provision of personalized solutions, on-premises placements, training, and data-localization guarantees could assist Iranian consultancies, university spin-offs, and specialized software integrators to land projects. Also, rising local talent (CFD centers, graduate programs) & hybrid business models that combine access to offshore solvers with local pre-/post-processing could enhance Computational Fluid Dynamics Market share in Iran. Further, for local providers, government-backed field development investments (oil & gas) build multi-year service pipelines, which elevated the market growth graph. Additionally, the demands of the market are met by university-led applied CFD research & the Iran CFD Expert Center, further generating prospects.

What market trends are affecting the Iran Computational Fluid Dynamics Market Outlook?

- Cloudification & AI-Accelerated Simulation: Vendors are flowing towards cloud-first, AI-accelerated workflows, offering on-demand compute, automated meshing, decreased turnaround, and physics-informed surrogate models. In 2025, vendor releases & platform updates have accentuated cloud/AI features, making replication more accessible to smaller teams & shortening design cycles. In addition, this trend encourages hybrid usage in Iran, which allows for faster duplication in product & automobile design by utilizing the cloud for unlimited workloads & on-premises for sensitive projects. Further, anticipating a surge in the usage of AI surrogates for quick parameter sweeps & reduced HPC expenses.

How is the Iran Computational Fluid Dynamics Market Defined as per Segments?

The Iran Computational Fluid Dynamics Market Research Reports provide detailed market data & insights in accordance with market segmentation. Some of the segments are:

- Deployment: Cloud-based, On-premises

- End User: Aerospace & defense industry, Automotive Industry, Electrical & Electronics Industry, Others

By Deployment:

The Cloud-based segment is anticipated to grab the potential share of the Iran Computational Fluid Dynamics Market in the following years. Cloud-based utilization is evolving as the foremost segment owing to on-demand compute, decreased upfront HPC investment, and easier access to AI-accelerated solver features. Also, Vendors’ 2025 drives for cloud-enabled workflows & subscription licensing, making cloud CFD appealing for SMEs & research groups across Iran, specifially for non-sensitive petroleum & automotive simulations.

By End User:

The Automotive industry leads the Iran Computational Fluid Dynamics Market by seizing the largest market share. The segment is observed to govern as domestic OEMs (Iran Khodro, Saipa) depend on CFD for aerodynamic design, thermal management, and HVAC/passenger comfort enhancements. Further, Iran’s considerable vehicle production (around 1.0–1.2 million units in recent years) generates incessant R&D demand for simulation, making automotive a major end-user of CFD tools & services. Further, CFD decreases prototype cycles & minimizes production expenses, motivating persistent investment.

Iran Computational Fluid Dynamics Market: What Recent Innovations Are Affecting the Industry?

- 2025: SIMULIA’s released series highlighted performance upgrades in Abaqus, XFlow, and related solvers, accentuating multi-physics workflows & enhanced incorporation on the 3DEXPERIENCE platform.

- 2025: Altair Engineering introduced HyperWorks 2025, emphasizing AI-driven workflows, broader cloud incorporation, and design-informed simulation features to augment virtual prototyping.

What are the Key Highlights of the Iran Computational Fluid Dynamics Market (2026–34)?

- The expanding demand from oil & gas and automotive industries to enhance market progression.

- The Iran Computational Fluid Dynamics Market is anticipated to attain a market size of about USD 5.62 billion by 2034, further estimating a CAGR of nearly 7.5% during 2026-34.

- Cloud-based & AI-accelerated CFD are flourishing owing to 2025 vendor releases.

- Localization & university–industry collaboration to form a resilient supply chain.

How does the Future Outlook of the Iran Computational Fluid Dynamics Market (2034) Appears?

Through the projected year, 2034, the Iran Computational Fluid Dynamics Market is witnessed to showcase swift growth, driven by energy-sector modeling, automotive R&D, and broader AI-enabled simulation adoption. Further, expect hybrid cloud/on-premises models, stronger local service providers, and quicker design cycles via AI surrogates, hence enhancing the market landscape. Moreover, projected national adoption would also align with global CFD growth trends & increasing industrial digitalization, thus creating opportunities for the Computational Fluid Dynamics Market in Iran during the forecast period.

What Does Our Iran Computational Fluid Dynamics Market Research Study Entail?

- The Iran Computational Fluid Dynamics Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis & market scope sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The Iran Computational Fluid Dynamics Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the Study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Breakdown of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- Iran Computational Fluid Dynamics Market Overview

- Market Size, By Value (USD Billion)

- Market Share, By Deployment

- Cloud-based

- On-premises

- Market Share, By End User

- Aerospace & defense industry

- Automotive Industry

- Electrical & Electronics Industry

- Others

- Market Share, By Company

- Revenue Shares

- Competition Characteristics

- Iran Cloud-based Computational Fluid Dynamics Market Overview, 2026–2034

- By Value (USD Billion)

- Iran On-premises Computational Fluid Dynamics Market Overview, 2026–2034

- By Value (USD Billion)

- Iran Computational Fluid Dynamics Market Overview, By End User, 2026–2034

- Iran Aerospace & defense industry Computational Fluid Dynamics Market Overview, 2026–2034

- By Value (USD Billion)

- Iran Automotive Industry Computational Fluid Dynamics Market Overview, 2026–2034

- By Value (USD Billion)

- Iran Electrical & Electronics Industry Computational Fluid Dynamics Market Overview, 2026–2034

- By Value (USD Billion)

- Iran Others Computational Fluid Dynamics Market Overview, 2026–2034

- By Value (USD Billion)

- Iran Aerospace & defense industry Computational Fluid Dynamics Market Overview, 2026–2034

- Competitive Outlook (Company Profiles)

- Ansys Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Dassault Systèmes (SIMULIA)

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Siemens Digital Industries Software (STAR-CCM+)

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Autodesk Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- COMSOL AB

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Altair Engineering Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Cadence Design Systems Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Hexagon AB

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- ESI Group SA

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- The MathWorks Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Ansys Inc.

- Contact Us & Disclaimer

List of Figure

Figure 1: Research Design and Methodology Flowchart

Figure 2: Data Triangulation Process

Figure 3: Breakdown of Primary Interviews (by Company, Designation, and Region)

Figure 4: Global Computational Fluid Dynamics (CFD) Market Snapshot, 2024

Figure 5: Iran Computational Fluid Dynamics Market Size, 2025–2034 (USD Billion)

Figure 6: Iran CFD Market Share, by Deployment, 2024 (%)

Figure 7: Iran CFD Market Share, by Deployment Type (Cloud-based vs. On-premises), 2024–2034 (USD Billion)

Figure 8: Iran Cloud-based CFD Market Size Forecast, 2026–2034 (USD Billion)

Figure 9: Iran On-premises CFD Market Size Forecast, 2026–2034 (USD Billion)

Figure 10: Iran CFD Market Share, by End User, 2024 (%)

Figure 11: Iran Aerospace & Defense Industry CFD Market Size, 2026–2034 (USD Billion)

Figure 12: Iran Automotive Industry CFD Market Size, 2026–2034 (USD Billion)

Figure 13: Iran Electrical & Electronics Industry CFD Market Size, 2026–2034 (USD Billion)

Figure 14: Iran CFD Market Size – Other End Users, 2026–2034 (USD Billion)

Figure 15: Market Drivers of Iran Computational Fluid Dynamics Market

Figure 16: Market Challenges in the Iran CFD Market

Figure 17: Opportunity Assessment Matrix for Iran CFD Market

Figure 18: Recent Trends and Technological Advancements in CFD Applications

Figure 19: Policy and Regulatory Framework for Computational Fluid Dynamics in Iran

Figure 20: Competitive Landscape: Market Share of Key Companies (%)

Figure 21: Company Revenue Share Analysis, 2024 (%)

Figure 22: Competitive Positioning of Major Players (Ansys, Dassault Systèmes, Siemens, etc.)

Figure 23: Strategic Alliances and Partnerships Map (2022–2025)

Figure 24: Product Portfolio Comparison of Leading Players

Figure 25: Growth Opportunities in Cloud-based CFD Solutions

Figure 26: Future Outlook and Forecast Summary, 2026–2034

List of Table

Table 1: Objective and Scope of the Study

Table 2: Definition and Classification of Computational Fluid Dynamics (CFD) Solutions

Table 3: Market Segmentation of the Iran CFD Market

Table 4: Study Variables and Key Parameters Considered

Table 5: List of Secondary Data Sources and References

Table 6: List of Companies Interviewed during Primary Research

Table 7: Breakdown of Primary Interviews (by Company Type, Designation, and Region)

Table 8: Key Assumptions and Limitations of the Study

Table 9: Iran Computational Fluid Dynamics Market Size, 2025–2034 (USD Billion)

Table 10: Iran CFD Market Share, by Deployment Type, 2024 (%)

Table 11: Iran Cloud-based CFD Market Forecast, 2026–2034 (USD Billion)

Table 12: Iran On-premises CFD Market Forecast, 2026–2034 (USD Billion)

Table 13: Iran CFD Market Share, by End User, 2024 (%)

Table 14: Iran Aerospace & Defense Industry CFD Market Size, 2026–2034 (USD Billion)

Table 15: Iran Automotive Industry CFD Market Size, 2026–2034 (USD Billion)

Table 16: Iran Electrical & Electronics Industry CFD Market Size, 2026–2034 (USD Billion)

Table 17: Iran Others End User CFD Market Size, 2026–2034 (USD Billion)

Table 18: Key Market Drivers – Impact Analysis (High/Medium/Low)

Table 19: Market Challenges – Impact Assessment

Table 20: Opportunity Assessment Matrix for Iran CFD Market

Table 21: Summary of Recent Trends and Technological Developments

Table 22: Policy and Regulatory Guidelines Impacting the CFD Market in Iran

Table 23: Competitive Landscape: Revenue Share of Leading Companies, 2024 (%)

Table 24: Comparative Analysis of Top 10 Market Players (Ansys, Dassault Systèmes, Siemens, Autodesk, etc.)

Table 25: Strategic Partnerships and Alliances of Key Players (2020–2025)

Table 26: Product/Software Portfolio of Major CFD Companies

Table 27: SWOT Analysis of Leading Companies

Table 28: Key Recent Developments and Product Launches by Major Companies

Table 29: Future Outlook: Market Forecast Summary, 2026–2034 (USD Billion)

Table 30: Research Findings and Analyst Recommendations

Top Key Players & Market Share Outlook

- Ansys Inc.

- Dassault Systèmes (SIMULIA)

- Siemens Digital Industries Software (STAR-CCM+)

- Autodesk Inc.

- COMSOL AB

- Altair Engineering Inc.

- Cadence Design Systems Inc.

- Hexagon AB

- ESI Group SA

- The MathWorks Inc.

- Others

Frequently Asked Questions