Understand The Key Trends Shaping This Market

Download Free SampleLatin America Bakery Products Market Insights & Analysis

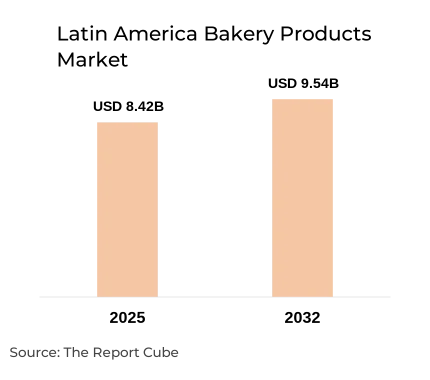

The Latin America Bakery Products Market Report reached a value of nearly USD 8.42 billion in 2025. The market is assessed to grow at a CAGR of around 1.8%, during the forecast period of 2025-2032 to attain a value of around USD 9.54 billion in 2032. It is predicted that the industry would experience substantial growth owing to changing customer tastes, increasing urbanization, and altering regional food consumption trends. Also, the dynamic landscape of the Latin America Bakery Products Market is marked by rising middle-class populations, mounting disposable incomes, and an increasing requirement for inventive & convenient bakery items.

Additionally, the industry is escalating considerably, owing to customers' elevated interest in high-end, health-conscious, and artisanal bakery items. Moreover, modern production techniques, a variation of product developments, and the region's rich culinary legacy are all contributing to the many chances for market applicants to increase their market share.

Furthermore, aspects such as advancing e-commerce platforms, new retail formats, and growing investment in product development are estimated to motivate Latin America Bakery Products Market growth. Also, the market seems to have bright future possibilities. Further, the industry is projected to upscale tremendously in the upcoming years in line with a trend towards organic & natural ingredients, packaging innovations, and technical advancements in food processing.

Latin America Bakery Products Market Upgrades & Recent Developments

2024:

- Grupo Bimbo introduced a new line of functional bread products with added nutritional benefits aimed at health-conscious customers.

- Empresas Carozzi SA expanded its gluten-free product range, addressing rising dietary preferences.

2025:

- Barry Callebaut AG launched sustainable chocolate ingredients for bakery products, stressing environmental responsibility.

- Arcor Group applied advanced manufacturing technologies to improve production efficacy & product quality.

Latin America Bakery Products Market Dynamics

- Shifting Customer Preferences to Elevate Market Demand: The Latin America Bakery Products Market is undergoing a substantial revolution driven by emerging customer tastes. Growing health awareness, rising requirements for convenient food options, and increasing preference for premium & artisanal products are driving market expansion.

- Fluctuating Raw Material Costs to Impede Market Growth: Unstable costs of major ingredients, such as wheat, sugar, and dairy, present challenges for producers. Also, these price variations can impact production costs & possibly affect product valuing strategies.

- Growing Product Innovation to Open New Avenues: There is a significant possibility for developing innovative bakery items that cater to developing consumer demands like plant-based, gluten-free, and functional food offerings.

Latin America Bakery Products Market Segment-wise Analysis

By Product Type:

- Bread

- Cakes & Pastries

- Biscuits & Cookies

- Other Bakery Products

The Biscuits segment is the most prominent in the Latin America Bakery Products Market, with the largest market share. Marie biscuits, Cream biscuits, glucose biscuits, and other kinds of crackers are among the widespread variety of biscuits that fall under this segment. Convenience, affordability, and broad appeal across age & socioeconomic categories are the factors behind the biscuits' prevalent acceptance.

Moreover, the demand for cream & glucose biscuits has been exceptionally high owing to their perceived nutritional benefits & adaptability. As customer preferences change, the industry has observed new flavors, healthier formulas, and container designs. Further, to draw in health-conscious consumers, producers are engaged in creating goods with less sugar, organic components, and useful features.

Country Projection of the Latin America Bakery Products Industry

The Latin America Bakery Products Market is geographically diversified, covering:

- Brazil

- Mexico

- Argentina

- Chile

- Others

Brazil to uphold the potential share of the Latin America Bakery Products Market. The country's market dominance is a result of its substantial population, robust economic foundation, and wide-ranging culinary traditions. Brazilian citizens embrace cosmopolitan & new products, but they also display a solid preference for classic bread items. Also, local baking customs & contemporary culinary trends coexist across the Brazilian market.

Furthermore, the demand for high-end, artisanal, and health-conscious bakery items is emerging in leading regions, such as São Paulo & Rio de Janeiro. Also, the competitive landscape & innovation potential of the industry are further heightened by the presence of powerful local producers & global corporations.

Top Companies in Latin America Bakery Products Market

Understand The Key Trends Shaping This Market

Download Sample ReportWhat Does Our Latin America Bakery Products Market Research Study Entail?

- The Latin America Bakery Products Market Research Report highlights the forecast growth rate or CAGR by anticipating the market size & share.

- The market analysis puts light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The Latin America Bakery Products Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- Latin America Bakery Products Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- Market Share, By Product Type

- Bread

- Cakes & Pastries

- Biscuits & Cookies

- Other Bakery Products

- Market Share, By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Independent Retailers

- Special Stores

- Online

- Others

- Market Share, By Region

- Brazil

- Mexico

- Argentina

- Chile

- Others

- Market Share, By Competitors

- Competition Characteristics

- Revenue Shares

- Latin America Bread Bakery Products Market Overview, 2020-2032F

- By Value (USD Million)

- By Distribution Channel- Market Size & Forecast 2019-2030, USD Million

- Latin America Cakes & Pastries Bakery Products Market Overview, 2020-2032F

- By Value (USD Million)

- By Distribution Channel- Market Size & Forecast 2019-2030, USD Million

- Latin America Biscuits & Cookies Bakery Products Market Overview, 2020-2032F

- By Value (USD Million)

- By Distribution Channel- Market Size & Forecast 2019-2030, USD Million

- Latin America Other Bakery Products Bakery Products Market Overview, 2020-2032F

- By Value (USD Million)

- By Distribution Channel- Market Size & Forecast 2019-2030, USD Million

- Competitive Outlook (Company Profile - Partial List)

- Grupo Bimbo

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Empresas Carozzi SA

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Barry Callebaut AG

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Arcor Group

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Others

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Grupo Bimbo

- Contact Us & Disclaimer

Top Key Players & Market Share Outlook

- Grupo Bimbo

- Empresas Carozzi SA

- Barry Callebaut AG

- Arcor Group

- Others

Frequently Asked Questions