Understand The Key Trends Shaping This Market

Download Free SampleWhat Is the South America Medical Device Connectivity Market Size & Value?

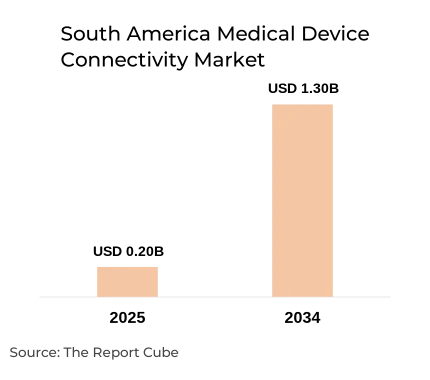

The South America Medical Device Connectivity Market is anticipated to register a CAGR of around 23.1% during the forecast period, 2026-34. Additionally, the market size was valued at nearly USD 0.20 billion in 2025 and is projected to reach almost USD 1.30 billion by 2034.

South America Medical Device Connectivity Market Key Highlights

- The South America Medical Device Connectivity Market is rapidly expanding, led by the demands from hospitals across Brazil & Argentina.

- Market drivers include Electronic Health Records (EHR) incorporation, interoperability, and constant patient monitoring data demand.

- Components segment comprises integration solutions, hardware, and services, fostering managed connectivity & cybersecurity growth.

- Wireless & IoT technologies govern, with wireless patient monitors enabling AI analytics & cloud platforms.

- Application segments cover ICU, ventilation, infusion pumps, and imaging linked to HL7 FHIR standards incorporation.

- Brazil to dominate regionally.

South America Medical Device Connectivity Market Dynamics

What is the key driver of the South America Medical Device Connectivity Market?

Strong EHR-Driven Digitalization to Act as a Core Demand Driver: Rapid hospital digital transformation in Brazil, Argentina, and Chile is augmenting Electronic Health Records (EHR) incorporation, encouraging hospitals to invest in medical device integration solutions in South America that restructure patient monitoring data flows into unified records for better clinical workflow efficacy. Also, this dynamic directly enhances the South America Medical Device Connectivity Market size, with hospitals prioritizing medical device data integration, hospitals, and standards-based interoperability in healthcare deploying HL7 FHIR standards.

What are the major challenges that affect the South America Medical Device Connectivity Industry?

Regulatory Fragmentation & Cybersecurity Burden as a Structural Challenge: Varied national standards & uneven telemedicine legislation in Brazil obstruct cross-border deployments, while accelerating cyber events encourage providers to spend extensively in cybersecurity for linked medical devices & compliant cloud-based medical device platforms. Also, these demands put a strain on finances, hamper South America's adoption of IoT in healthcare, and make it challenging for major market companies to offer safe, compatible solutions that are in line with Latin American medical device connection trends.

What are the future opportunities in the South America Medical Device Connectivity Market during 2026-34?

Home-Based Chronic Care as an Expanding Connectivity Opportunity: Escalating chronic disease management requirements are opening robust opportunities in remote patient monitoring across South America, predominantly via wireless patient monitors & telehealth solutions. Also, vendors providing bundled medical device incorporation services & home-ready cloud-based medical device platforms could tap the fast-growing wireless medical device industry, expanding the Brazil connected medical devices market model across the region.

What trends are affecting the South America Medical Device Connectivity Market Outlook?

Shift Toward Wireless & Standards-Based Ecosystems as a Defining Trend: Hospitals in South America are progressively adopting healthcare IoT architectures, featuring wireless patient monitors & interoperable gateways following HL7 FHIR standards. Also, this incorporation improves real-time patient data sharing, streamlines clinical workflow efficiency, and strengthens Electronic Health Records (EHR) incorporation, driving flexibility & multi-vendor interoperability, which considerably encourages the South America Medical Device Connectivity Market & supports Latin America medical device connectivity trends toward cohesive healthcare systems.

South America Medical Device Connectivity Industry Analysis (2026–2034)

Medical device connectivity in South America is the procedure of connecting sensors & medical equipment in homes & hospitals to IT systems, deploying technologies that allow real-time data transmission, specifically through the incorporation of Electronic Health Records (EHR) & adherence to HL7 FHIR standards. Through 2034, the South America Medical Device Connectivity Market is destined for substantial growth, powered by hospitals' digital transformation, demand for interoperability in healthcare, integration services, and the rise of wireless patient monitors & cloud-based medical device platforms.

Moreover, the South America Medical Device Connectivity Market is profitable owing to increasing investments in medical device integration solutions across South America, government digital health initiatives such as Brazil’s National Health Data Network, and wider acceptance of telemedicine regulation in Brazil & telehealth solutions across Latin America. Nonetheless, the market still faces challenges from uneven regulations & cost-sensitive healthcare systems. The major industries impacted by these hindrances are healthcare IT, device manufacturing, and telehealth services. Moreover, leading companies like Cisco, GE Healthcare, and Philips are modernizing with new connectivity platforms & partnerships in 2024-2025.

Furthermore, the Medical Device Connectivity Market expansion in South America is boosted by escalating chronic disease management, expanding remote patient monitoring, and healthcare IoT deployment across South America’s developing medical infrastructure. Also, the South America Medical Device Connectivity Industry size is expected to substantially increase, driven by technology adoption & governmental healthcare modernization policies improving clinical workflow efficiency & secure medical device data incorporation in hospital ecosystems, highlighting the region’s strategic prominence in the future years.

What is the Impact of AI in the South America Medical Device Connectivity Market?

AI enhances the South America Medical Device Connectivity Market by improving device data analytics & clinical decision support. Also, potential projects such as AI-powered predictive patient monitoring systems introduced by GE Healthcare in Brazil & Philips’ AI-based alarm management solutions enhancing workflow efficacy in the South American hospitals & other medical sectors.

How are the South America Medical Device Connectivity Market Segments Defined?

The South America Medical Device Connectivity Market Research Reports provide detailed market data & insights in accordance with market segmentation. Some of the segments are:

- Product & Services: Medical Device Connectivity Solutions, Medical Device Connectivity Services

- Technology: Wireless Technologies, Hybrid Technologies, Wired Technologies

By Product & Services:

Medical Device Connectivity Solutions governs with about a potential market share owing to hospitals emphasizing on Electronic Health Records (EHR) incorporation, seamless patient monitoring data, and clinical workflow efficacy. Also, these solutions are vital in medical device integration solutions & instigate the South America Medical Device Connectivity Market.

By Technology:

Wireless Technologies dominate the South America Medical Device Connectivity Industry, commanding for largest market share, enabling mobility & remote monitoring with wireless patient monitors. Also, wireless adoption augments healthcare IoT & robust cloud-based medical device platforms supporting telehealth solutions in South America.

South America Medical Device Connectivity Industry: Regional Insights

The South America Medical Device Connectivity Market is geographically diversified, covering:

- Brazil

- Argentina

- Colombia

- Venezuela

- Peru

- Chile

- Rest of South America

The Brazil Medical Device Connectivity Market leads with a substantial share of the regional industry, driven by big healthcare systems, a robust Brazil connected medical devices market, and initiatives such as the telemedicine regulations. Also, it anchors medical device incorporation services & innovation hubs for clinical workflow efficiency across South America.

South America Medical Device Connectivity Market: What Recent Innovations Are Affecting the Industry?

- 2025: Infosys introduced an advanced cloud-based medical device platform for real-time patient monitoring data in Brazil.

- 2025: Lantronix deployed secure medical device integration services enabling wireless patient monitors & HL7 FHIR standards in Argentina.

How does the South America Medical Device Connectivity Market (2034) Future Outlook Appear?

Sustained Growth: The South America Medical Device Connectivity Market size would augment owing to chronic disease management & digital health investments. By 2034, the market is foreseen to record a CAGR of about 23.1% and achieve a market value of around USD 1.30 billion.

Technological Upgrade: Massive migration to interoperable, AI-ready, cloud-powered devices leveraging HL7 FHIR standards.

Future Opportunities: Incorporation services, advanced monitoring, and Brazilian regulatory leadership would shape industry growth, creating profitable prospects.

What Does Our South America Medical Device Connectivity Market Research Study Entail?

- The South America Medical Device Connectivity Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis & market scope sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The South America Medical Device Connectivity Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the Study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Breakdown of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- South America Medical Device Connectivity Market Overview (2020-2034)

- Market Size, By Value (USD Billion)

- Market Share, By Product & Services

- Medical Device Connectivity Solutions

- Medical Device Connectivity Services

- Market Share, By Technology

- Wireless Technologies

- Hybrid Technologies

- Wired Technologies

- Market Share, By Application

- Vital Signs and Patient Monitors

- Anesthesia Machines and Ventilators

- Infusion Pumps

- Others

- Market Share, By End-User

- Hospitals

- Ambulatory Surgical Centres

- Imaging and Diagnostic Centres

- Homecare Settings

- Market Share, By Country

- Brazil

- Argentina

- Colombia

- Venezuela

- Peru

- Chile

- Rest of South America

- Market Share, By Company

- Revenue Shares

- Competition Characteristics

- South America Medical Device Connectivity Market Overview, By Product & Services

- By Value (USD Billion)

- Medical Device Connectivity Solutions Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Medical Device Connectivity Services Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- South America Medical Device Connectivity Market Overview, By Technology

- Wireless Technologies Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Hybrid Technologies Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Wired Technologies Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Wireless Technologies Market Overview

- South America Medical Device Connectivity Market Overview, By Application

- Vital Signs and Patient Monitors Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Anesthesia Machines and Ventilators Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Infusion Pumps Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Others Application Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Vital Signs and Patient Monitors Market Overview

- South America Medical Device Connectivity Market Overview, By End-User

- Hospitals Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Ambulatory Surgical Centres Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Imaging and Diagnostic Centres Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Homecare Settings Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Hospitals Market Overview

- South America Medical Device Connectivity Market Overview, By Country

- Brazil Medical Device Connectivity Market Overview, 2020-2034F

- Market Share, By Product & Services

- Market Share, By Technology

- Market Share, By Application

- Market Share, By End-User

- Argentina Medical Device Connectivity Market Overview, 2020-2034F

- Market Size, By Value (USD Billion)

- Market Share, By Product & Services

- Market Share, By Technology

- Market Share, By Application

- Market Share, By End-User

- Colombia Medical Device Connectivity Market Overview, 2020-2034F

- Market Size, By Value (USD Billion)

- Market Share, By Product & Services

- Market Share, By Technology

- Market Share, By Application

- Market Share, By End-User

- Venezuela Medical Device Connectivity Market Overview, 2020-2034F

- Market Size, By Value (USD Billion)

- Market Share, By Product & Services

- Market Share, By Technology

- Market Share, By Application

- Market Share, By End-User

- Peru Medical Device Connectivity Market Overview, 2020-2034F

- Market Size, By Value (USD Billion)

- Market Share, By Product & Services

- Market Share, By Technology

- Market Share, By Application

- Market Share, By End-User

- Chile Medical Device Connectivity Market Overview, 2020-2034F

- Market Size, By Value (USD Billion)

- Market Share, By Product & Services

- Market Share, By Technology

- Market Share, By Application

- Market Share, By End-User

- Rest of South America Medical Device Connectivity Market Overview, 2020-2034F

- Market Size, By Value (USD Billion)

- Market Share, By Product & Services

- Market Share, By Technology

- Market Share, By Application

- Market Share, By End-User

- Brazil Medical Device Connectivity Market Overview, 2020-2034F

- Competitive Outlook (Company Profiles)

- Infosys

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Lantronix

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- S3 Connected Health

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Iatric Systems Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Silex Technology Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- True Process

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Medicollector LLC

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Cerner Corporation

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Capsule Technologies Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Others

- Infosys

- Contact Us & Disclaimer

Top Key Players & Market Share Outlook

- Infosys

- Lantronix

- S3 Connected Health

- Iatric Systems Inc.

- Silex Technology Inc.

- True Process

- Medicollector LLC

- Cerner Corporation

- Capsule Technologies Inc.

- Others

Frequently Asked Questions