Understand The Key Trends Shaping This Market

Download Free SampleSaudi Arabia Apparel Market Insights & Analysis

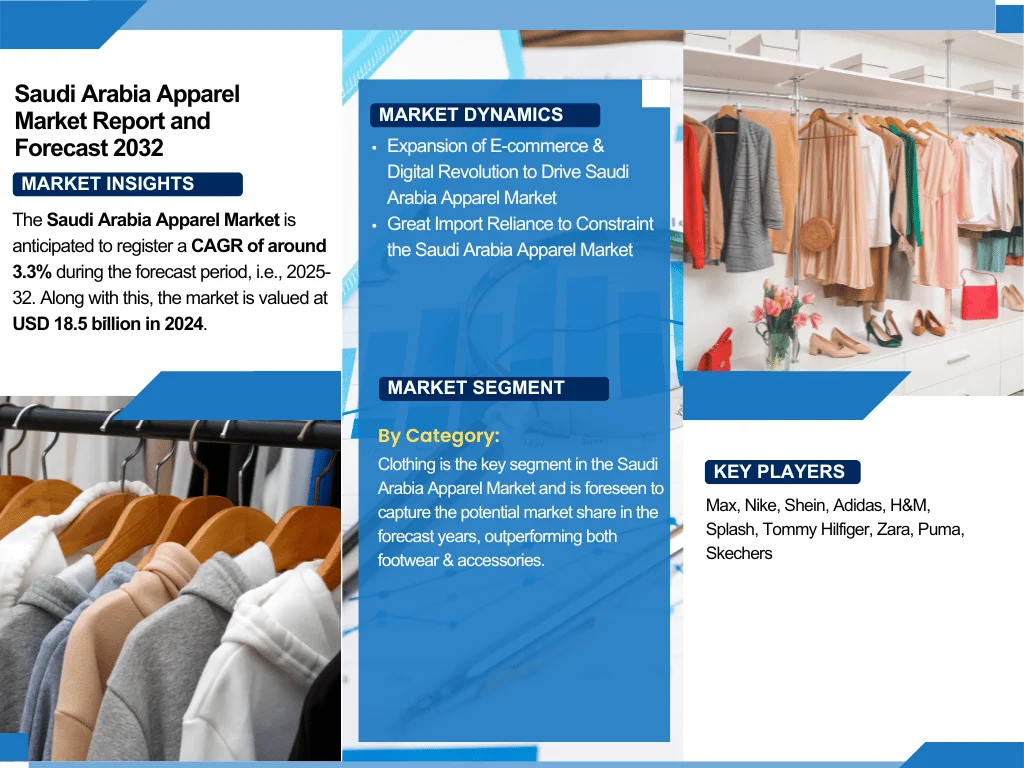

The Saudi Arabia Apparel Market is anticipated to register a CAGR of around 3.3% during the forecast period, i.e., 2025-32. Along with this, the market is valued at USD 18.5 billion in 2024. The Saudi Arabia Apparel Market is a vibrant & fast-moving industry, compelled by changing consumer preferences, economic diversification attempts, and a rising young population with more disposable cash. Casual wear, formal wear, sportswear, luxury fashion, and traditional attire, including thobes & abayas are among the industry's various categories. The surge of e-commerce has had a great impact on purchasing habits, with leading online merchants & foreign companies spreading their digital presence across the Kingdom of Saudi Arabia.

Moreover, government programs like Vision 2030 have played a vital role in reshaping the retail sector by reassuring foreign investment, developing infrastructure, and mounting tourism, resulting in upscaled demand for both global & local fashion brands. Also, the Saudi Arabia Apparel Market is inclining towards sustainability, with an increasing interest in eco-friendly fabrics & ethical fashion processes. In recent years, the growing influence of Western fashion trends, combined with a preference for modest clothing, has resulted in the formation of contemporary designs that fuse tradition with modernity. Furthermore, luxury fashion producers have also revealed a profitable market in Saudi Arabia, notably in places like Riyadh & Jeddah, where high-net-worth individuals drive demand for luxury apparel & accessories.

Additionally, the rising impact of social media & influencer marketing has largely influenced fashion trends, elevating brand awareness among Saudi customers & inspiring them to embrace new styles. Also, the rapid development of shopping malls, the entry of international retail brands, and the advent of local fashion designers have generated a highly competitive industry where innovation & branding are vital for success. Further, as the economy continues to emerge, digital transformation accelerates, and cultural openness grows, the Saudi Arabia Apparel Market is set for sustained expansion, appealing both international & local brands keen to capitalize on the nation's evolving fashion landscape.

Saudi Arabia Apparel Market Dynamics

- Expansion of E-commerce & Digital Revolution to Drive Saudi Arabia Apparel Market

E-commerce & digital revolution are driving the Saudi Arabia Apparel Market. With increasing internet penetration, smartphone usage, and a tech-savvy population, online shopping has gained traction. Prominent retailers & multinational companies are enhancing their digital presence with e-commerce platforms, smartphone apps, and social media marketing. Moreover, developments in logistics, digital payment technology, and AI-powered tailored shopping experiences are making online transactions easier. Furthermore, the Saudi government's Vision 2030 project, which supports digital transformation, is hastening the sector's expansion. Therefore, the garment market is inclining towards omnichannel commerce to meet shifting customer needs.

- Great Import Reliance to Constraint the Saudi Arabia Apparel Market

The Saudi Arabia Apparel Market is hindered by its high import reliance, as the country substantially relies on foreign producers for clothes & textiles. Owing to a lack of domestic production & raw resources, the companies are exposed to global supply chain disruptions, fluctuating import prices, and trade laws. Moreover, high customs & transportation prices raise retail prices, reducing customers' affordability. While Vision 2030 steps are being implemented to enhance local manufacturing, the sector's expansion potential is still hampered by the dominance of multinational brands & reliance on imports.

Saudi Arabia Apparel Market Segment-wise Analysis

By Category:

- Clothing

- Footwears

- Accessories

Clothing is the key segment in the Saudi Arabia Apparel Market and is foreseen to capture the potential market share in the forecast years, outperforming both footwear & accessories. Furthermore, in 2024, the apparel industry is predicted to generate roughly USD 19.35 billion, with women's apparel grabbing nearly USD 7.90 billion. This dominance is reinforced by the Kingdom's plans under Vision 2030, which seek to diversify the economy & develop the fashion sector. Also, footwear & accessories, on the other hand, are anticipated to upsurge, with their market share upscaling in the coming years.

What Does Our Saudi Arabia Apparel Market Research Study Entail?

- Saudi Arabia Apparel Market Research Report highlights the forecast growth rate or CAGR by anticipating the market size & share.

- The market analysis puts light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The Saudi Arabia Apparel Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- Saudi Arabia Apparel Market Overview (2020-2032)

- Market Size, By Value (USD Billions)

- Market Share, By Category

- Clothing

- Footwear

- Accessories

- Market Share, By Company

- Revenue Shares

- Competition Characteristics

- Competitive Outlook (Company Profile - Partial List)

- Max

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Nike

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Adidas

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- H&M

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Splash

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Tommy Hilfiger

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Zara

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Puma

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Skechers

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Max

- Contact Us & Disclaimer

Top Key Players & Market Share Outlook

- Max

- Nike

- Shein

- Adidas

- H&M

- Splash

- Tommy Hilfiger

- Zara

- Puma

- Skechers

- Others

Frequently Asked Questions