Saudi Arabia Dates Market

Source: The Report Cube

Understand The Key Trends Shaping This Market

Download Free SampleSaudi Arabia Dates Market Insights & Analysis

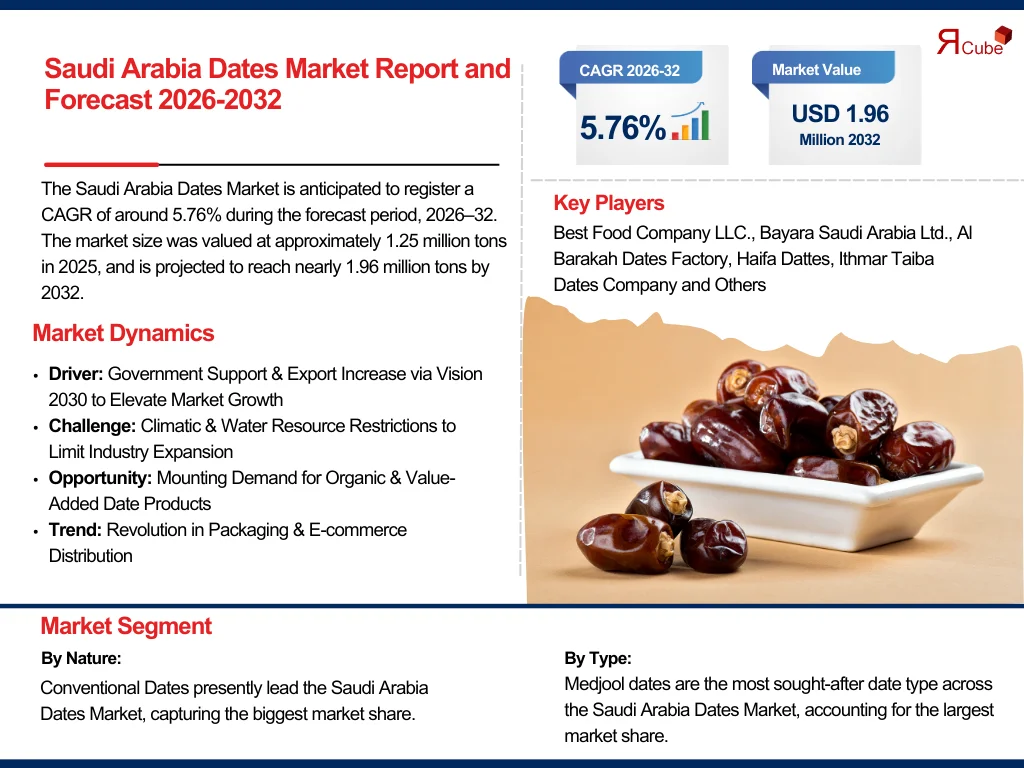

The Saudi Arabia Dates Market is anticipated to register a CAGR of around 5.76% during the forecast period, 2026–32. The market size was valued at approximately 1.25 million tons in 2025, and is projected to reach nearly 1.96 million tons by 2032. The market is instigated by mounting demand for high-quality fresh dates, strong domestic consumption, and robust export potential. Also, being one of the world’s top date producers, Saudi Arabia is regarded as a home to over 400 varieties of dates. The most widespread varieties, both domestically & internationally, are Sukkary dates & Medjool dates, which are aiding the market in gaining tremendous traction.

Moreover, the Saudi Arabia Dates Market has been advancing from promising government policies, such as the Kingdom’s Vision 2030 initiatives focused on improving non-oil exports. Also, regions, including Al Qassim, Madinah, and Riyadh, have evolved as key hubs of production owing to favorable climatic & soil conditions for date palm cultivation. Further, the nation produces over 1.5 million metric tons annually, making it the second-largest producer of dates globally.

Furthermore, the major developments across the country have augmented the Saudi Arabia Dates Market growth. The Ministry of Environment, Water and Agriculture (MEWA) introduced a blockchain-enabled traceability system to ensure the production procedures meet global food safety standards, improving the demand for high-quality Saudi dates in premium industries. Along with this, a new international alliance between Saudi Arabia’s National Center for Palms and Dates (NCPD) & international retailers facilitated in expansion of distribution channels across the landscape of Europe & Asia.

In addition, amplified requirements for organic dates, increasing global awareness of the health benefits of dates, and modernization in the Saudi Arabia Dates Market packaging have played a fundamental role in heightening exports. Also, key players are concentrating on automation & advanced sorting technologies to ensure quality stability & enhance processing efficacy.

Consequently, the Saudi Arabia Dates Market’s future remains optimistic with increasing investments in sustainable farming, technical upgrades, and premium product offerings. Also, Saudi Arabia is presumed to further consolidate its position across the Global Date Market, leveraging its broad range of fresh dates, enriched logistics, and government-backed trade missions. Further, the emphasis on branding Saudi Arabian dates as a symbol of cultural heritage & quality is likely to motivate market development in the following years.

Saudi Arabia Dates Market Upgrades & Recent Developments

2025:

- Best Food Company LLC. launched a new AI-powered grading system to enhance the uniformity & speed of sorting high-quality fresh dates, specifically aiming premium segments in European markets.

- Ithmar Taiba Dates Company signed a strategic partnership with a German organic food chain to expand the export of organic Sukkary dates, empowering better access to Western Europe’s health-conscious consumer base.

Saudi Arabia Dates Market Dynamics

-

Driver: Government Support & Export Increase via Vision 2030 to Elevate Market Growth

Saudi Arabia’s Vision 2030 has considerably prioritized the agricultural sector, particularly the Saudi Arabia Dates Market, targeting to make it a keystone of non-oil exports. Also, significant investment, international trade promotion, and infrastructure developments, including cold storage logistics & export-certified packing houses, are allowing the export of fresh dates to newer markets. Moreover, the unveiling of the “Saudi Dates Mark” certification by the NCPD also assures high quality, legitimacy, and traceability of dates in Saudi Arabia, further advancing their market outlook in the global landscape as well.

-

Challenge: Climatic & Water Resource Restrictions to Limit Industry Expansion

Despite being a prominent date producer, the Kingdom of Saudi Arabia faces surging climate change challenges, such as increasing temperatures & inadequate water availability. Also, water-intensive production processes for date palms in certain regions are becoming less sustainable, affecting yields. Therefore, cultivators are obliged to accept water-saving irrigation methods, which might need substantial initial investments, affecting small- & medium-sized farms' productivity.

-

Opportunity: Mounting Demand for Organic & Value-Added Date Products

The mounting customer swing toward healthy snacking & clean-label foods worldwide provides a ripe opportunity for Saudi producers to grow their assortment of organic, sugar-free, or stuffed date products. Furthermore, exporters can also tap into niche markets by encouraging fresh dates as natural energy boosters. Moreover, premium varieties, such as Medjool & Sukkary dates, managed with minimal additives, are attaining prevalence across the landscape of North America & Asia-Pacific.

-

Trend: Revolution in Packaging & E-commerce Distribution

Numerous date producers started deploying vacuum-sealed, biodegradable packaging in 2025 to maintain outstanding quality when roving internationally. Furthermore, the growth of e-commerce has made it possible for dates to be dispersed directly to Saudi Arabian customers, growing product accessibility for a larger clientele. Also, utilizing premium packaging formats & sharing stories about local roots (such as Al Qassim) is increasing customer trust & brand value, thus aiding in enhancing the Saudi Arabia Dates Market share.

Saudi Arabia Dates Market Segment-Wise Analysis

By Nature:

- Conventional

- Organic

Conventional Dates presently lead the Saudi Arabia Dates Market, capturing the biggest market share. This is owing to their prevalent cultivation, recognized export networks, and relatively reduced production prices compared to organic substitutes. Also, the Kingdom’s deep-rooted tradition of consuming date palm items has generated strong local & regional demand for conventionally grown varieties, mainly during religious events like Ramadan & Hajj. Nevertheless, organic dates are progressively gaining traction owing to mounting health consciousness & international demand for chemical-free produce.

By Type:

- Ajwa Dates

- Sukkary Dates

- Safawi Dates

- Amber Dates

- Sagai Dates

- Khalas Dates

- Majdool Dates

Medjool dates are the most sought-after date type across the Saudi Arabia Dates Market, accounting for the largest market share. This is attributed to the great size, soft texture, and sweet flavor of Medjool dates. Further, often referred to as the "King of Dates," this date type is a fundamental in high-end packaging & is predominantly prevalent in export markets such as the US, Europe, and the Gulf. Moreover, their perceived high-quality & rich nutritional profile make them perfect for premium health snacks, gifting, and gourmet usage, therefore obtaining their position as the foremost type in the Saudi Arabia market.

What Does Our Saudi Arabia Dates Market Research Study Entail?

- The Saudi Arabia Dates Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis puts light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The Saudi Arabia Dates Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- Saudi Arabia Dates Market Overview (2020-2032)

- Market Size, By Value (in USD Millions)

- Market Share, By Nature

- Conventional

- Organic

- Market Share, By Type

- Ajwa Dates

- Sukkary Dates

- Safawi Dates

- Amber Dates

- Sagai Dates

- Khalas Dates

- Majdool Dates

- Market Share, By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Stores

- Others

- Market Share, By Competitors

- Competition Characteristics

- Revenue Shares

- Saudi Arabia Conventional Dates Market Overview, 2020-2032F

- By Value (USD Million)

- By Type- Market Size & Forecast 2019-2030, USD Million

- Saudi Arabia Organic Dates Market Overview, 2020-2032F

- By Value (USD Million)

- By Type- Market Size & Forecast 2019-2030, USD Million

- Competitive Outlook (Company Profile - Partila List)

- Best Food Company LLC.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Bayara Saudi Arabia Ltd.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Al Barakah Dates Factory

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Haifa Dattes

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Ithmar Taiba Dates Company

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Palm Hill Dates

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Rayana Dates

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Others

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Best Food Company LLC.

- Contact Us & Disclaimer

List of Figure

Figure 1: Saudi Arabia Dates Market Research Framework

Figure 2: Study Methodology Flowchart

Figure 3: Breakdown of Primary Interviews by Stakeholder Type

Figure 4: Saudi Arabia Dates Market Size, 2020–2032F (USD Billion)

Figure 5: Saudi Arabia Dates Market Share by Nature, 2024 (%)

Figure 6: Saudi Arabia Conventional Dates Market Share, 2024 (%)

Figure 7: Saudi Arabia Organic Dates Market Share, 2024 (%)

Figure 8: Saudi Arabia Dates Market Share by Type, 2024 (%)

Figure 9: Saudi Arabia Dates Market Share by Distribution Channel, 2024 (%)

Figure 10: Saudi Arabia Dates Market Competition Landscape, 2024 (%)

Figure 11: Saudi Arabia Conventional Dates Market Size, 2020–2032F (USD Million)

Figure 12: Saudi Arabia Conventional Dates Market by Type, 2020–2032F (USD Million)

Figure 13: Saudi Arabia Organic Dates Market Size, 2020–2032F (USD Million)

Figure 14: Saudi Arabia Organic Dates Market by Type, 2020–2032F (USD Million)

Figure 15: Key Strategic Alliances and Partnerships in the Saudi Dates Market

Figure 16: Policy & Regulatory Landscape Affecting the Saudi Dates Market

List of Table

Table 1: Objective of the Study and Research Scope

Table 2: Market Segmentation of the Saudi Arabia Dates Market

Table 3: Key Study Variables and Definitions

Table 4: Secondary Data Sources and References

Table 5: List of Companies Interviewed

Table 6: Primary Data Sources and Respondent Categories

Table 7: Summary of Key Market Drivers, Challenges, and Opportunities

Table 8: Recent Trends and Developments in the Saudi Dates Industry

Table 9: Policy and Regulatory Framework in Saudi Arabia Dates Market

Table 10: Saudi Arabia Dates Market Size, 2020–2032F (USD Billion)

Table 11: Saudi Arabia Dates Market Share by Nature, 2024 (%)

Table 12: Saudi Arabia Dates Market Share by Type, 2024 (%)

Table 13: Saudi Arabia Dates Market Share by Distribution Channel, 2024 (%)

Table 14: Saudi Arabia Dates Market Share by Competitors, 2024 (%)

Table 15: Saudi Arabia Conventional Dates Market Size, 2020–2032F (USD Million)

Table 16: Saudi Arabia Conventional Dates Market by Type, 2020–2032F (USD Million)

Table 17: Saudi Arabia Organic Dates Market Size, 2020–2032F (USD Million)

Table 18: Saudi Arabia Organic Dates Market by Type, 2020–2032F (USD Million)

Table 19: Revenue Shares of Leading Competitors in the Saudi Dates Market, 2024 (%)

Table 20: Company Profile – Best Food Company LLC.

Table 21: Company Profile – Bayara Saudi Arabia Ltd.

Table 22: Company Profile – Al Barakah Dates Factory

Table 23: Company Profile – Haifa Dattes

Table 24: Company Profile – Ithmar Taiba Dates Company

Table 25: Company Profile – Palm Hill Dates

Table 26: Company Profile – Rayana Dates

Table 27: Company Profiles – Others

Top Key Players & Market Share Outlook

- Best Food Company LLC.

- Bayara Saudi Arabia Ltd.

- Al Barakah Dates Factory

- Haifa Dattes

- Ithmar Taiba Dates Company

- Palm Hill Dates

- Rayana Dates

- Others

Frequently Asked Questions