UAE Bottled Water Market

Source: The Report Cube

Understand The Key Trends Shaping This Market

Download Free SampleUAE Bottled Water Market Insights and Analysis

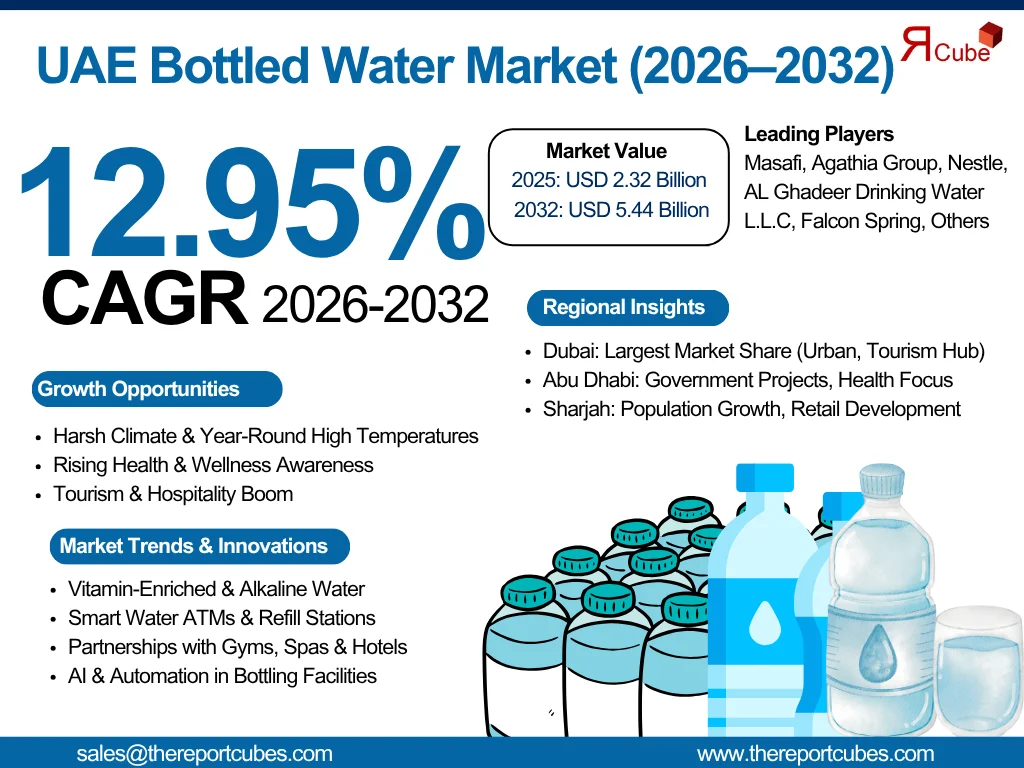

The UAE bottled water market is anticipated to register a CAGR of around 12.95% during the forecast period, 2026–2032. The market size is valued at nearly USD 2.32 billion in 2025 and is expected to reach approximately USD 5.44 billion by 2032. This flourishing growth is significantly attributed to the rising consumer health awareness, harsh climatic conditions, and an increasing preference for convenient hydration solutions.

With year-round high temperatures, limited freshwater resources, and a growing expatriate population, the country continues to rely heavily on bottled water as a primary source of safe hydration. This necessity, combined with evolving lifestyle habits and a rising emphasis on health and wellness, is significantly accelerating the bottled water market growth across the UAE.

Moreover, the rapid expansion of urban infrastructure, including airports, hospitality chains, fitness centers, retail outlets, and international tourism, is further creating new opportunities and demand hubs for the bottled water market growth. Additionally, the market is also witnessing a shift toward high-margin offerings such as mineral, alkaline, and vitamin-enriched water, driven by consumer preference for functional and value-added hydration solutions.

Understand The Key Trends Shaping This Market

In line with the UAE’s sustainability targets, regulatory pressure to phase out single-use plastics is prompting bottled water producers to adopt recyclable, biodegradable, and reusable packaging formats. This growing sustainable trend is further leading to the exponential growth of the UAE bottled water industry. Furthermore, advancements in bottling automation, localized water sourcing, and smart vending systems are streamlining operational efficiency while reducing environmental impact. These efforts not only enhance production scalability but also reinforce brand positioning among environmentally conscious consumers.

UAE Bottled Water Industry Recent News and Developments:

- February 2024: Bisleri expanded its footprint in the UAE by associating with major sporting events, including the Dubai Marathon and International League T20. The brand provided hydration support to players and spectators while leveraging on-ground branding and digital marketing to enhance visibility and consumer engagement.

- September 2024: A1RWATER, a UAE-based sustainable water company, announced the establishment of an advanced air-to-water bottling facility at Dubai Industrial City. The plant will produce over 100,000 liters of drinking water daily using atmospheric water generation (AWG) technology. The company aims to reduce plastic waste by bottling water in reusable glass containers, supporting the UAE’s broader sustainability goals.

UAE Bottled Water Market Dynamics

UAE Bottled Water Market Drivers

- Tourism and Hospitality-Driven Consumption Surge

- Premiumization of Water with Added Minerals & Functional Ingredients

- Government Initiatives Promoting Healthy Hydration

- Expansion of Organized Retail and HORECA Channels

UAE Bottled Water Market Restraints

- Environmental Concerns Over PET Bottles

- Price Competition from Local and International Brands

- Limited Availability of Freshwater Resources

- Regulatory Restrictions on Packaging Materials

UAE Bottled Water Market Opportunities

- Sustainable and Recyclable Packaging Solutions

- Innovations in Flavored and Functional Water

- Smart Bottling & Dispenser Technologies

- Growing Demand in Fitness and Corporate Wellness Sectors

UAE Bottled Water Market Trends and Developments

- Increased Launch of Vitamin-Infused and Alkaline Water

- Rising Popularity of Refill Stations and Smart Water ATMs

- IoT and Automation in Bottling Infrastructure

- Strategic Tie-ups with Gyms, Spas, and Hotels for Brand Positioning

Market Segmentation Analysis

Still Water to Dominate the Market – By Product Type

- Still bottled water continues to lead the UAE market, driven by its affordability, wide availability, and consumer trust in well-established local brands.

- Flavored water is emerging as the fastest-growing sub-segment due to rising health consciousness and preference for functional beverages.

- Mineral water is projected to gain traction through 2032, as consumers seek naturally enriched options offering added health benefits.

Supermarkets/Hypermarkets to Lead Distribution – By Distribution Channel

- Supermarkets and hypermarkets remain the dominant sales channel owing to their extensive shelf space, diverse brand availability, and consumer convenience.

- On-trade distribution (hotels, restaurants, cafes) is the fastest-growing channel, fueled by booming tourism and hospitality activities.

- Direct sales through corporate contracts and event partnerships are projected to grow steadily due to rising demand in institutional setups.

Dubai to Lead the Market – By Region

- Dubai remains the dominant market for bottled water consumption, attributed to its dense urban population, tourism-driven economy, and high concentration of hospitality, retail, and corporate establishments. The city's continuous hosting of international events and business expos further elevates the demand for premium and on-the-go hydration solutions.

- Abu Dhabi follows closely as a key consumption hub, driven by government infrastructure, residential growth, and increasing focus on public health and wellness initiatives.

- Sharjah is emerging as a rapidly growing region due to population expansion, rising awareness of water quality, and the development of modern retail formats across the Emirate.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- UAE Bottled Water Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- Market Share, By Product Type

- Still bottled water

- Flavored water

- Mineral water

- Market Share, By Distribution Channel

- Supermarkets and hypermarkets

- On-trade distribution

- Direct sales

- Market Share, By Category

- Plain

- Flavored

- Market Share, By Region

- Dubai

- Abu Dhabi

- Sharjah

- Northern Emirates

- Market Share, By Competitors

- Competition Characteristics

- Revenue Shares

- UAE Still bottled water Bottled Water Market Overview, 2020-2032F

- By Value (USD Million)

- By Distribution Channel- Market Size & Forecast 2019-2030, USD Million

- By Category- Market Size & Forecast 2019-2030, USD Million

- UAE Flavored water Bottled Water Market Overview, 2020-2032F

- By Value (USD Million)

- By Distribution Channel- Market Size & Forecast 2019-2030, USD Million

- By Category- Market Size & Forecast 2019-2030, USD Million

- UAE Mineral water Bottled Water Market Overview, 2020-2032F

- By Value (USD Million)

- By Distribution Channel- Market Size & Forecast 2019-2030, USD Million

- By Category- Market Size & Forecast 2019-2030, USD Million

- Competitive Outlook (Company Profile - Partila List)

- Masafi

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Agathia Group

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Nestle

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- AL Ghadeer Drinking Water L.L.C

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Falcon Spring

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Dubai Crystal Mineral Water & Refreshments L.L.C

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Our Oasis

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- AWAFI MINERAL WATER CO.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Zulal Water Company

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Mai Dubai etc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Masafi

- Contact Us & Disclaimer

List of Figure

Figure 1: Market Segmentation of the UAE Bottled Water Market

Figure 2: Breakdown of Primary Interviews by Stakeholder Type

Figure 3: UAE Bottled Water Market Value (USD Billion), 2020–2032

Figure 4: UAE Bottled Water Market Share by Product Type, 2024 (%)

Figure 5: UAE Bottled Water Market Share – Still Bottled Water, 2024 (%)

Figure 6: UAE Bottled Water Market Share – Flavored Water, 2024 (%)

Figure 7: UAE Bottled Water Market Share – Mineral Water, 2024 (%)

Figure 8: UAE Bottled Water Market Share by Distribution Channel, 2024 (%)

Figure 9: UAE Bottled Water Market Share – Supermarkets and Hypermarkets, 2024 (%)

Figure 10: UAE Bottled Water Market Share – On-Trade Distribution, 2024 (%)

Figure 11: UAE Bottled Water Market Share – Direct Sales, 2024 (%)

Figure 12: UAE Bottled Water Market Share by Category (Plain vs. Flavored), 2024 (%)

Figure 13: UAE Bottled Water Market Share by Region, 2024 (%)

Figure 14: Regional Market Share – Dubai, Abu Dhabi, Sharjah, Northern Emirates

Figure 15: Competitive Landscape – Market Share by Major Companies, 2024 (%)

Figure 16: UAE Still Bottled Water Market Value (USD Million), 2020–2032F

Figure 17: Still Bottled Water Market by Distribution Channel, 2020–2032F (USD Million)

Figure 18: Still Bottled Water Market by Category, 2020–2032F (USD Million)

Figure 19: UAE Flavored Water Market Value (USD Million), 2020–2032F

Figure 20: Flavored Water Market by Distribution Channel, 2020–2032F (USD Million)

Figure 21: Flavored Water Market by Category, 2020–2032F (USD Million)

Figure 22: UAE Mineral Water Market Value (USD Million), 2020–2032F

Figure 23: Mineral Water Market by Distribution Channel, 2020–2032F (USD Million)

Figure 24: Mineral Water Market by Category, 2020–2032F (USD Million)

Figure 25: Competitive Benchmarking of Key Players (Masafi, Nestle, Agthia, etc.)

Figure 26: Strategic Partnerships & Developments by Leading Companies (2019–2025)

List of Table

Table 1: UAE Bottled Water Market Segmentation Overview

Table 2: Key Secondary Data Sources and Research References

Table 3: List of Companies Interviewed During Primary Research

Table 4: Primary Respondent Breakdown by Designation and Region

Table 5: Key Market Drivers – UAE Bottled Water Market

Table 6: Key Market Challenges – UAE Bottled Water Market

Table 7: Opportunity Assessment by Segment and Region

Table 8: Recent Developments in the UAE Bottled Water Industry

Table 9: Regulatory and Policy Framework Impacting the UAE Bottled Water Market

Table 10: UAE Bottled Water Market Size, 2020–2032 (USD Billion)

Table 11: Market Share by Product Type – Still, Flavored, Mineral Water (%, 2024)

Table 12: Market Share by Distribution Channel – Supermarkets, On-Trade, Direct Sales (%, 2024)

Table 13: Market Share by Category – Plain vs. Flavored (%, 2024)

Table 14: Market Share by Region – Dubai, Abu Dhabi, Sharjah, Northern Emirates (%, 2024)

Table 15: Market Share by Key Competitors (%, 2024)

Table 16: UAE Still Bottled Water Market Size, 2020–2032F (USD Million)

Table 17: Still Bottled Water Market by Distribution Channel, 2020–2032F (USD Million)

Table 18: Still Bottled Water Market by Category (Plain/Flavored), 2020–2032F (USD Million)

Table 19: UAE Flavored Water Market Size, 2020–2032F (USD Million)

Table 20: Flavored Water Market by Distribution Channel, 2020–2032F (USD Million)

Table 21: Flavored Water Market by Category (Plain/Flavored), 2020–2032F (USD Million)

Table 22: UAE Mineral Water Market Size, 2020–2032F (USD Million)

Table 23: Mineral Water Market by Distribution Channel, 2020–2032F (USD Million)

Table 24: Mineral Water Market by Category (Plain/Flavored), 2020–2032F (USD Million)

Table 25: Company Profile Summary – Masafi

Table 26: Company Profile Summary – Agthia Group

Table 27: Company Profile Summary – Nestlé

Table 28: Company Profile Summary – AL Ghadeer Drinking Water L.L.C

Table 29: Company Profile Summary – Falcon Spring

Table 30: Company Profile Summary – Dubai Crystal Mineral Water & Refreshments L.L.C

Table 31: Company Profile Summary – Our Oasis

Table 32: Company Profile Summary – AWAFI Mineral Water Co.

Table 33: Company Profile Summary – Zulal Water Company

Table 34: Company Profile Summary – Mai Dubai

Table 35: Strategic Partnerships and Developments by Key Companies

Top Key Players & Market Share Outlook

- Masafi

- Agathia Group

- Nestle

- AL Ghadeer Drinking Water L.L.C

- Falcon Spring

- Dubai Crystal Mineral Water & Refreshments L.L.C

- Our Oasis

- AWAFI MINERAL WATER CO.

- Zulal Water Company

- Mai Dubai etc.

Frequently Asked Questions