Understand The Key Trends Shaping This Market

Download Free SampleUS Citric Acid Market Overview: Market Size & Forecast (2026–2034)

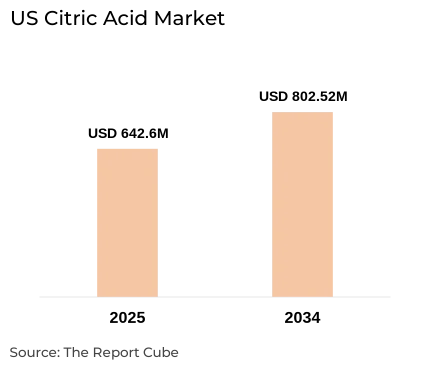

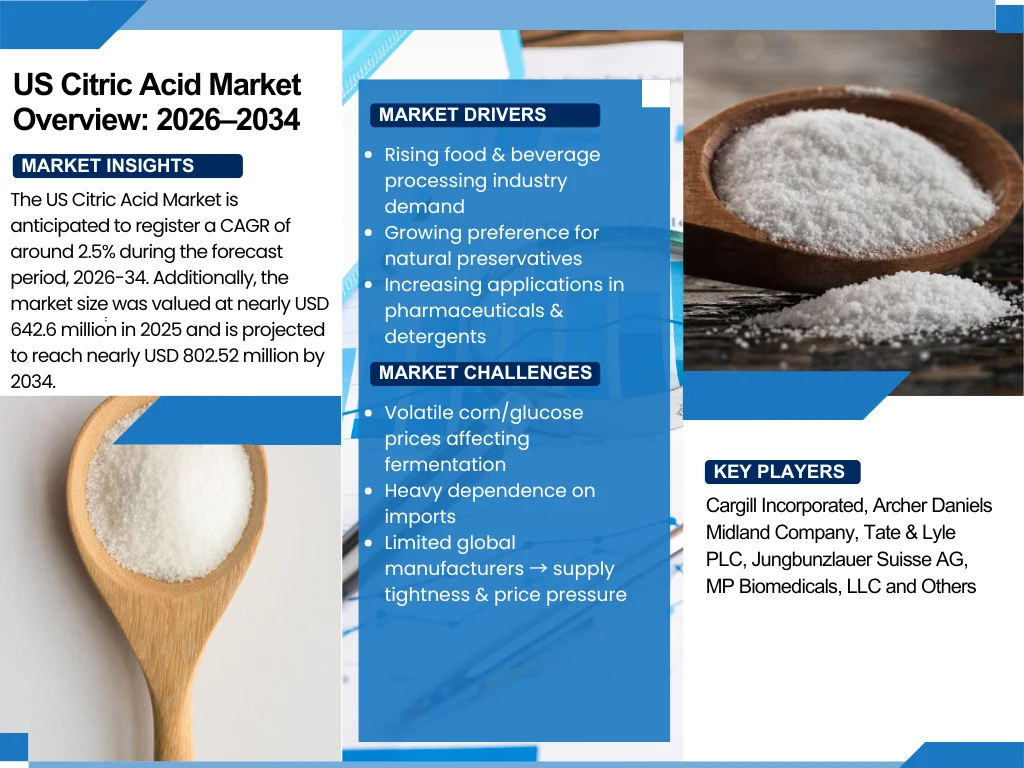

The US Citric Acid Market is anticipated to register a CAGR of around 2.5% during the forecast period, 2026-34. Additionally, the market size was valued at nearly USD 642.6 million in 2025 and is projected to reach nearly USD 802.52 million by 2034.

Market Analysis & Insights

The US Citric Acid Market growth is instigated by the increasing food & beverage processing industry, strong demand for natural preservatives, and growing usage in pharmaceuticals & detergents. As per the World Integrated Trade Solution (WITS), the United States imported nearly 203,942 tons of citric acid in 2023, valued at about USD 431.74 million, demonstrating substantial reliance on global market suppliers.

Furthermore, domestically, over 90% of US citric acid is produced by the process of fermentation utilizing corn-derived substrates (Aspergillus niger), as stated by the USDA. Thus, this highlights the significance of sustainable feedstock management & fermentation efficiency in maintaining production competitiveness. Also, globally, the US Citric Acid Market is positioned as one of the leading consumers within the international supply network, thus creating a positive market outlook.

Additionally, the US Citric Acid Market is destined to flourish in the coming years, owing to the surging clean-label acidulant demand, sustainable citric acid production techniques, and advanced AI integration. Further, growth in the anhydrous citric acid market, monohydrate citric acid demand, and increasing food preservative & pharmaceutical excipient applications would sustain long-term opportunities in the future years.

What is the Impact of AI in the US Citric Acid Market?

AI advances process control & yields in fermentation (predictive control), optimizes supply-chain procurement, enables predictive maintenance at production sites, and supports R&D for formulation & clean label, speeding product development & lowering operating costs for the Citric Acid Market in the US.

US Citric Acid Market Dynamics

What driving factor acts as a positive influencer for the US Citric Acid Market?

- The food & beverages industries remain the biggest end-user (beverage-heavy usage), supporting sustained demand for food preservatives & acidulant applications.

- Regional bans/limitations on phosphates in detergents & an emphasis on biodegradable ingredients increase citric acid acceptance in cleaning products.

What are the challenges that affect the US Citric Acid Market?

- Citric acid is produced by fermentation (corn/glucose feedstocks). Thus, variations in corn/glucose prices, logistics costs, and heavy dependence on imports to create margin pressure.

- Dependency on a few large manufacturers worldwide could cause short-term tightness & price upsurge, affecting US formulators.

How are the future opportunities transforming the market during 2026-34?

- Progression in pharmaceuticals, nutraceuticals, and high-purity applications supports premium pricing for specialty citric acid.

- On-shoring production or regional footprint expansions (e.g., Jungbunzlauer activity in North America) could minimize import dependency & shorten lead times, opening B2B service models & technical support market revenue.

What market trends are affecting the US Citric Acid Market Outlook?

- Food producers across the US are progressively preferring clean-label, bio-based acidulants, driving a trend toward sustainable, low-waste fermentation procedures.

- Process modernization (AI-enabled bioprocess control, energy optimization) & product variation (effervescent tablet grades, cosmetic-grade citrates) to enhance innovation.

How is the US Citric Acid Market Defined as per Segments?

The US Citric Acid Market Research Reports provide detailed market data & insights in accordance with market segmentation. Some of the segments are:

- Form: Anhydrous & Liquid

- Application: Food & Beverages, Household Detergents & Cleaners, Pharmaceuticals, and Others

By Form:

The Anhydrous form upholds a significant share of the US Citric Acid Market. As this form of citric acid suits powdered beverage mixes, dry food blends, and pharmaceutical tablets where low moisture is fundamental, it further instigates the market demand. Anhydrous citric acid provides storage & formulation advantages (longer shelf life & easier dosing) versus liquid grades, making it the favored option for leading food processors & supplement producers across the US Citric Acid Market.

By Application:

Food & Beverages sector dominates the US Citric Acid Market demand graph by seizing the potential market share. As the food & beverages industry is a potential customer of citric acid as it is broadly used as a food preservative, acidulant, flavor enhancer, and pH regulator in soft drinks, confectionery, dairy and prepared foods. Also, the beverage sector alone accounts for the biggest application portion, instigated by large-scale beverage production & flavor innovation, making F&B the prime demand engine for the US Citric Acid Market in the projected years as well.

US Citric Acid Market: What Recent Innovations Are Affecting the Industry?

- September 2025: Jungbunzlauer acquired a multipurpose site in Thomson, Illinois, marking its growth into US manufacturing & improving regional production abilities.

- July 2025: Tate & Lyle launched its new Mouthfeel Innovation Lab & clean-label ingredient range at IFT FIRST 2025, focused on enhancing texture & natural acidulant performance across beverage & food applications.

What are the Key Highlights of the US Citric Acid Market (2026–34)?

- The US Citric Acid Market is anticipated to reach about 2.5% CAGR during 2026-2034, and is estimated to have a market size of nearly USD 802.52 million in 2034.

- Food & beverage sector accounts for more than 60% of the market value, with pharmaceuticals & personal care products coming in second & third place in terms of share.

- Anhydrous citric acid is still extensively utilized due to its stability & adaptability. However, liquid form is becoming more prevalent across detergents & beverages.

- Producers are responding to the market trend toward clean-label, bio-based acidulants, and sustainable fermentation enhancements.

- By refining supply-chain optimization, fermentation yield, and predictive quality control, artificial intelligence (AI) upturns production efficiency & decreases waste.

How does the Future Outlook of the US Citric Acid Market (2034) Appear?

With the developments in bio-based fermentation, rising clean-label customers' preferences, and augmented domestic production, the US Citric Acid Industry is anticipated to experience steady expansion through 2034. Artificial intelligence (AI)-powered process automation & monitoring is anticipated to increase fermentation efficiency, maximize energy usage, and minimize waste, all of which would raise competitiveness. Also, local manufacturing projects, such as Jungbunzlauer's development in Illinois, might also decrease reliance on imports & stabilize prices, guaranteeing a robust & sustainable supply chain throughout the US Citric Acid Market from 2026 to 2034.

What Does Our US Citric Acid Market Research Study Entail?

- The US Citric Acid Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis & market scope sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The US Citric Acid Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- US Citric Acid Market Overview

- Market Size, By Value (USD Million)

- Market Share, By Form

- Anhydrous

- Liquid

- Market Share, By Application

- Food & Beverages

- Household Detergents & Cleaners

- Pharmaceuticals

- Others

- Market Share, By Product Type

- Lye

- Flake

- Others

- Market Share, By Manufacturing

- Membrane Cell

- Diaphragm Cell

- Others

- Market Share, By Company

- Revenue Shares

- Competition Characteristics

- US Citric Acid Market Overview, 2026–2034

- By Value (USD Million)

- By Form

- By Application

- By Product Type

- By Manufacturing

- Forecast 2026–2034 Tables

- Competitive Outlook (Company Profiles)

- Cargill Incorporated

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Archer Daniels Midland Company

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Tate & Lyle PLC

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Jungbunzlauer Suisse AG

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- MP Biomedicals, LLC

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Hawkins Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Others

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Cargill Incorporated

- Contact Us & Disclaimer

List of Figure

Figure 1.1: Objective of the Study Flowchart

Figure 1.2: Product Definition and Classification

Figure 1.3: Market Segmentation Overview

Figure 1.4: Study Variables Framework

Figure 2.1: Research Methodology Flow

Figure 2.2: Secondary Data Points Structure

Figure 2.3: Companies Interviewed (List/Map)

Figure 2.4: Primary Data Points Structure

Figure 2.5: Break Down of Primary Interviews

Figure 3.1: Executive Summary Snapshot

Figure 4.1: Market Drivers Illustration

Figure 4.2: Market Challenges Illustration

Figure 4.3: Opportunity Assessment Matrix

Figure 5.1: Recent Trends and Developments Timeline

Figure 6.1: Policy and Regulatory Landscape Overview

Figure 7.1: US Citric Acid Market Size, By Value (USD Million)

Figure 7.2: Market Share by Form (Pie Chart)

Figure 7.2.1: Anhydrous vs. Liquid Distribution

Figure 7.3: Market Share by Application (Pie/Bar Chart)

Figure 7.3.1: Food & Beverages Segment

Figure 7.3.2: Household Detergents & Cleaners Segment

Figure 7.3.3: Pharmaceuticals Segment

Figure 7.3.4: Others Segment

Figure 7.4: Market Share by Product Type

Figure 7.4.1: Lye

Figure 7.4.2: Flake

Figure 7.4.3: Others

Figure 7.5: Market Share by Manufacturing Type

Figure 7.5.1: Membrane Cell

Figure 7.5.2: Diaphragm Cell

Figure 7.5.3: Others

Figure 7.6: Market Share by Company

Figure 7.6.1: Revenue Shares of Top Companies

Figure 7.6.2: Competitive Characteristics Overview

Figure 8.1: US Citric Acid Market Forecast (2026–2034), By Value

Figure 8.2: Forecast by Form

Figure 8.3: Forecast by Application

Figure 8.4: Forecast by Product Type

Figure 8.5: Forecast by Manufacturing Type

Figure 8.6: Forecast Tables Overview

Figure 9.1: Competitive Outlook: Cargill Incorporated Overview

Figure 9.2: Competitive Outlook: Archer Daniels Midland Company Overview

Figure 9.3: Competitive Outlook: Tate & Lyle PLC Overview

Figure 9.4: Competitive Outlook: Jungbunzlauer Suisse AG Overview

Figure 9.5: Competitive Outlook: MP Biomedicals, LLC Overview

Figure 9.6: Competitive Outlook: Hawkins Inc. Overview

Figure 9.7: Competitive Outlook: Other Companies Overview

List of Table

Table 1.1: Objective of the Study Details

Table 1.2: Product Definition and Specifications

Table 1.3: Market Segmentation Table

Table 1.4: Study Variables Overview

Table 2.1: Secondary Data Points Details

Table 2.2: List of Companies Interviewed

Table 2.3: Primary Data Points Details

Table 2.4: Breakdown of Primary Interviews

Table 4.1: Market Drivers Analysis

Table 4.2: Market Challenges Analysis

Table 4.3: Opportunity Assessment Table

Table 5.1: Recent Trends and Developments Table

Table 6.1: Policy and Regulatory Summary

Table 7.1: US Citric Acid Market Size by Value (USD Million)

Table 7.2: Market Share by Form (%)

Table 7.3: Market Share by Application (%)

Table 7.4: Market Share by Product Type (%)

Table 7.5: Market Share by Manufacturing Type (%)

Table 7.6: Market Share by Company (Revenue %)

Table 8.1: US Citric Acid Market Forecast (2026–2034) by Value

Table 8.2: Forecast by Form

Table 8.3: Forecast by Application

Table 8.4: Forecast by Product Type

Table 8.5: Forecast by Manufacturing Type

Table 8.6: Forecast Tables Overview

Table 9.1: Cargill Incorporated: Company Overview & Key Metrics

Table 9.2: Archer Daniels Midland Company: Key Metrics

Table 9.3: Tate & Lyle PLC: Key Metrics

Table 9.4: Jungbunzlauer Suisse AG: Key Metrics

Table 9.5: MP Biomedicals, LLC: Key Metrics

Table 9.6: Hawkins Inc.: Key Metrics

Table 9.7: Other Companies: Key Metrics

Top Key Players & Market Share Outlook

- Cargill Incorporated

- Archer Daniels Midland Company

- Tate & Lyle PLC

- Jungbunzlauer Suisse AG

- MP Biomedicals, LLC

- Hawkins Inc.

- Others

Frequently Asked Questions