Understand The Key Trends Shaping This Market

Download Free SampleUS Data Center GPU Market Statistics & Future Outlook (2026–2034)

- The US Data Center GPU Market is expected to grow at a CAGR of around 32.9% during 2026 - 2034.

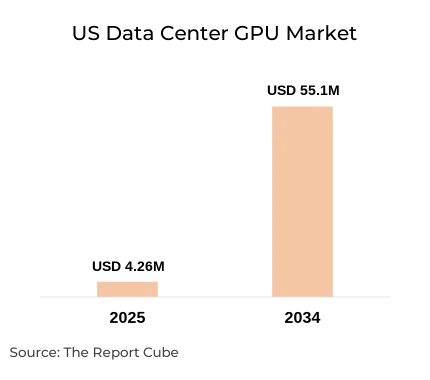

- In 2025, the market was valued at nearly USD 4.26 million.

- By 2034, it is projected to reach around USD 55.1 million.

- Growth of cloud gaming platforms drives US data center GPU demand for low-latency, high-performance graphics.

- High power consumption and complex cooling requirements increase operational costs and challenge GPU data center sustainability.

- Ultra-HD video rendering and live streaming needs create opportunities for specialized, high-capacity video-processing GPU infrastructure.

- Expansion of edge data centers drives demand for modular, energy-efficient GPUs supporting real-time graphics and IoT workloads.

Insightful Analysis

The US Data Center GPU Market report insights & analysis offer in-depth understanding of market trends, growth drivers, challenges, and opportunities. This comprehensive analysis includes market size, segmentation, competitive landscape, and customer behavior to guide strategic decisions. Further, it aids in providing thorough market research, industry breakdown, market forecast, competitive examination, market trends, growth factors, SWOT analysis, and market opportunities. These insights support business planning, investment decisions, and market positioning for sustainable success.

Why Choose This Report?

- Provides a comprehensive overview of the overall market analysis, encompassing key trends, consumer behavior analysis, and risk assessment to support strategic decision-making.

- Provides accurate, up-to-date insights into market size, segmentation, and emerging opportunities, helping to minimize risk & capitalizing on growth.

- Gives deep understanding of target audience preferences, investment habits, and communication channels for enhanced product development & marketing effectiveness.

- Delivers competitive analysis & benchmarking, uncovering the strengths & weaknesses of market competitors to guide strategies.

- Consolidate comprehensive market intelligence, reducing reasoning & streamlining research efforts.

- Facilitates customized market segmentation & risk mitigation strategies, fine-tuned to the business objectives.

- Aids in identifying both market challenges & untapped opportunities within the industry to drive long-term business growth.

- Provides valuable information based on actual customer data & search trends.

US Data Center GPU Market Dynamics (2026–2034)

Market Driver:

Surge in Cloud Gaming Adoption Fuels GPU Demand - One standout driver for the US data center GPU market is the rapid growth of cloud gaming platforms. Rising consumer demand for immersive, low-latency gaming across multiple devices is driving investments in high-performance GPU infrastructure, making cloud gaming a critical engine for market expansion.

Major Challenge:

Power and Cooling Complexities Increase Operational Costs - The market faces a significant challenge in managing GPU power consumption and cooling requirements. High-performance GPUs used for intensive computing, such as AI, rendering, and analytics, demand complex energy and thermal management solutions, which raise operational expenses and sustainability concerns.

Opportunity Ahead:

Next-Gen Video Rendering Spurs Infrastructure Upgrades - For future opportunities (2026–34), the growing need for ultra-HD video rendering and live streaming stands out. As businesses and entertainment platforms adopt 4K and 8K content for virtual events and remote collaboration, investment in specialized GPU infrastructure for video processing is expected to accelerate, driving market growth.

Industry Trend:

Rise of Edge Data Centers Redefines GPU Deployment - A defining trend is the proliferation of edge data centers, which deploy advanced GPUs to support real-time graphics workloads in simulation, visualization, and IoT analytics. This decentralization is reshaping GPU deployment models, emphasizing modular, energy-efficient solutions, and redefining market dynamics.

How is the US Data Center GPU Market Defined as per Segments?

The US Data Center GPU Market segmentation categorizes the market into distinct segments based on behavioral, psychographic, geographic, and demographic factors. Firmographic & technographic segmentation for B2B or B2C markets is also included. Further, by concentrating on client, lifestyle, location, behavior, and company attributes, these segments assist businesses in targeting particular customer or user needs, enhancing product/services positioning, and improving marketing methods. Effective market reach and resource allocation are achieved through this segmentation.

What is the Impact of Artificial Intelligence (AI) on the US Data Center GPU Market?

Artificial Intelligence (AI) significantly transforms the US Data Center GPU Market by enhancing efficiency, enabling faster data analysis, and driving innovation. AI tools automate repetitive processes, provide deeper insights using predictive analytics, and improve customer experiences through personalization. The technology unlocks new opportunities but requires strategic adaptation to fully realize its benefits and manage risks. Organizations integrating AI responsibly & strategically are expected to strengthen market outlook.

Company Profile: Largest US Data Center GPU Market Companies (2034)

By 2034, the US Data Center GPU Market would be led by NVIDIA, AMD, Intel, Google Cloud (Alphabet), Amazon Web Services, Microsoft Azure, IBM, Micron Technology, Qualcomm, Samsung Electronics, Imagination Technologies, Alibaba Cloud, Oracle, Tencent Cloud, CoreWeave, etc., who are forecasted to generate the highest market revenues & share owing to numerous activities like partnerships, collaborations & mergers, and innovation & launch of new products/services.

Major Queries Answered in the Report

- What is the current state of the US Data Center GPU Market?

- What key developments are influencing the US Data Center GPU industry?

- Which factors are shaping growth in the US Data Center GPU Market?

- What are the challenges faced by businesses in this sector?

- How are emerging technologies transforming the US Data Center GPU industry?

- Who are the primary competitive players in the US Data Center GPU domain?

- What new opportunities exist for stakeholders and investors?

- How are consumer and enterprise behaviors evolving within the market?

- Which regional and global factors impact US Data Center GPU adoption?

- Where can stakeholders access detailed, sector-specific insights on the US Data Center GPU Market?

- What innovations are defining the industry’s next phase of growth?

Table of Contents

- Introduction

- Objective of the Study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Breakdown of Secondary Sources

- Primary Data Points

- Breakdown of Primary Interviews

- Secondary Data Points

- Executive Summary

- US Data Center GPU Market Dynamics

- Drivers

- AI/ML and HPC Growth

- Cloud Computing Expansion

- Sector Digital Transformation

- Challenges

- Supply Chain and Chip Shortages

- High Technology Upgrade Costs

- Regulatory and Security Concerns

- Opportunity Assessment

- Generative AI Workloads

- Edge and Hybrid GPU Deployment

- Startup Innovation and Investments

- Drivers

- Recent Trends and Developments

- Advanced GPU Architectures

- Energy Efficiency and Sustainability

- Strategic Partnerships and M&A

- Policy and Regulatory Landscape

- Data Compliance and Privacy

- Export Controls and Trade Policies

- Environmental and Energy Regulations

- US Data Center GPU Market Overview (2026–2034)

- Market Size & Growth, By Value (USD Million)

- Market Share, By Deployment Type

- Cloud

- On-Premises

- Hybrid

- Market Share, By Function

- Training

- Inference

- Market Share, By Application

- Artificial Intelligence & ML

- Deep Learning

- HPC

- Data Analytics

- Autonomous Systems

- Natural Language Processing & Vision

- Market Share, By End User Industry

- Cloud Service Providers

- Healthcare

- Financial Services

- Defense & Aerospace

- Automotive

- Telecommunications

- Research & Academia

- Others

- Market Share, By GPU Type

- NVIDIA

- AMD

- Intel

- Others (Micron, Imagination Technologies)

- Market Share, By Data Center Size

- Large

- Medium

- Small

- Company Market Share Analysis

- Revenue Shares and Rankings

- Competitive Landscape Characteristics

- Segment-wise & Industry-wise Market Overview & Forecast (2026–2034)

- By Deployment Type

- By Function

- By Application

- By End User

- By GPU Type

- By Data Center Size

- Competitive Outlook & Profiles – Top 10-15 Genuine Companies

- NVIDIA

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- AMD

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Intel

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Google Cloud (Alphabet)

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Amazon Web Services

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Microsoft Azure

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- IBM

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Micron Technology

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Qualcomm

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Samsung Electronics

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Imagination Technologies

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Alibaba Cloud

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Oracle

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Tencent Cloud

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- CoreWeave

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- NVIDIA

- Contact Information / Disclaimer

Top Key Players & Market Share Outlook

- NVIDIA

- AMD

- Intel

- Google Cloud (Alphabet)

- Amazon Web Services

- Microsoft Azure

- IBM

- Micron Technology

- Qualcomm

- Samsung Electronics

- Imagination Technologies

- Alibaba Cloud

- Oracle

- Tencent Cloud

- CoreWeave

- Others

Frequently Asked Questions