Understand The Key Trends Shaping This Market

Download Free SampleAfrica Generator Sets Market Overview: Market Size & Forecast (2026–2034)

What is the anticipated CAGR & size of the Africa Generator Sets Market?

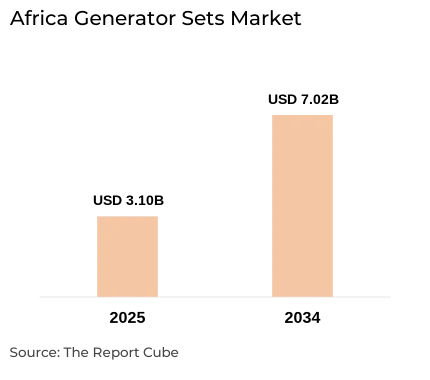

The Africa Generator Sets Market is anticipated to register a CAGR of around 9.5% during the forecast period, 2026-34. Additionally, the market size was valued at nearly USD 3.10 billion in 2025 and is projected to reach almost USD 7.02 billion by 2034.

Market Analysis & Insights

The Africa Generator Sets Market development is compelled by surging uninterrupted power supply requirements, frequent load shedding, and power grid instability in sub-Saharan Africa. Also, the industry largely provides products such as gas-fired gensets, diesel fuel-powered gensets, and hybrid generator sets, aiding sectors, including infrastructure development, telecom tower power solutions, and mining.

Furthermore, with their innovations & strategic associations, leading corporations like SFAfrica, Cummins, Kohler, and Caterpillar are impacting the market landscape. Also, to meet the rising demand for generators in sub-Saharan Africa, governments are implementing Captain Power Generation policies & Rental Power Solutions Africa. Furthermore, Nigeria's power sector reform & South Africa's prominence on assimilating renewable energy are some of the instance of recent projects. Besides, Africa's commercial & industrial generator industries are expanding quickly, chiefly as rental power solutions for a variety of industries become more prevalent, thus enhancing the Africa Generator Sets Market share.

Nevertheless, market challenges such as the instability of diesel fuel & the surge in natural gas costs, the industry is still expanding owing to continuous infrastructural development & renewable energy initiatives. Also, top African generator enterprises are taking advantage the improving market size & increasing local demand, specifically across South Africa & Nigeria, thus overall influencing the Africa Generator Sets Market outlook in the forthcoming years.

What is the Impact of AI in the Africa Generator Sets Market?

In line with the improvisation of predictive maintenance & load management, AI deployment reduces costs & enhances reliability. Market companies such as Kohler & Caterpillar are working on initiatives concerning AI-driven remote diagnostics, automating power plant operations, and optimizing hybrid generator sets for the African market. Thus, by doing so, they are transforming the environment of the market, as well as assuring to tackle crucial issues such as unstable power grids.

Africa Generator Sets Market Dynamics

What driving factor acts as a positive influencer for the Africa Generator Sets Market?

- Rising Demand for Uninterrupted Power Supply: The major driver in the Africa Generator Sets Market is related to the increasing demand for an uninterrupted power supply in multiple sectors experiencing load shedding & power grid instability. African nations, specifically in sub-Saharan Africa, experience frequent power outages, encouraging industries like telecom operators & several other commercial establishments to spend heavily in unfailing backup power solutions. Thus, this has augmented the acceptance of generator sets with fluctuating kVA ratings, catering to numerous requirements from small residential to large industrial establishments.

What are the challenges that affect the Africa Generator Sets Market?

- Inadequate Transmission & Distribution Infrastructure: Several regions struggle from outdated or inadequate grid networks, which restricts the actual integration & maintenance of generator sets. Also, poor road conditions further hinder access to remote locations, affecting fuel delivery & equipment servicing. Moreover, this infrastructural shortage elevates operational difficulties & raises downtime, limiting Africa Generator Sets Market growth despite of the great demand for power solutions.

How are the future opportunities transforming the market during 2026-34?

- Amalgamation of Renewable Energy & Hybrid Generator Sets: Rising consciousness for sustainable energy & government incentives are creating tremendous opportunity for the incorporation of renewable energy, primarily solar-hybrid gensets. Further, as companies embraces greener energy sources in conjunction with conventional gensets, Africa exhibits countless growth potential, reducing emissions & dependence on fuel. Moreover, this trend supports the demands of the mining sector & expanding infrastructure while also being in line with global sustainability goals.

What market trends are affecting the Africa Generator Sets Market Outlook?

- Growth of Rental Power Solutions & Captive Power Generation: The upscale of rental power solutions in Africa is an evolving trend as many companies opt flexible, affordable power generation without demanding a great upfront investment. Also, budding captive power generation setups by several establishments for self-sufficient power supply reflect a strategic approach to lessen the unreliable public grid. Further, these trends are strengthened by increasing demand in sectors such as mining & telecom that need customized power solutions.

How is the Africa Generator Sets Market Defined as per Segments?

The Africa Generator Sets Market Research Reports provide detailed market data & insights in accordance with market segmentation. Some of the segments are:

- Power Rating: Less than 50 kVA, 50-125 kVA, 125-200 kVA, 200-330 kVA, 330-750 kV, More than 750 kVA

- Application: Standby, Peak Shaving, Prime & Continuous

By Power Rating:

The Less Than 50 kVA segment dominates the Africa Generator Sets Market, capturing nearly 35% of the total power rating demand.

As power outages are a very common scenario or challenge faced by the households & small commercial settings, there is an expanding demand for portable, small-scale generator sets. Furthermore, these units imitate the variety of power demands in Africa by offering affordable, adaptable backup power for residences, small enterprises, and telecom towers.

By Application:

The Standby application segment governs with about 60% market share, as most consumers depend on generator sets for backup power during blackouts.

Further, the dominance is also due to the issues like frequent power outages & unreliable grid supply across Africa, making backup power indispensable. Moreover, enterprises, hospitals, and households largely rely on diesel & gas gensets to experience uninterrupted operations during load-shedding & grid instability.

Africa Generator Sets Market: What Recent Innovations Are Affecting the Industry?

- 2025: Caterpillar introduced its CAT Connect technology in Africa, incorporating advanced telematics & AI to remotely monitor genset performance, optimize fuel efficacy, and offer predictive maintenance alerts.

- 2025: Cummins declared a novel line of hybrid generator sets combining diesel & solar power designed for harsh African environments. These hybrid gensets assists in catering to industries such as telecom tower power solutions & mining sector power.

What are the Key Highlights of the Africa Generator Sets Market (2026–34)?

- The Africa Generator Sets Market is foreseen to grow at a CAGR of around 9.5%, attaining nearly USD 7.02 billion by 2034.

- Less than 50 kVA, under the power rating segment commands nearly 42% market share, instigated by residential & small commercial backup power requirements.

- Standby application leads with nearly 60% market share, essential for backup during regular grid outages.

- Industrial sector, under end-user accounts for approximately 55% market share, driven by mining, production, and infrastructure power demands.

- Diesel fuel governs with about 70% market share, due to the availability & operational efficacy in Africa.

- The embracing of AI influences predictive maintenance, load optimization, and fuel efficacy.

How does the Future Outlook of the Africa Generator Sets Market (2034) Appear?

- Sustained Growth: The Africa Generator Sets Industry would observe sustained, double-digit growth with predicted CAGR of nearly 9.5% during 2026-34, further estimating a market value of about USD 7.02 during 2026-34.

- Technological Upgrade: Incorporation of AI & IoT technologies would modernize operational efficiency, enabling automated load balancing, fuel-saving strategies, and analytical fault diagnostics, substantially minimizing downtime in perilous infrastructure.

- Future Opportunities: Government initiatives boosting the amalgamation of renewable energy sources & sustainable power solutions are fueling the progression of the Hybrid Generator Sets Market, which offers unrealized growth opportunities. Also, infrastructure developments, the increasing communication sector, and expanding industrialization would all contribute to more prime & backup power deployments.

The Africa Generator Sets Market is destined to thrive due to the sustained adoption of advanced AI-driven solutions optimizing kVA ratings, fuel usage, and dependability amidst ongoing power grid instability. Moreover, emerging demands from sectors like mining & telecom, together with innovative rental power solutions, would motivation industry growth. Also, market leaders such as Caterpillar & Cummins would continue altering the growth trajectory, cementing footprints across sub-Saharan Africa in the future years.

What Does Our Africa Generator Sets Market Research Study Entail?

- The Africa Generator Sets Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis & market scope sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The Africa Generator Sets Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the Study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Breakdown of Secondary Sources

- Primary Data Points

- Breakdown of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- Africa Generator Sets Market Overview (2020–2034)

- Market Size, By Value (USD Billion)

- Market Share, By Power Rating

- Less than 50 kVA

- 50-125 kVA

- 125-200 kVA

- 200-330 kVA

- 330-750 kV

- More than 750 kVA

- Market Share, By Application

- Standby

- Peak Shaving

- Prime & Continuous

- Market Share, By End User

- Residential

- Commercial

- Industrial

- Market Share, By Fuel Type

- Diesel

- Gas (Natural Gas, LPG)

- Hybrid (Diesel/Gas with solar or batteries)

- Market Share, By Country/Sub-Region

- Country/Sub-Region 1

- Country/Sub-Region 2

- Country/Sub-Region 3

- Market Share, By Company

- Revenue Shares

- Competition Characteristics

- Segment-wise / Industry-wise Market Overview (Forecast 2026–2034)

- By Power Rating Market Overview (2026–2034)

- By Application Market Overview (2026–2034)

- By End User Market Overview (2026–2034)

- By Fuel Type Market Overview (2026–2034)

- Forecast Year Tables (2026–2034)

- Competitive Outlook (Company Profiles)

- Atlas Copco

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Caterpillar

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Cummins

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Deere & Company

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Generac Power Systems

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- GENESAL ENERGY

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- HIMOINSA

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- J C Bamford Excavators

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Kirloskar

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- MAHINDRA POWEROL

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Atlas Copco

- Contact Us & Disclaimer

List of Figure

Figure 1: Africa Generator Sets Market Research Process

Figure 2: Breakdown of Secondary Data Sources

Figure 3: Breakdown of Primary Interviews by Stakeholder Category

Figure 4: Africa Generator Sets Market Snapshot (2020–2034)

Figure 5: Africa Generator Sets Market Size, By Value (USD Billion), 2020–2034

Figure 6: Africa Generator Sets Market Share, By Power Rating, 2024

Figure 7: Market Share of Generator Sets (<50 kVA), 2024

Figure 8: Market Share of Generator Sets (50–125 kVA), 2024

Figure 9: Market Share of Generator Sets (125–200 kVA), 2024

Figure 10: Market Share of Generator Sets (200–330 kVA), 2024

Figure 11: Market Share of Generator Sets (330–750 kVA), 2024

Figure 12: Market Share of Generator Sets (>750 kVA), 2024

Figure 13: Africa Generator Sets Market Share, By Application, 2024

Figure 14: Standby Generator Sets Demand, 2020–2034

Figure 15: Peak Shaving Application Demand, 2020–2034

Figure 16: Prime & Continuous Application Demand, 2020–2034

Figure 17: Market Share, By End User, 2024

Figure 18: Residential Generator Sets Market, 2020–2034

Figure 19: Commercial Generator Sets Market, 2020–2034

Figure 20: Industrial Generator Sets Market, 2020–2034

Figure 21: Market Share, By Fuel Type, 2024

Figure 22: Diesel Generator Sets Market Share, 2020–2034

Figure 23: Gas Generator Sets Market Share (Natural Gas, LPG), 2020–2034

Figure 24: Hybrid Generator Sets Market Share, 2020–2034

Figure 25: Market Share, By Country/Sub-Region, 2024

Figure 26: Generator Sets Market by Country/Sub-Region 1, 2020–2034

Figure 27: Generator Sets Market by Country/Sub-Region 2, 2020–2034

Figure 28: Generator Sets Market by Country/Sub-Region 3, 2020–2034

Figure 29: Market Share, By Company, 2024

Figure 30: Revenue Share of Leading Companies in the Africa Generator Sets Market, 2024

Figure 31: Competitive Landscape and Market Concentration, 2024

Figure 32: Africa Generator Sets Market Forecast by Power Rating (2026–2034)

Figure 33: Africa Generator Sets Market Forecast by Application (2026–2034)

Figure 34: Africa Generator Sets Market Forecast by End User (2026–2034)

Figure 35: Africa Generator Sets Market Forecast by Fuel Type (2026–2034)

Figure 36: Key Strategic Alliances and Partnerships among Leading Players

Figure 37: Recent Developments and Product Launches by Major Companies

Figure 38: Policy and Regulatory Framework Impacting the Africa Generator Sets Market

Figure 39: Opportunity Assessment Matrix for Key Market Players

Figure 40: Porter’s Five Forces Analysis of the Africa Generator Sets Market

List of Table

Table 1: Objective and Scope of the Africa Generator Sets Market Study

Table 2: Market Segmentation Framework

Table 3: Key Variables Considered in the Study

Table 4: Data Triangulation and Validation Approach

Table 5: Sources of Secondary Data

Table 6: List of Primary Respondents by Designation and Industry Segment

Table 7: Summary of Key Market Drivers (2025–2034)

Table 8: Summary of Major Challenges and Restraints

Table 9: Key Market Opportunities Identified in the Study

Table 10: Recent Trends and Technological Advancements in Generator Sets

Table 11: Regulatory Policies and Standards Influencing the Generator Sets Market in Africa

Table 12: Africa Generator Sets Market Size, By Value (USD Billion), 2020–2034

Table 13: Market Share, By Power Rating, 2024

Table 14: Market Share, By Application, 2024

Table 15: Market Share, By End User, 2024

Table 16: Market Share, By Fuel Type, 2024

Table 17: Market Share, By Country/Sub-Region, 2024

Table 18: Market Share, By Company, 2024

Table 19: Less than 50 kVA Generator Sets Market, 2020–2034

Table 20: 50–125 kVA Generator Sets Market, 2020–2034

Table 21: 125–200 kVA Generator Sets Market, 2020–2034

Table 22: 200–330 kVA Generator Sets Market, 2020–2034

Table 23: 330–750 kVA Generator Sets Market, 2020–2034

Table 24: More than 750 kVA Generator Sets Market, 2020–2034

Table 25: Standby Generator Sets Market Size, 2020–2034

Table 26: Peak Shaving Generator Sets Market Size, 2020–2034

Table 27: Prime & Continuous Generator Sets Market Size, 2020–2034

Table 28: Residential Sector Generator Sets Market, 2020–2034

Table 29: Commercial Sector Generator Sets Market, 2020–2034

Table 30: Industrial Sector Generator Sets Market, 2020–2034

Table 31: Diesel Generator Sets Market, 2020–2034

Table 32: Gas Generator Sets Market (Natural Gas, LPG), 2020–2034

Table 33: Hybrid Generator Sets Market, 2020–2034

Table 34: Country/Sub-Region 1 Market Overview, 2020–2034

Table 35: Country/Sub-Region 2 Market Overview, 2020–2034

Table 36: Country/Sub-Region 3 Market Overview, 2020–2034

Table 37: Forecast by Power Rating (2026–2034)

Table 38: Forecast by Application (2026–2034)

Table 39: Forecast by End User (2026–2034)

Table 40: Forecast by Fuel Type (2026–2034)

Table 41: Revenue Share of Leading Companies, 2024

Table 42: Key Strategic Alliances and Partnerships, 2020–2024

Table 43: Summary of Recent Developments by Leading Players

Table 44: Comparative Analysis of Company Strengths and Focus Areas

Table 45: Atlas Copco – Key Financials and Business Segments

Table 46: Caterpillar – Key Financials and Business Segments

Table 47: Cummins – Key Financials and Business Segments

Table 48: Deere & Company – Key Financials and Business Segments

Table 49: Generac Power Systems – Key Financials and Business Segments

Table 50: GENESAL ENERGY – Key Financials and Business Segments

Table 51: HIMOINSA – Key Financials and Business Segments

Table 52: J C Bamford Excavators – Key Financials and Business Segments

Table 53: Kirloskar – Key Financials and Business Segments

Table 54: Mahindra Powerol – Key Financials and Business Segments

Table 55: Research Assumptions and Limitations

Table 56: Contact Information and Disclaimer

Top Key Players & Market Share Outlook

- Atlas Copco

- Caterpillar

- Cummins

- Deere & Company

- Generac Power Systems

- GENESAL ENERGY

- HIMOINSA

- J C Bamford Excavators

- Kirloskar

- MAHINDRA POWEROL

Frequently Asked Questions