Understand The Key Trends Shaping This Market

Download Free SampleUS Agritourism Market Overview: Market Size & Forecast (2026–2032)

What is the anticipated CAGR & size of the US Agritourism Market?

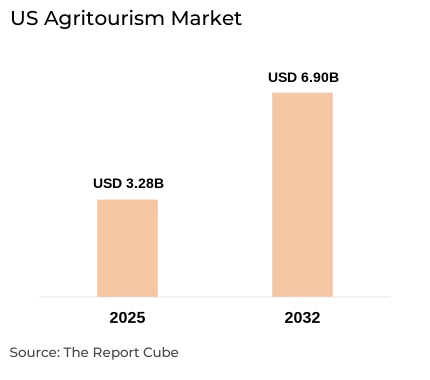

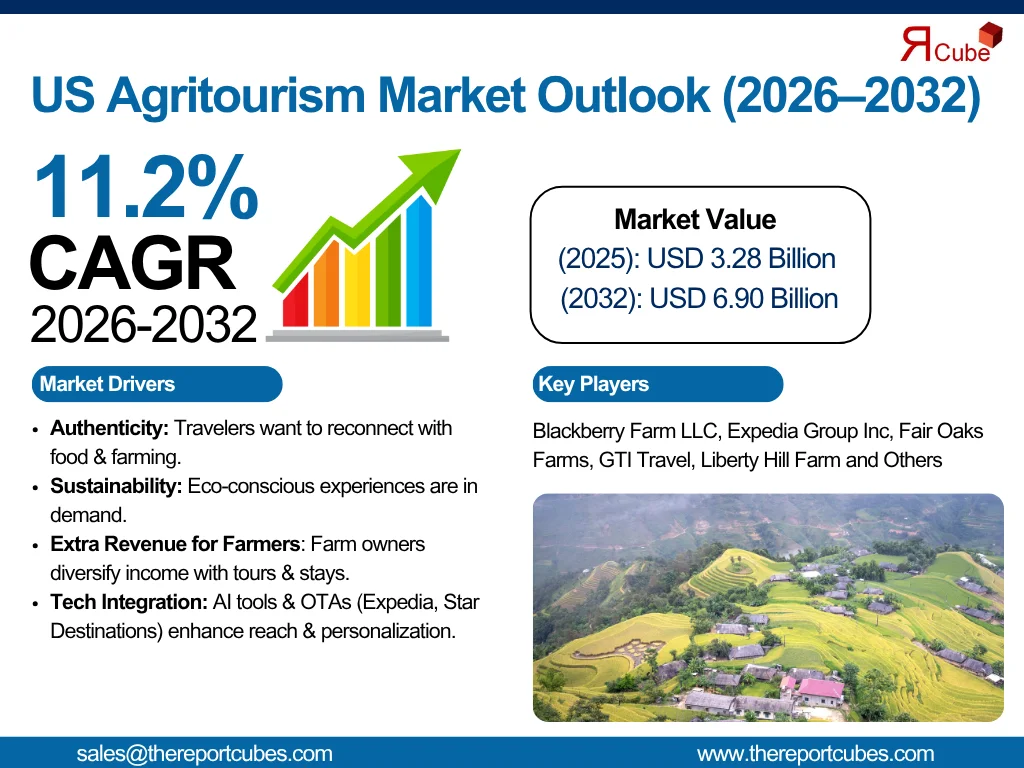

The US Agritourism Market is anticipated to register a CAGR of around 3.28% during the forecast period, 2026-32. Additionally, the market size was valued at nearly USD 3.28 billion in 2025 and is projected to reach nearly USD 6.90 billion by 2032.

Market Analysis & Insights

The US Agritourism Market is driven by growing participation in activities like farm-to-table dining, vineyard visits, fruit picking, and pumpkin patches. Also, as urbanization rises, more tourists are looking for getaways that allow them to remember traditional culture, sustainability, and traditional farming techniques. The US Agritourism Market report states that government-supported rural tourism initiatives & farm owners' modification strategies to generate extra revenue are instigating market demand.

Furthermore, the US Agritourism Market consists numerous offerings, including educational tours, farm stays, on-farm retail, and outdoor recreation. Also, major market companies such as Blackberry Farm LLC, Liberty Hill Farm, and Fair Oaks Farms are leading innovations in hospitality & agro-experiential tourism. Moreover, the ecosystem is supported by related industries, like hospitality, food processing, transport, and e-commerce, with robust offline & online sales channels managed by travel agencies & direct farm bookings. Along with this, State initiatives, such as USDA’s Rural Development Program & regional tourism campaigns in Kansas and Vermont (2024–2025), are further augmenting infrastructure & farmer contribution.

Additionally, prominent progression is the increasing embracing of AI across the US Agritourism Market. Further, platforms, including Expedia & Star Destinations are leveraging AI-driven recommendation engines, virtual farm tours, and dynamic costing to personalize experiences. Also, these developments enhance marketing, efficacy, and consumer engagement. Besides, with tourists’ rising interest in sustainable experiences, AI incorporation & digital innovation would substantially enhance the US Agritourism Market share through 2032.

US Agritourism Market Dynamics

What driving factor acts as a positive influencer for the US Agritourism Market?

- People Desire for Authentic, Sustainable, and Rural Experiences: Increasing customer interest in experiential travel that links urban dwellers to food sources, farm life, and outdoor recreation is a key demand-side driver. Elevated interest in local food & sustainability, post-pandemic behavior shifts, and the pragmatic economy have all augmented consumers' willingness to pay for immersive farm experiences, like workshops, educational tours, and farm-to-table dinners. Further, this inspires operators to provide higher-margin agritourism services in addition to commodity farming, with the assistance of marketing alliances with nearby eateries & artisanal food companies. Moreover, as operators become more professional, the US Agritourism Market attracts both domestic & niche foreign tourists, enhancing farm revenues & capturing greater per-visitor investments.

What are the challenges that affect the US Agritourism Market?

- Seasonality, Regulation, and Operator Capacity to Limit the Market Growth: Agritourism expansion is hindered by seasonality, weather sensitivity, and intricate regulations. Also, uneven visitor influx affects cash flow & staffing, while zoning & liability rules deter market growth. Moreover, limited digital marketing skills also hampers smaller farms. Further, training, cooperative marketing, and simplified permits are fundamental for inclusive, sustainable rural growth.

How are the future opportunities transforming the market during 2026-32?

- Digital Channels, OTAs, and AI Marketing: Online travel agencies & AI-driven personalization expand farm visibility & revenue. Moreover, chatbots, dynamic costing, and demand forecasting tools aid small operators manage bookings, optimize resources, and upsell experiences. Also, accessible AI toolkits & digital incorporation are altering agritourism into a scalable, data-informed, and customer-centric industry model.

What market trends are affecting the US Agritourism Market Outlook?

- Variation & Climate Resilience to be Trending: Operators now provide retreats, wellness stays, and educational programs year-round. Also, investments in glamping, green infrastructure, and climate-resilient crops lessen weather hazards. Furthermore, collaborations with chefs & schools generate recurring demand, ever-changing agritourism from seasonal visits to continuous hospitality & improving local economies through stable farm-based experiences.

How is the US Agritourism Market Defined as per Segments?

The US Agritourism Market Research Reports provide detailed market data & insights in accordance with market segmentation. Some of the segments are:

- Tourist Type: Domestic & International

- Activity: On-farm Sales, Outdoor Recreation, Agritainment, Educational Tourism, Accommodations, and Others

By Tourist Type:

Outdoor Recreation captures the largest share of the US Agritourism Market. This is due to family demand for active, educational outings, the majority of agritourism revenues are generated by outdoor recreation & hands-on experiences (pick-your-own, corn mazes, and farm tours). Also, outdoor leisure is a key source of income, as per studies & market reports. Further, its seasonality can be lessened by branching out into related activities (e.g., farm dinners, animal interactions, educational workshops). Moreover, these encounters organically complement on-farm hospitality & sales, rising per-visitor expenditure & promoting return trips.

By Activity:

Outdoor recreation and hands-on experiences (pick-your-own, corn mazes, farm tours) generate the largest share of agritourism revenues, supported by family demand for active, educational outings. Studies and market reports identify outdoor recreation as a top revenue driver—its seasonality is mitigated by diversifying into complementary activities (farm dinners, animal interactions, educational workshops). These experiences pair naturally with on-farm sales and hospitality, raising per-visitor spending and encouraging repeat visits. As operators professionalize, outdoor experiences are packaged with lodging, dining and branded retail, forming integrated guest journeys that increase average transaction value across the agritourism industry.

US Agritourism Market: Recent Developments (2025)

- Blackberry Farm continued development of curated guest programming & culinary partnerships, emphasizing farm-sourced dining & extended-stay retreats, strengthening its luxury agritourism positioning.

- Fair Oaks Farms rolled out improved family-education packages & overnight stay partnerships with hospitality brands, surging on-site accommodation capacity & year-round visitor programming.

What are the Key Highlights of the US Agritourism Market (2026–32)?

- The US Agritourism Market is anticipated to expand steadily from 2026–2032 at a CAGR of about 11.2%, driven by customer demand for authentic rural & farm-based experiences.

- Farm stays, fruit picking, wine tours, and pumpkin patches to lead the tourist preferences section.

- Surging AI adoption improves marketing personalization, visitor management, and dynamic costing.

- Digital platforms & OTAs inflate prominence for small farms.

- Sustainability, modification, and climate-resilient practices are transforming operations, supporting year-round tourism & rural economic expansion.

How does the Future Outlook of the US Agritourism Market (2032) Appears?

The US Agritourism Market would be considerably more professionalized by 2032, with a greater market share for multi-day rural stays, more strong OTA amalgamations, and a broader application of AI for operations & personalization. Also, cooperative marketing, governmental assistance, and climate-adaptive programming would surge the advantages in rural areas. Moreover, by utilizing AI-enabled demand, dynamic pricing, and virtual experiences, operators might enhance their market shares & maintain year-round revenue, which would propel the Agritourism Industry's robust expansion in the US through 2032.

What Does Our US Agritourism Market Research Study Entail?

- The US Agritourism Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The US Agritourism Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- US Agritourism Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- Market Share, By Tourist Type

- Domestic

- International

- Market Share, By Activity

- On-farm Sales

- Outdoor Recreation

- Agritainment

- Educational Tourism

- Accommodations

- Others

- Market Share, By Activity

- Educational Tourism

- Outdoor Recreation

- On-farm Sales

- Entertainment

- Accommodations

- Others

- Market Share, By Booking Channel

- Direct Booking

- Marketplace Booking

- Online Travel Agents and Travel Agencies (OTAs)

- Market Share, By Sales Channel

- Travel Agents

- Direct

- Market Share, By Competitors

- Competition Characteristics

- Revenue Shares

- US Domestic Agritourism Market Overview, 2020-2032F

- By Value (USD Million)

- By Activity- Market Size & Forecast 2019-2030, USD Million

- By Activity- Market Size & Forecast 2019-2030, USD Million

- By Booking Channel- Market Size & Forecast 2019-2030, USD Million

- US International Agritourism Market Overview, 2020-2032F

- By Value (USD Million)

- By Activity- Market Size & Forecast 2019-2030, USD Million

- By Activity- Market Size & Forecast 2019-2030, USD Million

- By Booking Channel- Market Size & Forecast 2019-2030, USD Million

- Competitive Outlook (Company Profile - Partila List)

- Blackberry Farm LLC

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Expedia Group Inc

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Fair Oaks Farms

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- GTI Travel

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Liberty Hill Farm

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Kansas Tourism

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Select Holidays

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Star Destinations

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Others

- Blackberry Farm LLC

- Contact Us & Disclaimer

List of Figure

Figure 1: Research Design and Methodology

Figure 2: Breakdown of Primary and Secondary Research Approach

Figure 3: Companies Interviewed During Secondary Research

Figure 4: Structure of Primary Interviews

Figure 5: U.S. Agritourism Market Snapshot, 2024

Figure 6: U.S. Agritourism Market Size, 2020–2032 (USD Billion)

Figure 7: Key Market Drivers, Challenges, and Opportunities

Figure 8: Recent Trends Shaping the U.S. Agritourism Market

Figure 9: Regulatory and Policy Framework in the U.S. Agritourism Sector

Figure 10: Market Segmentation of the U.S. Agritourism Industry

Figure 11: U.S. Agritourism Market Share, By Tourist Type, 2024 (%)

Figure 12: U.S. Agritourism Market Share, By Activity, 2024 (%)

Figure 13: Market Share Analysis – On-farm Sales vs Outdoor Recreation vs Agritainment

Figure 14: Market Share Analysis – Educational Tourism vs Accommodations vs Others

Figure 15: U.S. Agritourism Market Share, By Booking Channel, 2024 (%)

Figure 16: U.S. Agritourism Market Share, By Sales Channel, 2024 (%)

Figure 17: Competitive Landscape – Key Players and Market Concentration, 2024

Figure 18: U.S. Domestic Agritourism Market Size, 2020–2032 (USD Million)

Figure 19: Domestic Agritourism – Market Share, By Activity, 2024 (%)

Figure 20: Domestic Agritourism – Market Forecast, By Booking Channel, 2020–2032 (USD Million)

Figure 21: U.S. International Agritourism Market Size, 2020–2032 (USD Million)

Figure 22: International Agritourism – Market Share, By Activity, 2024 (%)

Figure 23: International Agritourism – Market Forecast, By Booking Channel, 2020–2032 (USD Million)

Figure 24: Comparative Growth Analysis: Domestic vs International Agritourism (2020–2032)

Figure 25: Market Share of Leading Competitors, 2024 (%)

Figure 26: Strategic Alliances and Partnerships Landscape (2020–2025)

Figure 27: SWOT Analysis of Major Agritourism Companies

Figure 28: Revenue Distribution of Key Players, 2024

Figure 29: Future Growth Potential of Agritourism in the U.S. (2030–2032F)

Figure 30: Value Chain Analysis of the Agritourism Industry

List of Table

Table 1: Objective and Scope of the Study

Table 2: Definition of Key Agritourism Activities

Table 3: Market Segmentation by Tourist Type, Activity, Booking Channel, and Sales Channel

Table 4: List of Key Study Variables and Indicators

Table 5: Secondary Data Sources and References

Table 6: List of Companies Interviewed for Secondary Research

Table 7: Primary Research Respondent Categories and Distribution

Table 8: U.S. Agritourism Market Summary, 2020–2032 (USD Billion)

Table 9: Key Market Drivers and Their Impact on Growth

Table 10: Key Market Challenges and Restraints

Table 11: Emerging Opportunities in U.S. Agritourism (2024–2032)

Table 12: Recent Trends and Developments in the Agritourism Industry

Table 13: Policy and Regulatory Frameworks Impacting Agritourism in the U.S.

Table 14: U.S. Agritourism Market Size, by Tourist Type (2020–2032, USD Billion)

Table 15: U.S. Agritourism Market Size, by Activity (2020–2032, USD Billion)

Table 16: U.S. Agritourism Market Size, by Booking Channel (2020–2032, USD Billion)

Table 17: U.S. Agritourism Market Size, by Sales Channel (2020–2032, USD Billion)

Table 18: Competitive Characteristics and Market Concentration Ratios (CR3, CR5)

Table 19: Revenue Share of Major Players, 2024 (%)

Table 20: U.S. Domestic Agritourism Market Size, 2020–2032 (USD Million)

Table 21: Domestic Agritourism – Market Size by Activity (2020–2032, USD Million)

Table 22: Domestic Agritourism – Market Size by Booking Channel (2020–2032, USD Million)

Table 23: U.S. International Agritourism Market Size, 2020–2032 (USD Million)

Table 24: International Agritourism – Market Size by Activity (2020–2032, USD Million)

Table 25: International Agritourism – Market Size by Booking Channel (2020–2032, USD Million)

Table 26: Comparison of Domestic vs. International Agritourism Market Growth (2020–2032)

Table 27: Company Profile – Blackberry Farm LLC

Table 28: Company Profile – Expedia Group Inc.

Table 29: Company Profile – Fair Oaks Farms

Table 30: Company Profile – GTI Travel

Table 31: Company Profile – Liberty Hill Farm

Table 32: Company Profile – Kansas Tourism

Table 33: Company Profile – Select Holidays

Table 34: Company Profile – Star Destinations

Table 35: Summary of Strategic Partnerships and Collaborations (2020–2025)

Table 36: SWOT Analysis of Leading Agritourism Operators

Table 37: Financial Overview and Revenue Comparison of Key Players

Table 38: Future Forecast of Agritourism Market Value, 2030–2032F

Table 39: Key Assumptions and Limitations of the Study

Table 40: Research Contact and Disclaimer

Top Key Players & Market Share Outlook

- Blackberry Farm LLC

- Expedia Group Inc

- Fair Oaks Farms

- GTI Travel

- Liberty Hill Farm

- Kansas Tourism

- Select Holidays

- Star Destinations

- Others

Frequently Asked Questions