Understand The Key Trends Shaping This Market

Download Free SampleVietnam AI in Agriculture Market Overview: Market Size & Forecast (2026–2034)

What is the anticipated CAGR & size of the Vietnam AI in Agriculture Market?

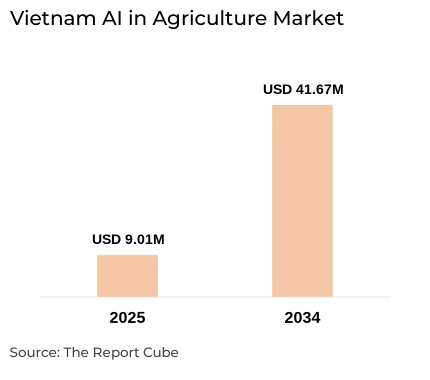

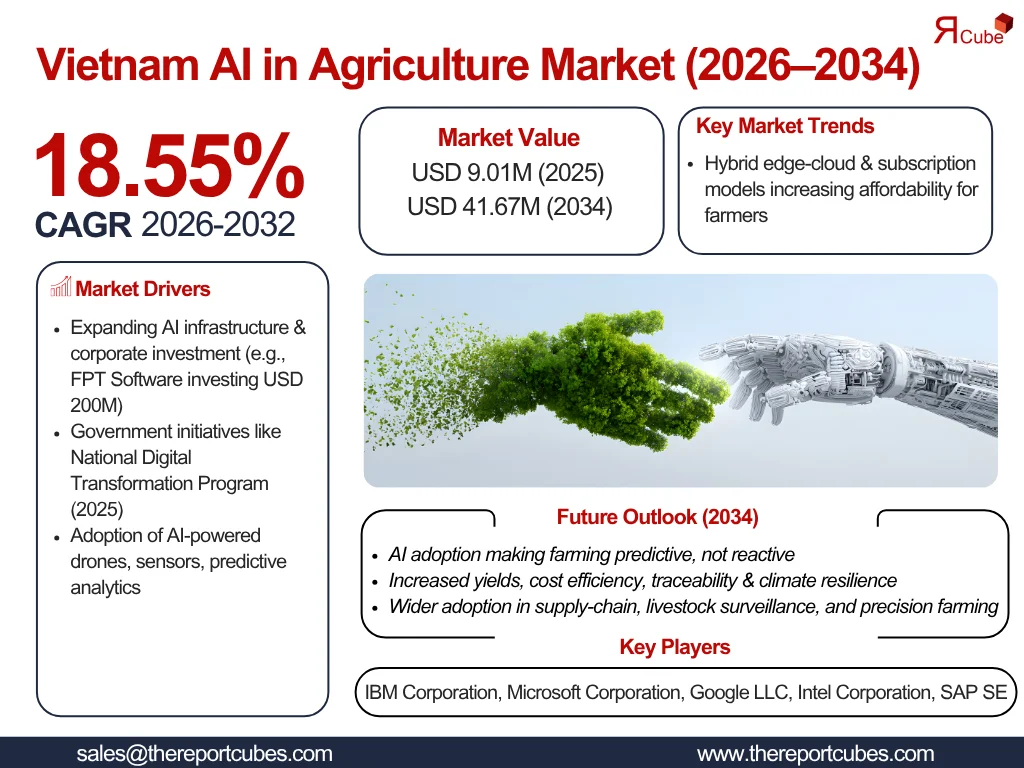

The Vietnam AI in Agriculture Market is anticipated to register a CAGR of around 18.55% during the forecast period, 2026-34. Additionally, the market size was valued at nearly USD 9.01 million in 2025 and is projected to reach nearly USD 41.67 million by 2034.

Market Insights & Analysis

With the surging deployment of AI-powered technologies in precision farming, crop monitoring, and smart irrigation, is creating a great difference across the transformation of the Vietnam AI in Agriculture Market. AI applications are modernizing Vietnam’s agriculture industry, with smart sensors, drone analytics, and predictive data models enabling farmers to monitor soil health, optimize fertilizer usage, and prevent pest infestations. Moreover, market companies such as John Deere & Company, IBM Corporation, and Microsoft Corporation are incorporating AI systems & IoT-based solutions to assist farmers make real-time decisions. Further, in 2024, IBM’s Watson Decision Platform was piloted in Vietnam to offer AI-driven crop yield forecasts, while FPT Software joined forces with Google Cloud AI to develop predictive analytics for rice production effectiveness.

Furthermore, government-backed initiatives, like the National Digital Transformation Program (2025), promote AI technology & data analytics acceptance in agriculture via subsidies, training, and R&D support. Also, related industries, like smart machinery, agri-tech, and supply chain management, are also leveraging AI to improve production efficiency & quality control. Along with this, ales channels mostly include agri-tech distributors, digital marketplaces, and B2B associations with cooperatives & export agencies, further aiding in enhancing the Vietnam AI in Agriculture Market share.

Additionally, the elevated acceptance of AI-powered drones, computer vision, and AI-driven pest control systems is redesigning Vietnam’s agricultural landscape. Also, as farmers incorporate AI solutions to attain real-time decision-making & optimize yield, the Vietnam AI in Agriculture Market is destined for solid growth. Further, looking ahead, the Vietnam AI in Agriculture Industry would observe wider acceptance driven by innovation, partnerships, and government-supported digital initiatives, putting Vietnam as a national front-runner across the field of precision agriculture by 2034.

Vietnam AI in Agriculture Market Dynamics

What driving factor acts as a positive influencer for the Vietnam AI in Agriculture Market?

- Expanding AI Infrastructure & Corporate Investment to Instigate Market Growth: Solid local investments in AI infrastructure & research are driving the AI in Agricultural Market in Vietnam. Further, to elevate computing capacity & foster local innovation, businesses, like FPT are investing more than USD 200 million on AI factories & research and development facilities. Thus, this expansion enables faster employment of precision agriculture, pest monitoring, and predictive analytics tools, improving productivity & minimizing costs for Vietnamese farmers through improved data access & real-time decision-making.

What are the challenges that affect the Vietnam AI in Agriculture Market?

- Uneven Farm Structure & Data Unpredictability to Hinder Industry: Large-scale AI deployment is hampered by the fact that Vietnam's agriculture is categorized by tiny, dispersed farms, the majority of which are smaller than two hectares. Also, accurate model training & predictive analytics are hindered by a variety of cropping patterns, inadequate data standards, and low levels of digital literacy among farmers. Moreover, the adoption of AI-driven solutions is slowed by the uneven environment, which surges the cost of equipment & data collection. Thus, attaining uniform technological access & commercial scalability throughout rural regions continues to be a crucial challenge to Vietnam AI in Agriculture Market progress.

How are the future opportunities transforming the market during 2026-34?

- AI-based Livestock Disease Detection & Management to Open New Avenues: The recurring outbreaks of diseases like African swine fever have created a pressing need for AI-based livestock monitoring solutions. AI tools using sensors and computer vision can detect early behavioral or environmental anomalies in animals, minimizing mortality rates. With over 500 livestock disease outbreaks reported recently, Vietnam’s adoption of AI-powered disease surveillance systems presents a major opportunity for enhancing food security, biosecurity, and overall livestock management efficiency.

What market trends are affecting the Vietnam AI in Agriculture Market Outlook?

- Surging Hybrid Edge-Cloud & Subscription Models: A key market trend is the shift toward hybrid edge-cloud systems and subscription-based AI services. Real-time data from drones and sensors are processed locally, while complex analytics are performed in domestic cloud centers for efficiency and scalability. This approach lowers connectivity challenges and upfront hardware costs, allowing small and medium-scale farmers to adopt AI solutions affordably, while vendors benefit from recurring revenues through AI-as-a-Service models.

How is the Vietnam AI in Agriculture Market Defined as per Segments?

- Offering: Software, Hardware, AI-as-a-Service, and Services

- Application: Precision Farming, Agriculture Robots, Livestock Monitoring, Drone Analytics, Labor Management, and Others

By Offering:

Software is one of the dominant segment across the Vietnam AI in Agriculture Market, capturing the potential market share. Also, the Software segment is presumed to attain a CAGR of nearly 28.1% during 2026-34.

As farm-management platforms, remote-sensing analytics, and prescriptive ML models provide instant operational value without foremost capital hardware investments the segment is destined to flourish in the following years as well. Cooperatives & farms with an export emphasis could employ cloud/edge software as it permits for supply-chain traceability, yield prediction, and pest/disease detection via subscription or API models. Also, as industries emphasize data analytics, model maintenance, and incorporation services, market indicators specify that software & analytics subscriptions account for the biggest vale of near-term investment in AI agritech. Moreover, the modularity of software also enables providers to profit from ongoing updates & AI-powered decision assistance, enhancing margins in comparison to hardware sales & boosting the expansion of Vietnam's AI in Agricultural Market share.

By Application:

Precision Farming accounts for the largest share of the Vietnam AI in Agriculture Market. Also, the Precision Farming is foreseen to grab a CAGR of about 19.4% during 2026-34.

The segment governs application acceptance as it delivers measurable input savings & yield enhancements, critical for export-oriented crops such as coffee, rice, and high-value vegetables. Also, AI-driven precision agriculture pools satellite/drone imagery, soil & microclimate sensors with predictive models to enhance fertilizer, water & pesticide application at the field-plot level. Moreover, early utilizations report minimized input usage & enhanced yield consistency, which makes ROI visible to commercial growers & cooperatives. Further, as traceability & quality control necessities tighten in global markets, precision solutions, traded as software subscriptions or bundled hardware + analytics, are the primary engine escalating the Vietnam AI in Agriculture Market size.

Vietnam AI in Agriculture Market: Recent Developments (2025)

- John Deere declared its Startup Collaborator cohort, increasing partnerships with ag-robotics & analytics startups. The program enables field validation of autonomous/ag-robotic solutions that could be directed or adapted for Southeast Asian operations, assisting speed technology transfer to markets such as Vietnam.

What are the Key Highlights of the Vietnam AI in Agriculture Market (2026–34)?

- The Vietnam AI in Agriculture Market is anticipated to expand at a CAGR of about 18.55% during 2026–2034, instigated by surging digital acceptance in farming practices.

- Robust government-supported programs are augmenting AI-powered technology employment in crop monitoring & precision agriculture.

- AI systems & data analytics allow real-time decision-making, enhancing productivity & sustainability.

- The Vietnam AI in Agriculture Market companies, including FPT Software, IBM, and John Deere are pioneering AI-driven innovations in Vietnam’s agriculture industry.

How does the Future Outlook of the Vietnam AI in Agriculture Market (2034) Appears?

As computing, data, and training expands, a wider usage of AI in supply-chain quality control, livestock surveillance, and precision farming is expected in the future years. Moreover, cooperatives & mid-sized farms would be able to afford advanced analytics owing to subscription AI solutions & hybrid edge/cloud deployments, which would enhance the AI in Vietnam Agricultural Market share & export competitiveness. Furthermore, with AI, farming would become more predictive rather than reactive, growing yields, decreasing input prices, enhancing traceability, and fortifying resistance to climate shocks. Also, the market forecast is observed to be positive, with private investment & government assistance fueling further acceptance growth across the country.

What Does Our Vietnam AI in Agriculture Market Research Study Entail?

- The Vietnam AI in Agriculture Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The Vietnam AI in Agriculture Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- Vietnam AI in Agriculture Market Overview (2020-2034)

- Market Size, By Value (in USD Millions)

- Market Share, By Offering

- Software

- Hardware

- AI-as-a-Service

- Services

- Market Share, By Application

- Precision Farming

- Agriculture Robots

- Livestock Monitoring

- Drone Analytics

- Labor Management

- Others

- Market Share, By Competitors

- Competition Characteristics

- Revenue Shares

- Vietnam Software AI in Agriculture Market Overview, 2020-2034F

- By Value (USD Million)

- Vietnam Hardware AI in Agriculture Market Overview, 2020-2034F

- By Value (USD Million)

- Vietnam AI-as-a-Service AI in Agriculture Market Overview, 2020-2034F

- By Value (USD Million)

- Vietnam Services AI in Agriculture Market Overview, 2020-2034F

- By Value (USD Million)

- Competitive Outlook (Company Profile - Partila List)

- IBM Corporation

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Microsoft Corporation

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Google LLC

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Intel Corporation

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- SAP SE

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- BASF SE

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- John Deere & Company

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Syngenta International AG

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Trimble Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Corteva Agriscience

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- IBM Corporation

- Contact Us & Discla

List of Figure

Figure 1.1: Objective of the Study

Figure 1.2: Product Definition

Figure 1.3: Market Segmentation Overview

Figure 1.4: Study Variables

Figure 2.1: Secondary Data Points Methodology

Figure 2.2: Companies Interviewed

Figure 2.3: Primary Data Points Methodology

Figure 2.4: Breakdown of Primary Interviews

Figure 3.1: Executive Summary Snapshot

Figure 4.1: Market Drivers

Figure 4.2: Market Challenges

Figure 4.3: Opportunity Assessment

Figure 5.1: Recent Trends and Developments in Vietnam AI in Agriculture

Figure 6.1: Policy and Regulatory Landscape

Figure 7.1: Vietnam AI in Agriculture Market Size (2020–2034, USD Million)

Figure 7.2: Market Share by Offering

Figure 7.2.1: Software Market Share

Figure 7.2.2: Hardware Market Share

Figure 7.2.3: AI-as-a-Service Market Share

Figure 7.2.4: Services Market Share

Figure 7.3: Market Share by Application

Figure 7.3.1: Precision Farming

Figure 7.3.2: Agriculture Robots

Figure 7.3.3: Livestock Monitoring

Figure 7.3.4: Drone Analytics

Figure 7.3.5: Labor Management

Figure 7.3.6: Other Applications

Figure 7.4: Market Share by Competitors

Figure 7.4.1: Competition Characteristics

Figure 7.4.2: Revenue Shares

Figure 8.1: Vietnam Software AI in Agriculture Market Value (USD Million, 2020–2034)

Figure 9.1: Vietnam Hardware AI in Agriculture Market Value (USD Million, 2020–2034)

Figure 10.1: Vietnam AI-as-a-Service Market Value (USD Million, 2020–2034)

Figure 11.1: Vietnam Services AI Market Value (USD Million, 2020–2034)

Figure 12.1: IBM Corporation – Company Overview & Business Segments

Figure 12.2: IBM Corporation – Strategic Alliances & Recent Developments

Figure 12.3: Microsoft Corporation – Company Overview & Business Segments

Figure 12.4: Microsoft Corporation – Strategic Alliances & Recent Developments

Figure 12.5: Google LLC – Company Overview & Business Segments

Figure 12.6: Google LLC – Strategic Alliances & Recent Developments

Figure 12.7: Intel Corporation – Company Overview & Business Segments

Figure 12.8: Intel Corporation – Strategic Alliances & Recent Developments

Figure 12.9: SAP SE – Company Overview & Business Segments

Figure 12.10: SAP SE – Strategic Alliances & Recent Developments

Figure 12.11: BASF SE – Company Overview & Business Segments

Figure 12.12: BASF SE – Strategic Alliances & Recent Developments

Figure 12.13: John Deere & Company – Company Overview & Business Segments

Figure 12.14: John Deere & Company – Strategic Alliances & Recent Developments

Figure 12.15: Syngenta International AG – Company Overview & Business Segments

Figure 12.16: Syngenta International AG – Strategic Alliances & Recent Developments

Figure 12.17: Trimble Inc. – Company Overview & Business Segments

Figure 12.18: Trimble Inc. – Strategic Alliances & Recent Developments

Figure 12.19: Corteva Agriscience – Company Overview & Business Segments

Figure 12.20: Corteva Agriscience – Strategic Alliances & Recent Developments

Figure 13.1: Contact Information & Disclaimer

List of Table

Table 1.1: Study Scope and Objective

Table 1.2: Product Definition

Table 1.3: Market Segmentation Overview

Table 1.4: Study Variables

Table 2.1: Secondary Data Points

Table 2.2: Companies Interviewed

Table 2.3: Primary Data Points

Table 2.4: Breakdown of Primary Interviews

Table 4.1: Key Market Drivers

Table 4.2: Major Market Challenges

Table 4.3: Opportunity Assessment

Table 5.1: Recent Trends and Developments

Table 6.1: Policy and Regulatory Landscape Overview

Table 7.1: Vietnam AI in Agriculture Market Size (2020–2034, USD Million)

Table 7.2: Market Share by Offering

Table 7.2.1: Software Market Share

Table 7.2.2: Hardware Market Share

Table 7.2.3: AI-as-a-Service Market Share

Table 7.2.4: Services Market Share

Table 7.3: Market Share by Application

Table 7.3.1: Precision Farming

Table 7.3.2: Agriculture Robots

Table 7.3.3: Livestock Monitoring

Table 7.3.4: Drone Analytics

Table 7.3.5: Labor Management

Table 7.3.6: Other Applications

Table 7.4: Market Share by Competitors

Table 7.4.1: Competition Characteristics

Table 7.4.2: Revenue Shares

Table 8.1: Vietnam Software AI in Agriculture Market Value (USD Million, 2020–2034)

Table 9.1: Vietnam Hardware AI in Agriculture Market Value (USD Million, 2020–2034)

Table 10.1: Vietnam AI-as-a-Service Market Value (USD Million, 2020–2034)

Table 11.1: Vietnam Services AI Market Value (USD Million, 2020–2034)

Table 12.1: IBM Corporation – Company Overview & Business Segments

Table 12.2: IBM Corporation – Strategic Alliances & Recent Developments

Table 12.3: Microsoft Corporation – Company Overview & Business Segments

Table 12.4: Microsoft Corporation – Strategic Alliances & Recent Developments

Table 12.5: Google LLC – Company Overview & Business Segments

Table 12.6: Google LLC – Strategic Alliances & Recent Developments

Table 12.7: Intel Corporation – Company Overview & Business Segments

Table 12.8: Intel Corporation – Strategic Alliances & Recent Developments

Table 12.9: SAP SE – Company Overview & Business Segments

Table 12.10: SAP SE – Strategic Alliances & Recent Developments

Table 12.11: BASF SE – Company Overview & Business Segments

Table 12.12: BASF SE – Strategic Alliances & Recent Developments

Table 12.13: John Deere & Company – Company Overview & Business Segments

Table 12.14: John Deere & Company – Strategic Alliances & Recent Developments

Table 12.15: Syngenta International AG – Company Overview & Business Segments

Table 12.16: Syngenta International AG – Strategic Alliances & Recent Developments

Table 12.17: Trimble Inc. – Company Overview & Business Segments

Table 12.18: Trimble Inc. – Strategic Alliances & Recent Developments

Table 12.19: Corteva Agriscience – Company Overview & Business Segments

Table 12.20: Corteva Agriscience – Strategic Alliances & Recent Developments

Top Key Players & Market Share Outlook

- IBM Corporation

- Microsoft Corporation

- Google LLC

- Intel Corporation

- SAP SE

- BASF SE

- John Deere & Company

- Syngenta International AG

- Trimble Inc.

- Corteva Agriscience

- Others

Frequently Asked Questions