AI in UAE Digital Healthcare Market

Source: The Report Cube

Understand The Key Trends Shaping This Market

Download Free SampleAI in UAE Digital Healthcare Market Overview: Market Size & Forecast (2026-2032)

What is the Anticipated CAGR & Size of the AI in UAE Digital Healthcare Market?

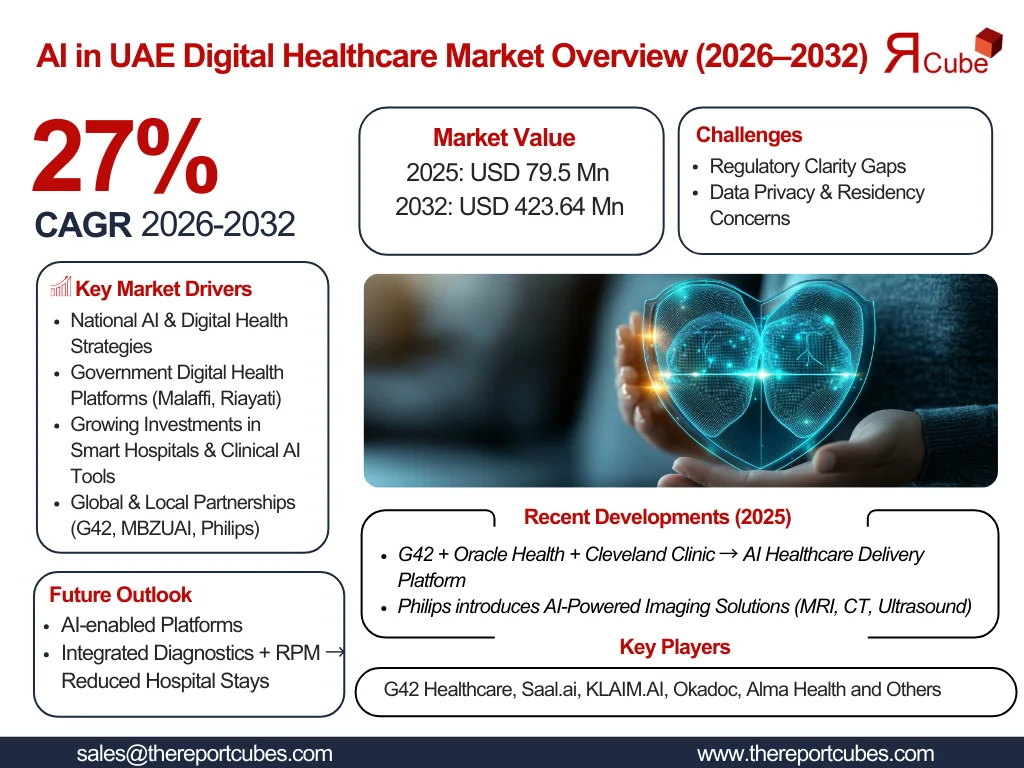

The AI in UAE Digital Healthcare Market is anticipated to register a CAGR of around 27% during the forecast period, 2026-32. Additionally, the market size was valued at nearly USD 79.5 million in 2025 and is projected to reach nearly USD 423.64 million by 2032.

How is AI Transforming Digital Healthcare?

AI advances diagnostic accuracy (imaging & retinal screening), automates triage (smart triage / virtual caregivers), enables constant care (wearables integration & RPM), and augments drug discovery (generative AI). It also motivates personalization (precision medicine, genomics & Emirati Genome Program) and efficacy (EHR interoperability, APIs & integration).

Also, agentic AI prototypes are being put into trial for workflow automation & clinical assistance, shifting beyond passive inference to agentic orchestration of tasks (e.g., scheduling, escalation, multi-step claims routing) while raising doubts about AI regulation/data privacy/responsible AI in healthcare. Moreover, local launches & partnerships in the historical years, as well as in the future years (platform rollouts, model releases, and telco-edge AI initiatives), are further catalyzing the AI deployments across the UAE Digital Healthcare Market.

Market Analysis

The AI in UAE Digital Healthcare Market is observing tremendous growth instigated by government digitization, private investment, and aggressive application of AI across the UAE Healthcare Market. The AI integration across the industry includes telehealth platforms, remote patient monitoring (RPM), electronic health records (EHR) integration, AI-powered diagnostics (e.g., radiology, retinal screening), and data-driven services, like predictive analytics (population health).

Moreover, healthcare providers & customers are investing in smart hospitals/hospital management systems to enhance throughput & outcomes, while start-ups and global vendors are emphasizing supplying clinical language models/medical LLM tools & gen-AI for decision support. Along with this, local AI players (notably G42 & MBZUAI) are fast-tracking model availability & applied R&D, increasing adoption of clinical decision support & radiology automation across the UAE hospitals, hence instigating the role-play of AI in UAE Digital Healthcare Market.

Moreover, to have a smooth deployment of AI in the digital healthcare, the UAE market requires established institutions & international vendors to redesign their services into integrated, certified clinical goods. For start-ups, the opportunity lies in verticalized solutions (teletriage, agentic workflow aides, radiology automation). Further, a decrease in readmissions (RPM + predictive analytics), enhanced chronic disease management (diabetes, cardiovascular use cases), and earlier identification (AI diagnostics) can all aid in improving patient outcomes.

Additionally, Abu Dhabi is developing as an AI & research hub (MBZUAI, G42 collaborations & research initiatives), while Dubai demonstrates a solid market penetration for telemedicine & hospital digitalization. Furthermore, neighboring GCC nations’ interoperability & cross-border pilots are supporting scale & talent exchange, growing acceptance across the Emirates. The near-term future of the UAE Digital Healthcare Market appears favorable, as public programs, private innovation, and AI acceptance would drive sustainable market growth & generate new clinical & commercial opportunities in the forthcoming years.

AI in UAE Digital Healthcare Market Dynamics

What driving factor acts as a positive influencer for the AI in UAE Digital Healthcare Market?

- Emphasis Upon National AI & Digital Health Strategies: The UAE’s explicit national drive for digital revolution, research institutes (MBZUAI), and flagship AI initiatives have considerably minimized accessibility friction for healthcare AI.

Also, public digital health platforms & investments in interoperability & EHR deployment (Malaffi, Riayati) make it easier for hospitals & clinics to onboard AI-powered diagnostics & predictive analytics (population health) tools. Thus, this robust policy & funding environment curtails commercialization cycles for vendors & incentivizes trials at scale, allowing faster transition from pilots to production systems.

What are the challenges that affect the AI in UAE Digital Healthcare Market?

- Data Governance, Privacy, and Regulatory Clarity to Limit Industry Growth: Nowadays, clinical language models, medical LLM tools, and agentic systems are being deployed more often than they are being regulated. Also, in line with the legal ambiguity & restrictions on seamless data incorporation among providers, concerns around residency, patient permission, and privacy framework compliance in cross-emirate data flows are hampering the prevalent deployment of AI across the UAE Digital Healthcare Market.

Furthermore, solid AI regulation, data privacy, and responsible AI in healthcare are becoming more & more demanding. Thus, regulators need to specify guidelines for model validation, liability, and auditing for both agentic AI acts & ML pipelines.Moreover, in the lack of clear rules & regulations, provider risk aversion might also slow the adoption of higher-value AI implementation cases across the national market.

How are the future opportunities transforming the market during 2026-32?

- Edge AI + Telco Convergence for Remote Care to Open New Avenues: The grouping of 5G, private networks, and edge compute (telco + chipset partnerships) enables real-time remote patient monitoring (RPM) & constant nursing through wearables integration, such as Apple Watch, Fitbit, etc.

In addition, collaborations between several chipset suppliers & local telecoms enable low-latency AI inference at the edge, creating new opportunities for sophisticated home care, mobile imaging, and tele-ICU solutions. Also, for numerous software developers, device producers, and healthcare establishments seeking decentralized care, this acts as a real-world commercial platform.

What market trends are affecting the AI in UAE Digital Healthcare Market Outlook?

- Greater Shift from Clinical Processes to Platformization, and to Point Solutions: Healthcare establishments favor integrated platforms (smart hospitals/hospital management systems) that pool EHRs, AI triage, imaging pipelines, and RPM dashboards. The market is shifting from one-off pilots to vendor ecosystems that provide end-to-end clinical workflows & billing integration. Thus, this trend promotes the value of interoperability (APIs & integration) & positions companies to provide bundled clinical-to-operational value as the market’s front-runners.

Also, the stress upon personalized medicine/precision medicine & genomics programs further pushes market demand for platforms that could store & compute big health-omics datasets strongly.

How is the AI in UAE Digital Healthcare Market Defined as per Segments?

The AI in UAE Digital Healthcare Market Research Reports provide detailed market data & insights in accordance with market segmentation. Some of the segments are:

- Application: Obesity, Diabetes, Cardiovascular, Respiratory Diseases, and Others.

- End-Use: Patients, Providers, Payers, and Others

By Application:

The Diabetes & Cardiovascular disease segment, supported by telemedicine/telehealth UAE platforms & remote patient monitoring (RPM), attains the potential share of the AI in UAE Digital Healthcare Market. This is owing to the increasing chronic disease incidence & patient fondness for remote follow-up.

Tele-care platforms that assimilate AI-powered diagnostics & predictive analytics (population health) enable active disease management, decreasing inpatient admissions & enhancing adherence. Also, hospitals & clients accentuate integrated care pathways, making telehealth the core development engine for making the diabetes & cardiovascular disease segment prominent across the UAE Digital Healthcare Industry.

By End-Use:

The Providers (hospitals, clinics, and diagnostic centers) segment grabs the largest share of the AI in UAE Digital Healthcare Market. This segment is the primary buyer of smart hospitals/hospital management systems, EHR integration (Malaffi, Riayati), imaging AI, and clinical decision support tools.

Also, providers invest to enhance throughput, diagnostic accuracy (AI for diagnostic imaging/radiology automation), and patient experience (teletriage, RPM). Moreover, government health organizations & greater hospital groups are early adopters, motivating procurement cycles & creating clinical validation pathways that smaller providers later follow. Further, incorporation with national platforms augments deployment across the widespread provider networks.

AI in UAE Digital Healthcare Industry Region Insights

The AI in UAE Digital Healthcare Market is geographically diversified, covering:

- Abu Dhabi

- Sharjah

- Dubai

- Ras Al Khaimah (RAK)

- Fujairah

- Rest of the UAE

Abu Dhabi is rapidly developing as the leading emirate region for the expansion of AI health models and research, making it the leading region across the AI in UAE Digital Healthcare Market, in terms of market share.

Being home to MBZUAI & various other primary AI companies (G42), Abu Dhabi has enticed higher research investment, clinical partnerships, and open-source AI initiatives that anchor the region’s capabilities. Also, institutions across the landscape of Abu Dhabi are channeling clinical language model/medical LLM projects, genomics work, and translational AI research tied to the Emirati Genome Program, placing the emirate as a hub for clinical validation & model governance.

AI in UAE Digital Healthcare Market: Recent Developments (2025)

G42 Healthcare:

- G42 declared a partnership with Oracle Health & the Cleveland Clinic to introduce a new AI-based global healthcare delivery platform. This combines Oracle’s cloud & AI data infrastructure & Cleveland Clinic’s clinical expertise with G42’s sovereign AI infrastructure & health data integration capabilities to deliver scalable, secure, & precision-oriented care.

- G42 announced that it has extended its strategic partnership with Cisco to further develop AI innovation & infrastructure across the public and private sectors across the UAE. The MoU between the two intends to scale AI infrastructure & jointly deliver AI-native services, specifically in sectors like health, leveraging G42’s regional data & R&D capabilities and Cisco’s networking/security portfolio.

Philips:

- At Arab Health 2025, Philips declared numerous AI-driven innovations in diagnostics, patient monitoring, and precision care & treatment. The major launches included the BlueSeal helium-free MRI with AI-enabled Smart Reading, the AI-enabled CT 5300 with Precise Image AI reconstruction, Spectral CT 7500, and enhanced ultrasound systems (EPIQ Elite Elevate, Affiniti) with workflow automation.

- Philips also entered a memorandum of understanding with the Department of Health – Abu Dhabi (DoH) and Abu Dhabi Health Data Services (ADHDS, operator of Malaffi) to introduce an AI-powered image-exchange solution through Malaffi. This includes automatic abnormality detection on radiology scans (e.g., chest X-rays for TB, COVID-19) assimilated into radiology reporting workflows by means of Philips’ AI Manager platform.

What are the Key Highlights of the AI in UAE Digital Healthcare Market (2026–32)?

- The AI in UAE Digital Healthcare Market is predicted to expand at a CAGR of about 27%, and is forecasted to reach nearly USD 423.64 million by 2032.

- AI in UAE healthcare is motivating diagnostics, RPM, clinical LLMs, and telemedicine acceptance.

- Telemedicine/telehealth & AI-powered diagnostics are top revenue drivers, attracting potential market share.

- Abu Dhabi appears to be an AI hub (MBZUAI, G42) with telco-edge partnerships accelerating RPM.

- The AI deployment across the UAE Digital Healthcare Market is being augmented by local launches & partnerships (platform rollouts, model releases, and telco-edge AI projects) in the past & future years.

How does the Future Outlook of the UAE Digital Healthcare Market (2032) Appears?

By 2032, the AI in UAE Digital Healthcare Market would be platform-centric & AI-enabled. The extensive AI-powered diagnostics, mature clinical language model usage, and integrated remote patient monitoring would minimize hospital stays & enable precision care, further enhancing market demand. Also, Abu Dhabi’s research investments & Dubai’s commercial penetration would mutually create a regional center of quality.

Further, constant emphasis on AI regulation/data privacy/responsible AI across healthcare & cross-emirate interoperability would convert pilots into normalized clinical workflows, generating market opportunities for both global vendors & local startups emphasizing digitalization & AI integration in the healthcare sector.

What Does Our UAE Digital Healthcare Market Research Study Entail?

- The UAE Digital Healthcare Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis puts light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The UAE Digital Healthcare Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- UAE AI Digital Healthcare Market Overview (2020-2032)

- Market Size, By Value (in USD Millions)

- Market Share, By Technology

- Machine Learning (ML)

- Natural Language Processing (NLP)

- Context-Aware Computing

- Computer Vision

- Generative AI

- Robotic Process Automation

- Market Share, By Offering

- Hardware

- Software Solutions

- Services

- Market Share, By Application

- Obesity

- Diabetes

- Cardiovascular

- Respiratory Diseases

- Others

- Market Share, By End-Use

- Patients

- Providers

- Payers

- Others

- Market Share, By Region

- Abu Dhabi

- Sharjah

- Dubai

- Ras Al Khaimah (RAK)

- Fujairah

- Rest of the UAE

- Market Share, By Competitors

- Competition Characteristics

- Revenue Shares

- UAE Machine Learning (ML) AI Digital Healthcare Market Overview, 2020-2032F

- By Value (USD Million)

- By Offering- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End-Use- Market Size & Forecast 2019-2030, USD Million

- UAE Natural Language Processing (NLP) AI Digital Healthcare Market Overview, 2020-2032F

- By Value (USD Million)

- By Offering- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End-Use- Market Size & Forecast 2019-2030, USD Million

- UAE Context-Aware Computing AI Digital Healthcare Market Overview, 2020-2032F

- By Value (USD Million)

- By Offering- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End-Use- Market Size & Forecast 2019-2030, USD Million

- UAE Computer Vision AI Digital Healthcare Market Overview, 2020-2032F

- By Value (USD Million)

- By Offering- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End-Use- Market Size & Forecast 2019-2030, USD Million

- UAE Generative AI AI Digital Healthcare Market Overview, 2020-2032F

- By Value (USD Million)

- By Offering- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End-Use- Market Size & Forecast 2019-2030, USD Million

- UAE Robotic Process Automation AI Digital Healthcare Market Overview, 2020-2032F

- By Value (USD Million)

- By Offering- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End-Use- Market Size & Forecast 2019-2030, USD Million

- Competitive Outlook (Company Profile - Partila List)

- G42 Healthcare

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Saal.ai

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- KLAIM.AI

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Okadoc

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Alma Health

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Nabta Health

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- TachyHealth

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Philips

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- GE Healthcare

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- uDent

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- G42 Healthcare

- Contact Us & Disclaimer

List of Figure

Figure 1: Market Segmentation Framework

Figure 2: Study Variables Structure

Figure 3: Research Methodology Flowchart

Figure 4: Secondary Data Points Overview

Figure 5: Primary Data Collection Process

Figure 6: Breakdown of Primary Interviews by Type

Figure 7: Executive Summary Highlights

Figure 8: Key Market Dynamics

Figure 9: Drivers of UAE AI Digital Healthcare Market

Figure 10: Challenges in UAE AI Digital Healthcare Market

Figure 11: Opportunity Assessment Matrix

Figure 12: Recent Trends and Developments in UAE AI Digital Healthcare

Figure 13: Policy and Regulatory Landscape Overview

Figure 14: UAE AI Digital Healthcare Market Size Forecast (USD Million)

Figure 15: Market Share by Technology

Figure 16: Machine Learning (ML) Market Share Breakdown

Figure 17: Natural Language Processing (NLP) Market Share Breakdown

Figure 18: Context-Aware Computing Market Share Breakdown

Figure 19: Computer Vision Market Share Breakdown

Figure 20: Generative AI Market Share Breakdown

Figure 21: Robotic Process Automation Market Share Breakdown

Figure 22: Market Share by Offering (Hardware, Software, Services)

Figure 23: Market Share by Application (Obesity, Diabetes, Cardiovascular, Respiratory, Others)

Figure 24: Market Share by End-Use (Patients, Providers, Payers, Others)

Figure 25: Market Share by Region (Abu Dhabi, Sharjah, Dubai, RAK, Fujairah, Rest of UAE)

Figure 26: Market Share by Competitors

Figure 27: Competitive Characteristics Overview

Figure 28: Revenue Shares of Major Competitors

Figure 29: Machine Learning Market Value Forecast (USD Million)

Figure 30: Machine Learning Market Size & Forecast by Offering

Figure 31: Machine Learning Market Size & Forecast by Application

Figure 32: Machine Learning Market Size & Forecast by End-Use

Figure 33: Natural Language Processing Market Value Forecast (USD Million)

Figure 34: Natural Language Processing Market Size & Forecast by Offering

Figure 35: Natural Language Processing Market Size & Forecast by Application

Figure 36: Natural Language Processing Market Size & Forecast by End-Use

Figure 37: Context-Aware Computing Market Value Forecast (USD Million)

Figure 38: Context-Aware Computing Market Size & Forecast by Offering

Figure 39: Context-Aware Computing Market Size & Forecast by Application

Figure 40: Context-Aware Computing Market Size & Forecast by End-Use

Figure 41: Computer Vision Market Value Forecast (USD Million)

Figure 42: Computer Vision Market Size & Forecast by Offering

Figure 43: Computer Vision Market Size & Forecast by Application

Figure 44: Computer Vision Market Size & Forecast by End-Use

Figure 45: Generative AI Market Value Forecast (USD Million)

Figure 46: Generative AI Market Size & Forecast by Offering

Figure 47: Generative AI Market Size & Forecast by Application

Figure 48: Generative AI Market Size & Forecast by End-Use

Figure 49: Robotic Process Automation Market Value Forecast (USD Million)

Figure 50: Robotic Process Automation Market Size & Forecast by Offering

Figure 51: Robotic Process Automation Market Size & Forecast by Application

Figure 52: Robotic Process Automation Market Size & Forecast by End-Use

Figure 53: G42 Healthcare – Business Segments and Strategic Partnerships

Figure 54: Saal.ai – Business Segments and Strategic Partnerships

Figure 55: KLAIM.AI – Business Segments and Strategic Partnerships

Figure 56: Okadoc – Business Segments and Strategic Partnerships

Figure 57: Alma Health – Business Segments and Strategic Partnerships

Figure 58: Nabta Health – Business Segments and Strategic Partnerships

Figure 59: TachyHealth – Business Segments and Strategic Partnerships

Figure 60: Philips – Business Segments and Strategic Partnerships

Figure 61: GE Healthcare – Business Segments and Strategic Partnerships

Figure 62: uDent – Business Segments and Strategic Partnerships

List of Table

Table 1: Study Objectives

Table 2: Product Definition Criteria

Table 3: Market Segmentation Parameters

Table 4: Study Variables

Table 5: Research Methodology Summary

Table 6: Secondary Data Sources

Table 7: List of Companies Interviewed

Table 8: Primary Data Points Collected

Table 9: Breakdown of Primary Interviews by Stakeholder Type

Table 10: Executive Summary Key Findings

Table 11: Key Market Drivers

Table 12: Major Market Challenges

Table 13: Opportunity Assessment Matrix

Table 14: Recent Trends and Developments

Table 15: Relevant Policies and Regulations

Table 16: Market Size Forecast (USD Million) – 2020 to 2032

Table 17: Market Share by Technology (%)

Table 18: Market Share by Offering (Hardware, Software, Services)

Table 19: Market Share by Application

Table 20: Market Share by End-Use

Table 21: Market Share by Region

Table 22: Competitive Market Share Analysis

Table 23: ML Market Size Forecast (USD Million) – 2020-2032

Table 24: ML Market Size by Offering

Table 25: ML Market Size by Application

Table 26: ML Market Size by End-Use

Table 27: NLP Market Size Forecast (USD Million) – 2020-2032

Table 28: NLP Market Size by Offering

Table 29: NLP Market Size by Application

Table 30: NLP Market Size by End-Use

Table 31: Context-Aware Computing Market Size Forecast – 2020-2032

Table 32: Context-Aware Computing by Offering

Table 33: Context-Aware Computing by Application

Table 34: Context-Aware Computing by End-Use

Table 35: Computer Vision Market Size Forecast – 2020-2032

Table 36: Computer Vision by Offering

Table 37: Computer Vision by Application

Table 38: Computer Vision by End-Use

Table 39: Generative AI Market Size Forecast – 2020-2032

Table 40: Generative AI by Offering

Table 41: Generative AI by Application

Table 42: Generative AI by End-Use

Table 43: RPA Market Size Forecast – 2020-2032

Table 44: RPA by Offering

Table 45: RPA by Application

Table 46: RPA by End-Use

Table 47: G42 Healthcare – Business Segments and Recent Developments

Table 48: Saal.ai – Business Segments and Recent Developments

Table 49: KLAIM.AI – Business Segments and Recent Developments

Table 50: Okadoc – Business Segments and Recent Developments

Table 51: Alma Health – Business Segments and Recent Developments

Table 52: Nabta Health – Business Segments and Recent Developments

Table 53: TachyHealth – Business Segments and Recent Developments

Table 54: Philips – Business Segments and Recent Developments

Table 55: GE Healthcare – Business Segments and Recent Developments

Table 56: uDent – Business Segments and Recent Developments

Table 57: Contact Information & Disclaimer

Top Key Players & Market Share Outlook

- G42 Healthcare

- Saal.ai

- KLAIM.AI

- Okadoc

- Alma Health

- Nabta Health

- TachyHealth

- Philips

- GE Healthcare

- uDent

Frequently Asked Questions