Understand The Key Trends Shaping This Market

Download Free SampleAircraft Interior Fabric Market Overview: Market Size & Forecast (2026–2034)

What is the anticipated CAGR & size of the Aircraft Interior Fabric Market?

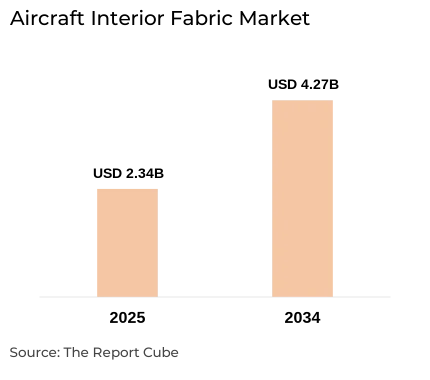

The Aircraft Interior Fabric Market is anticipated to register a CAGR of around 6.9% during the forecast period, 2026-34. Additionally, the market size was valued at nearly USD 2.34 billion in 2025 and is projected to reach almost USD 4.27 billion by 2034.

Market Analysis & Insights

The Aircraft Interior Fabric Market encompasses a broad array of products including synthetic leather, E-Leather, wool-nylon blends, and technical textiles, which are vital in maintaining FAR 25.853 compliance, a key flammability standard across the aviation textile industry. Aspects such as surging demand for fuel efficacy, the mounting requirement for cost-effective aircraft refurbishment, and a transition towards lightweight aircraft interior fabrics demand are instigating the expansion globally.

Moreover, the term "aircraft interior fabric" defines specialty materials utilized in aircraft cabins, like wool-nylon blends, synthetic leather, and technical textiles. Further, in order to enhance overall cabin aesthetics, save weight, and comply with aviation safety regulations, these textiles must exceed stringent specifications for durability, fire resistance, and passenger comfort. Also, in the Commercial Aviation Upholstery Industry, both OEM & aftermarket segments place a resilient emphasis on the usage of cutting-edge materials with antimicrobial treatments, lightweight design, and durability to enable regular cabin refurbishment cycles.

Globally, the suppliers across the Aircraft Cabin Fabric Market are aiming at sustainable & fire-retardant aircraft upholstery materials owing to increasing regulations & green initiatives, notably in North America, Europe, and Asia-Pacific. For instance, projects promoting the usage of sustainable aircraft interior fabrics align with recent government policies targeting for greener aviation. Furthermore, key market players such as Lantal, FACC AG, and E-Leather have launched ranges compliant with FAR 25.853, providing superior aircraft seating systems for both wide-body & narrow-body aircraft interior fabric projection.

Additionally, partnerships for antimicrobial treatments & smart textile incorporation are recent progresses that reflect advancements in the aviation textile sector. Consequently, increasing air travel, the prominence on passenger comfort, and regulatory enhancements guarantee consistent demand, and advances in the size of the global aircraft seat upholstery industry & company alliances boost Aircraft Interior Fabric Market prospects in the forthcoming years.

What is the Impact of AI in the Aircraft Interior Fabric Market?

AI is having a groundbreaking effect on the Aviation Interior Fabric Market, with rising usage in areas such as smart material tracking & predictive maintenance, which results in more effective aircraft refurbishing & quality control. Also, recent initiatives such as Lantal's digital inventory systems & E-Leather's AI-driven defect detection display how AI maximizes production, guaranteeing exact adherence to flammability regulations & enhancing product quality across the market.

Aircraft Interior Fabric Market Dynamics

What driving factor acts as a positive influencer for the Aircraft Interior Fabric Market?

- Advanced Technical Textiles & Antimicrobial Coatings: The exceptional driver thrusting the Aircraft Interior Fabric Market is the uptake in advanced technical textiles & innovative antimicrobial coatings. Also, airlines & OEMs seek lightweight, sustainable solutions that not only maximize fuel efficacy but also elevate passenger comfort & meet exacting flammability standards, like FAR 25.853 compliance. Also, the industry is witnessing quick adoption of sustainable E-Leather, wool-nylon blends, and fire-retardant materials, designed for both OEM vs Aftermarket channels, and driving superior cabin refurbishment cycles.

What are the challenges that affect the Aircraft Interior Fabric Market?

- Certification & Supply Chain Fluctuations: A key challenge is the lengthy certification process & unstable raw material supplies. Achieving standards for fire-retardant aircraft upholstery materials & passing global flammability standards such as FAR 25.853 compliance involves exhaustive testing, resulting in delayed market unveilings. Moreover, unstable costs in synthetic leather & technical textiles supply limit aircraft cabin fabric suppliers, affecting both premium & narrow-body aircraft interior fabric forecast segments.

Book your FREE 30-minute expert consultation today

Contact UsHow are the future opportunities transforming the market during 2026-34?

- Sustainable Aircraft Interior Fabrics: The transition towards circular economy models & sustainable airplane interior textiles is the most favorable potential. Further, in order to gratify green aviation standards, airlines & suppliers are launching upholstery made from natural fibers, recycled technological textiles, and next-generation synthetic leather. Also, demand for low-carbon, compliance, and eco-friendly solutions is radically upscaling as aircraft refurbishment cycles accelerate, specifically among global leaders in the Aviation Seat Upholstery Market & developing industries that prioritize sustainable growth.

What market trends are affecting the Aircraft Interior Fabric Market Outlook?

- Cabin Customization & Smart Fabric Invention: A crucial trend is the augmentation of cabin personalization & smart fabric innovation. Airlines are tailoring seat trims, wall covering, and flooring material, not simply for aesthetics but for enhanced passenger comfort, improved acoustics, and superior antimicrobial performance. The competitive thrust is instigated by Commercial Aircraft Upholstery Market trends & the future of Aircraft Interior Fabric Market, resulting in smart woven fabrics, durable vinyl trims, and multi-functional seat upholstery designed for longer refurbishment cycles & emerging passenger requirements.

How is the Aircraft Interior Fabric Market Defined as per Segments?

The Aircraft Interior Fabric Market Research Reports provide detailed market data & insights in accordance with market segmentation. Some of the segments are:

- Application: Upholstery (e.g., seat covers, cushions), Trims, Blankets, Wall Covering, Flooring Material

- Product/Material Type: Leather, Woven Fabric, Vinyl, Technical Textiles

By Application:

The Upholstery segment that exclusively seat covers & cushions, is considered to be the largest applicatiom, representing nearly 65% market share in 2025.

In line with the frequent cabin renovations & stringent flammability regulations such as FAR 25.853 compliance, airlines are able to ensure maximum passenger comfort & fuel efficacy by spending in lightweight, long-lasting, and antimicrobial coatings.

By Product/Material Type:

The Woven Fabric is the dominant segment, capturing for around 58% of market share in 2025. Also, the segment is foreseen to attain prominent position in the forecast years as well.

The segment surpasses leather & vinyl owing to its versatility, lightweight construction, and technical modernization that supports sustainable aircraft interior fabrics, greater fuel efficacy, and easier compliance with flammability standards & passenger comfort mandates.

Aircraft Interior Fabric Industry: Regional Insights

The Aircraft Interior Fabric Market is geographically diversified, covering:

- North America

- South America

- Europe

- The Middle East & Africa

The North America Aircraft Interior Fabric Market remains the most prominent region with approximately 35% of the market share in 2025.

Robust OEM markets, cutting-edge technical textile modernization, frequent cabin refurbishment cycles, and extensive adoption of flammability requirements such as FAR 25.853 compliance are all aspects subsidizing to the region's supremacy. Further, in response to changing commercial aviation upholstery market trends & estimates of the size of the Aircraft Seat Upholstery Industry, North American providers of airplane seating systems & cabin fabrics constantly introduce fire-retardant, sustainable, and antimicrobial goods.

Aircraft Interior Fabric Market: What Recent Innovations Are Affecting the Industry?

- 2025: Aircraft Cabin Modification GmbH’s strategic relocation to Hamburg’s aviation cluster, catalyzing new R&D around sustainable materials & digital cabin systems for OEM vs Aftermarket markets, with a solid emphasis on flammability standards & passenger comfort.

- 2025: LANTAL TEXTILES AG introduced its “Responsible Textiles x Lantal 2025” collection, presenting technical textiles & E-Leather with deep-dye technology, advancing lightweight aircraft interior fabrics demand.

What are the Key Highlights of the Aircraft Interior Fabric Market (2026–34)?

- The Aircraft Interior Fabric Market is projected reach about USD 4.27 billion by 2034, expanding at around 6.9% CAGR during 2026-34.

- Under application, the upholstery segment dominates with nearly 65% market share owing to demand for seat covers & cushions.

- By product/material type, woven fabric governs with approximately 58% market share due to durability & lightness.

- Under aircraft type, commercial aircraft captures the biggest market share instigated by expanding passenger traffic & fleet growth.

- By geography, North America tops with almost 35% market share, accredited to OEM dominance & refurbishment focus.

- AI enables predictive maintenance & advanced cabin refurbishment cycles.

- The industry growth is strong in both OEM vs Aftermarket, specifically for fire-retardant aircraft upholstery materials & sustainable aircraft interior fabrics, affecting narrow-body aircraft interior fabric forecast.

Top Companies in Aircraft Interior Fabric Market

Ask Our Lead Analyst a Question About This Report

Contact UsHow does the Future Outlook of the Aircraft Interior Fabric Market (2034) Appear?

- Sustained Growth: The Aircraft Interior Fabric Market is foreseen to expand at a CAGR of nearly 6.9% during 2026-34, attaining about USD 4.27 billion by 2034, instigated by fleet modernization, fuel efficacy, and passenger comfort.

- Technological Upgrade: FAR 25.853 compliance & cabin refurbishment cycles would be enhanced by advanced technical textiles such as E-Leather, wool-nylon mixes, and synthetic leather combined with antimicrobial coatings & artificial intelligence (AI).

- Future Opportunities: The industry progression would be driven by increasing demand for sustainable aircraft interior fabrics, lightweight materials, and customization aligning with Commercial Aircraft Upholstery Market trends.

The Aircraft Interior Fabric Industry outlook & growth trajectory by 2034 is cemented by this technical development, which would support market growth, stringent environmental guidelines, and increasing passenger comfort requirements globally.

Table of Contents

- Introduction

- Objective of the Study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Breakdown of Secondary Sources

- Primary Data Points

- Breakdown of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- Global Aircraft Interiors Textile Market Overview (2020–2034)

- Market Size, By Value (USD Billion)

- Market Share, By Application

- Upholstery (e.g., seat covers, cushions)

- Trims

- Blankets

- Wall Covering

- Flooring Material

- Market Share, By Product/Material Type

- Leather

- Woven Fabric

- Vinyl

- Technical Textiles

- Market Share, By Aircraft Type

- Commercial Aircraft

- Private Aircraft

- Military Aircraft

- Market Share, By Region

- North America

- Europe

- Asia-Pacific

- South America

- The Middle East & Africa

- Market Share, By Company

- Revenue Shares

- Competition Characteristics

- Segment-wise / Industry-wise Market Overview (Forecast 2026–2034)

- By Application Market Overview (2026–2034)

- By Product/Material Type Market Overview (2026–2034)

- By Aircraft Type Market Overview (2026–2034)

- Forecast Year Tables (2026–2034)

- Competitive Outlook

- Aircraft Cabin Modification GmbH

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Belgraver B.V.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Franklin Products, Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- LANTAL TEXTILES AG

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Botany Weaving Mill Limited

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Spectra Interior Products

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Aerotex Aircraft Interiors

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Tapis Corp

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- OmnAvia Interiors

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Douglass Interior Products

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Others

- Aircraft Cabin Modification GmbH

- Contact Us & Disclaimer

Top Key Players & Market Share Outlook

- Aircraft Cabin Modification GmbH

- Belgraver B.V.

- Franklin Products, Inc.

- LANTAL TEXTILES AG

- Botany Weaving Mill Limited

- Spectra Interior Products

- Aerotex Aircraft Interiors

- Tapis Corp

- OmnAvia Interiors

- Douglass Interior Products

- Others

Frequently Asked Questions