Understand The Key Trends Shaping This Market

Download Free SampleAustralia Digital Camera Market Insights & Analysis

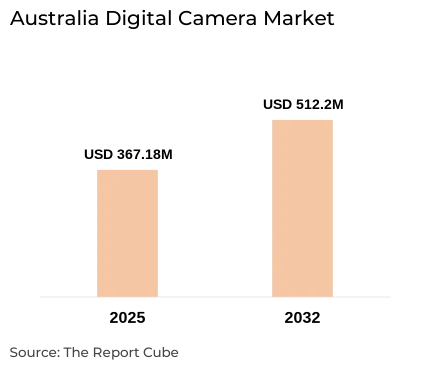

The Australia Digital Camera Market is anticipated to register a CAGR of around 4.87% during the forecast period, i.e., 2025-32. Along with this, the market is valued at USD 512.2 million by 2032. Owing to the widespread acceptance of digital cameras in varied industries, including manufacturing, retail, logistics, transportation, and healthcare, the Australian market for digital cameras has risen considerably in recent years. These industries comprehend the significance of digital camera solutions in streamlining supply chains, labeling, and packaging procedures to enhance results. Therefore, companies are making momentous investments in cutting-edge digital camera systems to augment operational efficiency & observe more stringent tracking & traceability regulations.

Moreover, with factors such as real-time inventory management, mobile networking, and shifting data printing, top suppliers of digital camera solutions are launching cutting-edge products. By refining operational visibility & scalability, these expansions aid companies in proficiently improving their operations. The assimilation of technologies like RFID encoding, computer vision, and Internet of Things sensors has transformed the capabilities of digital cameras, allowing for real-time analytics & automated workflows for tracking asset usage & inventory levels.

Furthermore, digital camera experts & facilities are progressively forming partnerships, with tailored solutions created to meet certain supply chain requirements & operational objectives. Prospects are evolving as a result of the rising trend toward data-driven operations, specifically in the industrial, retail, and transportation industries. Digital camera sales are increasing owing to the amplified need for high-quality imaging solutions in sectors, such as manufacturing, retail, healthcare, and transportation. Also, labeling, packing, quality control, and documentation are just a few of the uses for which companies require accurate image abilities.

Additionally, the growth of the Australia Digital Camera Market is significantly influenced by digital cameras, which are essential instruments for taking precise & detailed pictures owing to their exceptional image clarity, resolution, and sophisticated functions. Consequently, as digital transformation projects in many industries spur investments in labeling and tracking capabilities, the market for digital camera systems is predicted to continue mounting. Its capacity to facilitate end-to-end supply chain visibility via extensive logistical data would be essential in determining its long-term forecasts in light of the budding requirement for effective asset & inventory management procedures.

Australia Digital Camera Market Dynamics

- Growing Popularity of Vlogging and Streaming to Elevate the Australia Digital Camera Market

The market for digital cameras in Australia is developing at a considerable rate owing to the increasing prevalence of vlogging & streaming. To enhance their video production, more individuals, influencers, and enterprises are investing in top-notch digital cameras as content creation on websites such as YouTube, Instagram, and Twitch becomes widely common. Professional-grade abilities, enhanced image quality, and versatility make digital cameras the impeccable choice for vloggers & streamers who wish to make visually captivating material. Also, there is a rising need for cameras with sophisticated features, such as HD video, focusing, and integrated streaming capabilities owing to the popularity of live streaming, gaming, and online tutorials.

Besides, cameras made specifically for content creators, like mirrorless & small models are becoming widely well-liked due to their portability & user-friendliness. Further, it is foreseen that this tendency would continue, driving additional market progression as more Australians choose to pursue careers or hobbies in digital content production.

- High Competition from Mirrorless and DSLR Cameras to Hinder Australia Digital Camera Market

The fierce competition from mirrorless & DSLR cameras creates severe challenges to the Australia Digital Camera Market. Digital cameras used to be the favored option for both pros & amateur photographers, but the advent of mirrorless & DSLR cameras has substantially elevated their market share. Also, these cutting-edge cameras are very likable to both professional & amateur photographers owing to their enhanced performance, interchangeable lenses, and improved image quality.

Moreover, buyers considering convenience without sacrificing performance are drawn to mirrorless cameras because of their small size, sophisticated autofocus, and quicker shooting rates. As a result, digital cameras, which often have fixed lenses & limited functionality, find it challenging to compete in a market that is becoming very demanding, which results in limited sales and a retreating market share for digital cameras in Australia.

Australia Digital Camera Market Segment-wise Analysis

By Digital Sensor Type:

- Live MOS Sensor

- CCD Sensor

- CMOS Sensor

- FOVEON X3 Sensor

The Australia Digital Camera Market is dominated by the CMOS Sensor segment and is anticipated to uphold the largest market share in the forecast years. Due to its superior performance in line with low power consumption, higher processing speeds, and cost-effectiveness, CMOS (Complementary Metal-Oxide-Semiconductor) sensors are the market leaders. Compact digital cameras, DSLRs, mirrorless cameras, and other consumer & professional cameras all employ these sensors as they offer excellent image quality even in low light.

CMOS sensors are becoming prevalent because of the rising need for high-quality photography & videography, especially in the social media & content creation industries. Furthermore, the dominating sensor type in the Australian market is further reinforced by the continuous advancements in CMOS technology, which enable enhancements in resolution, dynamic range, and processing power.

By Distribution Channel:

- Online

- Offline

The Offline distribution channel captures the potential share of the Australia Digital Camera Market. Several Australian customers still prefer to buy digital cameras through physical channels such as electronics stores, camera specialist shops, and huge retail chains, even if internet purchasing is becoming widespread. Also, the capability to personally inspect the camera, evaluate its features, and consult an expert before making a purchase stimulates this desire. Moreover, offline retailers commonly provide warranties, in-store promotions, and after-sales support, all of which have a positive impact on customer choices. Further, the physical touch & technological aspects of digital cameras make offline channels the leading segment, even though internet sales have augmented owing to convenience.

What Does Our Australia Digital Camera Market Research Study Entail?

- Australia Digital Camera Market Research Report highlights the forecast growth rate or CAGR by anticipating the market size & share.

- The market analysis puts light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- Australia Digital Camera Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- Australia Digital Camera Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- Market Share, By Product Type

- Built-in Lens Cameras

- Interchangeable Lens Cameras

- Market Share, By Component

- Lenses

- Display

- Sensors

- Memory Card

- Others

- Market Share, By Digital Sensor Type

- Live MOS Sensor

- CCD Sensor

- CMOS Sensor

- FOVEON X3 Sensor

- Market Share, By End Use

- Hobbyists

- Professional Photographers

- Prosumers

- Market Share, By Distribution Channel

- Online

- Offline

- Market Share, By Region

- New South Wales

- Victoria

- Queensland

- Western Australia

- Australian Capital Territory

- Market Share, By Competitors

- Competition Characteristics

- Revenue Shares

- Australia Built-in Lens Cameras Digital Camera Market Overview, 2020-2032F

- By Value (USD Million)

- By Component- Market Size & Forecast 2019-2030, USD Million

- By Digital Sensor Type- Market Size & Forecast 2019-2030, USD Million

- By End Use- Market Size & Forecast 2019-2030, USD Million

- By Distribution Channel- Market Size & Forecast 2019-2030, USD Million

- Australia Interchangeable Lens Cameras Digital Camera Market Overview, 2020-2032F

- By Value (USD Million)

- By Component- Market Size & Forecast 2019-2030, USD Million

- By Digital Sensor Type- Market Size & Forecast 2019-2030, USD Million

- By End Use- Market Size & Forecast 2019-2030, USD Million

- By Distribution Channel- Market Size & Forecast 2019-2030, USD Million

- Competitive Outlook (Company Profile - Partila List)

- Canon Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Nikon Corporation

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Sony Group Corporation

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Panasonic Corporation

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Olympus Corporation

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Leica Camera AG

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Samsung Electronics Co., Ltd.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- SZ DJI Technology Co., Ltd.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Phase One A/S

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- RED Digital Cinema, LLC

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Canon Inc.

- Contact Us & Disclaimer

List of Figure

-

Figure 1: Australia Digital Camera Market Size, 2020–2032 (USD Billion)

-

Figure 2: Market Share by Product Type, 2024 (%)

-

Figure 3: Built-in Lens Cameras vs. Interchangeable Lens Cameras – Market Share Comparison, 2024 (%)

-

Figure 4: Market Share by Component, 2024 (%)

-

Figure 5: Lenses, Display, Sensors, Memory Card, and Others – Component-Wise Distribution, 2024 (%)

-

Figure 6: Market Share by Digital Sensor Type, 2024 (%)

-

Figure 7: Digital Camera Market by End Use (Hobbyists, Professionals, Prosumers), 2024 (%)

-

Figure 8: Market Share by Distribution Channel (Online vs. Offline), 2024 (%)

-

Figure 9: Market Share by Region, 2024 (%) – NSW, Victoria, Queensland, WA, ACT

-

Figure 10: Market Share by Competitors, 2024 (%)

-

Figure 11: Built-in Lens Cameras Market Size in Australia, 2020–2032 (USD Million)

-

Figure 12: Built-in Lens Cameras Market by Component, 2019–2030 (USD Million)

-

Figure 13: Built-in Lens Cameras Market by Digital Sensor Type, 2019–2030 (USD Million)

-

Figure 14: Built-in Lens Cameras Market by End Use, 2019–2030 (USD Million)

-

Figure 15: Built-in Lens Cameras Market by Distribution Channel, 2019–2030 (USD Million)

-

Figure 16: Interchangeable Lens Cameras Market Size in Australia, 2020–2032 (USD Million)

-

Figure 17: Interchangeable Lens Cameras Market by Component, 2019–2030 (USD Million)

-

Figure 18: Interchangeable Lens Cameras Market by Digital Sensor Type, 2019–2030 (USD Million)

-

Figure 19: Interchangeable Lens Cameras Market by End Use, 2019–2030 (USD Million)

-

Figure 20: Interchangeable Lens Cameras Market by Distribution Channel, 2019–2030 (USD Million)

-

Figure 21: Revenue Share of Leading Players in the Australia Digital Camera Market, 2024 (%)

-

Figure 22: Company-Wise Competitive Benchmarking (Canon, Nikon, Sony, etc.)

List of Table

Table 1: Objective of the Study

Table 2: Product Definition and Scope

Table 3: Market Segmentation – By Offerings, End User, and Country

Table 4: Key Study Variables

Table 5: Research Methodology Breakdown

Table 6: Secondary Data Sources Used

Table 7: List of Companies Interviewed (Partial)

Table 8: Primary Data Points Collected

Table 9: Primary Interview Respondent Breakdown – By Designation, Region & Company Type

Table 10: Middle East & Africa Smart Water Management Market Size, 2020–2032F (USD Billion)

Table 11: Market Share, By Offerings (Water Meters, Solutions, Services), 2024

Table 12: Market Share, By End User (Commercial & Industrial, Residential), 2024

Table 13: Market Share, By Country, 2024

Table 14: Market Share, By Company Revenue, 2024

Table 15: The UAE Smart Water Management Market Size, 2020–2032F (USD Billion)

Table 16: The UAE Market Size, By Offerings and End User, 2024

Table 17: Saudi Arabia Smart Water Management Market Size, 2020–2032F (USD Billion)

Table 18: Saudi Arabia Market Size, By Offerings and End User, 2024

Table 19: Qatar Smart Water Management Market Size, 2020–2032F (USD Billion)

Table 20: Qatar Market Size, By Offerings and End User, 2024

Table 21: Bahrain Smart Water Management Market Size, 2020–2032F (USD Billion)

Table 22: Bahrain Market Size, By Offerings and End User, 2024

Table 23: Oman Smart Water Management Market Size, 2020–2032F (USD Billion)

Table 24: Oman Market Size, By Offerings and End User, 2024

Table 25: Kuwait Smart Water Management Market Size, 2020–2032F (USD Billion)

Table 26: Kuwait Market Size, By Offerings and End User, 2024

Table 27: Egypt Smart Water Management Market Size, 2020–2032F (USD Billion)

Table 28: Egypt Market Size, By Offerings and End User, 2024

Table 29: South Africa Smart Water Management Market Size, 2020–2032F (USD Billion)

Table 30: South Africa Market Size, By Offerings and End User, 2024

Table 31: Strategic Developments by Key Players (M&A, Partnerships, Product Launches)

Table 32: Business Segments of Key Companies – Overview and Offerings

Table 33: Recent Developments of Leading Players in the Market

Top Key Players & Market Share Outlook

- Canon Inc.

- Nikon Corporation

- Sony Group Corporation

- Panasonic Corporation

- Olympus Corporation

- Leica Camera AG

- Samsung Electronics Co., Ltd.

- SZ DJI Technology Co., Ltd.

- Phase One A/S

- RED Digital Cinema, LLC

Frequently Asked Questions