Understand The Key Trends Shaping This Market

Download Free SampleAustralia Home Appliances Market Insights & Analysis

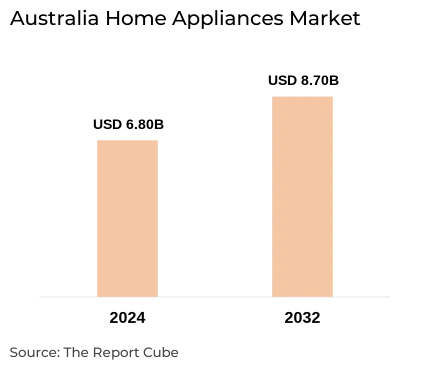

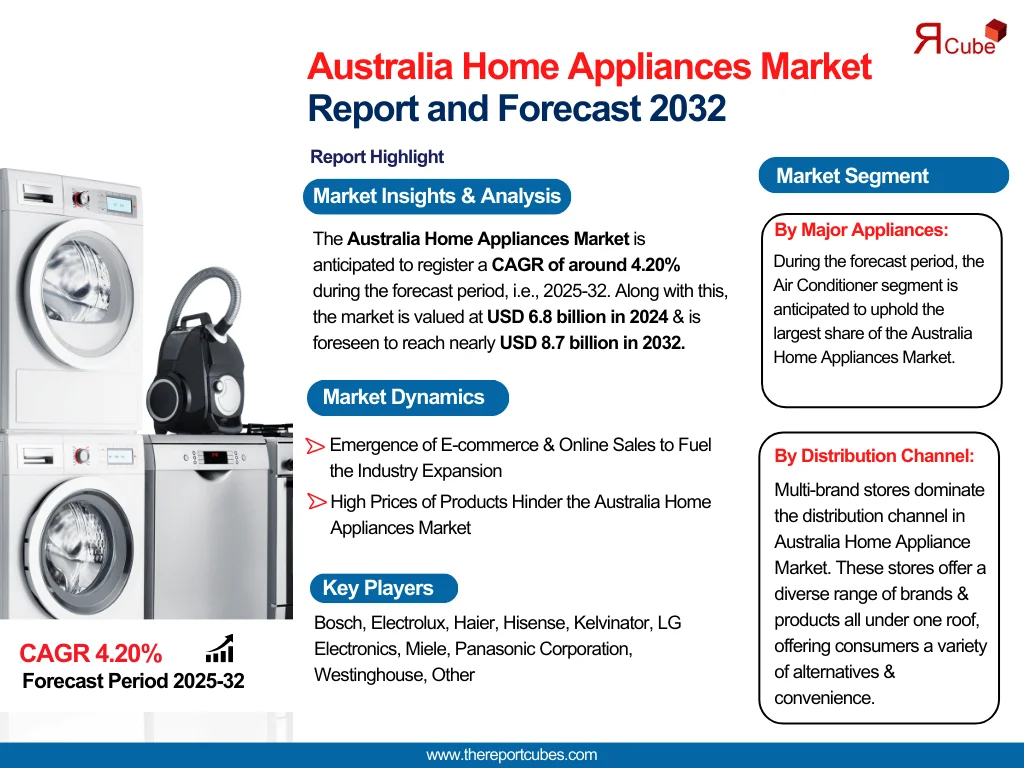

The Australia Home Appliances Market is anticipated to register a CAGR of around 4.20% during the forecast period, i.e., 2025-32. Along with this, the market is valued at USD 6.8 billion in 2024 & is foreseen to reach nearly USD 8.7 billion in 2032. The market is progressively growing owing to varied aspects, like high population growth, which needs more real estate and new appliances. This growth drives innovation, resulting in new product development for new homes & replacement sales for current appliances. Home appliances in the country are electrical or mechanical devices employed in the home to assist with everyday duties, including cooking, cleaning, heating, and cooling. These appliances differ in size, from large refrigerators, washing machines, and air conditioners to little vacuum cleaners, blenders, and hairdryers. Home appliances, which are often power-driven by electricity, are an essential component of modern life, making daily tasks easier & more proficient.

Moreover, home appliances are often utilized in Australian homes to help with tasks, like food preservation, laundry, and temperature control. The younger generation has a significant impact on market trends as they prioritize product attraction, ease of operation, automation, customization, and multi-functionality. Individuals are increasingly choosing energy & water-efficient appliances as their issues about the environment upscaled. Producers are heavily investing in innovation to pique millennials' attention & match their wishes. Also, the digital landscape has elevated online sales, with e-commerce platforms playing a vital role in meeting customers' wants & improving customer happiness through virtual reality tours & online stores.

Furthermore, as technology advances, varied appliances now offer smart features, such as remote control, energy efficiency, and greater connectivity to home automation systems. The future of home appliances in Australia includes continued innovation, with an increasing requirement for energy-efficient, eco-friendly, and IoT-enabled products. This trend is predicted to affect the future of the nation's households by infusing their connectivity, automation, and sustainability. The Australia Home Appliances Industry is experiencing a revolutionary move towards digital retail platforms and several brands are employing technology to differentiate themselves & offer smart, energy-efficient appliances that fulfill current consumers' requirements for convenience & efficiency.

Australia Home Appliances Market Dynamics

- Emergence of E-commerce & Online Sales to Fuel the Industry Expansion

The emergence of e-commerce & online sales is radically changing the Australia Home Appliances Market. Customers increasingly prefer online platforms owing to their comfort, wide product selection, competitive pricing, and fast comparison tools. Consumers could use e-commerce to get worldwide brands & new appliances that are not broadly available in traditional stores. Also, internet businesses generally offer exclusive discounts, flexible payment choices, and speedy delivery services, therefore growing consumer adoption. Thus, online sales are becoming a prevailing aspect in defining consumer behavior & motivating growth in the Australia Home Appliances Industry.

- High Prices of Products Hinder the Australia Home Appliances Market

Higher prices for produce are a noteworthy impediment to the growth of the Australia Home Appliances Market. Advanced home appliances, which commonly incorporate cutting-edge technology & creative features, carry considerable production & development expenses that are passed on to consumers. This makes them less attractive to price-sensitive buyers, specifically in the industry where economic instability & rising living costs decline purchasing power.

Additionally, the deployment of smart technologies, energy-efficient systems, and premium materials contributes to the higher prices. Also, as a result, several consumers might choose traditional or low-cost alternatives, restricting the usage of high-end home appliances. These restraints highlight the prominence of producers to establish a balance between innovation & affordability to encourage market growth.

Australia Home Appliances Market Segment-wise Analysis

By Major Appliances:

- Refrigerators

- Freezers

- Dishwashing Machines

- Washing Machines

- Ovens

- Air Conditioners

- Other

During the forecast period, the Air Conditioner segment is anticipated to uphold the largest share of the Australia Home Appliances Market. Some of the industry's promoters include the country's huge desert areas, which cause heatwaves & generate a substantial requirement for air conditioning. Moreover, the nation's large disposable income plays a vital role in individual’s ability to afford air conditioning. Therefore, the residential sector is probable to dominate the Australia Home Appliances Industry. Also, increasing real estate & industrialization, growing electricity expenses, and upscaled power consumption by air conditioners are being offset by energy-efficient air conditioners, thus driving the air conditioner segment.

By Distribution Channel:

- Multi-brand stores

- Exclusive

- Online Channels

- Others

Multi-brand stores dominate the distribution channel in Australia Home Appliance Market. These stores offer a diverse range of brands & products all under one roof, offering consumers a variety of alternatives & convenience. Harvey Norman, Appliances Online, and The Good Guys are some of the area's top retailers. Moreover, online channels are the fastest-expanding distribution channel across the Australia Home Appliance Industry. The increasing acceptance of the internet & the convenience of online purchasing have upsurged in e-commerce platforms that sell household appliances.

What Does Our Australia Home Appliances Market Research Study Entail?

- Australia Home Appliances Market Research Report highlights the forecast growth rate or CAGR by anticipating the market size & share.

- The market analysis puts light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- Australia Home Appliances Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- Australia Home Appliances Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- Market Share, By Major Appliances

- Refrigerators

- Freezers

- Dishwashing Machines

- Washing Machines

- Ovens

- Air Conditioners

- Other

- Market Share, By Small Appliances

- Coffee/Tea Makers

- Food Processors

- Grills and Toasters

- Vacuum Cleaners

- Other

- Market Share, By Distribution Channel

- Mass Merchandisers

- Exclusive Stores

- Online

- Others

- Market Share, By Region

- New South Wales

- Victoria

- Queensland

- Australian Capital Territory

- Western Australia

- Others

- Market Share, By Competitors

- Competition Characteristics

- Revenue Shares

- Australia Refrigerators Home Appliances Market Overview, 2020-2032F

- By Value (USD Million)

- By Small Appliances- Market Size & Forecast 2019-2030, USD Million

- By Distribution Channel- Market Size & Forecast 2019-2030, USD Million

- Australia Freezers Home Appliances Market Overview, 2020-2032F

- By Value (USD Million)

- By Small Appliances- Market Size & Forecast 2019-2030, USD Million

- By Distribution Channel- Market Size & Forecast 2019-2030, USD Million

- Australia Dishwashing Machines Home Appliances Market Overview, 2020-2032F

- By Value (USD Million)

- By Small Appliances- Market Size & Forecast 2019-2030, USD Million

- By Distribution Channel- Market Size & Forecast 2019-2030, USD Million

- Australia Washing Machines Home Appliances Market Overview, 2020-2032F

- By Value (USD Million)

- By Small Appliances- Market Size & Forecast 2019-2030, USD Million

- By Distribution Channel- Market Size & Forecast 2019-2030, USD Million

- Australia Ovens Home Appliances Market Overview, 2020-2032F

- By Value (USD Million)

- By Small Appliances- Market Size & Forecast 2019-2030, USD Million

- By Distribution Channel- Market Size & Forecast 2019-2030, USD Million

- Australia Air Conditioners Home Appliances Market Overview, 2020-2032F

- By Value (USD Million)

- By Small Appliances- Market Size & Forecast 2019-2030, USD Million

- By Distribution Channel- Market Size & Forecast 2019-2030, USD Million

- Australia Other Home Appliances Market Overview, 2020-2032F

- By Value (USD Million)

- By Small Appliances- Market Size & Forecast 2019-2030, USD Million

- By Distribution Channel- Market Size & Forecast 2019-2030, USD Million

- Competitive Outlook (Company Profile - Partila List)

- Bosch

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Electrolux

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Haier

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Hisense

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Kelvinator

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- LG Electronics

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Miele

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Panasonic Corporation

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Westinghouse

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Others

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Bosch

- Contact Us & Disclaimer

List of Figure

Figure 1: Market Segmentation Framework

Figure 2: Study Variables Overview

Figure 3: Research Methodology Flowchart

Figure 4: Secondary Data Points Sources

Figure 5: Companies Interviewed by Industry Segment

Figure 6: Breakdown of Primary Interviews by Respondent Type

Figure 7: Executive Summary Snapshot

Figure 8: Market Drivers and Challenges Overview

Figure 9: Opportunity Assessment Matrix

Figure 10: Recent Trends and Developments Timeline

Figure 11: Policy and Regulatory Landscape Summary

Figure 12: Australia Home Appliances Market Size (2020-2032) – USD Billion

Figure 13: Market Share by Major Appliances (2023)

Figure 14: Refrigerators Market Share by Value

Figure 15: Freezers Market Share by Value

Figure 16: Dishwashing Machines Market Share by Value

Figure 17: Washing Machines Market Share by Value

Figure 18: Ovens Market Share by Value

Figure 19: Air Conditioners Market Share by Value

Figure 20: Other Major Appliances Market Share by Value

Figure 21: Market Share by Small Appliances Segment

Figure 22: Coffee/Tea Makers Market Share

Figure 23: Food Processors Market Share

Figure 24: Grills and Toasters Market Share

Figure 25: Vacuum Cleaners Market Share

Figure 26: Other Small Appliances Market Share

Figure 27: Market Share by Distribution Channel

Figure 28: Mass Merchandisers Market Share

Figure 29: Exclusive Stores Market Share

Figure 30: Online Distribution Channel Market Share

Figure 31: Others Distribution Channel Market Share

Figure 32: Market Share by Region – New South Wales

Figure 33: Market Share by Region – Victoria

Figure 34: Market Share by Region – Queensland

Figure 35: Market Share by Region – Australian Capital Territory

Figure 36: Market Share by Region – Western Australia

Figure 37: Market Share by Other Regions

Figure 38: Market Share by Competitors Overview

Figure 39: Competition Characteristics Comparison

Figure 40: Revenue Shares of Leading Competitors

Figure 41: Australia Refrigerators Market Size and Forecast (2020-2032)

Figure 42: Refrigerators Market Size by Small Appliances (2019-2030)

Figure 43: Refrigerators Market Size by Distribution Channel (2019-2030)

Figure 44: Australia Freezers Market Size and Forecast (2020-2032)

Figure 45: Freezers Market Size by Small Appliances (2019-2030)

Figure 46: Freezers Market Size by Distribution Channel (2019-2030)

Figure 47: Australia Dishwashing Machines Market Size and Forecast (2020-2032)

Figure 48: Dishwashing Machines Market Size by Small Appliances (2019-2030)

Figure 49: Dishwashing Machines Market Size by Distribution Channel (2019-2030)

Figure 50: Australia Washing Machines Market Size and Forecast (2020-2032)

Figure 51: Washing Machines Market Size by Small Appliances (2019-2030)

Figure 52: Washing Machines Market Size by Distribution Channel (2019-2030)

Figure 53: Australia Ovens Market Size and Forecast (2020-2032)

Figure 54: Ovens Market Size by Small Appliances (2019-2030)

Figure 55: Ovens Market Size by Distribution Channel (2019-2030)

Figure 56: Australia Air Conditioners Market Size and Forecast (2020-2032)

Figure 57: Air Conditioners Market Size by Small Appliances (2019-2030)

Figure 58: Air Conditioners Market Size by Distribution Channel (2019-2030)

Figure 59: Australia Other Home Appliances Market Size and Forecast (2020-2032)

Figure 60: Other Appliances Market Size by Small Appliances (2019-2030)

Figure 61: Other Appliances Market Size by Distribution Channel (2019-2030)

Figure 62: Competitive Outlook – Bosch Company Overview

Figure 63: Bosch Business Segments Breakdown

Figure 64: Bosch Strategic Alliances and Partnerships

Figure 65: Bosch Recent Developments Timeline

Figure 66: Electrolux Company Overview

Figure 67: Electrolux Business Segments Breakdown

Figure 68: Electrolux Strategic Alliances and Partnerships

Figure 69: Electrolux Recent Developments Timeline

Figure 70: Haier Company Overview

Figure 71: Haier Business Segments Breakdown

Figure 72: Haier Strategic Alliances and Partnerships

Figure 73: Haier Recent Developments Timeline

Figure 74: Hisense Company Overview

Figure 75: Hisense Business Segments Breakdown

Figure 76: Hisense Strategic Alliances and Partnerships

Figure 77: Hisense Recent Developments Timeline

Figure 78: Kelvinator Company Overview

Figure 79: Kelvinator Business Segments Breakdown

Figure 80: Kelvinator Strategic Alliances and Partnerships

Figure 81: Kelvinator Recent Developments Timeline

Figure 82: LG Electronics Company Overview

Figure 83: LG Electronics Business Segments Breakdown

Figure 84: LG Electronics Strategic Alliances and Partnerships

Figure 85: LG Electronics Recent Developments Timeline

Figure 86: Miele Company Overview

Figure 87: Miele Business Segments Breakdown

Figure 88: Miele Strategic Alliances and Partnerships

Figure 89: Miele Recent Developments Timeline

Figure 90: Panasonic Corporation Company Overview

Figure 91: Panasonic Business Segments Breakdown

Figure 92: Panasonic Strategic Alliances and Partnerships

Figure 93: Panasonic Recent Developments Timeline

Figure 94: Westinghouse Company Overview

Figure 95: Westinghouse Business Segments Breakdown

Figure 96: Westinghouse Strategic Alliances and Partnerships

Figure 97: Westinghouse Recent Developments Timeline

Figure 98: Other Companies Overview

Figure 99: Other Companies Business Segments Breakdown

Figure 100: Other Companies Strategic Alliances and Partnerships

Figure 101: Other Companies Recent Developments Timeline

List of Table

Table 1: Objective of the Study

Table 2: Product Definition and Scope

Table 3: Market Segmentation Details

Table 4: Study Variables Description

Table 5: Research Methodology Summary

Table 6: Secondary Data Sources

Table 7: Companies Interviewed – List and Profiles

Table 8: Primary Data Collection Breakdown

Table 9: Executive Summary – Key Market Metrics

Table 10: Market Drivers and Challenges Summary

Table 11: Opportunity Assessment Matrix

Table 12: Recent Trends and Developments – Summary

Table 13: Policy and Regulatory Landscape Overview

Table 14: Australia Home Appliances Market Size and Growth (2020-2032)

Table 15: Market Size by Major Appliances (USD Billion)

Table 16: Market Share by Major Appliances – Percentage

Table 17: Market Share by Small Appliances Segment

Table 18: Market Share by Distribution Channel – Percentage

Table 19: Market Share by Region – Value and Growth Rates

Table 20: Competitor Market Share Overview

Table 21: Competition Characteristics Comparison

Table 22: Revenue Shares of Leading Competitors (USD Million)

Table 23: Australia Refrigerators Market Size & Forecast (2020-2032)

Table 24: Refrigerators Market Size by Small Appliances (2019-2030)

Table 25: Refrigerators Market Size by Distribution Channel (2019-2030)

Table 26: Australia Freezers Market Size & Forecast (2020-2032)

Table 27: Freezers Market Size by Small Appliances (2019-2030)

Table 28: Freezers Market Size by Distribution Channel (2019-2030)

Table 29: Australia Dishwashing Machines Market Size & Forecast (2020-2032)

Table 30: Dishwashing Machines Market Size by Small Appliances (2019-2030)

Table 31: Dishwashing Machines Market Size by Distribution Channel (2019-2030)

Table 32: Australia Washing Machines Market Size & Forecast (2020-2032)

Table 33: Washing Machines Market Size by Small Appliances (2019-2030)

Table 34: Washing Machines Market Size by Distribution Channel (2019-2030)

Table 35: Australia Ovens Market Size & Forecast (2020-2032)

Table 36: Ovens Market Size by Small Appliances (2019-2030)

Table 37: Ovens Market Size by Distribution Channel (2019-2030)

Table 38: Australia Air Conditioners Market Size & Forecast (2020-2032)

Table 39: Air Conditioners Market Size by Small Appliances (2019-2030)

Table 40: Air Conditioners Market Size by Distribution Channel (2019-2030)

Table 41: Australia Other Home Appliances Market Size & Forecast (2020-2032)

Table 42: Other Appliances Market Size by Small Appliances (2019-2030)

Table 43: Other Appliances Market Size by Distribution Channel (2019-2030)

Table 44: Bosch – Company Overview and Financials

Table 45: Bosch – Business Segments

Table 46: Bosch – Strategic Alliances/Partnerships

Table 47: Bosch – Recent Developments Summary

Table 48: Electrolux – Company Overview and Financials

Table 49: Electrolux – Business Segments

Table 50: Electrolux – Strategic Alliances/Partnerships

Table 51: Electrolux – Recent Developments Summary

Table 52: Haier – Company Overview and Financials

Table 53: Haier – Business Segments

Table 54: Haier – Strategic Alliances/Partnerships

Table 55: Haier – Recent Developments Summary

Table 56: Hisense – Company Overview and Financials

Table 57: Hisense – Business Segments

Table 58: Hisense – Strategic Alliances/Partnerships

Table 59: Hisense – Recent Developments Summary

Table 60: Kelvinator – Company Overview and Financials

Table 61: Kelvinator – Business Segments

Table 62: Kelvinator – Strategic Alliances/Partnerships

Table 63: Kelvinator – Recent Developments Summary

Table 64: LG Electronics – Company Overview and Financials

Table 65: LG Electronics – Business Segments

Table 66: LG Electronics – Strategic Alliances/Partnerships

Table 67: LG Electronics – Recent Developments Summary

Table 68: Miele – Company Overview and Financials

Table 69: Miele – Business Segments

Table 70: Miele – Strategic Alliances/Partnerships

Table 71: Miele – Recent Developments Summary

Table 72: Panasonic Corporation – Company Overview and Financials

Table 73: Panasonic – Business Segments

Table 74: Panasonic – Strategic Alliances/Partnerships

Table 75: Panasonic – Recent Developments Summary

Table 76: Westinghouse – Company Overview and Financials

Table 77: Westinghouse – Business Segments

Table 78: Westinghouse – Strategic Alliances/Partnerships

Table 79: Westinghouse – Recent Developments Summary

Table 80: Other Companies – Overview and Financials

Table 81: Other Companies – Business Segments

Table 82: Other Companies – Strategic Alliances/Partnerships

Table 83: Other Companies – Recent Developments Summary

Top Key Players & Market Share Outlook

- Bosch

- Electrolux

- Haier

- Hisense

- Kelvinator

- LG Electronics

- Miele

- Panasonic Corporation

- Westinghouse

- Others

Frequently Asked Questions