Understand The Key Trends Shaping This Market

Download Free SampleBrazil Edtech Market Overview: Market Size & Forecast (2026–2034)

What is the anticipated CAGR & size of the Brazil Edtech Market?

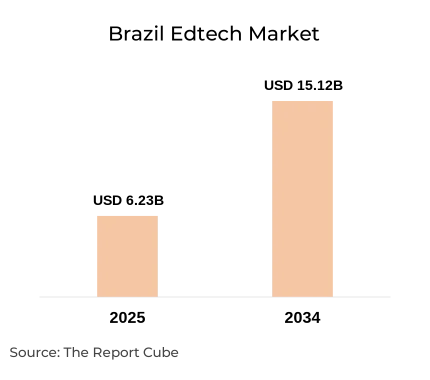

The Brazil Edtech Market is anticipated to register a CAGR of around 10.35% during the forecast period, 2026-34. Additionally, the market size was valued at nearly USD 6.23 billion in 2025 and is projected to reach almost USD 15.12 billion by 2034.

Market Analysis & Insights

The Brazil Edtech Market is quickly transforming, driven by government policy, such as the “Connected Education Innovation Program,” an upsurge in investments from venture capital edtech, Latin America, as well as emerging digital revolutions. The market comprehends learning management systems, virtual classrooms, curriculum digitization, and tech-driven lifelong learning Brazil, connecting the education paradox by addressing dissimilarities in distance learning statistics & private education market in Brazil.

Additionally, the scope of this brazilian education technology industry appears to be promising. Also, the active market sales channels, smooth distribution networks, and the booming influence of top edtech companies in Brazil, including Descomplica, Arco Platform, and Geekie are assisting in generating satisfying market share. Furthermore, the market research report aids in evaluating key drivers like digital inclusion, personalized learning, and government e-learning projects, while benchmarking edtech start-ups & the higher education establishments.

Moreover, recent initiatives such as the digital revolution of K-12 edtech market in Brazil & public-private partnerships have further expanded the Brazil e-learning market outlook. These factors, along with sustained venture capital interest & new collaborations & partnerships, are foreseen to drive strong future growth in Brazil Edtech Market share by 2034.

What is the Impact of AI in the Brazil Edtech Market?

The inclusion of the AI in the Edtech Market & across all the educational sectors is observed to bring a dramatic growth, as the deployment of AI-powered solutions for curriculum delivery, assessment, and administration, is largely enhancing the market outlook. For example, Descomplica's customized courses & Arco Platform's AI-based adaptive learning maximize student results while nurturing innovations throughout the Brazil Edtech Industry & securing the nation's position as a regional leader in AI in education sector.

Brazil Edtech Market Dynamics

What driving factor acts as a positive influencer for the Brazil Edtech Market?

- Expanding Mobile Penetration & Digital Inclusion in the Country: Surging internet penetration & mobile device utilization in Brazil’s diverse regions, specifically across the Southeast & developing areas, serve as a dynamic progression factor. Also, this expansion improves access to virtual classrooms & learning management systems, minimizing the education paradox that affects underserved communities.

What are the challenges that affect the Brazil Edtech Market?

- Resistance to Digital Adoption in Traditional Education: The deep-rooted opposition to implementing new technology in traditional educational institutions & learning sectors is a noteworthy challenge for the Brazil Edtech Market. Learning management system incorporation is being decelerated by the reluctance of numerous schools & educators to abandon traditional approaches, despite government policy in Brazil.

How are the future opportunities transforming the market during 2026-34?

- Niche Market Development Prospects: The market opportunities arising in niche educational segments are language learning, coding bootcamps, and upskilling platforms directing both youth & corporate sectors. Also, venture capital edtech Latin America is progressively investing in Brazilian start-ups addressing these niche demands, expanding market diversity and innovation.

What market trends are affecting the Brazil Edtech Market Outlook?

- Budding Demand for Gamification & Microlearning: To boost participation among K–12 students & participants in lifelong learning across Brazil, evolving trends place a strong emphasis on gamification & microlearning. Also, these formats, which are accessible via mobile platforms, complement existing curriculum digitalization initiatives in the country & the acceptance of hybrid learning while satisfying the appetite of contemporary learners.

How is the Brazil Edtech Market Defined as per Segments?

The Brazil Edtech Market Research Reports provide detailed market data & insights in accordance with market segmentation. Some of the segments are:

- Sector: Preschool (Early childhood education), K-12 (Primary and secondary education), Higher Education (Universities and colleges), Others (Additional educational sectors not specifically categorized)

- Type: Hardware, Software, Content

By Sector:

The biggest sector across the Brazil Edtech Market is K-12 education (primary & secondary), capturing nearly 45% of total market value.

The sector’s leadership is influenced by a vast base of about 47 million students & robust demand for digital tools that facilitate interactive, gamified, and curriculum-aligned learning, making digital alteration across the Brazilian education sector tangible in everyday classrooms.

By Type:

The Content-Based Solutions dominated the Brazil Edtech Marke, by commanding for over 50% market share in 2025, followed by software & hardware.

Across the Brazil Public & Private Education Markets, digital content, like videos, simulations, and interactive coursework assists in driving consumption & uptake as educators & students alike look for cutting-edge, effortlessly accessible resources for all educational levels.

Brazil Edtech Market: What Recent Innovations Are Affecting the Industry?

- 2025: UOL EdTech extended its flagship “Passei Direto” learning platform across Latin America, improving social learning features & incorporating advanced curriculum digitization to promote personalized learning & support digital transformation for both K-12 & higher education section.

- 2025: Afya outdid 300,000 users after introducing new tailored digital medical courses. These offerings underlined interactive content delivery & virtual classrooms Brazil.

What are the Key Highlights of the Brazil Edtech Market (2026–34)?

- The Brazil Edtech Market expected value & size: around USD 15.12 billion (2034), CAGR of about 10.35% (2026-34)

- By Sector: K-12 education attains over 45% of the market share.

- By Type: Content-based solutions dominated with nearly 50% share.

- By Deployment: Cloud-based deployment leads by capturing about 60% market share.

- By End-User: Institutes are the chief end users, commanding around 55% of Brazil Edtech Market share.

- Strong role for virtual classrooms, learning management systems, and government policy are prominent market drivers.

How does the Future Outlook of the Brazil Edtech Market (2034) Appear?

- Sustained Growth: The industry is envisioned to exceed nearly USD 15.12 billion by 2034, with a stable expected CAGR of about 10.35% during 2026-34, further leveraging lifelong learning in the country & booming digital access across all educational levels.

- Technological Upgrade: Pervasive adoption of smart learning management systems, curriculum digitization, and immersive virtual classrooms across the Brazil would define the Edtech Market’s headship.

- Future Opportunities: Developing edtech start-ups in Brazil & established leaders are observed to target distance learning statistics, rural inclusion, and new content innovations, making investment & funding appealing to the global & local investors.

Though 2034, the Brazil Edtech Market is anticipated to sustain double-digit growth influenced by digital transformation & expanded incorporation of AI in educational sector. Also, personalized learning, hybrid teaching models, and solid government backing are presumed to encourage equity, reach, and modernization across the industry, further creating a strong progression grounds for the leading market companies as well.

What Does Our Brazil Edtech Market Research Study Entail?

- The Brazil Edtech Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis & market scope sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The Brazil Edtech Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the Study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Breakdown of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- Brazil Edtech Market Overview

- Market Size, By Value (USD Billion)

- Market Share, By Sector

- Preschool (Early childhood education)

- K-12 (Primary and secondary education)

- Higher Education (Universities and colleges)

- Others (Additional educational sectors not specifically categorized)

- Market Share, By Type

- Hardware

- Software

- Content

- Market Share, By Deployment Mode

- Cloud-based

- On-premises

- Market Share, By End User

- Individual Learners

- Institutes

- Enterprises

- Market Share, By Regional (Brazil Region)

- Southeast

- South

- Northeast

- North

- Central-West

- Market Share, By Company

- Revenue Shares

- Competition Characteristics

- Brazil Edtech Market Overview, By Sector

- Preschool (Early childhood education) Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- K-12 (Primary and secondary education) Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Higher Education (Universities and colleges) Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Others Sector Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Preschool (Early childhood education) Market Overview

- Brazil Edtech Market Overview, By Type

- Hardware Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Software Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Content Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Hardware Market Overview

- Brazil Edtech Market Overview, By Deployment Mode

- Cloud-based Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- On-premises Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Cloud-based Market Overview

- Brazil Edtech Market Overview, By End User

- Individual Learners Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Institutes Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Enterprises Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Individual Learners Market Overview

- Brazil Edtech Market Overview, By Regional

- Southeast Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- South Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Northeast Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- North Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Central-West Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Southeast Market Overview

- Competitive Outlook (Company Profiles)

- UOL EdTech

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Afya

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Vitru Education

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Principia

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Teachy

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Alicerce Educação

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- EBAC (Escola Britânica de Artes Criativas)

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Others

- UOL EdTech

- Contact Us & Disclaimer

Top Key Players & Market Share Outlook

- UOL EdTech

- Afya

- Vitru Education

- Principia

- Teachy

- Alicerce Educação

- EBAC (Escola Britânica de Artes Criativas)

- Others

Frequently Asked Questions