Understand The Key Trends Shaping This Market

Download Free SampleIndia Animation Market Overview: Market Size & Forecast (2026–2034)

What is the anticipated CAGR & size of the India Animation Market?

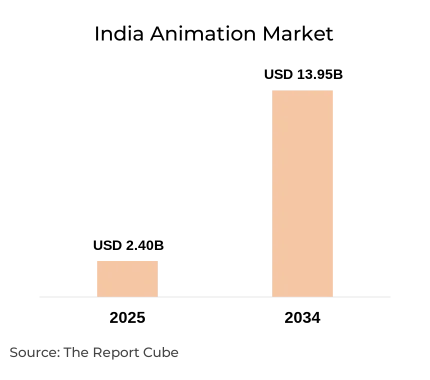

The India Animation Market is anticipated to register a CAGR of around 21.6% during the forecast period, 2026-34. Additionally, the market size was valued at nearly USD 2.4 billion in 2025 and is projected to reach almost USD 13.95 billion by 2034.

Market Analysis & Insights

The India Animation Market is destined for substantial growth between 2026 & 2034, instigated by increasing digital content consumption, the growth of OTT platforms, and booming demand for 3D animation, VFX, AR/VR, and real-time rendering. Also, the industry progression is driven by improved mobile gaming, co-production deals with government AVGC policies, the proliferation of OTT platforms, international studios, and upscaling investment in animation education.

Moreover, via co-productions, outsourcing, and strategic associations, India is actively involved with numerous overseas animation studios. Further, well-established international brands such as Amazon Prime, Sony, Netflix, Disney, Warner Brothers, and IMAX are working with Indian animation studios or companies on several projects, from gaming experiences to streaming originals to Hollywood blockbusters. Besides, significant European co-production agreements, including the one between Broadvision Perspectives (India) & Fabrique d'Images Group (Europe), and direct international partnerships, like Prayan Animation's cooperation with Los Angeles-based Moonstar Animation, have also been recognized, thus showcasing a strong foothold of the India Animation Market across the global landscape.

Additionally, some of the industry upgraders include prevalent adoption of 3D animation & VFX in advertising, entertainment, and education, supported by a trained talent pool & cost-effective production. Also, in recent years, government initiatives like the AVGC Promotion Task Force & the making of the National Centre of Excellence have fostered talent development & global effectiveness within the India AVGC sector. Further, the India Animation Market’s future is further transformed by the embrace of co-productions, increasing demand for localized & regional content, and strategic investments across digital infrastructure & skill gap minimization.

Furthermore, the value & supply chain of the India Animation Market are closely related to OTT platforms, mobile gaming, advertising agencies, international studios, and educational publishers. Leading market companies such as Technicolor India, Green Gold Animation, Cosmos-Maya, and Reliance Animation are utilizing AI, AR, and VR more & more to generate innovative content & cement country's position as a future leader across the VFX Market globally. Also, with OTT platforms & real-time rendering technology serving as considerable growth accelerators, the industry in India is foreseen to be shaped by insistent emphasis on co-production agreements, animation education, and the acceptance of sophisticated rendering tools by 2034.

What is the Impact of AI in the India Animation Market?

With its expanding usage in production pipelines, content generation, and real-time rendering, AI is drastically transforming the animation sector in India. AI incorporation makes it possible to automate animation workflows, which largely minimizes production time & costs while enhancing creative quality. Also, AI is enabling Indian studios to satisfy the industry's need for scalability & innovation, which is vital for catering to OTT platforms, gaming, and international partners. Some of the instances include generative AI in 3D animation & intelligent asset management, as well as post-production.

A few projects undertaken by companies in terms of AI that benefit the India animation market are:

- In 2025, Technicolor India’s incorporation of generative AI tools to accelerate character animation & crowd rendering for global OTT releases.

- Cosmos-Maya’s partnership with industry leaders in 2025 to leverage AI-powered storyboarding & asset creation, enhancing delivery speeds & quality for digital content.

India Animation Market Dynamics

What driving factor acts as a positive influencer for the India Animation Market?

- Upsurge in Localized Digital Content: The major driver of the India Animation Market is the booming demand for localized animated content in multiple regional languages. Also, elevated penetration of smartphones & the expansion of OTT platforms have extended access to tier-2 & tier-3 cities, driving consumption of culturally applicable animations. Hence, this trend supports the sector’s growth as studios produce content rooted in Indian culture, widening both domestic & international appeal, further contributing in enhancing the India Animation Market size.

What are the challenges that affect the India Animation Market?

- Persistent Skill Gap Incidents: Despite progression, the India Animation Industry struggles with a few challenges, such as the lack of highly skilled talent in advanced 3D animation, real-time rendering, and VFX. Though the government’s AVGC policy promotes skill development, the gap bounds the capacity of studios to meet the rising global outsourcing & co-production demands. Also, addressing this via enhanced animation education is fundamental for sustained market growth.

How are the future opportunities transforming the market during 2026-34?

- Rising Support of the Government & Co-productions: An enormous opportunity is presented by the government's targeted AVGC program, which includes funds for skill development centers & a National Center of Excellence. Further, along with an upsurge in international co-production agreements, Indian studios are becoming more renowned abroad, emerging their intellectual property, and drawing in investments that are indispensable to the industry's prosperous future during 2026-34.

What market trends are affecting the India Animation Market Outlook?

- Localization & Regional Content Growth: Beyond technology, a vital market trend is the upscale in the demand for originally Indian narratives & content specially made for regional audiences, primarily on OTT platforms. This trend appreciates studios crafted stories based on India’s diverse culture & mythologies, advancing the scope of India Animation Industry & making the industry more inclusive & dynamic.

How is the India Animation Market Defined as per Segments?

The India Animation Market Research Reports provide detailed market data & insights in accordance with market segmentation. Some of the segments are:

- Product Type: 2D Animation, 3D Animation, Motion Graphics, Stop Motion, Visual Effects (VFX)

- Application: Entertainment (films, television, OTT platforms), Gaming, Advertising, Education, Corporate Communication

By Product:

3D Animation leads the India Animation Market, holding approximately 45% market share by 2024.

This leadership is instigated by its widespread usage in films, gaming, and advertising, where immersive digital experiences are perilous. Also, advances in real-time rendering technologies strengthen the segment's ability to deliver rich, visual storytelling, fueling a substantial portion of India Animation Market growth & positioning it as an industry leader.

By Application:

The Entertainment Sector encompassing television, films, and primarily OTT platforms accounts for nearly 60% of the market share.

Platforms like Netflix & Amazon Prime that are established at the global scale are making substantial investments in Indian animation originals, which is upscaling the demand for diverse & locally produced content. Moreover, this growth augmented by this flood of funds & market opportunities, India has been recognized to be one of the major force across the Animation Market at a global scale by 2034.

India Animation Market: What Recent Innovations Are Affecting the Industry?

- 2025: Reliance MediaWorks Ltd launched an advanced real-time rendering suite, significantly boosting their 3D animation and VFX capabilities for global OTT platforms, allowing quicker project turnarounds and increased adaptive content for digital content consumption across India and international segments.

- 2025: Prime Focus Ltd rolled out an end-to-end virtual production pipeline incorporating AR & VR technology, making them a leading outsourcing hub for localized content, key co-production deals, and high-end animation education collaborations across the AVGC sector.

What are the Key Highlights of the India Animation Market (2026–34)?

- The India Animation Market expansion is influenced by the growing investment in 3D animation, further achieving nearly 21.6% CAGR during 2026-34 and estimated to reach about USD 13.95 billion by 2034.

- By product type, 3D animation grabs about 45% market share, instigated by great demand in films, gaming, and advertising.

- By application, entertainment segment, like films, television, and OTT platforms captures around 60% of market revenue by 2032.

- By technology, 3D computer animation is the leading technology with over 40% market share.

- By end-user, animation studios attain the largest market share of nearly 50%.

- AI incorporation is altering real-time rendering, mobile gaming, and outsourcing workflows, minimizing the persistent skill gap.

- Localized content & digital ingesting on OTT platforms continue to solidify the scope of Animation Industry & AVGC sector analysis in India.

How does the Future Outlook of the India Animation Market (2034) Appear?

- Sustained Growth: The future of India Animation Market focuses towards the sustained growth with expected market value of nearly USD 13.95 billion, and recording a CAGR of about 21.6% during 2026-32.

- Future Opportunities: Policies by the government (AVGC), growth of animation education, elevated co-production deals, and an emphasise upon mobile gaming & OTT platforms would generate further profitable market opportunities.

- Technology Upgrade: It is believed that the AI would transform the widespread framework of the market related to the production, fostering outsourcing hub status, and assisting in bridging the skill gap.

In all, the India Animation Market is positioned for global leadership in digital content consumption, IP creation, and innovation. Also, the Indian landscape has transformed from an outsourcing source to a creative hub, further grabbing a strong footprint across the global market as well in the forecast years.

What Does Our India Animation Market Research Study Entail?

- The India Animation Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis & market scope sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The India Animation Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the Study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Breakdown of Secondary Sources

- Primary Data Points

- Breakdown of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- India Animation Market Overview (2020–2034)

- Market Size, By Value (USD Billion)

- Market Share, By Product Type

- 2D Animation

- 3D Animation

- Motion Graphics

- Stop Motion

- Visual Effects (VFX)

- Market Share, By Application

- Entertainment (films, television, OTT platforms)

- Gaming

- Advertising

- Education

- Corporate Communication

- Market Share, By Technology

- Traditional Animation

- 2D Vector-Based Animation

- 3D Computer Animation

- Motion Capture

- Digital Compositing

- Market Share, By Region

- East

- West

- North

- South

- Market Share, By Company

- Revenue Shares

- Competition Characteristics

- Segment-wise / Industry-wise Market Overview (Forecast 2026–2034)

- By Product Type Market Overview (2026–2034)

- By Application Market Overview (2026–2034)

- By Technology Market Overview (2026–2034)

- Forecast Year Tables (2026–2034)

- Competitive Outlook (Company Profiles)

- Reliance MediaWorks Ltd

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- O’Reilly Media, Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- The Walt Disney Company (Pixar Animation Studios)

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Maya Entertainment Ltd.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Toonz Entertainment Pte. Ltd.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Sony Pictures Entertainment Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Prime Focus Ltd.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Pixelloid Studios Private Limited

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Graphic India Pte. Ltd.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Others

- Reliance MediaWorks Ltd

- Contact Us & Disclaimer

List of Figure

Figure1: India Animation Market Research Framework

Figure2: Breakdown of Secondary Data Sources

Figure3: Breakdown of Primary Interviews (By Stakeholder Type)

Figure4: India Animation Market Overview (2020–2034), Market Size (USD Billion)

Figure5: Market Share, By Product Type (2024/Base Year)

Figure6: Market Share – 2D Animation

Figure7: Market Share – 3D Animation

Figure8: Market Share – Motion Graphics

Figure9: Market Share – Stop Motion

Figure10: Market Share – Visual Effects (VFX)

Figure11: Market Share, By Application

Figure12: Entertainment Segment Share

Figure13: Gaming Segment Share

Figure14: Advertising Segment Share

Figure15: Education Segment Share

Figure16: Corporate Communication Segment Share

Figure17: Market Share, By Technology

Figure18: Traditional Animation Share

Figure19: 2D Vector-Based Animation Share

Figure20: 3D Computer Animation Share

Figure21: Motion Capture Technology Share

Figure22: Digital Compositing Share

Figure23: India Animation Market Share, By Region

Figure24: Regional Growth Comparison (2020–2034)

Figure25: Market Share, By Company

Figure26: Revenue Share of Leading Companies

Figure27: Competition Characteristics (Market Map)

Figure28: Product Type Market Forecast (2026–2034)

Figure29: Application-wise Market Forecast (2026–2034)

Figure30: Technology-wise Market Forecast (2026–2034)

Figure31: Forecast Tables Summary (2026–2034)

Figure32: Competitive Snapshot – Reliance MediaWorks Ltd

Figure33: Competitive Snapshot – O’Reilly Media, Inc.

Figure34: Competitive Snapshot – The Walt Disney Company (Pixar Animation Studios)

Figure35: Competitive Snapshot – Maya Entertainment Ltd.

Figure36: Competitive Snapshot – Toonz Entertainment Pte. Ltd.

Figure37: Competitive Snapshot – Sony Pictures Entertainment Inc.

Figure38: Competitive Snapshot – Prime Focus Ltd.

Figure39: Competitive Snapshot – Pixelloid Studios Private Limited

Figure40: Competitive Snapshot – Graphic India Pte. Ltd.

Figure41: Competitive Snapshot – Other Key Players

List of Table

Table1: Summary of Study Variables

Table2: Secondary Data Sources – Detailed Breakdown

Table3: Primary Interview Respondent Categories

Table4: India Animation Market Size (2020–2034), By Value (USD Billion)

Table5: Market Share, By Product Type (Base Year)

Table6: Market Share – 2D Animation

Table7: Market Share – 3D Animation

Table8: Market Share – Motion Graphics

Table9: Market Share – Stop Motion

Table10: Market Share – Visual Effects (VFX)

Table11: Market Share, By Application

Table12: Entertainment Application Breakdown

Table13: Gaming Application Breakdown

Table14: Advertising Application Breakdown

Table15: Education Application Breakdown

Table16: Corporate Communication Breakdown

Table17: Market Share, By Technology

Table18: Traditional Animation Share

Table19: 2D Vector-Based Animation Share

Table20: 3D Computer Animation Share

Table21: Motion Capture Technology Share

Table22: Digital Compositing Share

Table23: Market Share, By Region (East, West, North, South)

Table24: Regional Growth Indicators (2020–2034)

Table25: Market Share, By Company (Top Players)

Table26: Revenue Share of Leading Companies

Table27: Key Competitive Characteristics Summary

Table28: Product Type Market Forecast (2026–2034)

Table29: Application-wise Market Forecast (2026–2034)

Table30: Technology-wise Market Forecast (2026–2034)

Table31: Year-wise Forecast Tables (2026–2034)

Table32: Company Profile – Reliance MediaWorks Ltd

Table33: Company Profile – O’Reilly Media, Inc.

Table34: Company Profile – The Walt Disney Company (Pixar Animation Studios)

Table35: Company Profile – Maya Entertainment Ltd

Table36: Company Profile – Toonz Entertainment Pte. Ltd.

Table37: Company Profile – Sony Pictures Entertainment Inc.

Table38: Company Profile – Prime Focus Ltd

Table39: Company Profile – Pixelloid Studios Private Limited

Table40: Company Profile – Graphic India Pte. Ltd.

Table41: Other Key Companies – Summary Table

Top Key Players & Market Share Outlook

- Reliance MediaWorks Ltd

- O’Reilly Media, Inc.

- The Walt Disney Company (Pixar Animation Studios)

- Maya Entertainment Ltd.

- Toonz Entertainment Pte. Ltd.

- Sony Pictures Entertainment Inc.

- Prime Focus Ltd.

- Pixelloid Studios Private Limited

- Graphic India Pte. Ltd.

- Others

Frequently Asked Questions