Understand The Key Trends Shaping This Market

Download Free SampleCalcium Ammonium Nitrate Market Overview: Market Size & Forecast (2025–2032)

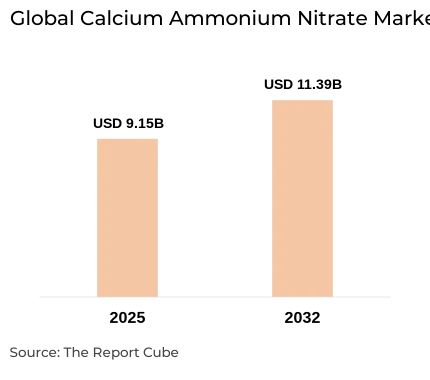

The Global Calcium Ammonium Nitrate Market is projected to register a CAGR of around 3.18% during the forecast period 2026–2032. The calcium ammonium nitrate market size was valued at nearly USD 9.15 billion in 2025 and is anticipated to reach USD 11.39 billion by 2032. The surging demand for sustainable fertilizers to improve crop yield, together with the increasing requirement for industrial-grade raw materials for explosives, is instigating market growth.

Additionally, one of the key stimulants is the extensive usage of calcium ammonium nitrate across India, where agriculture remains a leading source of income. Also, government movements encouraging the usage of cultured fertilizers to ensure food security have been perilous. Further, strategic alliances between calcium ammonium nitrate producers in India & global fertilizer suppliers are anticipated to surge supply capacity. For instance, in 2024, numerous collaborations emerged in Europe & Asia-Pacific, with an emphasis on Calcium Ammonium Nitrate Market improvements, nitrogen efficacy, and environmental effect. Along with this, in 2025, companies like Yara International ASA & Uralchem launched innovative fertilizer mixes that integrate market technology to cater to precision agriculture.

Moreover, while ammonium nitrate is largely deployed in explosives & is extremely volatile, calcium ammonium nitrate is moderately stable & safer to handle, as it contains a mixture of ammonium nitrate & calcium carbonate. Also, this makes it less hazardous, thus decreasing its misuse risks. For instance, while ammonium nitrate has been limited in several regions owing to security concerns, however, it is comparatively safer and is a favored choice for agricultural applications.

Furthermore, looking ahead, surging demand for high-yield crops, increasing acceptance of modern farming practices, and growing applications in controlled explosives would be major aspects shaping the future of the Calcium Ammonium Nitrate Market through 2032.

Calcium Ammonium Nitrate Market Dynamics

-

Driver: Increasing Demand for High-Efficiency Fertilizers to Instigate Market Growth

A key driver of the Calcium Ammonium Nitrate Market is the growing application as a nitrogen fertilizer across agriculture. Farmers prefer it owing to its capability to deliver nitrogen professionally while being less unstable compared to urea. Also, the rising global population & the corresponding demand for food production, specifically in the Asia-Pacific & Africa, are encouraging governments & farmers to adopt high-yield fertilizers. Moreover, government subsidies for calcium ammonium nitrate across numerous nations are augmenting the adoption rate globally.

-

Challenge: Regulatory Limitations on Explosives to Hinder Industry Development

Despite being beneficial, one of the most noteworthy challenges for the Calcium Ammonium Nitrate Market is the regulation of nitrate-based compounds owing to security apprehensions. Also, calcium ammonium nitrate is less explosive than pure ammonium nitrate. However, strict compliance & monitoring hinder its trade. Further, concerns about improvised explosive misuse have encouraged stringent laws in countries like the US & portions of Europe, creating challenges for the Calcium Ammonium Nitrate Market trade.

-

Opportunity: Progression in Precision Agriculture to Open New Avenues

A noteworthy prospect lies in the rising embrace of precision agriculture & controlled-release fertilizers. Calcium ammonium nitrate production innovations, like coated granules & blended formulations, are being established to ensure steady nutrient release. Also, market companies are investing in R&D to align with sustainable agricultural goals. Further, in 2025, technical innovations by the foremost calcium ammonium nitrate manufacturers across the landscape of India are foreseen to expand their presence globally, outfitting to eco-friendly fertilizer need.

-

Trend: Sustainable & Eco-Friendly Fertilizer Acceptance to be Trending

A prevalent trend is the growing preference for eco-friendly fertilizers. Also, with increasing concerns over soil health & water pollution, calcium ammonium nitrate is considered to be essential, as it not only enhances soil fertility but also decreases greenhouse gas emissions compared to other nitrogen fertilizers. Moreover, companies are aiming at bio-based production techniques & assimilating technologies into their product lines, further aligning with green initiatives worldwide.

Calcium Ammonium Nitrate Market Segmentation

By Application:

- Fertiliser

- Explosive

The Fertilizer segment leads the Calcium Ammonium Nitrate Market, capturing the biggest market share owing to its extensive utilization in agriculture. The segment is favored over ammonium nitrate owing to its stability & capacity to provide adequate nitrogen feeding. Also, with increasing concerns about food security, specifically across India, demand for this fertilizer is predicted to surge even higher. Moreover, government support programs & initiatives in Asia-Pacific & Africa are accelerating adoption, assuring that fertilizers remain the most prevalent deployed application throughout the forecast period.

Calcium Ammonium Nitrate Industry Regional Insights

The Global Calcium Ammonium Nitrate Market is geographically diversified, covering:

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East & Africa

Europe dominates the Global Calcium Ammonium Nitrate Market, seizing the potential market share owing to its widespread usage in both agriculture & controlled explosives. Nations such as Germany, France, and the UK have long depended on nitrate-based fertilizers to ensure high crop productivity. Moreover, European governments’ thrust towards sustainable agriculture, along with the existence of leading calcium ammonium nitrate producers, contributes to this supremacy. Also, the region invests greatly in R&D for safer, eco-friendly fertilizer solutions, solidifying its position across the global market.

Calcium Ammonium Nitrate Market: Recent Developments

2025:

- Yara International ASA introduced an advanced nitrate-based fertilizer integrating digital farming technologies for sustainable crop yield.

- Uralchem Holding PLC launched a new eco-friendly calcium ammonium nitrate manufacturing plant in Eastern Europe, aiming to lessen carbon emissions.

Key Takeaways of the Global Calcium Ammonium Nitrate Market (2026-32)

- The Global Calcium Ammonium Nitrate Market size is anticipated to expand progressively with increasing agricultural demand.

- What is calcium ammonium nitrate? It is a harmless, more stable alternative to ammonium nitrate, widely deployed in agriculture.

- The fertilizer segment is the foremost application, instigated by food security initiatives & high-yield farming.

- Europe dominates the global market in line with the advanced agriculture practices & sustainable fertilizer acceptance.

- Major challenges include stringent regulations owing to potential misuse, despite it being the least risky of the ammonium nitrates.

- Calcium ammonium nitrate continues to play a vital role with robust government support & emerging local calcium ammonium nitrate producers in India.

- Innovation, partnerships, and eco-friendly fertilizer tendencies are predicted to drive progression from 2026-32.

Calcium Ammonium Nitrate Market: Conclusion & Future Outlook (2032)

The surging global population, the demand for effective fertilizers, and the growth of precision agriculture would remain major growth drivers. Being less hazardous compared to ammonium nitrate, regulatory compliance would continue shaping the market’s framework.

Moreover, in the Asia-Pacific, specifically the Calcium Ammonium Nitrate Market in India, government-backed agricultural reforms & investments in fertilizer R&D would considerably elevate adoption. Also, with surging production capacities, local calcium ammonium nitrate producers are predicted to reinforce their global presence. Furthermore, in addition to the Calcium Ammonium Nitrate Industry & sustainable fertilizer technologies would open new market opportunities.

Consequently, the Calcium Ammonium Nitrate Market is destined for tremendous expansion, supported by innovation, eco-friendly practices, and the growing demand for safe, high-yield fertilizers, ensuring solid prospects in the forecast years.

What Does Our Global Calcium Ammonium Nitrate Market Research Study Entail?

- The Global Calcium Ammonium Nitrate Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis puts light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The Global Calcium Ammonium Nitrate Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- Global Calcium Ammonium Nitrate Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- Market Share, By Application

- Fertiliser

- Explosive

- Market Share, By Mode of Application

- Soil Application

- Fertigation

- Foliar

- Market Share, By Crop Type

- Cereals and Grains

- Oilseeds and Pulses

- Fruits and Vegetables

- Turf and Ornamentals

- Market Share, By Physical Form

- Granular (Dry) CAN

- Liquid (Solution) CAN

- Market Share, By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East & Africa

- Market Share, By Company

- Revenue Shares

- Competition Characteristics

- North America Calcium Ammonium Nitrate Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- Market Share, By Application

- Market Share, By Mode of Application

- Market Share, By Crop Type

- Market Share, By Physical Form

- By Country

- The US

- Canada

- Mexico

- The US Calcium Ammonium Nitrate Market Overview (2020-2032)

- Market Share, By Application

- Market Share, By Mode of Application

- Market Share, By Crop Type

- Market Share, By Physical Form

- Canada Calcium Ammonium Nitrate Market Overview (2020-2032)

- Market Share, By Application

- Market Share, By Mode of Application

- Market Share, By Crop Type

- Market Share, By Physical Form

- Mexico Calcium Ammonium Nitrate Market Overview (2020-2032)

- Market Share, By Application

- Market Share, By Mode of Application

- Market Share, By Crop Type

- Market Share, By Physical Form

- South America Calcium Ammonium Nitrate Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- Market Share, By Application

- Market Share, By Mode of Application

- Market Share, By Crop Type

- Market Share, By Physical Form

- By Country

- Brazil

- Argentina

- Rest of South America

- Brazil Calcium Ammonium Nitrate Market Overview (2020-2032)

- Market Share, By Application

- Market Share, By Mode of Application

- Market Share, By Crop Type

- Market Share, By Physical Form

- Argentina Calcium Ammonium Nitrate Market Overview (2020-2032)

- Market Share, By Application

- Market Share, By Mode of Application

- Market Share, By Crop Type

- Market Share, By Physical Form

- Europe Calcium Ammonium Nitrate Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- By Application

- By Mode of Application

- By Crop Type

- By Physical Form

- By Country

- Germany

- The UK

- France

- Spain

- Italy

- Rest of Europe

- Germany Calcium Ammonium Nitrate Market Overview (2020-2032)

- Market Share, By Application

- Market Share, By Mode of Application

- Market Share, By Crop Type

- Market Share, By Physical Form

- France Calcium Ammonium Nitrate Market Overview (2020-2032)

- Market Share, By Application

- Market Share, By Mode of Application

- Market Share, By Crop Type

- Market Share, By Physical Form

- The UK Calcium Ammonium Nitrate Market Overview (2020-2032)

- Market Share, By Application

- Market Share, By Mode of Application

- Market Share, By Crop Type

- Market Share, By Physical Form

- Spain Calcium Ammonium Nitrate Market Overview (2020-2032)

- Market Share, By Application

- Market Share, By Mode of Application

- Market Share, By Crop Type

- Market Share, By Physical Form

- Italy Calcium Ammonium Nitrate Market Overview (2020-2032)

- Market Share, By Application

- Market Share, By Mode of Application

- Market Share, By Crop Type

- Market Share, By Physical Form

- The Middle East & Africa Calcium Ammonium Nitrate Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- By Application

- By Mode of Application

- By Crop Type

- By Physical Form

- By Country

- The UAE

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- The UAE Calcium Ammonium Nitrate Market Overview (2020-2032)

- Market Share, By Application

- Market Share, By Mode of Application

- Market Share, By Crop Type

- Market Share, By Physical Form

- Saudi Arabia Calcium Ammonium Nitrate Market Overview (2020-2032)

- Market Share, By Application

- Market Share, By Mode of Application

- Market Share, By Crop Type

- Market Share, By Physical Form

- South Africa Calcium Ammonium Nitrate Market Overview (2020-2032)

- Market Share, By Application

- Market Share, By Mode of Application

- Market Share, By Crop Type

- Market Share, By Physical Form

- Asia-Pacific Calcium Ammonium Nitrate Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- By Application

- By Mode of Application

- By Crop Type

- By Physical Form

- By Country

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia-Pacific

- China Calcium Ammonium Nitrate Market Overview (2020-2032)

- Market Share, By Application

- Market Share, By Mode of Application

- Market Share, By Crop Type

- Market Share, By Physical Form

- India Calcium Ammonium Nitrate Market Overview (2020-2032)

- Market Share, By Application

- Market Share, By Mode of Application

- Market Share, By Crop Type

- Market Share, By Physical Form

- Japan Calcium Ammonium Nitrate Market Overview (2020-2032)

- Market Share, By Application

- Market Share, By Mode of Application

- Market Share, By Crop Type

- Market Share, By Physical Form

- South Korea Calcium Ammonium Nitrate Market Overview (2020-2032)

- Market Share, By Application

- Market Share, By Mode of Application

- Market Share, By Crop Type

- Market Share, By Physical Form

- Austraila Calcium Ammonium Nitrate Market Overview (2020-2032)

- Market Share, By Application

- Market Share, By Mode of Application

- Market Share, By Crop Type

- Market Share, By Physical Form

- Competitive Outlook (Company Profile - Partila List)

- Yara International ASA

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Seeds Pvt Ltd.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Sterling Chemicals

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Haifa Chemicals Ltd.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Rural Liquid Fertilizers (RLF)

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Shanxi Jiaocheng Tianlong Chemical Industry Co. Ltd.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Uralchem Holding PLC

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Agrium Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Vardhaman Fertilizers

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Prathista Industries Limited

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Swiss Formulations India

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- GFS Chemicals Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Others

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Yara International ASA

- Disclaimer

List of Figure

Figure 1: Research Methodology Framework

Figure 2: Breakdown of Primary Interviews, By Region and Stakeholder Type

Figure 3: Global Calcium Ammonium Nitrate Market Size (USD Billion), 2020–2032

Figure 4: Global Calcium Ammonium Nitrate Market Share, By Application, 2024 (%)

Figure 5: Global Calcium Ammonium Nitrate Market Share, By Mode of Application, 2024 (%)

Figure 6: Global Calcium Ammonium Nitrate Market Share, By Crop Type, 2024 (%)

Figure 7: Global Calcium Ammonium Nitrate Market Share, By Physical Form, 2024 (%)

Figure 8: Global Calcium Ammonium Nitrate Market Share, By Region, 2024 (%)

Figure 9: Global Calcium Ammonium Nitrate Market Share, By Key Companies, 2024 (%)

Figure 10: Revenue Share of Leading Companies in the Global Market, 2024

Regional Market Figures

North America

-

Figure 11: North America Calcium Ammonium Nitrate Market Size (USD Billion), 2020–2032

-

Figure 12: North America Market Share, By Application, 2024

-

Figure 13: North America Market Share, By Mode of Application, 2024

-

Figure 14: North America Market Share, By Crop Type, 2024

-

Figure 15: North America Market Share, By Physical Form, 2024

-

Figure 16: US Calcium Ammonium Nitrate Market Share, By Application, 2024

-

Figure 17: Canada Calcium Ammonium Nitrate Market Share, By Application, 2024

-

Figure 18: Mexico Calcium Ammonium Nitrate Market Share, By Application, 2024

South America

-

Figure 19: South America Calcium Ammonium Nitrate Market Size (USD Billion), 2020–2032

-

Figure 20: South America Market Share, By Application, 2024

-

Figure 21: Brazil Calcium Ammonium Nitrate Market Share, By Application, 2024

-

Figure 22: Argentina Calcium Ammonium Nitrate Market Share, By Application, 2024

Europe

-

Figure 23: Europe Calcium Ammonium Nitrate Market Size (USD Billion), 2020–2032

-

Figure 24: Europe Market Share, By Application, 2024

-

Figure 25: Germany Calcium Ammonium Nitrate Market Share, By Application, 2024

-

Figure 26: France Calcium Ammonium Nitrate Market Share, By Application, 2024

-

Figure 27: UK Calcium Ammonium Nitrate Market Share, By Application, 2024

-

Figure 28: Spain Calcium Ammonium Nitrate Market Share, By Application, 2024

-

Figure 29: Italy Calcium Ammonium Nitrate Market Share, By Application, 2024

Middle East & Africa

-

Figure 30: Middle East & Africa Calcium Ammonium Nitrate Market Size (USD Billion), 2020–2032

-

Figure 31: Middle East & Africa Market Share, By Application, 2024

-

Figure 32: UAE Calcium Ammonium Nitrate Market Share, By Application, 2024

-

Figure 33: Saudi Arabia Calcium Ammonium Nitrate Market Share, By Application, 2024

-

Figure 34: South Africa Calcium Ammonium Nitrate Market Share, By Application, 2024

Asia-Pacific

-

Figure 35: Asia-Pacific Calcium Ammonium Nitrate Market Size (USD Billion), 2020–2032

-

Figure 36: Asia-Pacific Market Share, By Application, 2024

-

Figure 37: China Calcium Ammonium Nitrate Market Share, By Application, 2024

-

Figure 38: India Calcium Ammonium Nitrate Market Share, By Application, 2024

-

Figure 39: Japan Calcium Ammonium Nitrate Market Share, By Application, 2024

-

Figure 40: South Korea Calcium Ammonium Nitrate Market Share, By Application, 2024

-

Figure 41: Australia Calcium Ammonium Nitrate Market Share, By Application, 2024

Competitive Landscape Figures

Figure 42: Competitive Landscape – Market Concentration Analysis, 2024

Figure 43: Key Strategic Developments by Leading Players, 2020–2024

List of Table

Table 1: Objective of the Study

Table 2: Market Segmentation of Calcium Ammonium Nitrate

Table 3: Key Study Variables Considered

Table 4: Secondary Data Sources

Table 5: List of Companies Interviewed (Primary & Secondary)

Table 6: Breakdown of Primary Interviews, By Region & Designation

Table 7: Global Calcium Ammonium Nitrate Market Size, 2020–2032 (USD Billion)

Table 8: Global Calcium Ammonium Nitrate Market Share, By Application, 2024 & 2032 (%)

Table 9: Global Calcium Ammonium Nitrate Market Share, By Mode of Application, 2024 & 2032 (%)

Table 10: Global Calcium Ammonium Nitrate Market Share, By Crop Type, 2024 & 2032 (%)

Table 11: Global Calcium Ammonium Nitrate Market Share, By Physical Form, 2024 & 2032 (%)

Table 12: Global Calcium Ammonium Nitrate Market Share, By Region, 2024 & 2032 (%)

Table 13: Global Calcium Ammonium Nitrate Market Share, By Key Companies, 2024 (%)

Regional Market Tables

North America

-

Table 14: North America Calcium Ammonium Nitrate Market Size, 2020–2032 (USD Billion)

-

Table 15: North America Market Share, By Application, 2024 & 2032 (%)

-

Table 16: North America Market Share, By Mode of Application, 2024 & 2032 (%)

-

Table 17: North America Market Share, By Crop Type, 2024 & 2032 (%)

-

Table 18: North America Market Share, By Physical Form, 2024 & 2032 (%)

-

Table 19: US, Canada & Mexico – Market Size, 2020–2032 (USD Billion)

South America

-

Table 20: South America Calcium Ammonium Nitrate Market Size, 2020–2032 (USD Billion)

-

Table 21: South America Market Share, By Application, 2024 & 2032 (%)

-

Table 22: Brazil, Argentina & Rest of South America – Market Size, 2020–2032

Europe

-

Table 23: Europe Calcium Ammonium Nitrate Market Size, 2020–2032 (USD Billion)

-

Table 24: Europe Market Share, By Application, 2024 & 2032 (%)

-

Table 25: Market Size of Major European Countries (Germany, UK, France, Spain, Italy), 2020–2032

Middle East & Africa

-

Table 26: Middle East & Africa Calcium Ammonium Nitrate Market Size, 2020–2032 (USD Billion)

-

Table 27: Middle East & Africa Market Share, By Application, 2024 & 2032 (%)

-

Table 28: Market Size of UAE, Saudi Arabia, South Africa & Rest of MEA, 2020–2032

Asia-Pacific

-

Table 29: Asia-Pacific Calcium Ammonium Nitrate Market Size, 2020–2032 (USD Billion)

-

Table 30: Asia-Pacific Market Share, By Application, 2024 & 2032 (%)

-

Table 31: Market Size of Major Asia-Pacific Countries (China, India, Japan, South Korea, Australia), 2020–2032

Competitive Landscape Tables

Table 32: Revenue Share of Leading Companies in the Global Market, 2024 (%)

Table 33: Competitive Characteristics of Global Calcium Ammonium Nitrate Market

Table 34: Key Strategic Developments (Mergers, Partnerships, Investments), 2020–2024

Table 35: Company Profile Summary – Yara International ASA

Table 36: Company Profile Summary – Seeds Pvt Ltd.

Table 37: Company Profile Summary – Sterling Chemicals

Table 38: Company Profile Summary – Haifa Chemicals Ltd.

Table 39: Company Profile Summary – Rural Liquid Fertilizers (RLF)

Table 40: Company Profile Summary – Shanxi Jiaocheng Tianlong Chemical Industry Co. Ltd.

Table 41: Company Profile Summary – Uralchem Holding PLC

Table 42: Company Profile Summary – Agrium Inc.

Table 43: Company Profile Summary – Vardhaman Fertilizers

Table 44: Company Profile Summary – Prathista Industries Limited

Table 45: Company Profile Summary – Swiss Formulations India

Table 46: Company Profile Summary – GFS Chemicals Inc.

Table 47: Company Profile Summary – Others

Top Key Players & Market Share Outlook

- Yara International ASA

- Seeds Pvt Ltd.

- Sterling Chemicals

- Haifa Chemicals Ltd.

- Rural Liquid Fertilizers (RLF)

- Shanxi Jiaocheng Tianlong Chemical Industry Co. Ltd.

- Uralchem Holding PLC

- Agrium Inc.

- Vardhaman Fertilizers

- Prathista Industries Limited

- Swiss Formulations India

- GFS Chemicals Inc.

- Others

Frequently Asked Questions