Latin America Oleochemicals Market

Source: The Report Cube

Understand The Key Trends Shaping This Market

Download Free SampleLatin America Oleochemicals Market Insights & Analysis

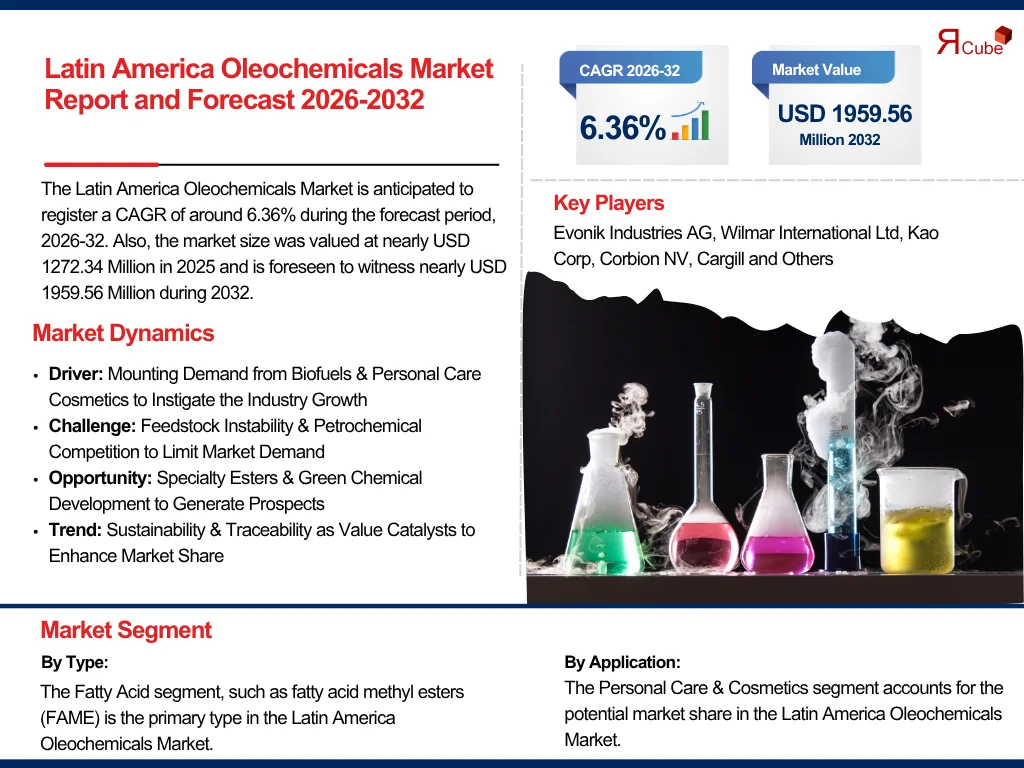

The Latin America Oleochemicals Market is anticipated to register a CAGR of around 6.36% during the forecast period, 2026-32. Also, the market size was valued at nearly USD 1272.34 Million in 2025 and is foreseen to witness nearly USD 1959.56 Million during 2032. The industry growth is influenced by the surging food & beverage and biofuel sectors, increasing eco-friendly chemical demand, and development in processing technologies.

The Latin America Oleochemicals Market outlook is observed to be molded by growing packaged goods production, biodiesel & lubricant making, and mounting demand for personal care items and soap & detergents. Also, nations such as Brazil & Argentina are investing in soybean & palm oil that are main raw materials for fatty acids, fatty alcohols, and glycerin & specialty esters. Along with this, progression in personal care cosmetics & industrial applications drives requirement for glycerol esters alkoxylates & other biodegradable molecules.

Additionally, the Latin America Oleochemicals Market products include fatty acid methyl ester (FAME) utilized in fatty alcohols, glycerin, specialty esters, biofuels, fatty acids, and alkoxylates. Also, delivery channels consist bulk supply to biodiesel plants, specialty chemicals to personal care producers, and intermediates for coatings & lubricants. Further, the region’s green chemical thrust positions oleochemicals as sustainable substitute to petrochemicals, bringing into line with green chemical initiatives & regulatory support.

Moreover, the Latin America Oleochemicals Industry is foreseen to gain traction in Brazil, Mexico, Argentina, and Colombia, instigated by growing end use industries & enhanced feedstock infrastructure. Also, market demand is fueled by rising requirement for lubricants, biodegradable surfactants, and cosmetics across sectors. Furthermore, the remarkable innovations, launches, partnerships, and government initiatives include growth of bio ester plants in Brazil for biodiesel, and association between Evonik & local producers to gauge specialty esters in 2025. In addition, governments in Brazil & Argentina announced incentives to support traceable sustainable supply chains & renewable ester manufaturing.

Consequently, the Oleochemicals Market expansion across the landscape of Latin America is destined to augment during the forthcoming period, instigated by key trends in sustainability, increasing biofuel mandates, growing personal care & detergent consumption, and reinforced production capacity. Also, as raw material access stabilizes & green chemical value chains mature, the market size is envisioned to expand substantially through 2032.

Latin America Oleochemicals Market Upgrades & Recent Developments

2025:

- Evonik Industries AG extended its production of specialty esters & glycerol-based surfactants at its São Paulo facility to cater to increasing demand in personal care cosmetics across Brazil & neighboring national markets.

- Wilmar International Ltd joined hands with a foremost biodiesel producer in Argentina to introduce a joint venture for large scale fatty acid methyl ester (FAME) production, aiming fuel & lubricant applications.

Latin America Oleochemicals Market Dynamics

-

Driver: Mounting Demand from Biofuels & Personal Care Cosmetics to Instigate the Industry Growth

The primary driver is the increasing demand for oleochemicals in biodiesel (through fatty acid methyl ester) & personal care items, such as emulsifiers, surfactants, and moisturizers. Also, rising packaged food, soaps, detergents, and cosmetics sectors drive Latin America Oleochemicals Market growth, specifically glycerol esters & alkoxylates. Furthermore, these leading trends reflect customer preference for renewable, biodegradable ingredients, advancing volumes in Latin America's green chemical setting.

-

Challenge: Feedstock Instability & Petrochemical Competition to Limit Market Demand

A major challenge is the variation in the cost of feedstock for palm & soybean oils, further impacting raw material prices. Also, competition from low-priced petrochemical derived substitutes aids in negatively affecting the market demand graph. Moreover, logistical complication in sourcing & transporting raw materials, together with unpredictable regulatory transparency, impedes growth, particularly for small companies focusing to scale specialty esters or glycerin making.

-

Opportunity: Specialty Esters & Green Chemical Development to Generate Prospects

The formation of high-value specialized esters, glycerol derivatives, alkoxylates, and novel eco-friendly formulations for lubricants, coatings, and cosmetics offers varied opportunities. Mandates for green chemicals & export prospects can advantage regional producers. Also, domestic companies colud raise profits by offering certified sustainable oleochemicals suited to high-end personal care markets due to relationships with key international players & expanding infrastructure in Brazil, Argentina, and Mexico. This, in turn, is observed to generate prospects for the Latin America Oleochemicals Market in the future years.

-

Trend: Sustainability & Traceability as Value Catalysts to Enhance Market Share

Nowadays, traceability, certification, and environmental sustainability are key subjects across Latin America. The requirement for environmentally friendly personal care items & the surge of biodiesel regulations are influencing investment in certified glycerol esters alkoxylates & traceable supply chains. Furthermore, manufacturers are deploying blockchain technology & RSPO-certified feedstock to enhance export competitiveness, link with global sustainability guidelines, and reassure end users of responsible sourcing, thus contributing in improving the market share.

Latin America Oleochemicals Market Segment Wise Analysis

By Type:

- Fatty Acid

- Fatty Alcohol

- Glycerin

- Others

The Fatty Acid segment, such as fatty acid methyl esters (FAME) is the primary type in the Latin America Oleochemicals Market. Fatty acids are broadly utilized in biodiesel, lubricants, soaps, detergents, and personal care items. FAME is the fastest growing sub segment, instigated by growing biofuel blending mandates across Brazil, Argentina, and Colombia. Moreover, with plentiful raw materials such as soybean & palm oil, and increasing processing capacity, fatty acids facilitate strong volume & revenue share. Also, their dual role as fuel feedstock & surfactant precursors makes them central, thus driving swift growth & strengthening the fatty acid segment at the forefront.

By Application:

- Personal Care & Cosmetics

- Soap & Detergents

- Biofuel & Lubricants

- Paint & Coatings

- Others

The Personal Care & Cosmetics segment accounts for the potential market share in the Latin America Oleochemicals Market. The dominance is fueled by solid regional demand for natural & biodegradable ingredients in hair care, skincare, and hygiene products. Oleochemicals, including fatty alcohols, specialty esters, glycerol esters, and alkoxylates are major raw inputs for moisturizers, surfactants, and emulsifiers. Additionally, increasing disposable incomes & e commerce penetration are enhancing consumption of premium personal care cosmetics, improving demand for high purity & certified oleochemical items.

Country Projection of the Latin America Oleochemicals Industry

The Latin America Oleochemicals Market is geographically diversified, covering:

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

The nation of Brazil leads the Latin America Oleochemicals Market, accounting for the biggest market share. The country’s robust biodiesel industry, ample supply of soybean & palm oil feedstock, and thriving personal care & soap and detergent industries are the aspects for the leadership across the regional market. Cost benefits & volume scale are guaranteed by Brazil's amalgamation of feedstock, chemical production, and end-use applications, thus enhancing the market’s growth graph. Also, the nation is the regional leader owing to its raw material base, processing infrastructure investment, and conformity to market trends such as sustainability & traceability. Moreover, Brazil is therefore the most active national market in Latin America, impelling the expansion of the Oleochemicals Industry as a whole across the regional landscape.

What Does Our Latin America Oleochemicals Market Research Study Entail?

- The Latin America Oleochemicals Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis puts light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The Latin America Oleochemicals Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- Latin America Oleochemicals Market Overview (2020-2032)

- Market Size, By Value (in USD Millions)

- Market Share, By Type

- Fatty Acid

- Fatty Alcohol

- Glycerin

- Others

- Market Share, By Application

- Personal Care & Cosmetics

- Soap & Detergents

- Biofuel & Lubricants

- Paint & Coatings

- Others

- Market Share, By Form

- Solid

- Liquid

- Market Share, By Country

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

- Market Share, By Company

- Revenue Shares

- Competition Characteristics

- Brazil Oleochemicals Market Overview, 2020-2032F

- Market Size, By Value (in USD Billions)

- By Type

- By Application

- By Form

- Mexico Oleochemicals Market Overview, 2020-2032F

- Market Size, By Value (in USD Billions)

- By Type

- By Application

- By Form

- Argentina Oleochemicals Market Overview, 2020-2032F

- Market Size, By Value (in USD Billions)

- By Type

- By Application

- By Form

- Colombia Oleochemicals Market Overview, 2020-2032F

- Market Size, By Value (in USD Billions)

- By Type

- By Application

- By Form

- Competitive Outlook (Company Profile - Partila List)

- Evonik Industries AG

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Wilmar International Ltd

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Kao Corp

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Corbion NV

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Cargill

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Godrej

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- IOI Corp Bhd

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Vantage Specialty Chemic

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Emery Oleochemicals

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Others

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Evonik Industries AG

- Contact Us & Disclaimer

List of Figure

Figure 1. Latin America Oleochemicals Market Segmentation Framework

Figure 2. Research Methodology Overview

Figure 3. Primary vs Secondary Data Sources

Figure 4. Break Down of Primary Interviews by Stakeholder Type and Geography

Figure 5. Latin America Oleochemicals Market Value (USD Billion), 2020–2032

Figure 6. Latin America Oleochemicals Market Share, by Type (%) – 2024

Figure 7. Market Share of Fatty Acid, Fatty Alcohol, Glycerin & Others – Comparative Analysis

Figure 8. Latin America Oleochemicals Market Share, by Application (%) – 2024

Figure 9. Share of Personal Care & Cosmetics, Soap & Detergents, Biofuel, Paints, Others

Figure 10. Latin America Oleochemicals Market Share, by Form (Solid vs Liquid) – 2024

Figure 11. Country-wise Market Share (%): Brazil, Mexico, Argentina, Colombia, Rest of Latin America

Figure 12. Company-wise Revenue Share in Latin America Oleochemicals Market – 2024

Figure 13. Brazil Oleochemicals Market Size (USD Billion), 2020–2032

Figure 14. Brazil Market Share, by Type (%) – 2024

Figure 15. Brazil Market Share, by Application (%) – 2024

Figure 16. Brazil Market Share, by Form (%) – 2024

Figure 17. Mexico Oleochemicals Market Size (USD Billion), 2020–2032

Figure 18. Mexico Market Share, by Type, Application, and Form – 2024

Figure 19. Argentina Oleochemicals Market Size (USD Billion), 2020–2032

Figure 20. Argentina Market Share, by Type, Application, and Form – 2024

Figure 21. Colombia Oleochemicals Market Size (USD Billion), 2020–2032

Figure 22. Colombia Market Share, by Type, Application, and Form – 2024

Figure 23. Competitive Landscape Overview – Key Companies and Market Positioning

Figure 24. Strategic Initiatives by Key Players (M&A, Partnerships, New Launches)

Figure 25. Company Comparison: Revenue, Segment Focus, Regional Presence

List of Table

Table 1. Latin America Oleochemicals Market: Key Segmentation Overview

Table 2. Study Variables and Definitions

Table 3. List of Companies Interviewed (Primary Research)

Table 4. Breakdown of Primary Interviews – By Company Type, Designation, and Geography

Table 5. Latin America Oleochemicals Market Value (USD Billion), 2020–2032

Table 6. Latin America Oleochemicals Market Share, by Type (%), 2020–2032

Table 7. Latin America Oleochemicals Market Share, by Application (%), 2020–2032

Table 8. Latin America Oleochemicals Market Share, by Form (%), 2020–2032

Table 9. Latin America Oleochemicals Market Share, by Country (%), 2020–2032

Table 10. Latin America Oleochemicals Market Share, by Company Revenue (%), 2024

Table 11. Brazil Oleochemicals Market Value (USD Billion), 2020–2032

Table 12. Brazil Oleochemicals Market, by Type (%), 2020–2032

Table 13. Brazil Oleochemicals Market, by Application (%), 2020–2032

Table 14. Brazil Oleochemicals Market, by Form (%), 2020–2032

Table 15. Mexico Oleochemicals Market Value (USD Billion), 2020–2032

Table 16. Mexico Oleochemicals Market, by Type, Application, and Form (%)

Table 17. Argentina Oleochemicals Market Value (USD Billion), 2020–2032

Table 18. Argentina Oleochemicals Market, by Type, Application, and Form (%)

Table 19. Colombia Oleochemicals Market Value (USD Billion), 2020–2032

Table 20. Colombia Oleochemicals Market, by Type, Application, and Form (%)

Table 21. Recent Trends and Developments in Latin America Oleochemicals Industry

Table 22. Regulatory Framework – Key Policies and Environmental Regulations by Country

Table 23. Company Profile Summary: Key Financials & Product Segments (Evonik, Wilmar, etc.)

Table 24. Strategic Alliances and Partnerships of Key Companies (2019–2024)

Table 25. Competitive Benchmarking – Key Players by Revenue, Presence & Offerings

Top Key Players & Market Share Outlook

- Evonik Industries AG

- Wilmar International Ltd

- Kao Corp

- Corbion NV

- Cargill

- Godrej

- IOI Corp Bhd

- Vantage Specialty Chemicals

- Emery Oleochemicals

- Oleon

- Evyap

- Sakamoto Yakuhin Kogyo

- The Stephan Co.

- Others

Frequently Asked Questions