Understand The Key Trends Shaping This Market

Download Free SampleCanada Credit Cards Market Insights & Analysis

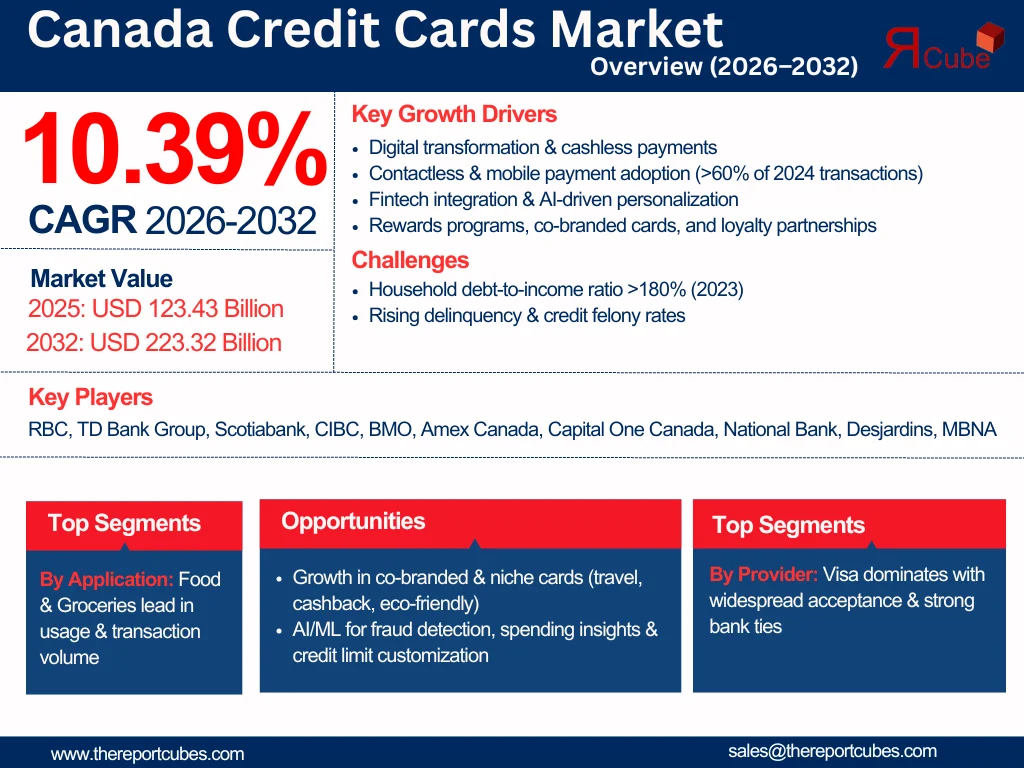

The Canada Credit Cards Market is anticipated to register a CAGR of around 10.39% during the forecast period, 2026-32. Also, the market size was valued at nearly USD 123.43 billion in 2025 and is foreseen to witness nearly USD 223.32 billion during 2032. The market is driven by increasing digital transformation, customer preference for cashless transactions, and financial product modernizations.

In Canada, credit cards serve as a prevailing form of payment, presenting financial flexibility, rewards programs, and enhanced consumer protection. Credit cards across the market range from basic no-annual-fee cards to premium cards providing travel insurance, cashback, and loyalty rewards. Furthermore, leading banks & financial institutions are modifying credit offerings for several customer segments, such as small business owners, students, and high-net-worth individuals, thus enhancing the Canada Credit Cards Market share.

Moreover, major industry drivers include rising e-commerce activity, contactless payment acceptance, and promotional incentives, including sign-up bonuses & zero-interest initial periods. Customers are becoming more credit-savvy, leveraging tools such as credit monitoring & budgeting apps, hence instigating the Canada Credit Cards Market demand. Furthermore, fintech incorporation has augmented digital onboarding processes, enhancing consumer experience & card accessibility. Besides, despite inflationary pressures & regulatory scrutiny around consumer debt, the Canada Credit Cards Market remains robust.

Additionally, as per Statistics Canada, household credit card debt continued to surge progressively post-pandemic, showcasing constant demand. The Canada Credit Cards Industry is presumed to flourish owing to constant digitization, loyalty reward partnerships, and the incorporation of AI-driven risk analytics. Also, improved cybersecurity, personalized offers, and co-branded card partnerships with travel & retail giants are foreseen to shape future development. For instance, the association between RBC & WestJet has led to the launch of highly prevalent travel-centric cards, increasing user engagement & transaction volumes, further contributing to the Canada Credit Cards Market growth in the future years.

Canada Credit Cards Market Upgrades & Recent Developments

- Royal Bank of Canada (RBC) introduced a revamped RBC Avion Visa Infinite Credit Card with improved travel rewards, AI-powered spending insights, and real-time fraud alerts.

- Scotiabank joined hands with Cineplex to reintroduce its Scene+ credit card with high reward points on entertainment & groceries, aiming at younger demographics.

Canada Credit Cards Market Dynamics

-

Driver: Rising Customer Inclination towards Contactless & Digital Payments to Drive Market Demand

The transition toward contactless & mobile payments considerably drives the Canada Credit Cards Market. Canadian customers are swiftly embracing digital wallets like Apple Pay, Google Pay, and Samsung Pay, which are effortlessly assimilated with major credit card providers, including Visa & Mastercard. Also, as per Payments Canada, over 60% of transactions in 2024 were contactless. Further, banks are capitalizing on this trend by introducing tap-enabled credit cards & improving mobile banking features, stimulating the Canada Credit Cards Market expansion.

-

Challenge: Increasing Household Debt & Credit Felony Rates to Hamper Industry Growth

A key challenge limiting the Canada Credit Cards Market is the growing household debt level across the country. According to the Bank of Canada, the average Canadian household debt-to-income ratio exceeded 180% in 2023. Also, credit card debt, owing to its high-interest nature, remains an issue for policymakers & financial institutions. Furthermore, rising interest rates have strained repayment capacities, leading to an uptick in delinquency rates, particularly among young adults. Also, this creates a threat to the long-term sustainability of aggressive credit card issuance strategies & needs better financial literacy initiatives & risk management.

-

Opportunity: Expansion of Co-Branded & Niche Credit Card Offerings

Co-branded & specialty credit card products are becoming more & more prevalent, which presents a budding opportunity for the Canada Credit Card Market. Customers aggressively look for personalized incentives that fit their lifestyle, whether it’s dining, vacation, or online shopping. Moreover, companies such as TD Bank Group & Aeroplan have taken advantage of this by providing travel cards that come with airline & trip insurance, complimentary lounge access, and mileage gains. Also, retail consumers are progressively utilizing CIBC & BMO's cashback-focused cards. Targeted products (like cards with carbon-offsetting features) for students, gig workers, and environmentally aware customers offer new growth prospects.

-

Trend: AI & Big Data Altering Credit Card Personalization

The application of big data analytics & AI to credit card customization and fraud protection is one of the most considerable trends. Also, AI is being utilized by banks such as American Express Canada & Capital One Canada to offer vibrant rewards, spending data, and personalized credit limits. Moreover, AI is vital for detecting fraud as machine learning (ML) algorithms use real-time transaction data to recognize irregularities. Further, along with enhancing security, this increases user engagement & trust, which advances usage rates & depresses churn.

Canada Credit Cards Market Segment-Wise Analysis

By Application:

- Food & Groceries

- Health & Pharmacy

- Restaurants & Bars

- Consumer Electronics

- Media & Entertainment

- Travel & Tourism

- Other

The Food & Groceries segment leads the Canada Credit Cards Market in terms of transaction volume & frequency, further seizing the potential market share. Consumers are progressively utilizing their credit cards for regular purchases as a result of the development of credit card rewards programs that emphasize major categories. Well-known banks such as TD & Scotiabank offer cashback & point-based incentives designed specifically for grocery store purchases. Also, by proposing special discounts & bonus points, credit card issuers' associations with large grocery chains, including Loblaw & Sobeys, enhance value propositions.

By Provider:

- Visa

- MasterCard

- Other

The Visa segment captures the primary position in the Canada Credit Cards Market by grabbing the largest market share. This can be attributed to its widespread network of merchant acceptance & solid alliances with the foremost Canadian financial institutions. Visa provides several products in numerous categories, like student cards, cashback, and travel incentives. Also, consumers & banks favor it due to its solid fraud detection systems, global reach, and adaptable connection with digital wallets. Further, in addition to promoting fintech partnerships, Visa has maintained its standing as a safe & convenient payment method, amalgamating its market leadership.

Top Companies in Canada Credit Cards Market

Book your FREE 30-minute expert consultation today

Contact UsWhat Does Our Canada Credit Cards Market Research Study Entail?

- The Canada Credit Cards Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis puts light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The Canada Credit Cards Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- Canada Credit Cards Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- Market Share, By Application

- Food & Groceries

- Health & Pharmacy

- Restaurants & Bars

- Consumer Electronics

- Media & Entertainment

- Travel & Tourism

- Other

- Market Share, By Provider

- Visa

- MasterCard

- Other

- Market Share, By End-user

- Individual

- Corporate

- Market Share, By Competitors

- Competition Characteristics

- Revenue Shares

- Canada Food & Groceries Credit Cards Market Overview, 2020-2032F

- By Value (USD Million)

- By Provider- Market Size & Forecast 2019-2030, USD Million

- Canada Health & Pharmacy Credit Cards Market Overview, 2020-2032F

- By Value (USD Million)

- By Provider- Market Size & Forecast 2019-2030, USD Million

- Canada Restaurants & Bars Credit Cards Market Overview, 2020-2032F

- By Value (USD Million)

- By Provider- Market Size & Forecast 2019-2030, USD Million

- Canada Consumer Electronics Credit Cards Market Overview, 2020-2032F

- By Value (USD Million)

- By Provider- Market Size & Forecast 2019-2030, USD Million

- Canada Media & Entertainment Credit Cards Market Overview, 2020-2032F

- By Value (USD Million)

- By Provider- Market Size & Forecast 2019-2030, USD Million

- Canada Travel & Tourism Credit Cards Market Overview, 2020-2032F

- By Value (USD Million)

- By Provider- Market Size & Forecast 2019-2030, USD Million

- Canada Other Credit Cards Market Overview, 2020-2032F

- By Value (USD Million)

- By Provider- Market Size & Forecast 2019-2030, USD Million

- Competitive Outlook (Company Profile - Partila List)

- Royal Bank of Canada (RBC)

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- TD Bank Group

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Scotiabank

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- CIBC

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- BMO Financial Group

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- American Express Canada

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Capital One Canada

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- National Bank of Canada

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Desjardins Group

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- MBNA Canada

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Royal Bank of Canada (RBC)

- Contact Us & Disclaimer

Top Key Players & Market Share Outlook

- Royal Bank of Canada (RBC)

- TD Bank Group

- Scotiabank

- CIBC

- BMO Financial Group

- American Express Canada

- Capital One Canada

- National Bank of Canada

- Desjardins Group

- MBNA Canada

Frequently Asked Questions