Understand The Key Trends Shaping This Market

Download Free SampleJapan Cannabidiol Market Overview: Market Size & Forecast (2026–2034)

What is the anticipated CAGR & size of the Japan Cannabidiol Market?

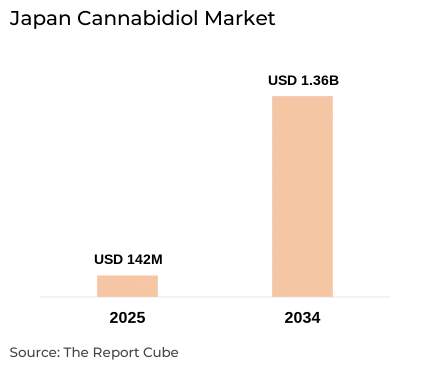

The Japan Cannabidiol Market is anticipated to register a CAGR of around 28.5% during the forecast period, 2026-34. Additionally, the market size was valued at nearly USD 142 million in 2025 and is projected to reach nearly USD 1356.49 million by 2034.

Market Analysis & Insights

The Japan Cannabidiol Market is emerging from its roots in limited recreational policies to a combination of sternly regulated medical usage & cautiously approved consumer goods. Stronger but more transparent CBD guidelines in Japan, expanding consumer demand in non-psychoactive cannabinoids, and foreign companies' investments adjusting to ingredient-based rules & THC restrictions are some of the growth factors influencing the positive market outlook. Also, while pursuing product developments & clinical trials, companies must adhere to MHLW CBD standards & changes to the Cannabis Control Law of Japan, to keep the market up to the prescribed guidelines.

Moreover, regulatory steps in the nation clarified product classifications (oils, powders, cosmetics) & introduced ingredient-based THC thresholds, making lawful product paths clearer for hemp-derived CBD Japan suppliers & importers. Also, market demand for CBD cosmetics & non-ingestible wellness goods has infused, supporting personal-care & topical introductions. Furthermore, sales channels of the Japan Cannabidiol Market are broadening, as online DTC remains leading, while pharmacies & healthcare distributors are preparing to transmit medically authorized cannabinoid medicines.

Additionally, industries that are dealing with compliance expenses are also finding varied opportunities. As by investing in ISO-17025 labs, AI quality-control, and local regulatory knowledge, they can gain a greater portion of the market. Also, new government regulations (effective December 2024) cleared up confusion around acceptable THC levels & product labeling, permitting for more innovation in Japanese CBD products. Therefore, in general, the combination of customer wellness demands, regulatory clarity, and business safety/traceability investment the Japan Cannabidiol Market is destined for favorable growth in the future years.

What is the Impact of AI in the Japan Cannabidiol Market?

By improving R&D, facilitating personalized dosing & predictive formulation, automating ISO-grade lab analytics for traceability, and assisting businesses in adhering to strict MHLW CBD regulations, AI elevates the progression of the Japan CBD Market, while also enhancing product safety & time-to-market.

Japan Cannabidiol Market Dynamics

What driving factor acts as a positive influencer for the Japan Cannabidiol Market?

- Regulatory Clarification to Instigate Market Entry: By minimizing legislative ambiguity & implementing ingredient-based restrictions & published test procedures in late 2024-2025, Japan fortified both domestic & foreign industries to enter the market with compliant formulations (oils, powders, cosmetics), further driving market prominence. Also, previous complications are eradicated by clear THC thresholds & laboratory needs (ISO-grade testing). Thus, the growing market shares are majorly owing to this regulatory certainty.

What are the challenges that affect the Japan Cannabidiol Market?

- Enormously Low THC Limits & Compliance Costs to Hamper Growth: Stringent THC regulations in Japan (practically nonexistent in numerous product kinds) call for advanced extraction, validation, and batch testing. Also, ISO-17025 testing & thorough documentation are essential for compliance, which increases unit costs & decrease margin for commoditized ingestible formats. Further, notwithstanding consumer demand, these restrictions prevent edible CBD from being broadly adopted.

How are the future opportunities transforming the market during 2026-34?

- Medical & Pharmaceutical Pathways Open: Producers & pharmaceutical partners can now chase prescription-grade goods (approvals similar to those of Epilex) owing to amendments that permit the clinical development of cannabis-derived medications. Thus, this opens up reimbursement potentials, inspires R&D partnerships with Japanese pharmaceutical companies, and creates higher-value B2B & hospital channels, which a wide range of opportunities that go beyond customer wellbeing. Also, increasing prospects for the medical cannabis business are specified by early clinical trial activities & regulatory developments.

What market trends are affecting the Japan Cannabidiol Market Outlook?

- Premiumization, Topical, and Non-Ingestible Growth: CBD cosmetics in the country & topical skincare products that circumvent ingestible regulatory barriers are preferred by people. Further, with AI-driven traceability, third-party lab evidence, and organic/clean certifications, brands are enriching their offerings. Moreover, pharmacy-style retail (for products with a medical clearance) & e-commerce are expanding. Also, instead of the immediate spread of edibles, presumed innovation in transdermals, cosmeceuticals, and medicinal adjuncts would create profitable grounds for the CBD Market in Japan.

How is the Japan Cannabidiol Market Defined as per Segments?

The Japan Cannabidiol Market Research Reports provide detailed market data & insights in accordance with market segmentation. Some of the segments are:

- Product Type: CBD Oil, CBD Tincture, CBD Creams, CBD Capsules, Others

- Application: Tincture, Pharmaceuticals, Personal Care, Food & Beverage, Pet Care

By Product Type:

The CBD Oil segment governs in the Japan Cannabidiol Market by capturing around 45% market share, supported by demand for CBD oil in wellness sector.

The CBD oil remain the major product type owing to comfort of dosing, familiarity, and suitability for medical/formulation work. Further, in 2024, oil-based products & ingredient sales embraced the biggest revenue share compared to edibles as topical & non-ingestible forms avoid some legal limits. Also, oil segment’s supremacy reflects both customer preference & regulatory practices.

By Application:

The Personal Care Products segment, particularly CBD cosmetics Japan accounts for roughly 40% share of the Japan Cannabidiol Market.

The segment is the fastest expanding application across Japan, instigated by population demand for non-ingestible wellness & beauty products that comply easier with THC limits Japan & MHLW CBD regulations. Also, these categories generated the biggest retail market revenues in 2024 among consumer formats.

Japan Cannabidiol Market: What Recent Innovations Are Affecting the Industry?

- 2025: Elixinol Japan introduced a new “CBD Tincture Night Time” product across the national market.

- 2025: Naturecan announced to offer THC-free, high-purity CBD raw materials (like CBD isolate & CBN isolate) from its Japanese warehouse, imported by its US group company.

What are the Key Highlights of the Japan Cannabidiol Market (2026–34)?

- The Japan Cannabidiol Market is predicted to expand swiftly with a CAGR of around 28.5% during 2026–2034, driven by evolving MHLW CBD guidelines, consumer shift toward hemp-derived CBD etc.

- Also, the market size was valued at about USD 142 million in 2025, and is foreseen to grab nearly USD 1356.49 million by 2034.

- Hemp-based CBD leads the market with about 70% share, replicating customer preference for hemp-derived CBD Japan over marijuana-based.

- Under product type, CBD oil dominates with nearly 45% market share, supported by demand for CBD Oil Market in wellness & self-care applications.

- Under application, personal care products, specifically CBD cosmetics commanded around 40% market share.

- Food grade CBD remains the biggest grade segment, generating roughly USD 391.21 million in 2024.

- Organic CBD products govern with about USD 480.59 million in 2024, aligning with Japan’s soild clean-label & sustainable customer trends.

- Online channels segment attains approx. 60% of market sales, with robust e-commerce & direct-to-consumer presence through platforms selling Japanese CBD products.

- Amalgamation of AI in the Japan CBD Market assists in improving product formulation, quality testing, and customer trend analysis, fueling precision marketing & advancements.

How does the Future Outlook of the Japan Cannabidiol Market (2034) Appears?

Through 2034, the Japan CBD Market would be structured, with a mix of premium topicals, pharmaceutical cannabinoids, and wisely authorized ingestible. Also, with stronger Cannabis Control Law, Japan interpretations, MHLW CBD guidelines, and AI-enabled quality control, assume sustained acceptance, medical product endorsements, and maturing retail channels, positioning the country as a high-value, compliance-first Cannabidiol Market across the Asia.

What Does Our Japan Cannabidiol Market Research Study Entail?

- The Japan Cannabidiol Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis & market scope sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The Japan Cannabidiol Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the Study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Breakdown of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- Japan Cannabidiol Market Overview (2020–2034)

- Market Size, By Value (USD Million)

- Market Share, By Product Type

- CBD Oil

- CBD Tincture

- CBD Creams

- CBD Capsules

- Others

- Market Share, By Application

- Tincture

- Pharmaceuticals

- Personal Care

- Food & Beverage

- Pet Care

- Market Share, By Source Type

- Hemp-derived

- Marijuana-derived

- Market Share, By CBD Type

- Full spectrum

- Broad spectrum

- Isolate

- Market Share, By Distribution Channel

- E-commerce

- Specialty stores

- Pharmacies

- Market Share, By Company

- Revenue Shares

- Competition Characteristics

- Japan Cannabidiol Market Overview, By Product Type (2020–2034)

- CBD Oil Market Overview, 2034F (By Value, USD Billion)

- CBD Tincture Market Overview, 2034F (By Value, USD Billion)

- CBD Creams Market Overview, 2034F (By Value, USD Billion)

- CBD Capsules Market Overview, 2034F (By Value, USD Billion)

- Others Market Overview, 2034F (By Value, USD Billion)

- Japan Cannabidiol Market Overview, By Application (2020–2034)

- Tincture Market Overview, 2034F (By Value, USD Billion)

- Pharmaceuticals Market Overview, 2034F (By Value, USD Billion)

- Personal Care Market Overview, 2034F (By Value, USD Billion)

- Food & Beverage Market Overview, 2034F (By Value, USD Billion)

- Pet Care Market Overview, 2034F (By Value, USD Billion)

- Japan Cannabidiol Market Overview, By Source Type (2020–2034)

- Hemp-derived Market Overview, 2034F (By Value, USD Billion)

- Marijuana-derived Market Overview, 2034F (By Value, USD Billion)

- Japan Cannabidiol Market Overview, By CBD Type (2020–2034)

- Full spectrum Market Overview, 2034F (By Value, USD Billion)

- Broad spectrum Market Overview, 2034F (By Value, USD Billion)

- Isolate Market Overview, 2034F (By Value, USD Billion)

- Japan Cannabidiol Market Overview, By Distribution Channel (2020–2034)

- E-commerce Market Overview, 2034F (By Value, USD Billion)

- Specialty stores Market Overview, 2034F (By Value, USD Billion)

- Pharmacies Market Overview, 2034F (By Value, USD Billion)

- Competitive Outlook (Company Profiles)

- Elixinol Wellness Ltd

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Medical Marijuana Inc (via Kannaway)

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Endoca

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Naturecan JP

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- PharmaHemp

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Canopy Growth Corp

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Cronos Group

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Isodiol International Inc

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- NuLeaf Naturals

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Folium Biosciences

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Elixinol Wellness Ltd

- Contact Us & Disclaimer

List of Figure

Figure 1: Research Framework and Methodology

Figure 2: Study Scope and Segmentation Overview

Figure 3: Market Estimation Process — Data Triangulation Approach

Figure 4: Japan Cannabidiol Market Snapshot (2020–2034)

Figure 5: Japan Cannabidiol Market Size, By Value (USD Million), 2020–2034

Figure 6: Market Share, By Product Type

Figure 7: Market Share, By Application

Figure 8: Market Share, By Source Type

Figure 9: Market Share, By CBD Type

Figure 10: Market Share, By Distribution Channel

Figure 11: Key Market Drivers Influencing the Japan Cannabidiol Industry

Figure 12: Major Challenges Impacting Market Growth

Figure 13: Opportunity Matrix – Japan Cannabidiol Market (2026–2034)

Figure 14: Recent Developments and Product Launches (2020–2025)

Figure 15: Policy & Regulatory Landscape Overview in Japan

Figure 16: CBD Oil Market Size and Forecast, 2020–2034 (USD Million)

Figure 17: CBD Tincture Market Size and Forecast, 2020–2034 (USD Million)

Figure 18: CBD Creams Market Size and Forecast, 2020–2034 (USD Million)

Figure 19: CBD Capsules Market Size and Forecast, 2020–2034 (USD Million)

Figure 20: Other CBD Products Market Size and Forecast, 2020–2034 (USD Million)

Figure 21: Application-wise Market Breakdown – Tincture Segment (USD Million)

Figure 22: Application-wise Market Breakdown – Pharmaceuticals Segment (USD Million)

Figure 23: Application-wise Market Breakdown – Personal Care Segment (USD Million)

Figure 24: Application-wise Market Breakdown – Food & Beverage Segment (USD Million)

Figure 25: Application-wise Market Breakdown – Pet Care Segment (USD Million)

Figure 26: Hemp-derived vs. Marijuana-derived CBD Market Comparison, 2020–2034

Figure 27: CBD Market by Type – Full Spectrum, Broad Spectrum, Isolate (USD Million)

Figure 28: Distribution Channel Analysis – E-commerce, Specialty Stores, Pharmacies (USD Million)

Figure 29: Competitive Landscape – Market Share by Key Companies (2024)

Figure 30: Company Benchmarking Matrix – Product Portfolio vs. Market Presence

Figure 31: Elixinol Wellness Ltd: Product Portfolio Overview

Figure 32: Medical Marijuana Inc (Kannaway): Regional Revenue Mix

Figure 33: Endoca: Product Development Timeline

Figure 34: Naturecan JP: Strategic Partnerships Overview

Figure 35: PharmaHemp: Business Segment Breakdown

Figure 36: Canopy Growth Corp: Japan CBD Market Entry Strategy

Figure 37: Cronos Group: Revenue and Product Line Analysis

Figure 38: Isodiol International Inc: Recent Developments (2023–2025)

Figure 39: NuLeaf Naturals: Product Portfolio Expansion, 2020–2034

Figure 40: Folium Biosciences: Global CBD Supply Chain Overview

Figure 41: Competitive Positioning of Key Players in Japan Cannabidiol Market (2024)

Figure 42: Future Growth Roadmap for the Japan Cannabidiol Market (2025–2034)

List of Table

Table 1: Objective and Scope of the Study

Table 2: Definition and Classification of Cannabidiol (CBD) Products

Table 3: Market Segmentation – By Product Type, Application, Source, CBD Type, and Distribution Channel

Table 4: Key Study Variables and Measurement Parameters

Table 5: Data Sources Utilized for Secondary Research

Table 6: List of Companies Interviewed (Primary Respondents)

Table 7: Breakdown of Primary Interviews – By Company Type, Designation, and Region

Table 8: Summary of Market Estimation and Forecasting Methodology

Table 9: Japan Cannabidiol Market Overview, 2020–2034 (By Value, USD Million)

Table 10: Market Size Comparison, 2020–2024 vs. Forecast 2034

Table 11: Key Market Drivers and Their Impact on Growth

Table 12: Key Market Challenges and Restraining Factors

Table 13: Opportunity Assessment – Emerging Segments and Growth Hotspots

Table 14: Recent Trends and Strategic Developments (2022–2025)

Table 15: Regulatory Policies Governing Cannabidiol Products in Japan

Table 16: Market Size, By Product Type, 2020–2034 (USD Million)

Table 17: CBD Oil Market Size, 2020–2034 (USD Million)

Table 18: CBD Tincture Market Size, 2020–2034 (USD Million)

Table 19: CBD Creams Market Size, 2020–2034 (USD Million)

Table 20: CBD Capsules Market Size, 2020–2034 (USD Million)

Table 21: Other Product Types Market Size, 2020–2034 (USD Million)

Table 22: Market Size, By Application, 2020–2034 (USD Million)

Table 23: Tincture Application Market, 2020–2034 (USD Million)

Table 24: Pharmaceuticals Application Market, 2020–2034 (USD Million)

Table 25: Personal Care Application Market, 2020–2034 (USD Million)

Table 26: Food & Beverage Application Market, 2020–2034 (USD Million)

Table 27: Pet Care Application Market, 2020–2034 (USD Million)

Table 28: Market Size, By Source Type, 2020–2034 (USD Million)

Table 29: Hemp-derived CBD Market, 2020–2034 (USD Million)

Table 30: Marijuana-derived CBD Market, 2020–2034 (USD Million)

Table 31: Market Size, By CBD Type, 2020–2034 (USD Million)

Table 32: Full Spectrum CBD Market, 2020–2034 (USD Million)

Table 33: Broad Spectrum CBD Market, 2020–2034 (USD Million)

Table 34: Isolate CBD Market, 2020–2034 (USD Million)

Table 35: Market Size, By Distribution Channel, 2020–2034 (USD Million)

Table 36: E-commerce Channel Market, 2020–2034 (USD Million)

Table 37: Specialty Stores Channel Market, 2020–2034 (USD Million)

Table 38: Pharmacies Channel Market, 2020–2034 (USD Million)

Table 39: Market Share Analysis, By Company, 2024 (%)

Table 40: Competitive Landscape – Revenue Shares of Major Players (2024)

Table 41: Elixinol Wellness Ltd – Financial Overview and Key Metrics

Table 42: Medical Marijuana Inc (via Kannaway) – Business Segment Analysis

Table 43: Endoca – Strategic Partnerships and Product Portfolio

Table 44: Naturecan JP – Product Lines and Distribution Channels

Table 45: PharmaHemp – Key Financial Indicators

Table 46: Canopy Growth Corp – Strategic Expansion Initiatives in Japan

Table 47: Cronos Group – Key Product Launches (2022–2025)

Table 48: Isodiol International Inc – Business Segmentation Overview

Table 49: NuLeaf Naturals – Sales Performance, 2020–2034

Table 50: Folium Biosciences – Production Capacity and Global Presence

Table 51: Comparative SWOT Analysis of Key Market Players

Table 52: Summary of Key Findings and Strategic Recommendations

Top Key Players & Market Share Outlook

- Elixinol Wellness Ltd

- Medical Marijuana Inc (via Kannaway)

- Endoca

- Naturecan JP

- PharmaHemp

- Canopy Growth Corp

- Cronos Group

- Isodiol International Inc

- NuLeaf Naturals

- Folium Biosciences

- Others

Frequently Asked Questions