Understand The Key Trends Shaping This Market

Download Free SampleUAE Caustic Soda Market Overview: Market Size & Forecast (2026–2034)

What is the anticipated CAGR & size of the UAE Caustic Soda Market?

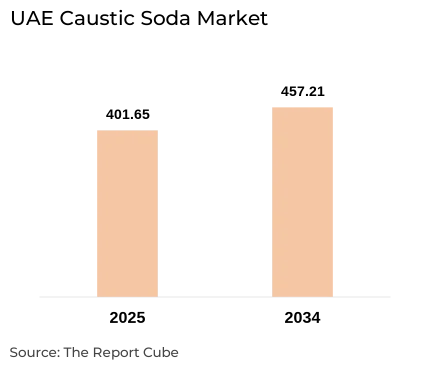

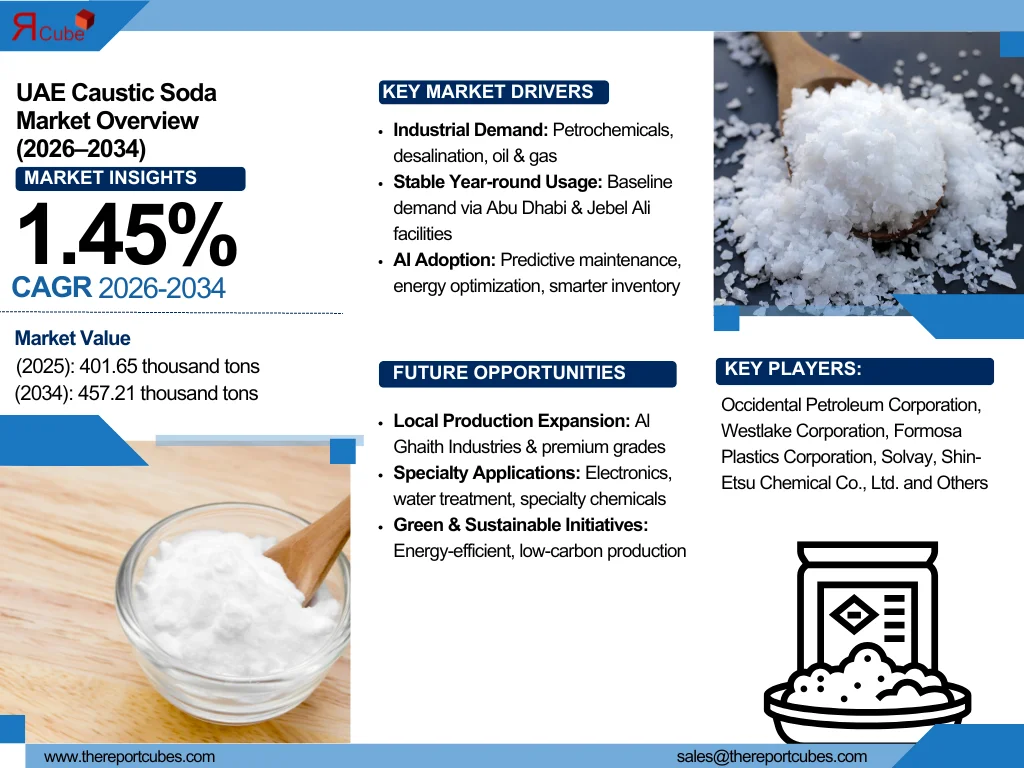

The UAE Caustic Soda Market is anticipated to register a CAGR of around 1.45% during the forecast period, 2026-34. Additionally, the market size was valued at nearly USD 401.65 thousand tons in 2025 and is projected to reach nearly USD 457.21 thousand tons by 2034.

Market Insights & Analysis

The UAE Caustic Soda Market is molded by swift industrial consumption anchored in desalination, petrochemical, and oil & gas operations. With widespread desalination infrastructure & robust petrochemical groups in Abu Dhabi & Jebel Ali, the country maintains year-round baseline demand, offering resilience against global fluctuations.

Further, the market price averaged around USD 287 per ton in March 2024, reflecting volatility instigated by global maintenance cycles & supply disruptions. Also, end-use industries include water treatment, oil & gas (for sour-gas cleaning), aluminium refining, and chemical manufacturing, all of which rely on stable supply & port-driven trade efficiency across the industry landscape.

Moreover, major trade flows pass through Jebel Ali & Khalifa Ports, placing logistics access as a significant factor for competitiveness through 2034. Additionally, domestic manufacturers, such as Al Ghaith Industries, serve large utilities, while regional distributors & global traders like Gulf Global Commerce and Innoveda manage spot & export contracts.

Along with this, as buyers progressively favor long-term agreements to mitigate price fluctuation, investments emphasize process electrification, energy-efficient production, and advanced storage systems. Further, these advancements strive to strengthen local supply chains, minimizing import reliance, and ensuring uninterrupted availability to meet the UAE’s expanding industrial & water treatment requirements in the coming years.

What is the Impact of AI in the UAE Caustic Soda Market?

In the UAE Caustic Soda Market, AI improves plant energy management, predictive maintenance, and supply-chain forecasting in the UAE chlor-alkali operations, depressing electricity usage & downtime while enabling smarter inventory control and price projection across chemical logistics in UAE networks.

UAE Caustic Soda Market Dynamics

What driving factor acts as a positive influencer for the UAE Caustic Soda Market?

- Robust Demand from Petrochemical & Desalination Industries: The UAE’s large desalination & petrochemical base across Abu Dhabi, Dubai, and Ruwais ensures continuous demand for caustic soda utilized in pH control & cleaning. Further, constant desalination operations and recurring oil & gas applications offer stable offtake, making the country a reliable consumption hub & an eye-catching logistics center for global suppliers as well.

What are the challenges that affect the UAE Caustic Soda Market?

- Challenges Related to Import Reliance & Logistics: Limited domestic capacity keeps the nation dependent on imports & regional traders, which is eventually hampering market demand. Any port congestion, supply disruption, or transport delay could lead to upscale costs & restrict availability. Also, efficient storage, bonded terminals, and robust distribution networks are vital to maintaining a steady supply & competitive pricing in the market.

How are the future opportunities transforming the market during 2026-34?

- Development of Local Production & Premium Grades: Local manufacturers, such as Al Ghaith, are expanding output & targeting high-purity grades for electronics, water treatment, and specialty chemicals. Further, developing tailored lye formulations, certified packaging, and on-site storage could assist in capturing premium pricing opportunities & open export access to neighboring Gulf markets, minimizing future reliance on imports.

What market trends are affecting the UAE Caustic Soda Market Outlook?

- Digitalization, Sustainability, and Contract-based Supply: Suppliers are progressively deploying digital platforms, AI forecasting, and process automation to enhance efficiency & decrease stockouts. Also, buyers favor longer contracts to stabilize market costs. Thus, the shift toward green, low-carbon, and electrified production methods supports the United Arab Emirates’ move to market sustainable caustic soda across numerous sectors, for desalination & other uses.

How is the UAE Caustic Soda Market Defined as per Segments?

The UAE Caustic Soda Market Research Reports provide detailed market data & insights in accordance with market segmentation. Some of the segments are:

- Grade: Reagent Grade, Industrial Grade, Pharmaceutical Grade, Others

- Application: Alumina, Inorganic Chemicals, Organic Chemicals, Food, Pulp, and Paper, Soap & Detergents, Textiles, Water Treatment, Steel/Metallurgy-Sintering, Others

By Grade:

The Industrial Grade caustic soda (liquid lye) is dominating across the grade segment in the UAE Caustic Soda Market, capturing the potential market share. As large desalination plants, oil & gas operations, and chemical processors sector utilize bulk solution for pH control, cleaning & alkali-based processes, the demand for this caustic soda grade is increasing. Lye’s liquid form simplifies tanker deliveries, on-site dosing & storage, making it the ideal, high-volume product for UAE industrial consumers & distributors.

By Application:

The Water Treatment & Desalination segment led the UAE NaOH Market by accounting for the largest market share. Owing to the nation’s dependence on desalinated water for municipal & industrial supply, the application for water treatment & desalination would surge. Caustic soda is vital for pH adjustment, scaling control, and wastewater neutralization in plants across Abu Dhabi & Dubai. Thus, this sturdy, year-round demand makes water treatment the biggest application, supporting predictable procurement contracts & generating a baseline market for local suppliers & importers.

UAE Caustic Soda Market: What Recent Innovations Are Affecting the Industry?

- 2025: Solvay, in partnership with IUCN at its soda ash manufacturing site in France, introduced a landmark biodiversity pilot scheme. Launched in October, this program incorporates science-based biodiversity targets & environmental stewardship directly into chemical plant operations, setting new sustainability benchmarks in the industry & aligning caustic soda production with global green objectives.

What are the Key Highlights of the UAE Caustic Soda Market (2026–34)?

- The UAE Caustic Soda Market is projected to expand at a CAGR of about 1.45% during 2026-32, anticipated to register a market size of about USD 457.21 thousand tons by 2034 during 2034.

- The market demand is driven by industrial diversification (chemicals, aluminum, petrochemicals), water treatment & infrastructure expansion.

- Production approaches are shifting toward energy-efficient technologies such as membrane-cell electrolysis to meet environmental norms.

- AI & data analytics deployed in demand forecasting & adaptive production scheduling to align supply with unpredictable downstream demand.

- Under application, alumina refining, inorganic & organic chemicals, water treatment, soaps & detergents are major consumers.

How does the Future Outlook of the UAE Caustic Soda Market (2034) Appears?

Through 2034, the UAE Caustic Soda Market is expected to remain stable with modest growth, as desalination & petrochemical demand continue to increase. Also, expanded local capacity, enhanced port logistics, and sustainable sodium hydroxide offerings would minimize import risk. Further, AI-enabled forecasting & stronger contracting models would decrease volatility, while premium, high-purity, and low-carbon products generate varied market opportunities.

What Does Our UAE Caustic Soda Market Research Study Entail?

- The UAE Caustic Soda Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis & market scope sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The UAE Caustic Soda Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the Study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- UAE Caustic Soda Market Overview (2020–2034)

- Market Size, By Value (in thousand tons)

- Market Share, By Grade

- Reagent Grade

- Industrial Grade

- Pharmaceutical Grade

- Others

- Market Share, By Application

- Alumina

- Inorganic Chemicals

- Organic Chemicals

- Food

- Pulp, and Paper

- Soap & Detergents

- Textiles

- Water Treatment

- Steel/Metallurgy-Sintering

- Others

- Market Share, By Product Type

- Lye

- Flake

- Others

- Market Share, By Manufacturing Process

- Membrane Cell

- Diaphragm Cell

- Others

- Market Share, By Competitors

- Revenue Shares

- Competition Characteristics

- UAE Reagent Grade Caustic Soda Market Overview, 2026–2034

- Market Size, By Value (USD Million)

- UAE Industrial Grade Caustic Soda Market Overview, 2026–2034

- Market Size, By Value (USD Million)

- UAE Pharmaceutical Grade Caustic Soda Market Overview, 2026–2034

- Market Size, By Value (USD Million)

- UAE Others Grade Caustic Soda Market Overview, 2026–2034

- Market Size, By Value (USD Million)

- UAE Alumina Caustic Soda Market Overview, 2026–2034

- Market Size, By Value (USD Million)

- UAE Inorganic Chemicals Caustic Soda Market Overview, 2026–2034

- Market Size, By Value (USD Million)

- UAE Organic Chemicals Caustic Soda Market Overview, 2026–2034

- Market Size, By Value (USD Million)

- UAE Food Caustic Soda Market Overview, 2026–2034

- Market Size, By Value (USD Million)

- UAE Pulp, and Paper Caustic Soda Market Overview, 2026–2034

- Market Size, By Value (USD Million)

- UAE Soap & Detergents Caustic Soda Market Overview, 2026–2034

- Market Size, By Value (USD Million)

- UAE Textiles Caustic Soda Market Overview, 2026–2034

- Market Size, By Value (USD Million)

- UAE Water Treatment Caustic Soda Market Overview, 2026–2034

- Market Size, By Value (USD Million)

- UAE Steel/Metallurgy-Sintering Caustic Soda Market Overview, 2026–2034

- Market Size, By Value (USD Million)

- UAE Others Application Caustic Soda Market Overview, 2026–2034

- Market Size, By Value (USD Million)

- UAE Lye Caustic Soda Market Overview, 2026–2034

- Market Size, By Value (USD Million)

- UAE Flake Caustic Soda Market Overview, 2026–2034

- Market Size, By Value (USD Million)

- UAE Others Product Type Caustic Soda Market Overview, 2026–2034

- Market Size, By Value (USD Million)

- UAE Membrane Cell Caustic Soda Market Overview, 2026–2034

- Market Size, By Value (USD Million)

- UAE Diaphragm Cell Caustic Soda Market Overview, 2026–2034

- Market Size, By Value (USD Million)

- UAE Others Manufacturing Process Caustic Soda Market Overview, 2026–2034

- Market Size, By Value (USD Million)

- Competitive Outlook (Company Profiles)

- Occidental Petroleum Corporation

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Westlake Corporation

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Formosa Plastics Corporation

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Solvay

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Shin-Etsu Chemical Co., Ltd.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Grasim Industries Limited

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Covestro AG

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Hanwha Group

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Iin Corporation

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Innoveda

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Others

- Occidental Petroleum Corporation

- Contact Us & Disclaimer

List of Figure

Figure 1.1: Market Segmentation of UAE Caustic Soda

Figure 1.2: Study Variables in the Research

Figure 2.1: Companies Interviewed for Secondary Research

Figure 2.2: Breakdown of Primary Interviews

Figure 3.1: Executive Summary – Key Insights

Figure 4.1: Key Market Drivers of UAE Caustic Soda

Figure 4.2: Challenges in the UAE Caustic Soda Market

Figure 4.3: Opportunity Assessment for Market Growth

Figure 5.1: Recent Trends and Developments in UAE Caustic Soda

Figure 6.1: Policy and Regulatory Landscape Overview

Figure 7.1: UAE Caustic Soda Market Size (2020–2034)

Figure 7.2: Market Share by Grade (Reagent, Industrial, Pharmaceutical, Others)

Figure 7.3: Market Share by Application

Figure 7.4: Market Share by Product Type

Figure 7.5: Market Share by Manufacturing Process

Figure 7.6: Competitor Revenue Shares

Figure 7.7: Competition Characteristics

Figure 8.1: UAE Reagent Grade Caustic Soda Market Size (2026–2034)

Figure 9.1: UAE Industrial Grade Caustic Soda Market Size (2026–2034)

Figure 10.1: UAE Pharmaceutical Grade Caustic Soda Market Size (2026–2034)

Figure 11.1: UAE Other Grades Caustic Soda Market Size (2026–2034)

Figure 12.1: UAE Alumina Application Caustic Soda Market Size (2026–2034)

Figure 13.1: UAE Inorganic Chemicals Caustic Soda Market Size (2026–2034)

Figure 14.1: UAE Organic Chemicals Caustic Soda Market Size (2026–2034)

Figure 15.1: UAE Food Application Caustic Soda Market Size (2026–2034)

Figure 16.1: UAE Pulp & Paper Application Market Size (2026–2034)

Figure 17.1: UAE Soap & Detergents Application Market Size (2026–2034)

Figure 18.1: UAE Textiles Application Market Size (2026–2034)

Figure 19.1: UAE Water Treatment Application Market Size (2026–2034)

Figure 20.1: UAE Steel/Metallurgy-Sintering Market Size (2026–2034)

Figure 21.1: UAE Other Applications Market Size (2026–2034)

Figure 22.1: UAE Lye Product Type Market Size (2026–2034)

Figure 23.1: UAE Flake Product Type Market Size (2026–2034)

Figure 24.1: UAE Other Product Types Market Size (2026–2034)

Figure 25.1: UAE Membrane Cell Manufacturing Process Market Size (2026–2034)

Figure 26.1: UAE Diaphragm Cell Manufacturing Process Market Size (2026–2034)

Figure 27.1: UAE Other Manufacturing Process Market Size (2026–2034)

Figure 28.1: Occidental Petroleum Corporation – Company Overview & Market Share

Figure 28.2: Westlake Corporation – Company Overview & Market Share

Figure 28.3: Formosa Plastics Corporation – Company Overview & Market Share

Figure 28.4: Solvay – Company Overview & Market Share

Figure 28.5: Shin-Etsu Chemical Co., Ltd. – Company Overview & Market Share

Figure 28.6: Grasim Industries Limited – Company Overview & Market Share

Figure 28.7: Covestro AG – Company Overview & Market Share

Figure 28.8: Hanwha Group – Company Overview & Market Share

Figure 28.9: Iin Corporation – Company Overview & Market Share

Figure 28.10: Innoveda – Company Overview & Market Share

Figure 28.11: Others – Competitive Landscape

List of Table

Table 1.1: Objective of the Study

Table 1.2: Product Definition

Table 1.3: Market Segmentation

Table 1.4: Study Variables

Table 2.1: Secondary Data Points

Table 2.2: Companies Interviewed

Table 2.3: Primary Data Points

Table 2.4: Breakdown of Primary Interviews

Table 4.1: Key Market Drivers

Table 4.2: Market Challenges

Table 4.3: Opportunity Assessment

Table 5.1: Recent Trends and Developments

Table 6.1: Policy and Regulatory Framework

Table 7.1: UAE Caustic Soda Market Size (2020–2034)

Table 7.2: Market Share by Grade

Table 7.3: Market Share by Application

Table 7.4: Market Share by Product Type

Table 7.5: Market Share by Manufacturing Process

Table 7.6: Competitor Revenue Shares

Table 7.7: Competition Characteristics

Table 8.1: UAE Reagent Grade Market Size (2026–2034)

Table 9.1: UAE Industrial Grade Market Size (2026–2034)

Table 10.1: UAE Pharmaceutical Grade Market Size (2026–2034)

Table 11.1: UAE Other Grades Market Size (2026–2034)

Table 12.1: UAE Alumina Application Market Size (2026–2034)

Table 13.1: UAE Inorganic Chemicals Market Size (2026–2034)

Table 14.1: UAE Organic Chemicals Market Size (2026–2034)

Table 15.1: UAE Food Application Market Size (2026–2034)

Table 16.1: UAE Pulp & Paper Application Market Size (2026–2034)

Table 17.1: UAE Soap & Detergents Application Market Size (2026–2034)

Table 18.1: UAE Textiles Application Market Size (2026–2034)

Table 19.1: UAE Water Treatment Application Market Size (2026–2034)

Table 20.1: UAE Steel/Metallurgy-Sintering Market Size (2026–2034)

Table 21.1: UAE Other Applications Market Size (2026–2034)

Table 22.1: UAE Lye Product Type Market Size (2026–2034)

Table 23.1: UAE Flake Product Type Market Size (2026–2034)

Table 24.1: UAE Other Product Types Market Size (2026–2034)

Table 25.1: UAE Membrane Cell Manufacturing Process Market Size (2026–2034)

Table 26.1: UAE Diaphragm Cell Manufacturing Process Market Size (2026–2034)

Table 27.1: UAE Other Manufacturing Process Market Size (2026–2034)

Table 28.1: Occidental Petroleum Corporation – Company Overview & Financials

Table 28.2: Westlake Corporation – Company Overview & Financials

Table 28.3: Formosa Plastics Corporation – Company Overview & Financials

Table 28.4: Solvay – Company Overview & Financials

Table 28.5: Shin-Etsu Chemical Co., Ltd. – Company Overview & Financials

Table 28.6: Grasim Industries Limited – Company Overview & Financials

Table 28.7: Covestro AG – Company Overview & Financials

Table 28.8: Hanwha Group – Company Overview & Financials

Table 28.9: Iin Corporation – Company Overview & Financials

Table 28.10: Innoveda – Company Overview & Financials

Table 28.11: Others – Competitive Landscape

Top Key Players & Market Share Outlook

- Occidental Petroleum Corporation

- Westlake Corporation

- Formosa Plastics Corporation

- Solvay

- Shin-Etsu Chemical Co., Ltd.

- Grasim Industries Limited

- Covestro AG

- Hanwha Group

- lin Corporation

- Innoveda

- Others

Frequently Asked Questions