China Mobile Payments Market

Source: The Report Cube

Understand The Key Trends Shaping This Market

Download Free SampleChina Mobile Payments Market Insights & Analysis

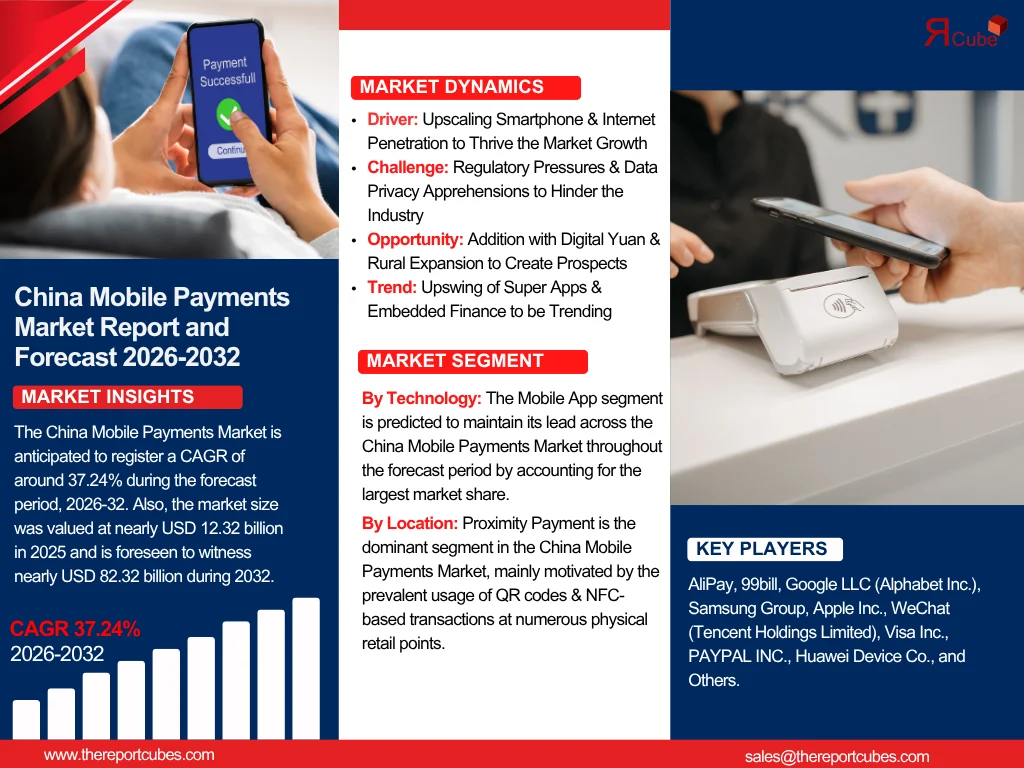

The China Mobile Payments Market is anticipated to register a CAGR of around 37.24% during the forecast period, 2026-32. Also, the market size was valued at nearly USD 12.32 billion in 2025 and is foreseen to witness nearly USD 82.32 billion during 2032. This outstanding growth trajectory has transformed China's financial ecosystem & customer behavior patterns, placing the nation as the global leader in mobile payment usage & innovation.

The China Mobile Payments Market comprises a broad ecosystem of digital payment solutions, specifically dominated by Alipay & WeChat Pay, which together control over 90% of the market share. From June 2024, the acceptance rate of mobile payment among smartphone users across China was over 88%, demonstrating a user base of nearly 969 million. Also, the includes includes several payment methodologies like QR code payments, Near Field Communication (NFC) transactions, biometric authentication systems, and emerging digital currency implementations, as well as the digital yuan (e-CNY).

Moreover, leading drivers encouraging market growth include extensive smartphone penetration above 95% of the population, strong digital infrastructure development, government policies supporting the digital economy, and constant technical innovations in finTech solutions. Further, the incorporation of mobile payments with super-app ecosystems has generated seamless user experiences, bridging transportation, healthcare, e-commerce, and social interactions. Along with this, the continuing pilot programs for China's Central Bank Digital Currency (CBDC) are foreseen to augment the China Mobile Payments Market progression by providing government-backed digital payment substitutes.

Furthermore, sustained industry growth is fueled by rural market penetration, cross-border payment expansion, incorporation with developing technologies such as blockchain & AI, and rising acceptance in offline retail environments. The China Mobile Payments Market’s evolution would be supported by 5G network deployment, empowering faster transaction processing, improved security protocols integrating advanced biometric authentication, and the government's pledge to build a cashless society. Also, the introduction of programmable digital yuan features & interoperability with existing platforms would further produce new revenue streams & market opportunities, creating a positive market outlook across China in the future years.

China Mobile Payments Market Upgrades & Recent Developments

2025:

- Huawei Device Co. incorporated mobile payment functionality directly into its HarmonyOS ecosystem, permitting seamless NFC & QR payments through native applications & wearables.

China Mobile Payments Market Dynamics

-

Driver: Upscaling Smartphone & Internet Penetration to Thrive the Market Growth

The volatile growth in smartphone use & high-speed mobile internet across China has been a vital driver of mobile payments embracing. Also, with over 1 billion mobile internet users, customers progressively rely on their phones for day-to-day transactions. Hence, the convenience of paying with a QR code or mobile wallet for goods & services, even in remote villages, has regularized mobile payment behavior. Moreover, amalgamation with lifestyle & e-commerce apps further intensifies this trend, empowering payment services within social, food delivery, ride-hailing, and travel apps. Further, seamless UI/UX, prompt transaction confirmations, and increasing acceptance in small vendors & traditional businesses are making mobile payments the default choice for several Chinese customers.

-

Challenge: Regulatory Pressures & Data Privacy Apprehensions to Hinder the Industry

The country has a flourishing mobile payments industry, but regulatory examination is a key challenge. To avert financial hazards, stop monopolistic practices, and safeguard customer information, the People's Bank of China (PBoC) has stepped up its observation. Also, companies like Tencent & Ant Group have been forced to reorganize following the country's new financial holding company model. Furthermore, stringent cybersecurity, anti-money laundering, and user data handling compliance rules are affecting scalability & innovation cycles.

-

Opportunity: Addition with Digital Yuan & Rural Expansion to Create Prospects

Mobile payment solutions that assimilate with e-CNY, China's central bank digital money, present a substantial opportunity. Payment infrastructures might be standardized & digitalized with a broader rollout, as pilots in locations such as Shenzhen & Suzhou demonstrate promising acceptance. Also, the incorporation of e-CNY with mobile wallets would offer more seamless social insurance payouts, subsidies, and public sector transactions. Further, the rural industry is still primarily underserved, too. Additionally, fintech companies might enroll millions of new consumers via streamlined mobile solutions, farmer subsidies, and village e-commerce with the aid of rural revitalization programs & infrastructural developments.

-

Trend: Upswing of Super Apps & Embedded Finance to be Trending

In China, services are being combined into super applications such as WeChat & Alipay, where financial, social, communication, shopping, and entertainment services all coincide. Both transaction frequency & user stickiness are elevated by this one-stop shop. Additionally, embedded finance is becoming more prevalent, like investment offerings, insurance, and instant credit within payment channels. Also, these incredible apps are turning mobile payments into a complete financial ecosystem rather than just a tool for transactions. Further, gamified savings tools & AI-powered personal finance assistants are instances of the trend toward user-centric digital financial management.

China Mobile Payments Market Segment-Wise Analysis

By Technology:

- Mobile Web Payment

- Interactive Voice Response System

- Mobile App

- Others

- Near Field Communication (NFC)

- Direct Mobile Billing

- SMS

The Mobile App segment is predicted to maintain its lead across the China Mobile Payments Market throughout the forecast period by accounting for the largest market share. Mobile applications offer secure biometric authentication, individualized financial services, and an instinctive user experience. WeChat Pay & Alipay have established market standards by incorporating widespread ecosystems into their smartphone applications. Also, peer-to-peer transfers, e-commerce, transportation, utility bills, and micropayments are just a few of the transactions that these apps assist. Moreover, their app-based financing possibilities, loyalty benefits, and real-time transaction capabilities make them vital tools for consumers. Further, real-time data, connection with financial items, and frequent upgrades make mobile apps prevalent with both tech-savvy customers & enterprises.

By Location:

- Proximity Payment

- Remote Payment

Proximity Payment is the dominant segment in the China Mobile Payments Market, mainly motivated by the prevalent usage of QR codes & NFC-based transactions at numerous physical retail points. In line with the convenience of scanning QR codes for anything from street food transactions to metro rides, proximity payments have become an essential component of daily living. Due to reasonable QR payment kits, small enterprises are now able to accept digital wallets connected to bank accounts or stored value balances. Also, progressions in offline payment techniques, wearable technology, and facial recognition are all contributing to elevated customer convenience. Moreover, the preferred method over conventional cash or card purchases, proximity payments shorten checkout times, boost cashless transactions, and offer enhanced integration with reward programs & real-time incentives.

What Does Our China Mobile Payments Market Research Study Entail?

- The China Mobile Payments Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis puts light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The China Mobile Payments Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- China Biocontrol Agents Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- Market Share, By Technology

- Mobile Web Payment

- Interactive Voice Response System

- Mobile App

- Others

- Near Field Communication (NFC)

- Direct Mobile Billing

- SMS

- Market Share, By Location

- Proximity Payment

- Remote Payment

- Market Share, By Competitors

- Competition Characteristics

- Revenue Shares

- China Mobile Web Payment Biocontrol Agents Market Overview, 2020-2032F

- By Value (USD Million)

- China Interactive Voice Response System Biocontrol Agents Market Overview, 2020-2032F

- By Value (USD Million)

- China Mobile App Biocontrol Agents Market Overview, 2020-2032F

- By Value (USD Million)

- China Others Biocontrol Agents Market Overview, 2020-2032F

- By Value (USD Million)

- China Near Field Communication (NFC) Biocontrol Agents Market Overview, 2020-2032F

- By Value (USD Million)

- China Direct Mobile Billing Biocontrol Agents Market Overview, 2020-2032F

- By Value (USD Million)

- China SMS Biocontrol Agents Market Overview, 2020-2032F

- By Value (USD Million)

- Competitive Outlook (Company Profile - Partila List)

- AliPay

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- 99bill

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Google LLC (Alphabet Inc.)

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Samsung Group

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Apple Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- WeChat (Tencent Holdings Limited)

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Visa Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- PAYPAL INC.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Huawei Device Co.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Others

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- AliPay

- Contact Us & Disclaimer

List of Figure

Figure 1: Research Methodology Flowchart

Figure 2: Breakdown of Primary and Secondary Data Sources

Figure 3: Distribution of Primary Interviews by Company Type, Designation, and Geography

Figure 4: China Biocontrol Agents Market Size (USD Billion), 2020–2032

Figure 5: China Biocontrol Agents Market Share by Technology, 2024 (%)

Figure 6: Market Share by Location (Proximity vs Remote), 2024

Figure 7: Competitive Landscape – Market Share by Major Players, 2024

Figure 8: Opportunity Assessment Matrix – China Biocontrol Agents Market

Figure 9: Policy & Regulatory Influence Timeline on Biocontrol Agents in China

Figure 10: Market Size by Technology Type (Mobile Web, IVR, App, NFC, etc.), 2020–2032

Figure 11: Mobile Web Payment Biocontrol Agents Market Size, 2020–2032 (USD Million)

Figure 12: IVR System Biocontrol Agents Market Size, 2020–2032 (USD Million)

Figure 13: Mobile App Biocontrol Agents Market Size, 2020–2032 (USD Million)

Figure 14: NFC Biocontrol Agents Market Size, 2020–2032 (USD Million)

Figure 15: Direct Mobile Billing Biocontrol Agents Market Size, 2020–2032 (USD Million)

Figure 16: SMS-Based Biocontrol Agents Market Size, 2020–2032 (USD Million)

Figure 17: Company Comparison: Revenue Shares of Key Players (2024)

Figure 18: Strategic Alliances and Product Launches by Leading Companies

Figure 19: SWOT Analysis of Major Players in the China Market

Figure 20: China Biocontrol Agents Technology Adoption Curve

List of Table

Table 1: Study Objectives and Scope

Table 2: Product Definitions and Classifications

Table 3: Market Segmentation – By Technology and Location

Table 4: Key Study Variables and Assumptions

Table 5: Secondary Data Sources Used in the Study

Table 6: List of Companies Interviewed

Table 7: Primary Data Breakdown by Region, Designation, and Company Type

Table 8: China Biocontrol Agents Market Size (USD Billion), 2020–2032

Table 9: China Biocontrol Agents Market Share by Technology (%), 2024

Table 10: China Biocontrol Agents Market Share by Location (%), 2024

Table 11: Technology-Wise Market Size (USD Million), 2020–2032

Table 12: Proximity vs Remote Payment Market Share (%), 2024

Table 13: Market Share by Major Competitors, 2024 (%)

Table 14: Mobile Web Payment Market Size in China, 2020–2032 (USD Million)

Table 15: Interactive Voice Response System Market Size in China, 2020–2032 (USD Million)

Table 16: Mobile App Market Size in China, 2020–2032 (USD Million)

Table 17: Other Technologies Market Size in China, 2020–2032 (USD Million)

Table 18: Near Field Communication (NFC) Market Size in China, 2020–2032 (USD Million)

Table 19: Direct Mobile Billing Market Size in China, 2020–2032 (USD Million)

Table 20: SMS Payment Market Size in China, 2020–2032 (USD Million)

Table 21: Key Strategic Developments of Leading Companies (2020–2024)

Table 22: Company Profiles – Segment Revenue Comparison

Table 23: Mergers, Acquisitions, and Partnerships in China Biocontrol Market

Table 24: SWOT Analysis Summary of Key Competitors

Table 25: Regulatory Bodies and Relevant Policies Impacting Biocontrol Agents in China

Top Key Players & Market Share Outlook

- AliPay

- 99bill

- Google LLC (Alphabet Inc.)

- Samsung Group

- Apple Inc.

- WeChat (Tencent Holdings Limited)

- Visa Inc.

- PAYPAL INC.

- Huawei Device Co.

- Others

Frequently Asked Questions