Understand The Key Trends Shaping This Market

Download Free SampleWhat is The UK Commercial Motor Insurance Market Size & Value

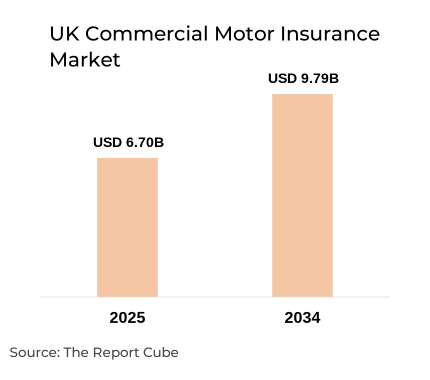

The UK Commercial Motor Insurance Market is anticipated to register a CAGR of around 4.3% during the forecast period, 2026-34. Additionally, the market size was valued at nearly USD 6.7 billion in 2025 and is projected to reach almost USD 9.79 billion by 2034.

UK Commercial Motor Insurance Market Key Highlights

- The market growth is supported by fleet digitalization, ADAS-equipped vehicles, vehicle repair cost inflation, and Ogden discount rate change.

- The Vehicle Type is bifurcated into LCV, HGV, PSV, EVs. Among all, LCVs captures the biggest share of the UK Commercial Motor Insurance Market.

- Market opportunities: usage-based insurance (UBI) for fleets, cyber risk in telematics, green parts adoption, EV cover, and AI-led claims automation.

- The industry challenges include HGV driver shortage & increasing claims complexity.

UK Commercial Motor Insurance Market Dynamics

What is the key driver of the UK Commercial Motor Insurance Market?

Developing Compliance Standards Reforming Market Structure: A distinctive industry driver prompting the UK Commercial Motor Insurance Market is the tightening of regulatory oversight under the FCA Fair Value review, captivating insurers to refine pricing transparency & recalibrate business vehicle insurance quotes. Also, government supervision of compensation frameworks, specifically the Ogden discount rate change, continues to influence long-term liabilities & commercial auto liability rates, impelling both fleet policies & the overall market shares in the UK.

What are the major challenges that affect the UK Commercial Motor Insurance Industry?

Workforce Shortages Disrupting Fleet Risk Profiles: A major concern surfaces from the constant HGV driver shortage in the UK, which modifies fleet risk behaviour & strengthens exposure levels for transportation firms. Also, this structural labour gap contributes to larger dependency on newer technologies like ADAS-equipped vehicles, which further transforms risk modelling & adds complexity to claims inflation across the UK motor market evaluations. Thus, these aspects generate potential challenges for the UK Commercial Vehicle Insurance Market.

What are the future opportunities in the UK Commercial Motor Insurance Market during 2026-34?

Electrification Momentum in Commercial Fleets: The UK government's EV incentives & clean transport pledges promote the rising usage of zero-emission fleets, which provides some noteworthy market opportunities. Further, demand for electric commercial vehicle insurance is growing, with fleet interest in green parts repair adoption & flexible usage-based insurance (UBI) for fleets, supporting commercial fleet insurance trends & expanding the UK Commercial Motor Insurance Market size.

What trends are affecting the UK Commercial Motor Insurance Market Outlook?

Heightened Telematics Incorporation for Risk Governance: The widespread usage of telematics is a booming market trend, and cyber risk in telematics & structured data governance are receiving more attention. Also, the expansion of telematics in commercial motor insurance is redefining underwriting, enhancing incident reconstruction, and supporting emerging commercial fleet insurance, while reinforcing market competitiveness.

UK Commercial Motor Insurance Industry Analysis (2026–2034)

The UK Commercial Motor Insurance Market, is a place that covers all the policies-related things for business or commercial vehicles such as HGVs, vans, and fleets. The industry is shaped by emerging risk factors like claims inflation & vehicle repair cost inflation, swayed by complex factors such as the FCA Fair Value review & the Ogden discount rate change. Furthermore, profitability is buoyed by increasing commercial auto liability rates & technology-driven innovations, including telematics in commercial motor insurance & usage-based insurance (UBI) for fleets.

Nevertheless, market challenges remain from the HGV driver shortage & intense market competition. Moreover, government policies encouraging electric vehicles, such as the 2030 ICE ban, and sustainability initiatives instigate growth in electric commercial vehicle insurance & green parts repair adoption. Also, major market players such as Allianz & Zurich incorporate AI & telematics with partnerships improving business vehicle insurance quotes & fleet risk management. Additionally, the UK Commercial Motor Insurance Market is foreseen to expand steadily with rising commercial insurance amid digital transformation & regulatory reforms in the future years.

What is the Impact of AI in the UK Commercial Motor Insurance Market?

The adoption of AI is surging across the UK Commercial Motor Insurance Market, as is assists in improving risk assessment via telematics in commercial motor insurance & enabling AI-powered damage estimation. Also, projects like AI-driven UBI fleet programs & automated green repair systems that minimize vehicle repair cost inflation & support green parts repair adoption are also transforming the market’s future landscape.

How are the UK Commercial Motor Insurance Market Segments Defined?

The UK Commercial Motor Insurance Market Research Reports provide detailed market data & insights in accordance with market segmentation. Some of the segments are:

- Coverage Type: Liability, Third‑Party, Fire, and Theft (TPFT), Comprehensive, Collision, Personal Injury Protection

- Vehicle Type: Commercial Vehicles, Passenger Cars, Motorcycles, Other

By Coverage Type:

The Comprehensive segment is observed to be leading with potential market share. This is attributed to the offerings, like the highest protection covering third-party damage, fire, theft, and own-vehicle damage. Moreover, this coverage type is favored for its wide coverage & often includes telematics for fleet risk management, supporting usage-based insurance (UBI) for fleets & green parts repair adoption trends across the UK Commercial Motor Insurance Market.

By Vehicle Type:

The Commercial vehicles type governs, consisting vans & HGVs, further holding a largest share of the UK Commercial Motor Insurance Market. This is owing to their extensive usage in logistics & deliveries. Also, this segment influences most of the UK Commercial Motor Insurance Market size, reflecting encounters such as vehicle repair cost inflation & the HGV driver shortage.

UK Commercial Motor Insurance Industry: Regional Insights

The UK Commercial Motor Insurance Market is geographically diversified, covering:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Rest of the UK

Geographically, London dominates with the uppermost market share due to concentrated commercial fleets & advanced acceptance of telematics, improved by a dense network of the UK commercial motor insurance brokers & vibrant regulatory consciousness like the FCA Fair Value review.

UK Commercial Motor Insurance Market: What Recent Innovations Are Affecting the Industry?

- 2025: Allianz introduced AI-powered fleet risk partnership with Samsara, assimilating dashcams & telematics into usage-based insurance (UBI) for fleets.

- 2025: Aviva improved digital freight & motor solutions for fleets, simplifying broker trading & business vehicle insurance quotes.

How does the UK Commercial Motor Insurance Market (2034) Future Outlook Appear?

Sustained Growth: By 2034, UK Commercial Motor Insurance Market size is expected to expand steadily, with nearly 4.3% CAGR and recording a market value of about USD 9.79 billion. This is supported by greater commercial auto liability rates, and resilient demand from delivery, logistics, & services fleets.

Technological Upgrade: The industry would embed telematics in commercial motor insurance, ADAS-equipped vehicles, and electric commercial vehicle insurance as standard, with AI models supervising cyber risk in telematics, navigating green parts repair adoption, and refining business vehicle insurance quotes via data‑driven pricing aligned with the FCA Fair Value review.

Future Opportunities: Expanding usage-based insurance (UBI) for fleets, EV-centric products, and advanced analytics would address challenges such as the UK HGV driver shortage, fraud, and regulatory changes, improving market shares for innovative carriers & UK commercial motor insurance brokers, further creating lucrative future prospects for the market.

What Does Our UK Commercial Motor Insurance Market Research Study Entail?

- The UK Commercial Motor Insurance Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis & market scope sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The UK Commercial Motor Insurance Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the Study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Breakdown of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- UK Commercial Motor Insurance Market Overview (2020-2034)

- Market Size, By Value (USD Billion)

- Market Share, By Coverage Type

- Liability

- Third Party, Fire, and Theft (TPFT)

- Comprehensive

- Collision

- Personal Injury Protection

- Other Coverage Types

- Market Share, By Vehicle Type

- Commercial Vehicles

- Passenger Cars (Used Commercially, e.g., Taxis/Ride-Share)

- Motorcycles (Used Commercially, e.g., Delivery)

- Others

- Market Share, By End-User

- Fleet Operators & Logistics

- Courier & Last-Mile Delivery

- Tradespeople & Small Businesses

- Others

- Market Share, By Premium Type

- Fixed Annual Premium

- Fleet-Rated Premium

- Pay-Per-Vehicle Premium

- Others

- Market Share, By Distribution Channel

- Insurance Brokers

- Direct Insurers

- Managing General Agents (MGAs)

- Insurtech & Digital Platforms

- Others

- Market Share, By Region

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Rest of the UK

- Market Share, By Company

- Revenue Shares

- Competition Characteristics

- UK Commercial Motor Insurance Market Overview, By Coverage Type

- Liability Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Third Party, Fire, and Theft (TPFT) Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Comprehensive Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Collision Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Personal Injury Protection Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Other Coverage Types Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Liability Market Overview

- UK Commercial Motor Insurance Market Overview, By Vehicle Type

- Commercial Vehicles Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Passenger Cars (Used Commercially) Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Motorcycles (Used Commercially) Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Others Vehicle Type Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Commercial Vehicles Market Overview

- UK Commercial Motor Insurance Market Overview, By End-User

- Fleet Operators & Logistics Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Courier & Last-Mile Delivery Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Tradespeople & Small Businesses Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Others End-User Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Fleet Operators & Logistics Market Overview

- UK Commercial Motor Insurance Market Overview, By Premium Type

- Fixed Annual Premium Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Fleet-Rated Premium Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Pay-Per-Vehicle Premium Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Others Premium Type Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Fixed Annual Premium Market Overview

- UK Commercial Motor Insurance Market Overview, By Distribution Channel

- Insurance Brokers Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Direct Insurers Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Managing General Agents (MGAs) Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Insurtech & Digital Platforms Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Others Distribution Channel Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Insurance Brokers Market Overview

- UK Commercial Motor Insurance Market Overview, By Region

- London Commercial Motor Insurance Market Overview, 2020-2034F

- Market Size, By Value (USD Billion)

- Market Share, By Coverage Type

- Market Share, By Vehicle Type

- Market Share, By End-User

- Market Share, By Distribution Channel

- South East Commercial Motor Insurance Market Overview, 2020-2034F

- Market Size, By Value (USD Billion)

- Market Share, By Coverage Type

- Market Share, By Vehicle Type

- Market Share, By End-User

- Market Share, By Distribution Channel

- North West Commercial Motor Insurance Market Overview, 2020-2034F

- Market Size, By Value (USD Billion)

- Market Share, By Coverage Type

- Market Share, By Vehicle Type

- Market Share, By End-User

- Market Share, By Distribution Channel

- East of England Commercial Motor Insurance Market Overview, 2020-2034F

- Market Size, By Value (USD Billion)

- Market Share, By Coverage Type

- Market Share, By Vehicle Type

- Market Share, By End-User

- Market Share, By Distribution Channel

- South West Commercial Motor Insurance Market Overview, 2020-2034F

- Market Size, By Value (USD Billion)

- Market Share, By Coverage Type

- Market Share, By Vehicle Type

- Market Share, By End-User

- Market Share, By Distribution Channel

- Scotland Commercial Motor Insurance Market Overview, 2020-2034F

- Market Size, By Value (USD Billion)

- Market Share, By Coverage Type

- Market Share, By Vehicle Type

- Market Share, By End-User

- Market Share, By Distribution Channel

- West Midlands Commercial Motor Insurance Market Overview, 2020-2034F

- Market Size, By Value (USD Billion)

- Market Share, By Coverage Type

- Market Share, By Vehicle Type

- Market Share, By End-User

- Market Share, By Distribution Channel

- Yorkshire and The Humber Commercial Motor Insurance Market Overview, 2020-2034F

- Market Size, By Value (USD Billion)

- Market Share, By Coverage Type

- Market Share, By Vehicle Type

- Market Share, By End-User

- Market Share, By Distribution Channel

- East Midlands Commercial Motor Insurance Market Overview, 2020-2034F

- Market Size, By Value (USD Billion)

- Market Share, By Coverage Type

- Market Share, By Vehicle Type

- Market Share, By End-User

- Market Share, By Distribution Channel

- Rest of the UK Commercial Motor Insurance Market Overview, 2020-2034F

- Market Size, By Value (USD Billion)

- Market Share, By Coverage Type

- Market Share, By Vehicle Type

- Market Share, By End-User

- Market Share, By Distribution Channel

- London Commercial Motor Insurance Market Overview, 2020-2034F

- Competitive Outlook (Company Profiles)

- Allianz

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Aviva

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Admiral Group

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Direct Line Group

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Hastings

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- AXA

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- LV

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- esure

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- RSA

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Others

- Allianz

- Contact Us & Disclaimer

Top Key Players & Market Share Outlook

- Allianz

- Aviva

- Admiral Group

- Direct Line Group

- Hastings

- AXA

- LV

- esure

- RSA

- Others

Frequently Asked Questions