Understand The Key Trends Shaping This Market

Download Free SampleConcrete Restoration Market Insights & Analysis

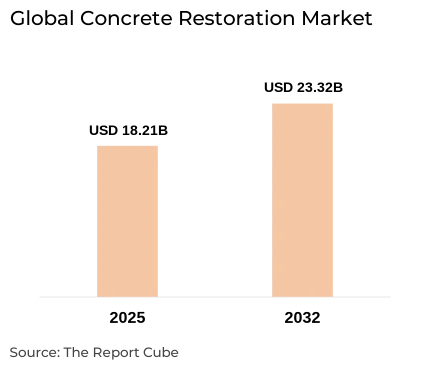

The Global Concrete Restoration Market is projected to register a CAGR of around 3.60% during the forecast period 2026–32. Valued at approximately USD 18.21 billion in 2025, it is expected to reach nearly USD 23.32 billion by 2032. Concrete repair demand is being driven by aging infrastructure across industrialized countries, stringent structural safety norms, and augmented investment in renovation projects. The industry specializes in the restoration of structures spoiled by corrosion, cracking, weathering, or seismic activity, providing services like shotcrete, fiber-reinforced systems, epoxy injection, and sealants.

Also, fiber concrete, repair mortars, corrosion inhibitors, shotcrete, quick-setting cement mortars, and protective coatings are among the products & services offered by this sector. These restorative materials are utilized in numerous applications, such as highways & bridges, marine constructions, and home balconies. For instance, governments have introduced renewal projects to repair seismic-prone bridges, deploying fiber-reinforced shotcrete systems.

Moreover, self-healing concrete technologies have made prompt inroads, corresponding with sustainable & long-term infrastructure objectives. MAPEI's Construction & Restoration Systems line expanded in 2024 to include improved waterproofing coatings, structural grouts, and eco-certified repair mortars for heritage & key civil works. Hence, these initiatives encourage regional infrastructure expansion & procurement efficacy.

Furthermore, the future outlook of the Concrete Restoration Market is destined to be positive owing to amplified investment in transportation networks, green & historical restoration legislation, and climate-adaptive repair methods. Also, fiber-reinforced materials, rapid-setting mortars, and smart digital technologies (like real-time crack-monitoring sensors) are becoming progressively prevalent.

Additionally, manufacturers are spending on low-carbon cement, self-healing additives, and prefabricated repair kits as concrete restoration prices surge & environmental sustainability becomes increasingly essential. Further, such developments, supported by government investment for aging infrastructure, would aid in enhancing the Concrete Restoration Market share in the forthcoming years.

Concrete Restoration Market Upgrades & Recent Developments

2025:

- Sika AG opened a new manufacturing facility in Ust Kamenogorsk (Kazakhstan) explicitly for concrete admixtures & mortars, improving regional supply for infrastructure & mining.

- MAPEI extended its Construction & Restoration Systems range to include improved waterproofing, structural grouts, cementitious coatings, and eco-certified mortars, solidifying its position in infrastructure & civil restoration industries.

Concrete Restoration Market Dynamics

-

Driver: Aging Infrastructure & Increasing Renovation Requirement to Instigate Market Growth

The primary driver in the Concrete Restoration Market is the requirement to rehabilitate aging infrastructure like roads, bridges, and public buildings in North America, Europe, and various parts of Asia-Pacific. As per the industry data, the worldwide retrospective market reached nearly USD 16.9 billion in 2024, with an anticipated upswing to about USD 17.9 billion by 2025. This rise is instigated by safety guidelines, repair necessities owing to natural wear, and climate impacts like scour & expansion. Also, government-funded bridge rehabilitation & highway maintenance programs constantly elevate demand for shotcrete & structural repair mortars.

-

Challenge: Growing Restoration Prices & Supply Restraints to Impede Industry Expansion

As demand surges, the concrete restoration expenses continue to burden budgets. Also, instability in cement & polymer costs, together with labor shortages & site logistics, are pressing margins. Moreover, there's a transition towards prefabricated repair kits & digital condition testing tools to decrease on-site time & cost. Additionally, in 2025, Sika’s digital venture with Giatec reflected this trend to control cement content & decrease CO₂ emissions. However, still, the provisional cost & skill necessities hamper extensive adoption, specifically in developing economies.

-

Opportunity: Ecological & Advanced Repair Materials

The swing toward eco-friendly restoration provides profitable opportunities. Also, acceptance of fiber-reinforced shotcrete, self-healing concrete, and low-carbon mortars is gaining traction. Moreover, producers such as Sika & MAPEI are introducing low-VOC formulations, rapid-setting mortars, and smart digital repair systems, allowing quicker, greener, more resilient restoration. Further, in cold regions, cold-curing admixtures offer off-season repair choices, opening wider project scopes.

-

Trend: Incorporation of Smart Technologies to Advance Market Progression

Monitoring & predictive maintenance are gaining prevalence in restoration. In 2025, Sika collaborated with Giatec on smart concrete sensors & AI-powered analytics, indicating an emerging digital change in restoration procedures. Also, these systems enable real-time structural health checks, precise material dosage, and performance prediction, thereby assisting condition-based maintenance & preventing expensive breakdowns.

Concrete Restoration Market Segment-Wise Analysis

By Material:

- Shotcrete

- Quick Setting Cement Mortar

- Fiber Concrete

- Others

The Shotcrete segment continues to capture the largest share of the Concrete Restoration Market. The segment's leadership is accredited to its great structural strength, compliance with vertical & overhead repairs, and suitability for swift applications. It is usually used for infrastructure maintenance, tunnel construction, and bridge overlay projects. Also, North American & European transport agencies favor Shotcrete, owing to its long-term durability & ease of deployment in challenging geometries.

Moreover, fiber-reinforced shotcrete & polymer-modified mixtures are instances of innovations that offer improved crack resistance & longevity. Further, with rising investment in critical infrastructure, demand for refined shotcrete solutions remains high, making it the industry's best-performing material.

By End User:

- Building & Balconies

- Roads, Bridges & Highways

- Industrial Structures

- Marine

- Others

The Roads, Bridges & Highways segment dominates demand in the Concrete Restoration Market, accounting for the largest market share. Traffic-induced wear, freeze-thaw cycles, and corrosion all need frequent rehabilitation in the US, Europe, and China's aging transportation networks. Government motivation & infrastructure packages often include considerable expenditures for bridge deck resurfacing, highway repairs, and tunnel maintenance.

Also, companies like Sika & MAPEI offer specialist repair mortars, corrosion inhibitors, and overlay solutions for road surface rehabilitation. Furthermore, the massive volume of restoration activity, together with regulatory prominence on public safety, guarantees that demand for this structural end-use industry remains resilient.

Regional Projection of the Global Concrete Restoration Industry

The Global Concrete Restoration Market is geographically diversified, covering:

- North America

- Europe

- Asia-Pacific

- South America

- The Middle East & Africa

Asia-Pacific is the fastest-growing & major region in the Global Concrete Restoration Market, motivated by its enormous infrastructure build-out & rising emphasis on renovation. Countries, including China & India, are investing widely in bridge retrofitting, marine structure modifications, and highway restoration, assisted by public infrastructure investment. With aged infrastructure progressively leading the investment agenda, Asia-Pacific restoration demand has outdone new-build activity.

Moreover, to address regional requirements & local sourcing necessities, market companies are constructing local manufacturing facilities, like Sika's plants in Singapore & Xi'an. Further, with accelerating concrete restoration expenses, Asia-Pacific is foreseen to be the major region across the global market landscape through 2032.

What Does Our Global Concrete Restoration Market Research Study Entail?

- The Global Concrete Restoration Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis puts light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The Global Concrete Restoration Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- Global Concrete Restoration Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- Market Share, By Material

- Shotcrete

- Quick Setting Cement Mortar

- Fiber Concrete

- Others

- Market Share, By End User

- Building & Balconies

- Roads, Bridges & Highways

- Industrial Structures

- Marine

- Others

- Market Share, By Region

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

- Market Share, By Company

- Revenue Shares

- Competition Characteristics

- North America Concrete Restoration Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- Market Share, By Material

- Market Share, By End User

- By Country

- The US

- Canada

- Mexico

- The US Concrete Restoration Market Overview (2020-2032)

- Market Share, By Material

- Market Share, By End User

- Canada Concrete Restoration Market Overview (2020-2032)

- Market Share, By Material

- Market Share, By End User

- Mexico Concrete Restoration Market Overview (2020-2032)

- Market Share, By Material

- Market Share, By End User

- South America Concrete Restoration Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- Market Share, By Material

- Market Share, By End User

- By Country

- Brazil

- Argentina

- Rest of South America

- Brazil Concrete Restoration Market Overview (2020-2032)

- Market Share, By Material

- Market Share, By End User

- Argentina Concrete Restoration Market Overview (2020-2032)

- Market Share, By Material

- Market Share, By End User

- Europe Concrete Restoration Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- By Material

- By End User

- By Country

- Germany

- The UK

- France

- Spain

- Italy

- Rest of Europe

- Germany Concrete Restoration Market Overview (2020-2032)

- Market Share, By Material

- Market Share, By End User

- France Concrete Restoration Market Overview (2020-2032)

- Market Share, By Material

- Market Share, By End User

- The UK Concrete Restoration Market Overview (2020-2032)

- Market Share, By Material

- Market Share, By End User

- Spain Concrete Restoration Market Overview (2020-2032)

- Market Share, By Material

- Market Share, By End User

- Italy Concrete Restoration Market Overview (2020-2032)

- Market Share, By Material

- Market Share, By End User

- The Middle East & Africa Concrete Restoration Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- By Material

- By End User

- By Country

- The UAE

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- The UAE Concrete Restoration Market Overview (2020-2032)

- Market Share, By Material

- Market Share, By End User

- Saudi Arabia Concrete Restoration Market Overview (2020-2032)

- Market Share, By Material

- Market Share, By End User

- South Africa Concrete Restoration Market Overview (2020-2032)

- Market Share, By Material

- Market Share, By End User

- Asia-Pacific Concrete Restoration Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- By Material

- By End User

- By Country

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia-Pacific

- China Concrete Restoration Market Overview (2020-2032)

- Market Share, By Material

- Market Share, By End User

- India Concrete Restoration Market Overview (2020-2032)

- Market Share, By Material

- Market Share, By End User

- Japan Concrete Restoration Market Overview (2020-2032)

- Market Share, By Material

- Market Share, By End User

- South Korea Concrete Restoration Market Overview (2020-2032)

- Market Share, By Material

- Market Share, By End User

- Austraila Concrete Restoration Market Overview (2020-2032)

- Market Share, By Material

- Market Share, By End User

- Competitive Outlook (Company Profile - Partila List)

- Sika AG

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- MAPEI Corporation

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- RPM International Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Fosroc, Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- ARDEX GmbH

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- TCC Materials

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- The Euclid Chemical Company

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Saint-Gobain Group

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- SCHOMBURG GmbH & Co. KG

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Others

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Sika AG

- Disclaimer

List of Figure

Figure 1: Global Concrete Restoration Market Value, 2020–2032 (USD Billion)

Figure 2: Market Share by Material, Global, 2024 (%)

Figure 3: Market Share by End User, Global, 2024 (%)

Figure 4: Market Share by Region, Global, 2024 (%)

Figure 5: Competitive Landscape – Revenue Share of Key Players, Global, 2024 (%)

Figure 6: Market Share by Company – Competition Characteristics, Global, 2024

Regional Market Figures

Figure 7: North America Concrete Restoration Market Value, 2020–2032 (USD Billion)

Figure 8: Market Share by Material, North America, 2024 (%)

Figure 9: Market Share by End User, North America, 2024 (%)

Figure 10: Market Share by Country, North America, 2024 (%)

Figure 11: South America Concrete Restoration Market Value, 2020–2032 (USD Billion)

Figure 12: Market Share by Material, South America, 2024 (%)

Figure 13: Market Share by End User, South America, 2024 (%)

Figure 14: Market Share by Country, South America, 2024 (%)

Figure 15: Europe Concrete Restoration Market Value, 2020–2032 (USD Billion)

Figure 16: Market Share by Material, Europe, 2024 (%)

Figure 17: Market Share by End User, Europe, 2024 (%)

Figure 18: Market Share by Country, Europe, 2024 (%)

Figure 19: Middle East & Africa Concrete Restoration Market Value, 2020–2032 (USD Billion)

Figure 20: Market Share by Material, MEA, 2024 (%)

Figure 21: Market Share by End User, MEA, 2024 (%)

Figure 22: Market Share by Country, MEA, 2024 (%)

Figure 23: Asia-Pacific Concrete Restoration Market Value, 2020–2032 (USD Billion)

Figure 24: Market Share by Material, Asia-Pacific, 2024 (%)

Figure 25: Market Share by End User, Asia-Pacific, 2024 (%)

Figure 26: Market Share by Country, Asia-Pacific, 2024 (%)

Country-Level Figures

(Similar figures for each country-level segment may be added as per data availability)

-

Figure 27: U.S. Market Share by Material and End User

-

Figure 28: Canada Market Share by Material and End User

-

Figure 29: Mexico Market Share by Material and End User

-

… (Continue similar for Brazil, Argentina, Germany, UK, France, China, India, etc.)

Company Profiles (If visualized)

Figure 50+: Revenue Trend or Product Portfolio of Key Companies (Sika, MAPEI, RPM, etc.)

List of Table

Table 1: Market Segmentation Overview

Table 2: Study Variables and Definitions

Table 3: Secondary Research Sources

Table 4: List of Companies Interviewed (Primary and Secondary Sources)

Table 5: Primary Interview Breakdown by Designation, Company Type, and Region

Global Market Tables

Table 6: Global Concrete Restoration Market Size, 2020–2032 (USD Billion)

Table 7: Global Market Share, by Material, 2024 (%)

Table 8: Global Market Share, by End User, 2024 (%)

Table 9: Global Market Share, by Region, 2024 (%)

Table 10: Global Market Share, by Company – Revenue Share, 2024 (%)

Table 11: Competitive Landscape – Company Characteristics Matrix

Regional Market Tables

North America

Table 12: North America Market Size, 2020–2032 (USD Billion)

Table 13: North America Market Share, by Material (%)

Table 14: North America Market Share, by End User (%)

Table 15: Market Size & Share by Country – US, Canada, Mexico

South America

Table 16: South America Market Size, 2020–2032 (USD Billion)

Table 17: Market Share by Material, South America (%)

Table 18: Market Share by End User, South America (%)

Table 19: Market Size & Share by Country – Brazil, Argentina, RoSA

Europe

Table 20: Europe Market Size, 2020–2032 (USD Billion)

Table 21: Market Share by Material, Europe (%)

Table 22: Market Share by End User, Europe (%)

Table 23: Market Size & Share by Country – Germany, UK, France, Italy, Spain, RoE

Middle East & Africa

Table 24: MEA Market Size, 2020–2032 (USD Billion)

Table 25: Market Share by Material, MEA (%)

Table 26: Market Share by End User, MEA (%)

Table 27: Market Size & Share by Country – UAE, Saudi Arabia, South Africa, RoMEA

Asia-Pacific

Table 28: Asia-Pacific Market Size, 2020–2032 (USD Billion)

Table 29: Market Share by Material, Asia-Pacific (%)

Table 30: Market Share by End User, Asia-Pacific (%)

Table 31: Market Size & Share by Country – China, India, Japan, South Korea, Australia, RoAPAC

Country-Level Market Tables

(Subset of above regional data)

-

Table 32: US Market Share, by Material and End User

-

Table 33: Germany Market Share, by Material and End User

-

Table 34: China Market Share, by Material and End User

(Continue similarly for all major countries covered in the report.)

Company Profiles Tables

Table 50+: Company Snapshot – Revenue, Product Segments, Strategies (Sika AG, MAPEI, RPM, Fosroc, ARDEX, etc.)

Table 60+: Strategic Alliances and Recent Developments by Leading Players

Top Key Players & Market Share Outlook

- Sika AG

- MAPEI Corporation

- RPM International Inc.

- Fosroc, Inc.

- ARDEX GmbH

- TCC Materials

- The Euclid Chemical Company

- Saint-Gobain Group

- SCHOMBURG GmbH & Co. KG

- Others

Frequently Asked Questions