Understand The Key Trends Shaping This Market

Download Free SampleDigitalization of retail tire Market in UAE Overview: Market Size and Forecast (2026-32)

What is Digitalization of Retail Tire?

Digitalization of retail tire involves integrating digital technologies into traditional tire retail operations to enhance customer experience and business efficiency. This transformation includes e-commerce platforms for online tire purchasing, IoT-enabled smart tires for real-time monitoring, AI-powered product recommendations, mobile apps for service scheduling, and digital inventory management systems. Additionally, it encompasses innovative service models like subscription-based tire programs, virtual fitting tools using augmented reality, and automated customer relationship management.

What is the anticipated CAGR & size of the Digitalization of retail tire Market in UAE?

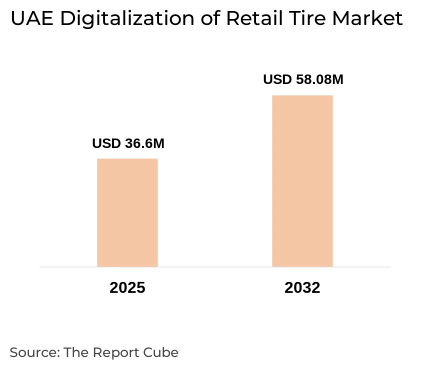

The Digitalization of retail tire Market in UAE is anticipated to register a CAGR of around 6.82% during the forecast period, 2026-32. Additionally, the market size was valued at nearly USD 36.6 million in 2025 and is projected to reach nearly USD 58.08 million by 2032.

Market Analysis

The digitalization of the UAE’s retail tire market is propelled by rising replacement demand underpins digital uptake, as harsh desert conditions and high vehicle utilization lead to frequent tire wear. Consequently, motorists and fleet operators increasingly seek online platforms offering real-time inventory visibility, dynamic price comparisons, and expedited delivery slots, driving e-retailing expansion and elevating the demand for digitalization of UAE retail tire industry.

Moreover, Omni channel integration plays a fundamental role in expanding digitalization of tire retails industry, with over 70% of retailers merging physical and digital channels to deliver seamless shopping experiences. This strategy not only enhances reach across Dubai, Abu Dhabi, and emerging emirates but also synchronizes loyalty programs, digital appointments, and in-store kiosks, thereby boosting conversion rates and customer retention. Furthermore, service model innovation, notably subscription and leasing offerings, addresses the need for cost predictability and maintenance convenience, particularly among commercial fleets whose unscheduled downtime costs can exceed 5% of operating budgets. Digital scheduling and IoT-enabled usage tracking reinforce these models by enabling proactive tire replacements that reduce on-road failures by up to 30%. Thereby, elevating the adoption of digitalization of retail tire industry across the country. In addition, another crucial component elevating market expansion is integration of smart tire technologies. The IoT sensors embedded in tires deliver continuous pressure, temperature, and tread-wear data, facilitating predictive maintenance and personalized service alerts. These capabilities not only improve fleet safety and fuel efficiency by 8–12% but also open recurring revenue streams through data-driven maintenance contracts.

Additionally, regulatory mandates, including periodic digital tire inspections and blockchain-secured certification, compel retailers to adopt digital inspection tools. For instance, the UAE’s Federal Decree-Law No. (14) of 2024 on Traffic Regulation mandates that all vehicle fitness certificates must be issued and stored digitally via the national e-registration portal rather than on paper. The law requires that inspection centers use tablet-based digital inspection modules to record tread depth, pressure, and wear data, which are automatically uploaded to the Ministry of Interior’s blockchain-secured Vehicle Compliance System. This regulation compels tire retailers and service providers to adopt certified digital inspection tools and integrate with the centralized platform, thereby standardizing digital workflows, eliminating manual paperwork, and enhancing both regulatory compliance and consumer confidence.

Collectively, these interrelated factors regulatory compliance, strategic partnerships, and infrastructure readiness, drive the demand for and expansion of digitalization across the UAE retail tire market in the upcoming years.

What is the role of AI in revolutionizing Digitalization of retail tire adoption in UAE?

AI revolutionizes digital tire retail in the UAE by powering personalized recommendation engines, optimizing inventory, and enabling predictive maintenance. Machine learning algorithms analyze driving patterns, tire wear data, and purchase history to suggest the ideal tire model and replacement timing, boosting conversion rates and customer satisfaction. Moreover, AI-driven chatbots and virtual fitting assistants streamline support and engagement, while demand-forecasting models improve stock accuracy by 15–20%, reducing overstock and stockouts.

Digitalization of UAE retail tire Market Dynamics

What driving factor acts as a positive influencer for the Digitalization of retail tire Market in UAE?

Predictive maintenance through IoT integration significantly accelerate the digitalization of the UAE retail tire market by enabling real-time monitoring of tire health, such as pressure, temperature, and tread wear. This capability allows fleet operators and individual users to anticipate tire issues before failures occur, thereby reducing costly downtime, unscheduled repairs, and maintenance expenses. Moreover, the actionable insights generated by IoT sensors facilitate shift towards proactive tire management, driving adoption of digital platforms that offer subscription services, automated alerts, and seamless scheduling. Consequently, predictive maintenance not only improves operational efficiency and safety but also fosters customer trust in digital tire retail solutions, accelerating market growth and expanding the digital ecosystem.

How are the future opportunities transforming the market during 2026-32?

Subscription and leasing models represent a high-growth opportunity in the UAE digital tire retail market. These service offerings bundle tire usage, maintenance, and replacements into fixed-fee packages managed via digital platforms. Commercial fleets benefit from predictable budgeting and reduced administrative overhead, while individual motorists enjoy hassle-free tire care. Additionally, digital platforms facilitate seamless onboarding, usage tracking, and renewal processes. As consumers increasingly favor access-over-ownership solutions, subscription programs can capture new customer segments and generate stable, recurring revenue, transforming one-time transactions into long-term digital relationships.

What are the challenges that affect the Digitalization of retail tire Market in UAE?

High implementation costs and integration complexity significantly limit the digitalization of the UAE’s tire retail market. Many tire retailers, especially smaller players, face substantial upfront investments for IoT sensors, cloud platforms, and AI systems. Additionally, these advanced technologies must often integrate with legacy systems that were not designed for digital interoperability, causing prolonged deployment timelines and technical challenges. This complexity leads to fragmented solutions rather than unified platforms, hampering seamless omnichannel experiences. Consequently, hesitant adoption slows overall digital ecosystem growth, restricting efficiencies and customer benefits essential for market expansion.

How is the Digitalization of retail tire Market in UAE Defined as per Segments?

- Vehicle Type: Passenger Car, Two-Wheeler & Three-Wheeler, Commercial Vehicle, and Speciality, Off-Road Vehicles

- Tire Type: Radial Tires, Bias Tires

By Vehicle Type

The Passenger Car segment is expected to lead the digitalization of the retail tire market in the UAE in the coming years. This dominance is driven by the high vehicle ownership rates in the country, the rising demand for luxury and electric vehicles, and a digitally savvy consumer base seeking convenience through e-commerce and digital services. With electric vehicles comprising 13% of new light vehicle sales in 2023, demand for advanced, EV-compatible tires incorporating IoT and AI technologies is growing rapidly. Additionally, passenger car owners increasingly prefer digital platforms offering virtual tire fitting, AI-based recommendations, and seamless mobile purchasing experiences, further propelling digital adoption within this segment.

By Tire Type

The Radial Tires segment is expected to lead the digitalization of the retail tire market in the UAE in upcoming years. This dominance is due to radial tires offering superior benefits such as enhanced fuel efficiency, better grip, improved vehicle control, and longer durability, making them the preferred choice for passenger cars and commercial vehicles alike. Increasing demand for fuel-efficient and high-performance tires aligns with the UAE’s focus on sustainability and smart mobility, further driving radial tire adoption. Additionally, radial tires are increasingly integrated with digital monitoring technologies like IoT sensors for real-time performance tracking and predictive maintenance, boosting the need for digital retail platforms catering to this segment.

What Does Our Digitalization of Tire Retail Market in UAE Research Study Entail?

- The UAE Digitalization of Tire Retail Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The UAE Digitalization of Tire Retail Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- UAE Digitalization of retail tire Market Overview (2020-2032)

- Market Size, By Value (in USD Millions)

- Market Share, By Vehicle Type

- Passenger Car

- Two-Wheeler & Three-Wheeler

- Commercial Vehicle

- Speciality Off-Road Vehicles

- Market Share, By Tire Type

- Radial Tires

- Bias Tires

- Market Share, By Sales Channel

- Dealers/Exclusive Outlets

- Online

- Others

- Market Share, By Demand Category

- OEM (Original Equipment Manufacturer)

- Replacement

- Market Share, By Price Category

- Budget

- Economy

- Premium

- Market Share, By Competitors

- Competition Characteristics

- Revenue Shares

- UAE Passenger Car Digitalization of retail tire Market Overview, 2020-2032F

- By Value (USD Million)

- By Tire Type- Market Size & Forecast 2019-2030, USD Million

- By Sales Channel- Market Size & Forecast 2019-2030, USD Million

- By Demand Category- Market Size & Forecast 2019-2030, USD Million

- UAE Two-Wheeler & Three-Wheeler Digitalization of retail tire Market Overview, 2020-2032F

- By Value (USD Million)

- By Tire Type- Market Size & Forecast 2019-2030, USD Million

- By Sales Channel- Market Size & Forecast 2019-2030, USD Million

- By Demand Category- Market Size & Forecast 2019-2030, USD Million

- UAE Commercial Vehicle Digitalization of retail tire Market Overview, 2020-2032F

- By Value (USD Million)

- By Tire Type- Market Size & Forecast 2019-2030, USD Million

- By Sales Channel- Market Size & Forecast 2019-2030, USD Million

- By Demand Category- Market Size & Forecast 2019-2030, USD Million

- UAE Speciality Off-Road Vehicles Digitalization of retail tire Market Overview, 2020-2032F

- By Value (USD Million)

- By Tire Type- Market Size & Forecast 2019-2030, USD Million

- By Sales Channel- Market Size & Forecast 2019-2030, USD Million

- By Demand Category- Market Size & Forecast 2019-2030, USD Million

- Competitive Outlook (Company Profile - Partila List)

- Majid Al Futtaim Holding LLC

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Landmark Group

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Union Coop

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Azadea Group

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Amazon (Souq)

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- M.H. Alshaya Co. (Al Shaya Group)

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Lulu Group International

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Spinneys Dubai LLC

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Al Maya Group LLC

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- West Zone LLC

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Majid Al Futtaim Holding LLC

- Contact Us & Disclaimer

List of Figure

Figure 1.1: Market Segmentation Framework

Figure 2.1: Research Methodology Flowchart

Figure 2.2: Primary vs. Secondary Data Collection Process

Figure 2.3: Breakdown of Primary Interviews (by Stakeholder Type)

Figure 4.1: Key Market Drivers of UAE Digitalization in Retail Tire Market

Figure 4.2: Major Challenges Hindering Market Growth

Figure 4.3: Opportunity Assessment Matrix

Figure 5.1: Recent Technological Trends in Retail Tire Digitalization

Figure 6.1: Policy & Regulatory Landscape of UAE Tire Market

Figure 7.1: UAE Retail Tire Market Size, By Value (USD Million), 2020–2032

Figure 7.2: Market Share, By Vehicle Type (Passenger Car, Two-Wheeler, Commercial, Off-Road)

Figure 7.3: Market Share, By Tire Type (Radial vs. Bias Tires)

Figure 7.4: Market Share, By Sales Channel (Dealers, Online, Others)

Figure 7.5: Market Share, By Demand Category (OEM vs. Replacement)

Figure 7.6: Market Share, By Price Category (Budget, Economy, Premium)

Figure 7.7: Market Share, By Competitors – Revenue Distribution

Figure 8.1: Passenger Car Tire Market Size, By Value (USD Million)

Figure 8.2: Passenger Car Tire Market Size & Forecast, By Tire Type

Figure 8.3: Passenger Car Tire Market Size & Forecast, By Sales Channel

Figure 8.4: Passenger Car Tire Market Size & Forecast, By Demand Category

Figure 9.1: Two-Wheeler & Three-Wheeler Tire Market Size, By Value (USD Million)

Figure 9.2: Market Size & Forecast, By Tire Type

Figure 9.3: Market Size & Forecast, By Sales Channel

Figure 9.4: Market Size & Forecast, By Demand Category

Figure 10.1: Commercial Vehicle Tire Market Size, By Value (USD Million)

Figure 10.2: Market Size & Forecast, By Tire Type

Figure 10.3: Market Size & Forecast, By Sales Channel

Figure 10.4: Market Size & Forecast, By Demand Category

Figure 11.1: Off-Road Vehicle Tire Market Size, By Value (USD Million)

Figure 11.2: Market Size & Forecast, By Tire Type

Figure 11.3: Market Size & Forecast, By Sales Channel

Figure 11.4: Market Size & Forecast, By Demand Category

Figure 12.1: Market Positioning of Key Players in UAE Tire Retail Digitalization

Figure 12.2: Revenue Share Comparison of Major Competitors

Figure 12.3: Strategic Partnerships & Alliances – Mapping of Key Players

List of Table

Table 1.1: Objectives of the Study

Table 1.2: Market Segmentation Categories

Table 2.1: Sources of Secondary Data

Table 2.2: List of Companies Interviewed

Table 2.3: Primary Data Points Collected

Table 2.4: Breakdown of Primary Interviews (by Region & Respondent Type)

Table 4.1: Key Market Drivers in UAE Retail Tire Digitalization

Table 4.2: Major Challenges in the Market

Table 4.3: Opportunity Assessment by Market Segment

Table 5.1: Recent Trends and Developments in UAE Tire Retail Digitalization

Table 6.1: Regulatory Policies Impacting UAE Retail Tire Market

Table 7.1: UAE Retail Tire Market Size, By Value (USD Million), 2020–2032

Table 7.2: Market Share, By Vehicle Type

Table 7.3: Market Share, By Tire Type

Table 7.4: Market Share, By Sales Channel

Table 7.5: Market Share, By Demand Category

Table 7.6: Market Share, By Price Category

Table 7.7: Market Share, By Competitors (Revenue Distribution)

Table 8.1: UAE Passenger Car Tire Market Size, By Value (USD Million), 2020–2032

Table 8.2: Passenger Car Tire Market Size & Forecast, By Tire Type

Table 8.3: Passenger Car Tire Market Size & Forecast, By Sales Channel

Table 8.4: Passenger Car Tire Market Size & Forecast, By Demand Category

Table 9.1: UAE Two-Wheeler & Three-Wheeler Tire Market Size, By Value (USD Million), 2020–2032

Table 9.2: Market Size & Forecast, By Tire Type

Table 9.3: Market Size & Forecast, By Sales Channel

Table 9.4: Market Size & Forecast, By Demand Category

Table 10.1: UAE Commercial Vehicle Tire Market Size, By Value (USD Million), 2020–2032

Table 10.2: Market Size & Forecast, By Tire Type

Table 10.3: Market Size & Forecast, By Sales Channel

Table 10.4: Market Size & Forecast, By Demand Category

Table 11.1: UAE Off-Road Vehicle Tire Market Size, By Value (USD Million), 2020–2032

Table 11.2: Market Size & Forecast, By Tire Type

Table 11.3: Market Size & Forecast, By Sales Channel

Table 11.4: Market Size & Forecast, By Demand Category

Table 12.1: Company Profile Summary – Majid Al Futtaim Holding LLC

Table 12.2: Company Profile Summary – Landmark Group

Table 12.3: Company Profile Summary – Union Coop

Table 12.4: Company Profile Summary – Azadea Group

Table 12.5: Company Profile Summary – Amazon (Souq)

Table 12.6: Company Profile Summary – M.H. Alshaya Co.

Table 12.7: Company Profile Summary – Lulu Group International

Table 12.8: Company Profile Summary – Spinneys Dubai LLC

Table 12.9: Company Profile Summary – Al Maya Group LLC

Table 12.10: Company Profile Summary – West Zone LLC

Top Key Players & Market Share Outlook

- Majid Al Futtaim Holding LLC

- Landmark Group

- Union Coop

- Azadea Group

- Amazon (Souq)

- M.H. Alshaya Co. (Al Shaya Group)

- Lulu Group International

- Spinneys Dubai LLC

- Al Maya Group LLC

- West Zone LLC

Frequently Asked Questions