GCC Electric Vehicle Charging Station Market

Source: The Report Cube

Understand The Key Trends Shaping This Market

Download Free SampleGCC Electric Vehicle Charging Station Market Insights & Analysis

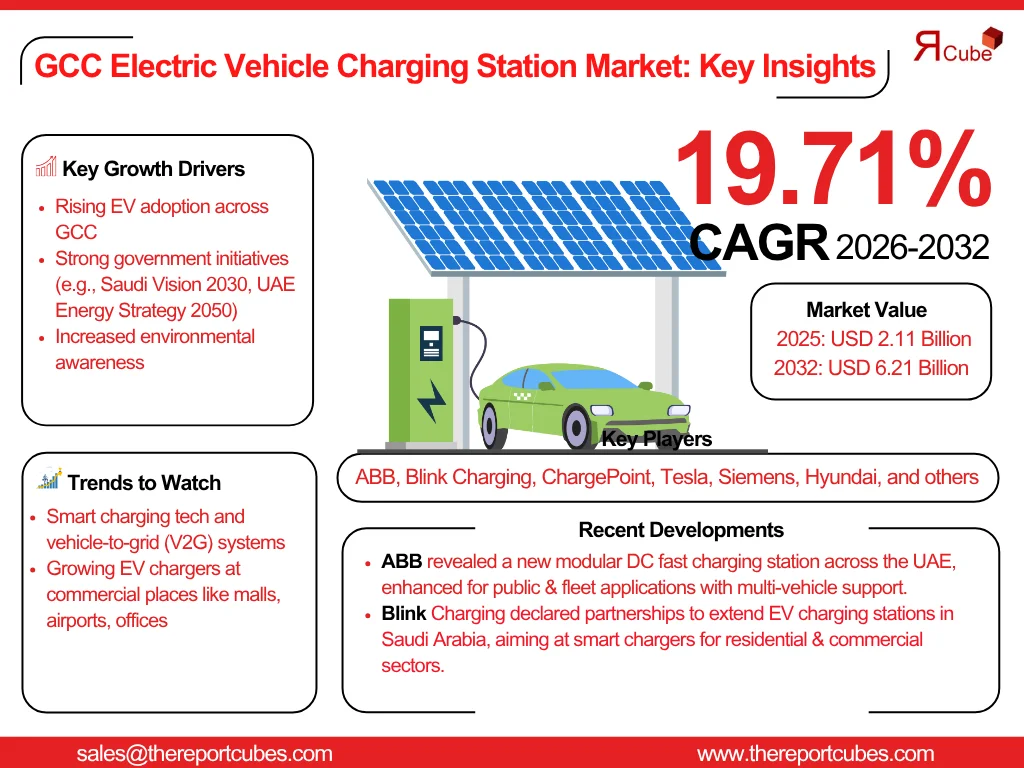

The GCC Electric Vehicle Charging Station Market is anticipated to register a CAGR of around 19.71% during the forecast period, 2026-32. Also, the market size was valued at nearly USD 2.11 billion in 2025 and is foreseen to witness nearly USD 6.21 billion during 2032. This market expansion reflects the rising adoption of electric vehicles (EVs), aggressive government initiatives, and rising environmental consciousness in the GCC region.

The GCC Electric Vehicle Charging Station Market includes several EV charging stations, catering to residential & commercial requirements. Substantial investment in electric vehicle charging infrastructure, chiefly in high-density urban areas & highways, is elevating market expansion. Also, nations such as Saudi Arabia & the UAE are leading the integration of sustainable transportation frameworks as part of their national visions (e.g., Saudi Vision 2030 & UAE Energy Strategy 2050).

Moreover, the swing towards smart charging solutions, improved grid integration, and real-time monitoring systems has enhanced the usability & efficiency of EV charging stations. For instance, fast-growing demand in cities such as Riyadh & Dubai encourages private & public entities to deploy EV charging stations at strategic locations, including office complexes, malls, and residential communities.

Additionally, in the forthcoming years, the GCC Electric Vehicle Charging Station Market is presumed to flourish owing to increasing customer interest in clean mobility, the cost-efficiency of EVs over their lifecycle, and falling prices of EV batteries. Also, with stricter policy backing, improved charging infrastructure expansion, and increasing EV model availability from global automakers, the GCC Electric Vehicle Charging Market is destined to experience tremendous growth & long-term viability in the forecast years.

GCC Electric Vehicle Charging Station Market Upgrades & Recent Developments

2025:

- ABB revealed a new modular DC fast charging station across the UAE, enhanced for public & fleet applications with multi-vehicle support.

- Blink Charging declared partnerships to extend EV charging stations in Saudi Arabia, aiming at smart chargers for residential & commercial sectors.

GCC Electric Vehicle Charging Station Market Dynamics

-

Driver: Mounting Adoption of Electric Vehicles (EVs) Across the GCC Region to Elevate Market Demand

The growing acceptance of electric vehicles in the GCC region is the major growth driver for the Electric Vehicle Charging Station Market. Also, governments are motivating EV adoption by proposing incentives like decreased vehicle registration fees, tax exemptions, and free parking for EV owners. Moreover, infrastructure plans, including Saudi Arabia’s NEOM & the UAE’s smart cities, have enthusiastic EV zones equipped with fast charging stations. Further, these progressions are considerably enhancing the Electric Vehicle Charging Station Market size and accelerating the electric vehicles market.

-

Challenge: Higher Charges for Fast-Charging Infrastructure to Impede Market Growth

Fast charging station deployment still involves a noteworthy upfront investment & ongoing operating expenses, even with technical breakthroughs. This covers equipment attainment, maintenance, and grid enhancements. Also, the lack of funding in smaller countries such as Bahrain & Oman prevents the construction of widespread charging infrastructure. Additionally, station adoption in metropolitan areas is slowed significantly by installation & real estate restrictions, chiefly for plug-in & public fast-charging systems.

-

Opportunity: Incorporation of Smart Charging Solutions

There are a ton of opportunities for market companies owing to the increasing demand for smart charging solutions. Also, energy efficiency & consumer experience are enhanced through load management, vehicle-to-grid (V2G) technologies, real-time analytics, and app-based station locators. Also, the UAE's & Saudi Arabia's smart city goals, which highlight eco-friendly urban mobility, are in line with this digital incorporation. Moreover, enterprises that offer integrated software & hardware charging environments are in a good position to take advantage of the trend of tech-savvy customers & smart infrastructure rollouts.

-

Trend: Development of Charging Infrastructure at Commercial Places

EV charging infrastructure is transforming due to the rising trend of installing EV charging stations in lodging facilities, airports, shopping centers, and office buildings. Also, to draw in eco-aware clients, Saudi Arabian & UAE hospitality and retail establishments are incorporating EV chargers. Moreover, as charging infrastructure is integrated as a standard providing in new expansions by real estate developers, commercial addition is predicted to accelerate. Further, this aids in achieving the bigger objective of developing a smooth & accessible EV charging network in the GCC.

GCC Electric Vehicle Charging Station Market Segment-Wise Analysis

By Product Type:

- AC Charging Station

- DC Charging Station

- Inductive Charging Station

The DC Charging Station segment leads the GCC Electric Vehicle Charging Station Market, grabbing the largest market share. In comparison to HEVs, which partly rely on gasoline, electric vehicles require regular & exclusive access to EV charging stations. As BEVs have no emissions & reduced operating expenses, their market share in the GCC Electric Vehicle Industry is growing rapidly. Also, the market for BEVs is expanding as a result of government incentives & infrastructure support, specifically in Saudi Arabia. Further, to improve market outlook, foremost automakers are also introducing a larger variety of BEV vehicles that are suitable for the driving habits & environment of the country.

By End User:

- BEV (Battery Electric Vehicle)

- PHEV (Plug-in Hybrid Electric Vehicle)

- HEV (Hybrid Electric Vehicle)

The BEV segment dominates the GCC Electric Vehicle Charging Station Market by capturing the potential market share. As fully electric vehicles require frequent and exclusive access to EV charging stations, unlike HEVs, which rely partially on gasoline. The share of BEVs is growing rapidly in the GCC electric vehicles market due to zero-emission benefits and reduced operational costs. Governments, especially in Saudi Arabia, are promoting BEV adoption through incentives and infrastructure support, further expanding the market. Additionally, major automakers are introducing a wider range of BEV models tailored for the GCC region’s climate and driving preferences, boosting this segment.

Country Projection of the GCC Electric Vehicle Charging Station Industry

The GCC Electric Vehicle Charging Station Market is geographically diversified, covering:

- The UAE

- Saudi Arabia

- Qatar

- Bahrain

- Oman

- Kuwait

Saudi Arabia accounts for the GCC Electric Vehicle Charging Station Market, supported by its encouraged sustainability goals under Vision 2030. With initiatives such as NEOM & the Red Sea progression integrating various EV charging stations, the Kingdom of Saudi Arabia is making substantial investments in the expansion of charging infrastructure. Also, the government's efforts to establish a strong network of EV charging stations are supported by its partnerships with multinational technology enterprises, including ABB & Tesla. Moreover, Saudi Arabia is leading the GCC region's inclination to sustainable mobility due to the increasing number of fast charging stations on public roads & in public areas, as well as legislative incentives for EV acceptance.

What Does Our GCC Electric Vehicle Charging Station Market Research Study Entail?

- The GCC Electric Vehicle Charging Station Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis puts light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The GCC Electric Vehicle Charging Station Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- GCC Electric Vehicle Charging Station Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- Market Share, By Product Type

- AC Charging Station

- DC Charging Station

- Inductive Charging Station

- Market Share, By End User

- BEV (Battery Electric Vehicle)

- PHEV (Plug-in Hybrid Electric Vehicle)

- HEV (Hybrid Electric Vehicle)

- Market Share, By Charger Type

- Fast

- Slow/Moderate

- Market Share, By Application

- Commercial

- Residential

- Market Share, By Connector

- J1772

- Mennekes

- GB/T

- CCS1

- CHAdeMO

- CCS2

- Tesla

- Market Share, By Level

- Level 1

- Level 2

- Level 3

- Market Share, By Country

- The UAE

- Saudi Arabia

- Qatar

- Bahrain

- Oman

- Kuwait

- Market Share, By Company

- Revenue Shares

- Competition Characteristics

- The UAE Electric Vehicle Charging Station Market Overview, 2020-2032F

- Market Size, By Value (in USD Billions)

- By Product Type

- By End User

- By Charger Type

- By Application

- By Connector

- By Level

- Saudi Arabia Electric Vehicle Charging Station Market Overview, 2020-2032F

- Market Size, By Value (in USD Billions)

- By Product Type

- By End User

- By Charger Type

- By Application

- By Connector

- By Level

- Qatar Electric Vehicle Charging Station Market Overview, 2020-2032F

- Market Size, By Value (in USD Billions)

- By Product Type

- By End User

- By Charger Type

- By Application

- By Connector

- By Level

- Bahrain Electric Vehicle Charging Station Market Overview, 2020-2032F

- Market Size, By Value (in USD Billions)

- By Product Type

- By End User

- By Charger Type

- By Application

- By Connector

- By Level

- Oman Electric Vehicle Charging Station Market Overview, 2020-2032F

- Market Size, By Value (in USD Billions)

- By Product Type

- By End User

- By Charger Type

- By Application

- By Connector

- By Level

- Competitive Outlook (Company Profile - Partila List)

- ABB

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Blink Charging

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- CHAEVI

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- ChargePoint

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Delta Electronics

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Eaton

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Elli

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- EVBox

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- GreenWay Infrastructure

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Hyundai Motor

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- ABB

- Contact Us & Disclaimer

List of Figure

Figure 1: Market Segmentation Overview

Figure 2: Study Variables Framework

Figure 3: Companies Interviewed for Secondary Data

Figure 4: Breakdown of Primary Interviews by Stakeholder Type

Figure 5: Key Market Drivers for GCC Electric Vehicle Charging Stations

Figure 6: Major Market Challenges in GCC Region

Figure 7: Opportunity Assessment Matrix for GCC Market

Figure 8: Recent Trends and Developments in EV Charging Market

Figure 9: Regulatory Landscape Affecting GCC EV Charging Market

Figure 10: GCC Electric Vehicle Charging Station Market Size (2020-2032)

Figure 11: Market Share by Product Type in GCC Region

Figure 12: AC vs DC vs Inductive Charging Station Market Share

Figure 13: Market Share by End User Segment in GCC

Figure 14: Market Share by Charger Type (Fast vs Slow/Moderate)

Figure 15: Market Share by Application (Commercial vs Residential)

Figure 16: Market Share by Connector Type in GCC

Figure 17: Market Share by Level (Level 1, 2, 3)

Figure 18: Market Share by GCC Country

Figure 19: Company Revenue Shares in GCC EV Charging Market

Figure 20: Competitive Landscape Characteristics of Key Players

Figure 21: UAE EV Charging Station Market Size (2020-2032)

Figure 22: UAE Market Share by Product Type

Figure 23: UAE Market Share by End User

Figure 24: UAE Market Share by Charger Type

Figure 25: UAE Market Share by Application

Figure 26: UAE Market Share by Connector

Figure 27: UAE Market Share by Level

Figure 28: Saudi Arabia EV Charging Market Size (2020-2032)

Figure 29: Saudi Arabia Market Share by Product Type

Figure 30: Saudi Arabia Market Share by End User

Figure 31: Saudi Arabia Market Share by Charger Type

Figure 32: Saudi Arabia Market Share by Application

Figure 33: Saudi Arabia Market Share by Connector

Figure 34: Saudi Arabia Market Share by Level

Figure 35: Qatar EV Charging Market Size (2020-2032)

Figure 36: Qatar Market Share by Product Type

Figure 37: Qatar Market Share by End User

Figure 38: Qatar Market Share by Charger Type

Figure 39: Qatar Market Share by Application

Figure 40: Qatar Market Share by Connector

Figure 41: Qatar Market Share by Level

Figure 42: Bahrain EV Charging Market Size (2020-2032)

Figure 43: Bahrain Market Share by Product Type

Figure 44: Bahrain Market Share by End User

Figure 45: Bahrain Market Share by Charger Type

Figure 46: Bahrain Market Share by Application

Figure 47: Bahrain Market Share by Connector

Figure 48: Bahrain Market Share by Level

Figure 49: Oman EV Charging Market Size (2020-2032)

Figure 50: Oman Market Share by Product Type

Figure 51: Oman Market Share by End User

Figure 52: Oman Market Share by Charger Type

Figure 53: Oman Market Share by Application

Figure 54: Oman Market Share by Connector

Figure 55: Oman Market Share by Level

Figure 56: ABB Company Revenue and Market Position

Figure 57: Blink Charging Company Overview and Market Share

Figure 58: CHAEVI Business Segments and Strategic Alliances

Figure 59: ChargePoint Recent Developments and Market Impact

Figure 60: Delta Electronics Business and Partnership Highlights

Figure 61: Eaton Strategic Alliances and Market Activity

Figure 62: Elli Company Overview and Competitive Position

Figure 63: EVBox Market Share and Recent Developments

Figure 64: GreenWay Infrastructure Market Presence and Partnerships

Figure 65: Hyundai Motor EV Charging Initiatives and Alliances

List of Table

Table 1: Objective of the Study

Table 2: Product Definition and Key Specifications

Table 3: Market Segmentation Details

Table 4: Study Variables and Metrics Used

Table 5: Secondary Data Sources and Companies Interviewed

Table 6: Breakdown of Primary Interviews by Respondent Type

Table 7: Summary of Market Drivers and Challenges

Table 8: Opportunity Assessment Summary

Table 9: Policy and Regulatory Framework Affecting GCC EV Charging Market

Table 10: GCC Electric Vehicle Charging Station Market Size and Forecast (2020-2032)

Table 11: Market Share by Product Type in GCC Region

Table 12: Market Share by End User Segment in GCC

Table 13: Market Share by Charger Type in GCC

Table 14: Market Share by Application in GCC

Table 15: Market Share by Connector Type in GCC

Table 16: Market Share by Level in GCC

Table 17: Market Share by Country in GCC

Table 18: Key Companies and Revenue Shares in GCC Market

Table 19: Competitive Landscape Summary

Table 20: UAE EV Charging Station Market Size and Forecast (2020-2032)

Table 21: UAE Market Share by Product Type

Table 22: UAE Market Share by End User

Table 23: UAE Market Share by Charger Type

Table 24: UAE Market Share by Application

Table 25: UAE Market Share by Connector

Table 26: UAE Market Share by Level

Table 27: Saudi Arabia EV Charging Station Market Size and Forecast (2020-2032)

Table 28: Saudi Arabia Market Share by Product Type

Table 29: Saudi Arabia Market Share by End User

Table 30: Saudi Arabia Market Share by Charger Type

Table 31: Saudi Arabia Market Share by Application

Table 32: Saudi Arabia Market Share by Connector

Table 33: Saudi Arabia Market Share by Level

Table 34: Qatar EV Charging Station Market Size and Forecast (2020-2032)

Table 35: Qatar Market Share by Product Type

Table 36: Qatar Market Share by End User

Table 37: Qatar Market Share by Charger Type

Table 38: Qatar Market Share by Application

Table 39: Qatar Market Share by Connector

Table 40: Qatar Market Share by Level

Table 41: Bahrain EV Charging Station Market Size and Forecast (2020-2032)

Table 42: Bahrain Market Share by Product Type

Table 43: Bahrain Market Share by End User

Table 44: Bahrain Market Share by Charger Type

Table 45: Bahrain Market Share by Application

Table 46: Bahrain Market Share by Connector

Table 47: Bahrain Market Share by Level

Table 48: Oman EV Charging Station Market Size and Forecast (2020-2032)

Table 49: Oman Market Share by Product Type

Table 50: Oman Market Share by End User

Table 51: Oman Market Share by Charger Type

Table 52: Oman Market Share by Application

Table 53: Oman Market Share by Connector

Table 54: Oman Market Share by Level

Table 55: ABB Company Profile and Financial Highlights

Table 56: Blink Charging Company Overview and Key Metrics

Table 57: CHAEVI Business Segments and Partnership Details

Table 58: ChargePoint Market Position and Recent Updates

Table 59: Delta Electronics Strategic Alliances and Performance

Table 60: Eaton Company Overview and Business Segments

Table 61: Elli Company Profile and Market Activities

Table 62: EVBox Key Developments and Market Position

Table 63: GreenWay Infrastructure Business Summary

Table 64: Hyundai Motor EV Charging Initiatives and Alliances

Top Key Players & Market Share Outlook

- ABB

- Blink Charging

- CHAEVI

- ChargePoint

- Delta Electronics

- Eaton

- Elli

- EVBox

- GreenWay Infrastructure

- Hyundai Motor

- Leviton Manufacturing

- NIO

- Nissan Motor

- Schneider Electric

- Others

Frequently Asked Questions