UAE Electric Vehicle Charging Infrastructure Market

Source: The Report Cube

Understand The Key Trends Shaping This Market

Download Free SampleUAE Electric Vehicle Charging Infrastructure Market Insights & Analysis

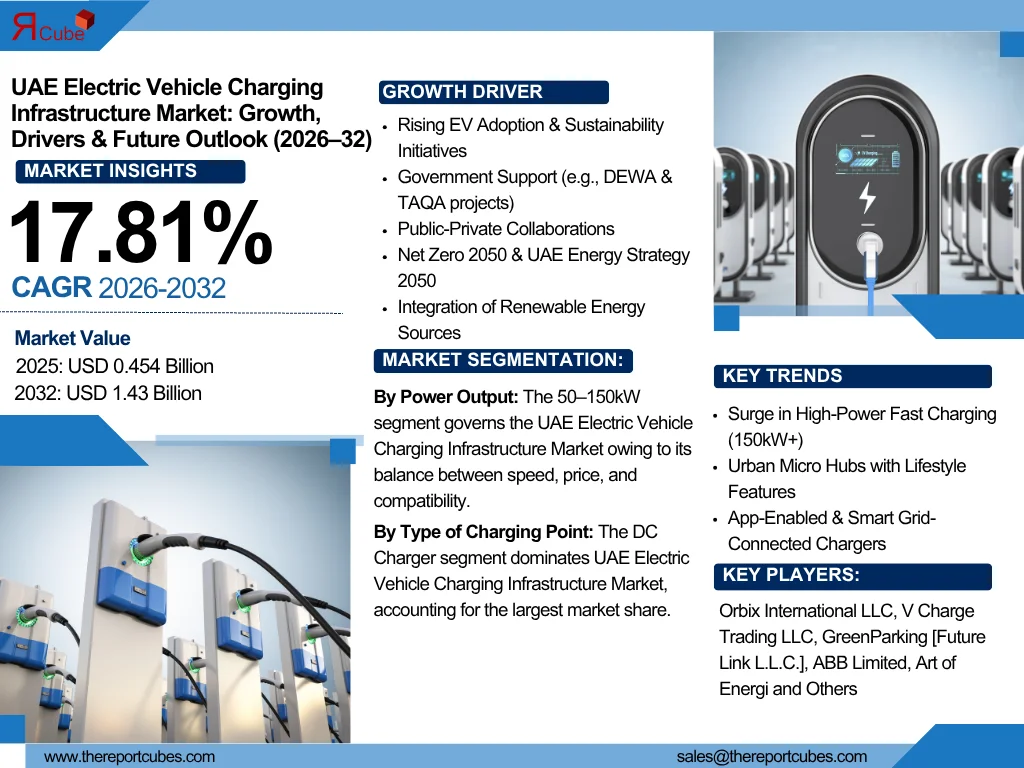

The UAE Electric Vehicle Charging Infrastructure Market is anticipated to register a CAGR of around 17.81% during the forecast period, 2026–32. The market size was valued at nearly USD 0.454 billion in 2025, and it is expected to reach approximately USD 1.43 billion by 2032. The industry development is driven by the growing acceptance of electric vehicles (EVs), rising sustainability initiatives, and quick infrastructure development. The UAE’s strategic vision for decarbonization, together with solid government support, is considerably advancing the development of electric vehicle charging infrastructure across the nation.

The increasing emphasis on sustainable mobility & the amalgamation of renewable energy sources are major contributors to UAE Electric Vehicle Charging Infrastructure Market growth. Further, leading infrastructure developers, in partnership with the public & private sectors, are using both fast charging stations & standard chargers in significant urban regions, highways, and residential complexes. Also, the Dubai Electricity and Water Authority (DEWA) & Abu Dhabi National Energy Company (TAQA) have been foremost initiatives to expand the EV charging network, safeguarding enhanced accessibility for both urban & intercity commuters.

Moreover, the demand for high-speed EV charging stations is mounting, specifically with the accumulating usage of long-range electric cars. Also, progressive DC fast chargers, smart grid amalgamation, and app-enabled EV charging are becoming the custom. Furthermore, the UAE government’s thrust towards electric mobility under its Net Zero 2050 initiative & the UAE Energy Strategy 2050, supports substantial spending in charging points, guidelines, and incentives to inspire EV embracing.

Additionally, numerous expansions in 2024 & 2025 have further improved the UAE Electric Vehicle Charging Infrastructure Market outlook. Further, in 2024, DEWA introduced its "EV Green Charger" expansion project, adding more than 100 EV charging stations in Dubai. Also, in 2025, collaboration between private sector entities & public utilities strengthened, with several pilot projects for solar-powered chargers & wireless charging.

Besides, looking ahead, the UAE EV Charging Infrastructure Market is set to expand swiftly owing to strong investment, growing EV penetration, and public-private collaborations. Also, with promising policies, constant innovation, and alliance with the wider market, the future embraces robust potential for network scalability, quicker technology acceptance, and improved user experience in the following years.

UAE Electric Vehicle Charging Infrastructure Market Upgrades & Recent Developments

2025:

- Siemens LLC unveiled a next-gen ultra-fast EV charging station in Abu Dhabi, highlighting 350kW capacity & assimilated load management for high-demand zones like commercial hubs & urban highways.

- GreenParking joined hands with a major real estate developer in Dubai in mid-2025 to install over 250 smart EV chargers in mixed-use properties, combined with app-based monitoring & billing solutions for seamless user experience.

UAE Electric Vehicle Charging Infrastructure Market Dynamics

-

Driver: Government Support & Public-Private Partnerships to Enhance the Industry Growth

The UAE government has been a vital motivating force behind the growth of electric vehicle charging infrastructure via strong regulations, funding programs, and strategic public-private partnerships. Also, initiatives managed by Dubai Electricity and Water Authority (DEWA) & Abu Dhabi National Energy Company (TAQA) focuses to create an extensive charging network to meet the increasing demand. Moreover, incentives such as free charging (for precise vehicle types), green parking, and dedicated lanes for EVs are boosting acceptance. Also, this assurance to sustainable mobility safeguards ongoing investment & market stability.

-

Challenge: Energy Demand Management & Grid Capacity to Hinder the Market

Handling energy load distribution, specifically during peak hours, is a key challenge for utilities. The lack of unvarying energy protocols & delayed grid upgrades in remote or immature areas can hinder seamless EV acceptance. Moreover, the incorporation of smart grid systems & renewable energy is vital, but implementation is uneven across all emirates. Also, the strain on the national grid is rising as the number of electric vehicle EV charging stations increases.

-

Opportunity: Incorporation of Renewable Energy & Smart Charging to Create Market Opportunities

EV charging stations with renewable energy sources are two of the most favorable combinations. Battery storage systems, AI-powered load optimization, and solar-deployed charging devices open the door to scalable & sustainable charging infrastructure. Moreover, associations between digital companies & infrastructure developers might hasten the implementation of dynamic costing & real-time energy management systems, enhancing consumer contentment & efficacy.

-

Trend: Surge of High-Power Fast Charging & Urban Micro Hubs to be Trending

A growing trend in the UAE market is the rise of fast charging stations with outputs of 150kW and above, enabling ultra-fast charging within minutes. Urban micro hubs—compact stations with multiple high-speed chargers located in densely populated areas—are becoming popular to address range anxiety and reduce urban congestion. These hubs often support integrated services like cafes, waiting lounges, or co-working spaces, reflecting a lifestyle-oriented shift in EV charging infrastructure design.

UAE Electric Vehicle Charging Infrastructure Market Segment-Wise Analysis

By Type of Charging Point:

- AC Charger

- DC Charger

- Others (Wireless Charging, etc.)

The DC Charger segment dominates UAE Electric Vehicle Charging Infrastructure Market, accounting for the largest market share. The rising requirement for quick charging stations in commercial areas & busy hallways is the cause of this. Also, earlier turnaround times are demanded by consumers as the number of long-range electric vehicles on UAE roadways upsurges. Moreover, compared to conventional AC units, DC chargers considerably shorten charging times, with average outputs ranging from 50kW to 350kW. Its market share has expanded as a result of its usage by both public & private organizations in cities & on highways. Further, DC chargers are also favored in smart city initiatives & are vital for travel between emirates.

By Power Output:

- 0–50kW

- 50–150kW

- More than 150kW

The 50–150kW segment governs the UAE Electric Vehicle Charging Infrastructure Market owing to its balance between speed, price, and compatibility. These chargers, which offer reasonably fast charging without the grid strain of ultra-high-capacity devices, are impeccable for commercial districts, shopping centers, and residential complexes. Also, they are suitable for wide deployment owing to their adaptability to numerous vehicle types & applications. Moreover, throughout the forthcoming period, this segment is expected to observe the largest number of installations owing to supportive legislation & increasing urban density. Further, it supports the utilization objectives of the public & commercial sectors & serves as the foundation of the UAE's mid-speed charging network.

What Does Our UAE Electric Vehicle Charging Infrastructure Market Research Study Entail?

- The UAE Electric Vehicle Charging Infrastructure Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis puts light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The UAE Electric Vehicle Charging Infrastructure Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- UAE Electric Vehicle Charging Infrastructure Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- Market Share, By Type of Charging Point

- AC Charger

- DC Charger

- Others (Wireless Charging, etc.)

- Market Share, By Power Output

- 0–50kW

- 50–150kW

- More than 150kW

- Market Share, By Charger Type

- Wall Mounted

- Pedestal Mounted

- Roof Mounted

- Market Share, By Connector Type

- CHAdeMo

- CCS

- Others (Tesla Supercharger, Type 2, etc.)

- Market Share, By Installation Type

- Fixed

- Portable

- Market Share, By Vehicle Type

- Two-Wheelers

- Passenger Cars

- Commercial Vehicles

- Market Share, By Location

- Residential

- Commercial

- Market Share, By Power Output

- 0-50kW

- 51-150kW

- More than 150kW

- Market Share, By Region

- Dubai

- Abu Dhabi & Al Ain

- Sharjah & Northern Emirates

- Market Share, By Competitors

- Competition Characteristics

- Revenue Shares

- UAE AC Charger Electric Vehicle Charging Infrastructure Market Overview, 2020-2032F

- By Value (USD Million)

- By Power Output- Market Size & Forecast 2019-2030, USD Million

- By Charger Type- Market Size & Forecast 2019-2030, USD Million

- By Connector Type- Market Size & Forecast 2019-2030, USD Million

- By Installation Type- Market Size & Forecast 2019-2030, USD Million

- By Vehicle Type- Market Size & Forecast 2019-2030, USD Million

- By Location- Market Size & Forecast 2019-2030, USD Million

- By Power Output- Market Size & Forecast 2019-2030, USD Million

- UAE DC Charger Electric Vehicle Charging Infrastructure Market Overview, 2020-2032F

- By Value (USD Million)

- By Power Output- Market Size & Forecast 2019-2030, USD Million

- By Charger Type- Market Size & Forecast 2019-2030, USD Million

- By Connector Type- Market Size & Forecast 2019-2030, USD Million

- By Installation Type- Market Size & Forecast 2019-2030, USD Million

- By Vehicle Type- Market Size & Forecast 2019-2030, USD Million

- By Location- Market Size & Forecast 2019-2030, USD Million

- By Power Output- Market Size & Forecast 2019-2030, USD Million

- UAE Others (Wireless Charging, etc.) Electric Vehicle Charging Infrastructure Market Overview, 2020-2032F

- By Value (USD Million)

- By Power Output- Market Size & Forecast 2019-2030, USD Million

- By Charger Type- Market Size & Forecast 2019-2030, USD Million

- By Connector Type- Market Size & Forecast 2019-2030, USD Million

- By Installation Type- Market Size & Forecast 2019-2030, USD Million

- By Vehicle Type- Market Size & Forecast 2019-2030, USD Million

- By Location- Market Size & Forecast 2019-2030, USD Million

- By Power Output- Market Size & Forecast 2019-2030, USD Million

- Competitive Outlook (Company Profile - Partila List)

- Orbix International LLC

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- V Charge Trading LLC

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- GreenParking [Future Link L.L.C.]

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- ABB Limited

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Art of Energi

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Regeny

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Powertech Electrical Trading LLC

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- eMagine

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Efacec

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Other

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Orbix International LLC

- Contact Us & Disclaimer

List of Figure

Figure 1: UAE Electric Vehicle Charging Infrastructure Market Size, by Value (USD Billion), 2020–2032

Figure 2: Market Share by Type of Charging Point (AC, DC, Others), 2020–2032

Figure 3: Market Share by Power Output (0–50kW, 50–150kW, >150kW), 2020–2032

Figure 4: Market Share by Charger Type (Wall Mounted, Pedestal, Roof Mounted), 2020–2032

Figure 5: Market Share by Connector Type (CHAdeMO, CCS, Others), 2020–2032

Figure 6: Market Share by Installation Type (Fixed, Portable), 2020–2032

Figure 7: Market Share by Vehicle Type (2-Wheelers, Passenger Cars, Commercial Vehicles), 2020–2032

Figure 8: Market Share by Location (Residential, Commercial), 2020–2032

Figure 9: Market Share by Region (Dubai, Abu Dhabi & Al Ain, Sharjah & Northern Emirates), 2020–2032

Figure 10: Competition Landscape by Revenue Share, 2020–2032

AC Charger Segment

Figure 11: AC Charger Market Size by Value (USD Million), 2020–2032

Figure 12: AC Charger Market by Power Output, 2020–2032

Figure 13: AC Charger Market by Charger Type, 2020–2032

Figure 14: AC Charger Market by Connector Type, 2020–2032

Figure 15: AC Charger Market by Installation Type, 2020–2032

Figure 16: AC Charger Market by Vehicle Type, 2020–2032

Figure 17: AC Charger Market by Location, 2020–2032

DC Charger Segment

Figure 18: DC Charger Market Size by Value (USD Million), 2020–2032

Figure 19: DC Charger Market by Power Output, 2020–2032

Figure 20: DC Charger Market by Charger Type, 2020–2032

Figure 21: DC Charger Market by Connector Type, 2020–2032

Figure 22: DC Charger Market by Installation Type, 2020–2032

Figure 23: DC Charger Market by Vehicle Type, 2020–2032

Figure 24: DC Charger Market by Location, 2020–2032

Others (Wireless, etc.) Segment

Figure 25: Wireless Charger Market Size by Value (USD Million), 2020–2032

Figure 26: Wireless Charger Market by Power Output, 2020–2032

Figure 27: Wireless Charger Market by Charger Type, 2020–2032

Figure 28: Wireless Charger Market by Connector Type, 2020–2032

Figure 29: Wireless Charger Market by Installation Type, 2020–2032

Figure 30: Wireless Charger Market by Vehicle Type, 2020–2032

Figure 31: Wireless Charger Market by Location, 2020–2032

Primary & Secondary Research

Figure 32: Breakdown of Primary Interviews by Designation and Geography

Figure 33: Sources of Secondary Research Data

List of Table

Table 1: Objective of the Study

Table 2: Product Definition – UAE Electric Vehicle Charging Infrastructure

Table 3: Market Segmentation Overview

Table 4: Study Variables and Assumptions

Table 5: Secondary Data Sources and References

Table 6: List of Companies Interviewed (Primary Research)

Table 7: Breakdown of Primary Interviews (by Company Type, Designation, and Geography)

Table 8: UAE Electric Vehicle Charging Infrastructure Market Size, by Value (USD Billion), 2020–2032

Market Segmentation Tables

Table 9: Market Share by Type of Charging Point (AC, DC, Others), 2020–2032

Table 10: Market Share by Power Output (0–50kW, 50–150kW, >150kW), 2020–2032

Table 11: Market Share by Charger Type (Wall Mounted, Pedestal, Roof Mounted), 2020–2032

Table 12: Market Share by Connector Type (CHAdeMo, CCS, Others), 2020–2032

Table 13: Market Share by Installation Type (Fixed, Portable), 2020–2032

Table 14: Market Share by Vehicle Type (Two-Wheelers, Passenger Cars, Commercial Vehicles), 2020–2032

Table 15: Market Share by Location (Residential, Commercial), 2020–2032

Table 16: Market Share by Region (Dubai, Abu Dhabi & Al Ain, Sharjah & Northern Emirates), 2020–2032

Table 17: Competitor Market Share by Revenue, 2020–2032

Segment-Specific Tables

AC Charger Segment (2020–2032)

Table 18: AC Charger Market Size by Value (USD Million), 2020–2032

Table 19: AC Charger Market by Power Output

Table 20: AC Charger Market by Charger Type

Table 21: AC Charger Market by Connector Type

Table 22: AC Charger Market by Installation Type

Table 23: AC Charger Market by Vehicle Type

Table 24: AC Charger Market by Location

DC Charger Segment (2020–2032)

Table 25: DC Charger Market Size by Value (USD Million), 2020–2032

Table 26: DC Charger Market by Power Output

Table 27: DC Charger Market by Charger Type

Table 28: DC Charger Market by Connector Type

Table 29: DC Charger Market by Installation Type

Table 30: DC Charger Market by Vehicle Type

Table 31: DC Charger Market by Location

Wireless/Others Segment (2020–2032)

Table 32: Wireless Charging Market Size by Value (USD Million), 2020–2032

Table 33: Wireless Charging Market by Power Output

Table 34: Wireless Charging Market by Charger Type

Table 35: Wireless Charging Market by Connector Type

Table 36: Wireless Charging Market by Installation Type

Table 37: Wireless Charging Market by Vehicle Type

Table 38: Wireless Charging Market by Location

Competitive Landscape

Table 39: Company Overview – Orbix International LLC

Table 40: Strategic Partnerships & Recent Developments – Orbix

Table 41: Company Overview – V Charge Trading LLC

Table 42: Company Overview – GreenParking (Future Link LLC)

Table 43: Company Overview – ABB Limited

Table 44: Company Overview – Art of Energi

Table 45: Company Overview – Regeny

Table 46: Company Overview – Powertech Electrical Trading LLC

Table 47: Company Overview – eMagine

Table 48: Company Overview – Efacec

Table 49: Company Overview – Other Players

Top Key Players & Market Share Outlook

- Orbix International LLC

- V Charge Trading LLC

- GreenParking [Future Link L.L.C.]

- ABB Limited

- Art of Energi

- Regeny

- Powertech Electrical Trading LLC

- eMagine

- Efacec

- Siemens LLC

- Catec

- Others

Frequently Asked Questions