Understand The Key Trends Shaping This Market

Download Free SamplePhilippines Health Insurance Market Overview: Market Size & Forecast (2026–2034)

What is the anticipated CAGR & size of the Philippines Health Insurance Market?

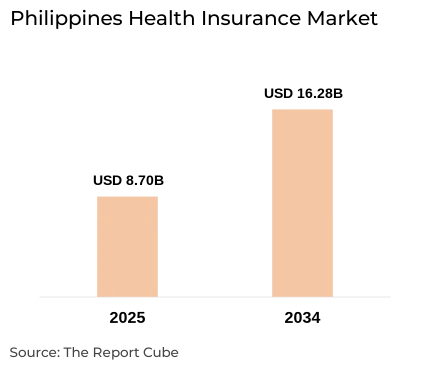

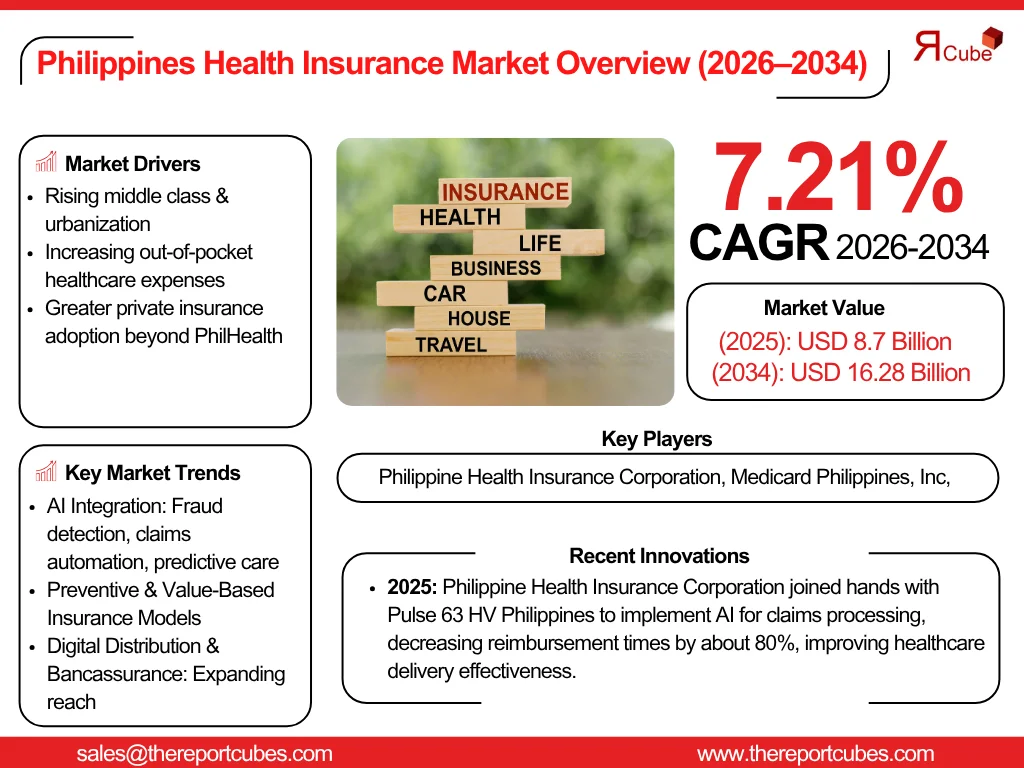

The Philippines Health Insurance Market is anticipated to register a CAGR of around 7.21% during the forecast period, 2026-34. Additionally, the market size was valued at nearly USD 8.7 billion in 2025 and is projected to reach nearly USD 16.28 billion by 2034.

Market Analysis & Insights

The increasing middle class, augmented out-of-pocket expenses, amplified private sector acceptance, digital distribution, and quick urbanization are all contributing to the continuous progression of the Philippines Health Insurance Market. Also, consumers' desire for private health insurance is expanding as they seek larger coverage outside of PhilHealth's limitations. Large market companies, such as Sun Life, FWD Life Insurance, and Pru Life UK practice customer-focused technologies & digital insurance platforms to gain national market governance.

Moreover, government programs & changes that promote industry expansion include the Universal Health Care Act (UHC) & enhanced regulatory supervision by the insurance regulatory body (IC). Also, innovations in value-added services, including critical illness insurance protection & preventative care, as well as digital distribution, are motivating Philippines Health Insurance Market demand. Furthermore, in order to meet the market demands of people with chronic & critical illnesses, value-added packages are being introduced by private insurers & health maintenance organizations (HMOs), while distribution is moving toward digital insurance platforms, bancassurance, and employer-sponsored group health insurance.

Additionally, as insurers adjust to the Philippines' medical cost inflation & increasing healthcare expenditures, the future outlook of the Philippines Health Insurance Market appears promising for more private industry expansion, innovation in digital platforms, and closer public-private alignment in the forthcoming years.

What is the Impact of AI in the Philippines Health Insurance Market?

AI aids in accelerating digital insurance platforms, fraud detection, and telemedicine incorporation by automating claims, underwriting, and customizable pricing. Also, by minimizing costs, expediting approvals, and offering predictive care management, insurers are leveraging AI to enhance the uptake of retail & group health insurance plans, further improving the Philippines Health Insurance Market landscape.

Philippines Health Insurance Market Dynamics

What driving factor acts as a positive influencer for the Philippines Health Insurance Market?

- Increasing Medical Inflation & Benefit Gaps to Drive the Market: Medical inflation across the Philippines has been materially greater than general inflation (medical inflation reported near the high teens in recent years), pushing households & employers to seek private cover to evade catastrophic out-of-pocket investments. Hence, this cost pressure expands demand for supplemental private plans & critical illness insurance, growing premium volumes & forcing insurers to redesign benefit packs with strict utilization management & value-based care partnerships. Also, healthcare expenditure upgrade & government cost-containment shifts under UHC make private purchases more striking to urban & corporate clients across the nation.

What are the challenges that affect the Philippines Health Insurance Market?

- Affordability Limitations & PhilHealth Funding Risks Undermining Market Stability: Despite PhilHealth's proclaimed universal coverage, administrative glitches & benefit restrictions have generated gaps that are filled by private insurers. Further, uncertainty surrounding public financing timelines has been brought about by political & fiscal actions (fund transfers & budget revisions) in 2024-2025, which has complicated insurers' pricing & estimates. Also, affordability is still a key market challenge as insurance penetration is still low (less than 2% as per recent Q1–Q2 2025 estimates). Moreover, as a result, microinsurance, bancassurance, and greatly digitalized distribution are essential for mass retail growth, but they also need investment & regulatory alignment.

How are the future opportunities transforming the market during 2026-34?

- Digital Distribution, Bancassurance, and Embedded Insurance: Low penetration generates an enormous addressable market. Digital insurers & bancassurance tie-ups (bank e-wallets & insurtech partnerships) let micro & parametric products to reach mass segments at lesser acquisition cost. Moreover, insurers that entrench simple hospital cash, outpatient drug assistances, or critical illness riders into digital wallets & payroll could promptly scale. Also, the Insurance Commission’s thrust for digital access & recent insurer associations demonstrate execution pathways to advance penetration & financial enclosure.

What market trends are affecting the Philippines Health Insurance Market Outlook?

- Technology-driven Swing Toward Preventive & Value-Based Insurance Models: For predictive underwriting & fraud detection, insurers & HMOs are employing AI, telehealth, and remote monitoring, further contributing in enhancing Philippines Health Insurance Market share. Also, these technologies enable outcome-linked goods, augment claims cycles, and improve remote care administration. Moreover, the swing towards outcome-oriented insurance products marketed via digital insurance platforms & employer schemes is enhanced by regulatory openness to outpatient drug benefits & digital health efforts (PhilHealth circulars & BUCAS/primary-care expansion). Further, product design is shifting toward chronic-care & preventive management as a result of AI, telemedicine, and HMO collaborations, which is a major market trend.

How is the Philippines Health Insurance Market Defined as per Segments?

The Philippines Health Insurance Market Research Reports provide detailed market data & insights in accordance with market segmentation. Some of the segments are:

- Type: Life-Time Coverage, Term Insurance

- Plan Type: Medical Insurance, Critical Illness Insurance, Family Floater Health Insurance, Others

By Type:

Life-Time Coverage captures the potential market share of about 65% of the Philippines Health Insurance Market, instigated by long-term protection demand & surging awareness about group health insurance benefits.

Life-Time Coverage is the foremost type as biggest insurers combine lifetime savings & protection features into their flagship plans, supporting persistency & bancassurance distribution. Also, these products generally bundle medical riders & acute illness benefits, making them appealing to middle-income Filipinos looking for long-term financial & health protection. Moreover, life insurers’ scale (e.g., Sun Life leading premiums) reinforces the ascendency of lifetime offerings across the market premium pools.

By Plan Type:

Medical Insurance dominates the Philippines Health Insurance Market with nearby 70% market share, supported by rising healthcare expenditure & medical cost inflation, demanding inclusive hospital & treatment coverages.

As core medical coverage becomes more crucial to consumers & employers owing to ever-increasing hospital & drug expenses, medical insurance (hospitalization & outpatient packages) motivates plan-type demand. Also, the demand for outpatient, preventive, and chronic care coverage is rising at the individual retail level, while employer-sponsored group health insurance is a substantial channel for medical plans. Further, in order to cater to this mushrooming Medical Insurance Market, insurers are expanding their networked HMO agreements & digital claims.

Philippines Health Insurance Market: What Recent Innovations Are Affecting the Industry?

- 2025: Philippine Health Insurance Corporation joined hands with Pulse 63 HV Philippines to implement AI for claims processing, decreasing reimbursement times by about 80%, improving healthcare delivery effectiveness.

- 2025: Sun Life Philippines employed Munich Re’s ALLFINANZ SPARK to automate underwriting & enable real-time decisions, limitating turnaround times, enhancing pricing accuracy, and enabling quicker product launches that influence AI & predictive underwriting.

- 2025: FWD Life Insurance launched an AI-powered app guiding users to personalized insurance plans, merging data analytics with user engagement.

What are the Key Highlights of the Philippines Health Insurance Market (2026–34)?

- The Philippines Health Insurance Market is envisioned to achieve a market size of about USD 16.28 billion in 2034, further recording a CAGR of nearly 7.21%, during 2026-34.

- By Provider: Private providers lead the market with around 65% share, compelled by a rising demand for comprehensive health insurance beyond public coverage such as PhilHealth coverage. Also, public providers attain the remaining share of about 35%.

- By Plan Type: Medical insurance is the biggest segment with nearly 70% market share, replicating high demand for hospitalization & treatment coverage

- By Demographics: The adults segment comprises the widely held market share, i.e., nearly 58%, as working-age populations look for coverage.

- By Provider Type: Health Maintenance Organizations (HMOs) command the prominent share of about 50%, supported by integrated healthcare services.

- AI incorporation reshapes claims, underwriting, and consumer experiences across the Health Insurance Market in the Philippines.

- Digital insurance platforms & bancassurance magnify market reach in the following years.

- Also, regulatory frameworks support market trust & compliance across the country.

How does the Future Outlook of the Philippines Health Insurance Market (2034) Appear?

The Philippines Health Insurance Market would expand strongly, compelled by digital insurance platforms, developing PhilHealth vs private insurance dynamics, and surging healthcare expenditure. Moreover, AI amalgamation with the health insurance would modernize service delivery & risk assessment, ensuring better health outcomes & operational efficacy, positioning the health insurance sector as a major industry in the future across the Philippines.

What Does Our Philippines Health Insurance Market Research Study Entail?

- The Philippines Health Insurance Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis & market scope sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The Philippines Health Insurance Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the Study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Breakdown of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- Philippines Health Insurance Market Overview (2020–2034)

- Market Size, By Value (USD Billion)

- Market Share, By Type

- Life-Time Coverage

- Term Insurance

- Market Share, By Plan Type

- Medical Insurance

- Critical Illness Insurance

- Family Floater Health Insurance

- Others

- Market Share, By Provider

- Public Providers

- Private Providers

- Market Share, By Demographics

- Minors

- Adults

- Senior Citizens

- Market Share, By Provider Type

- HMOs

- PPOs

- POS

- EPOs

- Market Share, By Company

- Revenue Shares

- Competition Characteristics

- Segment-wise Market Overview (2026–2034)

- By Value (USD Billion)

- By Type Overview

- By Plan Type Overview

- By Provider Overview

- By Demographics Overview

- By Provider Type Overview

- Forecast Year Tables

- Competitive Outlook (Company Profiles)

- Philippine Health Insurance Corporation

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Medicard Philippines, Inc

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Kaiser International Healthgroup, Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Maxicare

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Caritas Health Shield, Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Fwd Life Insurance Corporation

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Singlife Philippines Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Sun Life Assurance Company

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Pru Life

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Others

- Philippine Health Insurance Corporation

- Contact Us & Disclaimer

List of Figure

Figure 1.1: Overview of Study Objectives

Figure 1.2: Product Definition Framework

Figure 1.3: Market Segmentation of Philippine Health Insurance

Figure 1.4: Study Variables Considered

Figure 2.1: Research Methodology Overview

Figure 2.2: Sources of Secondary Data

Figure 2.3: Companies Interviewed for Secondary Research

Figure 2.4: Primary Data Collection Approach

Figure 2.5: Breakdown of Primary Interviews

Figure 3.1: Executive Summary – Key Market Insights

Figure 4.1: Market Drivers of Philippine Health Insurance

Figure 4.2: Key Challenges in the Market

Figure 4.3: Opportunity Assessment

Figure 5.1: Recent Trends and Developments in Philippine Health Insurance

Figure 6.1: Policy and Regulatory Landscape Overview

Figure 7.1: Philippine Health Insurance Market Size (2020–2034, USD Billion)

Figure 7.2: Market Share by Type (Life-Time Coverage vs Term Insurance)

Figure 7.3: Market Share by Plan Type

Figure 7.3.1: Market Share – Medical Insurance

Figure 7.3.2: Market Share – Critical Illness Insurance

Figure 7.3.3: Market Share – Family Floater Health Insurance

Figure 7.3.4: Market Share – Other Plan Types

Figure 7.4: Market Share by Provider Type

Figure 7.4.1: Public Providers vs Private Providers

Figure 7.5: Market Share by Demographics

Figure 7.5.1: Minors

Figure 7.5.2: Adults

Figure 7.5.3: Senior Citizens

Figure 7.6: Market Share by Provider Type (HMO, PPO, POS, EPO)

Figure 7.7: Market Share by Company

Figure 7.7.1: Revenue Shares of Top Companies

Figure 7.7.2: Competition Characteristics

Figure 8.1: Segment-wise Market Overview (2026–2034, USD Billion)

Figure 8.2: Segment-wise Market Share by Type

Figure 8.3: Segment-wise Market Share by Plan Type

Figure 8.4: Segment-wise Market Share by Provider

Figure 8.5: Segment-wise Market Share by Demographics

Figure 8.6: Segment-wise Market Share by Provider Type

Figure 8.7: Forecast Year Tables

Figure 9.1: Competitive Landscape – Company Profiles

Figure 9.1.1: Philippine Health Insurance Corporation – Business Segments

Figure 9.1.2: Philippine Health Insurance Corporation – Strategic Alliances/Partnerships

Figure 9.1.3: Philippine Health Insurance Corporation – Recent Developments

Figure 9.2.1: Medicard Philippines, Inc – Business Segments

Figure 9.2.2: Medicard Philippines, Inc – Strategic Alliances/Partnerships

Figure 9.2.3: Medicard Philippines, Inc – Recent Developments

Figure 9.3.1: Kaiser International Healthgroup, Inc. – Business Segments

Figure 9.3.2: Kaiser International Healthgroup, Inc. – Strategic Alliances/Partnerships

Figure 9.3.3: Kaiser International Healthgroup, Inc. – Recent Developments

Figure 9.4.1: Maxicare – Business Segments

Figure 9.4.2: Maxicare – Strategic Alliances/Partnerships

Figure 9.4.3: Maxicare – Recent Developments

Figure 9.5.1: Caritas Health Shield, Inc. – Business Segments

Figure 9.5.2: Caritas Health Shield, Inc. – Strategic Alliances/Partnerships

Figure 9.5.3: Caritas Health Shield, Inc. – Recent Developments

Figure 9.6.1: FWD Life Insurance Corporation – Business Segments

Figure 9.6.2: FWD Life Insurance Corporation – Strategic Alliances/Partnerships

Figure 9.6.3: FWD Life Insurance Corporation – Recent Developments

Figure 9.7.1: Singlife Philippines Inc. – Business Segments

Figure 9.7.2: Singlife Philippines Inc. – Strategic Alliances/Partnerships

Figure 9.7.3: Singlife Philippines Inc. – Recent Developments

Figure 9.8.1: Sun Life Assurance Company – Business Segments

Figure 9.8.2: Sun Life Assurance Company – Strategic Alliances/Partnerships

Figure 9.8.3: Sun Life Assurance Company – Recent Developments

Figure 9.9.1: Pru Life – Business Segments

Figure 9.9.2: Pru Life – Strategic Alliances/Partnerships

Figure 9.9.3: Pru Life – Recent Developments

Figure 9.10: Other Companies – Overview

Figure 10.1: Contact Information & Disclaimer

List of Table

Table 1.1: Study Objectives and Scope

Table 1.2: Product Definitions and Features

Table 1.3: Market Segmentation Criteria

Table 1.4: Study Variables and Metrics

Table 2.1: Secondary Data Sources

Table 2.2: Companies Interviewed (Secondary Research)

Table 2.3: Primary Data Collection – Respondent Profile

Table 2.4: Breakdown of Primary Interviews

Table 3.1: Key Market Insights – Executive Summary

Table 4.1: Market Drivers

Table 4.2: Market Challenges

Table 4.3: Opportunity Assessment

Table 5.1: Recent Trends and Developments

Table 6.1: Policy and Regulatory Overview

Table 7.1: Philippine Health Insurance Market Size (2020–2034, USD Billion)

Table 7.2: Market Share by Type (Life-Time Coverage vs Term Insurance)

Table 7.3: Market Share by Plan Type

Table 7.3.1: Medical Insurance Market Share

Table 7.3.2: Critical Illness Insurance Market Share

Table 7.3.3: Family Floater Health Insurance Market Share

Table 7.3.4: Other Plan Types Market Share

Table 7.4: Market Share by Provider Type

Table 7.4.1: Public vs Private Providers

Table 7.5: Market Share by Demographics

Table 7.5.1: Minors

Table 7.5.2: Adults

Table 7.5.3: Senior Citizens

Table 7.6: Market Share by Provider Type (HMO, PPO, POS, EPO)

Table 7.7: Market Share by Company

Table 7.7.1: Revenue Shares of Top Companies

Table 7.7.2: Competition Characteristics

Table 8.1: Segment-wise Market Overview (2026–2034, USD Billion)

Table 8.2: Segment-wise Market Share by Type

Table 8.3: Segment-wise Market Share by Plan Type

Table 8.4: Segment-wise Market Share by Provider

Table 8.5: Segment-wise Market Share by Demographics

Table 8.6: Segment-wise Market Share by Provider Type

Table 8.7: Forecast Year Tables

Table 9.1: Company Profiles – Overview

Table 9.1.1: Philippine Health Insurance Corporation – Business Segments

Table 9.1.2: Philippine Health Insurance Corporation – Strategic Alliances/Partnerships

Table 9.1.3: Philippine Health Insurance Corporation – Recent Developments

Table 9.2.1: Medicard Philippines, Inc – Business Segments

Table 9.2.2: Medicard Philippines, Inc – Strategic Alliances/Partnerships

Table 9.2.3: Medicard Philippines, Inc – Recent Developments

Table 9.3.1: Kaiser International Healthgroup, Inc. – Business Segments

Table 9.3.2: Kaiser International Healthgroup, Inc. – Strategic Alliances/Partnerships

Table 9.3.3: Kaiser International Healthgroup, Inc. – Recent Developments

Table 9.4.1: Maxicare – Business Segments

Table 9.4.2: Maxicare – Strategic Alliances/Partnerships

Table 9.4.3: Maxicare – Recent Developments

Table 9.5.1: Caritas Health Shield, Inc. – Business Segments

Table 9.5.2: Caritas Health Shield, Inc. – Strategic Alliances/Partnerships

Table 9.5.3: Caritas Health Shield, Inc. – Recent Developments

Table 9.6.1: FWD Life Insurance Corporation – Business Segments

Table 9.6.2: FWD Life Insurance Corporation – Strategic Alliances/Partnerships

Table 9.6.3: FWD Life Insurance Corporation – Recent Developments

Table 9.7.1: Singlife Philippines Inc. – Business Segments

Table 9.7.2: Singlife Philippines Inc. – Strategic Alliances/Partnerships

Table 9.7.3: Singlife Philippines Inc. – Recent Developments

Table 9.8.1: Sun Life Assurance Company – Business Segments

Table 9.8.2: Sun Life Assurance Company – Strategic Alliances/Partnerships

Table 9.8.3: Sun Life Assurance Company – Recent Developments

Table 9.9.1: Pru Life – Business Segments

Table 9.9.2: Pru Life – Strategic Alliances/Partnerships

Table 9.9.3: Pru Life – Recent Developments

Table 9.10: Other Companies – Overview

Table 10.1: Contact Information & Disclaimer

Top Key Players & Market Share Outlook

- Philippine Health Insurance Corporation

- Medicard Philippines, Inc

- Kaiser International Healthgroup, Inc.

- Maxicare

- Caritas Health Shield, Inc.

- Fwd Life Insurance Corporation

- Singlife Philippines Inc.

- Sun Life Assurance Company

- Pru Life

- Others

Frequently Asked Questions