Understand The Key Trends Shaping This Market

Download Free SampleIndia Cyber Insurance Market Overview: Market Size & Forecast (2026–2034)

What is the anticipated CAGR & size of the India Cyber Insurance Market?

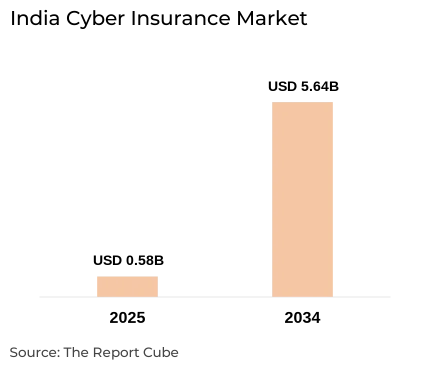

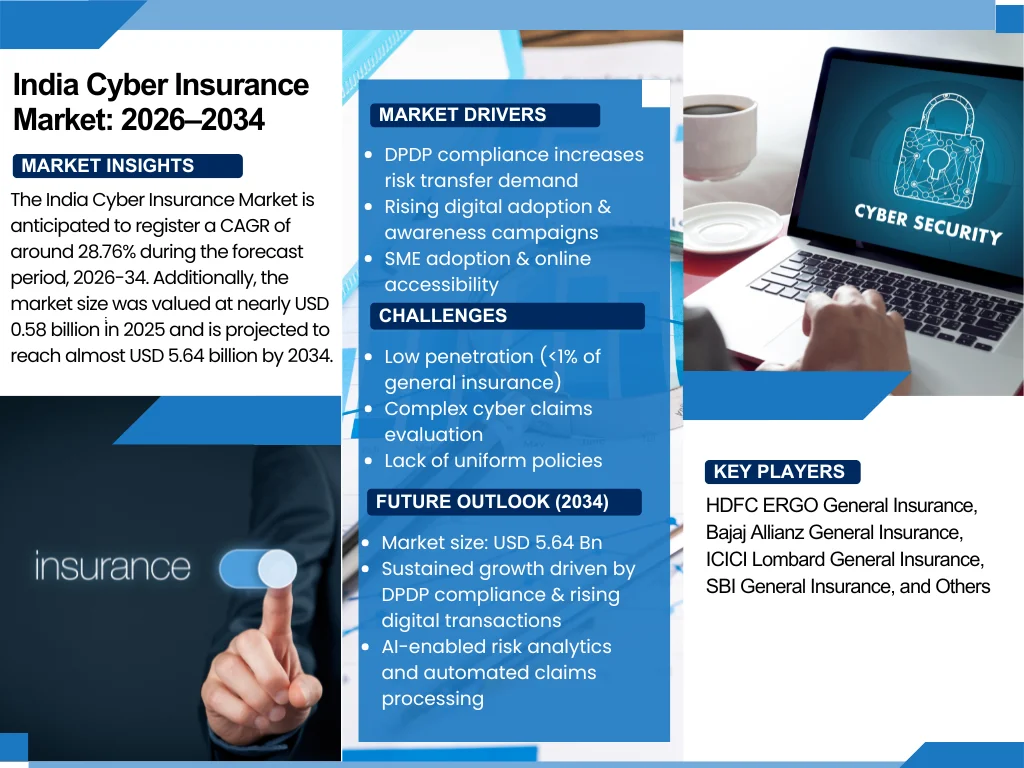

The India Cyber Insurance Market is anticipated to register a CAGR of around 28.76% during the forecast period, 2026-34. Additionally, the market size was valued at nearly USD 0.58 billion in 2025 and is projected to reach almost USD 5.64 billion by 2034.

Market Analysis & Insights

As more companies & individuals seek defense against ransomware, social engineering fraud, and data breaches, the India Cyber Insurance Market is expanding swiftly. India recorded about 1.3 million cyberattacks in 2023 (CERT-In), according to industry estimates, with incidents growing by over 15% year over year. Thus, this forced insurer to develop new coverage frameworks. Moreover, in India, cyber insurance covers costs linked with ransomware, cyber extortion, business interruption, and data breaches.

Further, manufacturing, IT & telecom, BFSI, and healthcare are among the major industries that gain prominence across the market by adopting cyber insurance. Furthermore, coverage access is assisted by sales intermediaries such as brokers, internet platforms, and direct sales. Also, leading market companies include Tata AIG, Bajaj Allianz, HDFC ERGO, and ICICI Lombard that contribute in creating a positive market outlook. Additionally, customized policies for individuals & SMEs have been made recently to combat the rise in social engineering fraud. Further, initiatives from the government prioritize cyber risk reduction & CERT-In reporting, hence creating prospects.

Besides. Indian cyber security insurance trends are being influenced by the growing knowledge of cyberattack statistics & business disruption losses, which is echoed in the elevated acceptance of cyber insurance. Thus, this inspires companies to get cyber insurance online across India for comprehensive coverage, further instigating the India Cyber Insurance Market demand.

Furthermore, the India Cyber Insurance Market’s growth is supported by increasing awareness campaigns, accessibility of cyber liability insurance for SMEs India, and the facility to purchase cyber insurance online. Also, with digital transactions climbing & the government aiming at DPDP compliance, the future of cyber insurance in India would center on AI-led risk assessment, real-time incident response, and evolving claims models to address the expanding cyber claims ratio across the country in the future years.

What is the Impact of AI in the India Cyber Insurance Market?

AI is altering Indian Cyber Security Insurance Market trends by enhancing risk profiling, automating underwriting, and detecting fraudulent claims. Also, AI-based analytics aid insurers model ransomware & data breach exposure in real-time.

India Cyber Insurance Market Dynamics

What driving factor acts as a positive influencer for the India Cyber Insurance Market?

- Growing DPDP-Driven Compliance & Risk Transfer Demand: The Digital Personal Data Protection Act (DPDP) 2023's passage has elevated business demand for liability transfer & cyber risk mitigation, thus driving market. Also, the acceptance of customized policies has augmented as a result of the obligation for industries to secure personal data & notify CERT-In of breaches. Also, the BFSI, IT, and healthcare sectors across India are observing sturdy growth due to this regulation change in the demand for dependable cyber insurance coverage.

What are the challenges that affect the India Cyber Insurance Market?

- Low Penetration & Complex Cyber Claims Ratio to Hinder Market: Even though cyberattacks are on the surge in India, less than 1% of all general insurance is covered by cyber insurance. Lack of uniform policy wording, low knowledge, and India's complex cyber claims ratio all hinder implementation, predominantly among SMEs. Additionally, evaluating business interruption losses & assigning liability after a breach continue to be considerable operational challenges for insurers & reinsurers across India's shifting risk environment.

How are the future opportunities transforming the market during 2026-34?

- Increasing SME Adoption & Digital Distribution: The surge of cyber liability insurance for SMEs in India via digital platforms & aggregators has created an untapped growth opportunity for the India Cyber Insurance Market. Further, easy access to acquire cyber insurance online, along with IRDAI’s thrust for digital underwriting, allows insurers to expand low-cost coverage. Thus, this democratization promotes deeper reach across India’s start-up & MSME sectors, substantially enhancing market scalability & resilience.

What market trends are affecting the India Cyber Insurance Market Outlook?

- AI-Powered Underwriting & Automated Risk Analytics: Predictive analytics & AI are being applied by more & more insurers to dynamically price cyber insurance policies in India. Also, companies now customize premiums by scrutinizing social engineering fraud risks, historical breach trends, and network security flaws. Further, the future of cyber insurance in India is being reformed by the incorporation of risk-scoring algorithms, real-time data feeds, and security automation, which redefines operational efficacy.

How is the India Cyber Insurance Market Defined as per Segments?

The India Cyber Insurance Market Research Reports provide detailed market data & insights in accordance with market segmentation. Some of the segments are:

- Type: First-Party Coverage, Third-Party Liability, Data Breach Response, Ransomware Coverage, Business Interruption

- End-User: Small & Medium Enterprises (SMEs), Large Enterprises, Government & Public Sector, Individuals

By Type:

The First-Party Coverage segment captures the prominent market share of around 50% in the India Cyber Insurance Industry.

The segment addresses the direct monetary damages resulting from cyber events such as data breaches, ransomware attacks, and company disruptions. Also, as SMEs are chiefly vulnerable to cyberattacks & need protection against immediate operational & financial effects, it is a vital element in the context of increasing cyber risk awareness.

By End-User:

The Small & Medium Enterprises (SMEs) lead the India Cyber Insurance Market with about 45% market share.

SMEs face rising cyber risk exposure but generally lack satisfactory in-house cybersecurity expertise, motivating dependence on cyber insurance for risk transfer. Also, large enterprises & government sectors make up the rest, usually opting for wide-ranging, customized policies, addressing regulatory compliance & complex cyber risk mitigation needs.

India Cyber Insurance Market: What Recent Innovations Are Affecting the Industry?

- 2025: HDFC ERGO General Insurance launched an AI-enabled CyberSafe 360 Policy incorporating automatic breach response & digital forensics support for businesses.

- 2025: ICICI Lombard General Insurance introduced the Cyber Shield for Businesses, introducing predictive threat modeling & real-time DPDP compliance assessment for large corporate clients.

What are the Key Highlights of the India Cyber Insurance Market (2026–34)?

- The India Cyber Insurance Market CAGR is expected around 28.76% during 2034, with market size reaching USD 5.64 billion by 2034.

- By type, first-party coverage dominates with about 50% market share, covering direct losses such as ransomware & data breach risks.

- By end-user, small & medium enterprises (SMEs) lead with nearly 45% market share owing to amplified cyber risk exposure & narrow internal defenses.

- By industry, BFSI captures the biggest market share of nearly 30%, influenced by critical requirement for cyber risk mitigation & compliance necessities.

- By coverage type, packaged policies seize approximately 60% market share, favored for forthright, all-inclusive cyber insurance coverage.

- By distribution channel, insurance brokers govern with around 40% market share, providing expert guidance & broader market access.

- By policy duration, long-term policies rule the market with over 70% share, favored for ongoing cyber protection.

- By premium range, medium premium range (INR 1-10 Lakh) covers roughly 55% share, complementing affordability & comprehensive

- AI reforms underwriting & cyber claims ratio across the India Cyber Insurance Market.

How does the Future Outlook of the India Cyber Insurance Market (2034) Appear?

- Sustained Growth: Through 2034, the India Cyber Insurance Market would be instigated by rising digital acceptance & compliance with the Digital Personal Data Protection Act (DPDP), further recording nearly 28.76% CAGR (2026-34), and envisioned market value of approx. USD 5.64 bn in 2034.

- Technological Upgrade: AI-driven risk analysis, automated claims, and dynamic cyber risk profiling enhance underwriting accuracy across Cyber Insurance Market in India.

- Future Opportunities: Augmented cyberattacks & regulatory pressure drive demand for customized SME & individual cyber insurance, with AI improving fraud detection & risk mitigation.

The future outlook of the India Cyber Insurance Market is projected to progress, offering both individuals & businesses scalable & reasonably priced security.

What Does Our India Cyber Insurance Market Research Study Entail?

- The India Cyber Insurance Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis & market scope sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The India Cyber Insurance Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the Study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Breakdown of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- India Cyber Insurance Market Overview

- Market Size, By Value (in USD Billion)

- Market Share, By Type

- First-Party Coverage

- Third-Party Liability

- Data Breach Response

- Ransomware Coverage

- Business Interruption

- Market Share, By End-User

- Small & Medium Enterprises (SMEs)

- Large Enterprises

- Government & Public Sector

- Individuals

- Market Share, By Industry

- BFSI (Banking, Financial Services & Insurance)

- Healthcare

- IT & Telecom

- Retail & E-commerce

- Manufacturing

- Education

- Others

- Market Share, By Coverage Type

- Packaged (Bundled) Policies

- Stand-alone Policies

- Customized Coverage

- Market Share, By Distribution Channel

- Direct Sales

- Insurance Brokers

- Online Platforms

- Agents

- Market Share, By Policy Duration

- Short-Term Policies

- Long-Term Policies

- Market Share, By Premium Range

- Low Premium (Below INR 1 Lakh)

- Medium Premium (INR 1 Lakh - INR 10 Lakh)

- High Premium (Above INR 10 Lakh)

- Market Share, By Region

- North India

- West and Central India

- South India

- East and Northeast India

- Market Share, By Company

- Revenue Shares

- Competition Characteristics

- India Cyber Insurance Market Overview, 2026-2034

- By Value (USD Billion)

- By Type

- By End-User

- By Industry

- By Coverage Type

- By Distribution Channel

- By Policy Duration

- By Premium Range

- By Region

- Competitive Outlook (Company Profiles)

- HDFC ERGO General Insurance

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Bajaj Allianz General Insurance

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- ICICI Lombard General Insurance

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- SBI General Insurance

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- TATA AIG General Insurance

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Zurich Kotak General Insurance

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Go Digit General Insurance

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Others

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- HDFC ERGO General Insurance

- Contact Us & Disclaimer

List of Figure

Figure 1.1: Objective of the Study

Figure 1.2: Product Definition of Cyber Insurance

Figure 1.3: Market Segmentation Overview

Figure 1.4: Study Variables

Figure 2.1: Research Methodology Flowchart

Figure 2.2: Secondary Data Sources

Figure 2.3: Companies Interviewed for Secondary Research

Figure 2.4: Primary Data Collection Breakdown

Figure 2.5: Distribution of Primary Interviews

Figure 3.1: Executive Summary Snapshot

Figure 4.1: Key Market Drivers

Figure 4.2: Challenges in the India Cyber Insurance Market

Figure 4.3: Opportunity Assessment Matrix

Figure 5.1: Recent Trends and Developments in Cyber Insurance

Figure 6.1: Policy and Regulatory Landscape Overview

Figure 7.1: India Cyber Insurance Market Size (USD Billion)

Figure 7.2: Market Share by Type

Figure 7.2.1: First-Party Coverage Share

Figure 7.2.2: Third-Party Liability Share

Figure 7.2.3: Data Breach Response Share

Figure 7.2.4: Ransomware Coverage Share

Figure 7.2.5: Business Interruption Coverage Share

Figure 7.3: Market Share by End-User

Figure 7.3.1: SMEs vs Large Enterprises vs Government vs Individuals

Figure 7.4: Market Share by Industry

Figure 7.4.1: BFSI

Figure 7.4.2: Healthcare

Figure 7.4.3: IT & Telecom

Figure 7.4.4: Retail & E-commerce

Figure 7.4.5: Manufacturing

Figure 7.4.6: Education

Figure 7.4.7: Others

Figure 7.5: Market Share by Coverage Type

Figure 7.5.1: Packaged Policies

Figure 7.5.2: Stand-alone Policies

Figure 7.5.3: Customized Coverage

Figure 7.6: Market Share by Distribution Channel

Figure 7.6.1: Direct Sales

Figure 7.6.2: Insurance Brokers

Figure 7.6.3: Online Platforms

Figure 7.6.4: Agents

Figure 7.7: Market Share by Policy Duration

Figure 7.7.1: Short-Term Policies

Figure 7.7.2: Long-Term Policies

Figure 7.8: Market Share by Premium Range

Figure 7.8.1: Low Premium (< INR 1 Lakh)

Figure 7.8.2: Medium Premium (INR 1–10 Lakh)

Figure 7.8.3: High Premium (> INR 10 Lakh)

Figure 7.9: Market Share by Region

Figure 7.9.1: North India

Figure 7.9.2: West & Central India

Figure 7.9.3: South India

Figure 7.9.4: East & Northeast India

Figure 7.10: Market Share by Company

Figure 7.10.1: Revenue Shares of Key Players

Figure 7.10.2: Competitive Landscape Characteristics

Figure 8.1: India Cyber Insurance Market Forecast (2026–2034) – By Value

Figure 8.2: Market Forecast by Type

Figure 8.3: Market Forecast by End-User

Figure 8.4: Market Forecast by Industry

Figure 8.5: Market Forecast by Coverage Type

Figure 8.6: Market Forecast by Distribution Channel

Figure 8.7: Market Forecast by Policy Duration

Figure 8.8: Market Forecast by Premium Range

Figure 8.9: Market Forecast by Region

Figure 9.1: HDFC ERGO General Insurance – Company Overview

Figure 9.2: Bajaj Allianz General Insurance – Company Overview

Figure 9.3: ICICI Lombard General Insurance – Company Overview

Figure 9.4: SBI General Insurance – Company Overview

Figure 9.5: TATA AIG General Insurance – Company Overview

Figure 9.6: Zurich Kotak General Insurance – Company Overview

Figure 9.7: Go Digit General Insurance – Company Overview

Figure 9.8: Other Key Players – Overview

List of Table

Table 1.1: Study Objectives

Table 1.2: Product Definition

Table 1.3: Market Segmentation

Table 1.4: Study Variables

Table 2.1: Secondary Data Sources

Table 2.2: Companies Interviewed for Secondary Research

Table 2.3: Primary Data Points

Table 2.4: Breakdown of Primary Interviews

Table 4.1: Key Market Drivers

Table 4.2: Challenges in the India Cyber Insurance Market

Table 4.3: Opportunity Assessment

Table 5.1: Recent Trends and Developments

Table 6.1: Policy and Regulatory Landscape

Table 7.1: India Cyber Insurance Market Size (USD Billion)

Table 7.2: Market Share by Type

Table 7.2.1: First-Party Coverage Share (%)

Table 7.2.2: Third-Party Liability Share (%)

Table 7.2.3: Data Breach Response Share (%)

Table 7.2.4: Ransomware Coverage Share (%)

Table 7.2.5: Business Interruption Coverage Share (%)

Table 7.3: Market Share by End-User

Table 7.3.1: SMEs vs Large Enterprises vs Government vs Individuals

Table 7.4: Market Share by Industry

Table 7.4.1: BFSI

Table 7.4.2: Healthcare

Table 7.4.3: IT & Telecom

Table 7.4.4: Retail & E-commerce

Table 7.4.5: Manufacturing

Table 7.4.6: Education

Table 7.4.7: Others

Table 7.5: Market Share by Coverage Type

Table 7.5.1: Packaged Policies

Table 7.5.2: Stand-alone Policies

Table 7.5.3: Customized Coverage

Table 7.6: Market Share by Distribution Channel

Table 7.6.1: Direct Sales

Table 7.6.2: Insurance Brokers

Table 7.6.3: Online Platforms

Table 7.6.4: Agents

Table 7.7: Market Share by Policy Duration

Table 7.7.1: Short-Term Policies

Table 7.7.2: Long-Term Policies

Table 7.8: Market Share by Premium Range

Table 7.8.1: Low Premium (< INR 1 Lakh)

Table 7.8.2: Medium Premium (INR 1–10 Lakh)

Table 7.8.3: High Premium (> INR 10 Lakh)

Table 7.9: Market Share by Region

Table 7.9.1: North India

Table 7.9.2: West & Central India

Table 7.9.3: South India

Table 7.9.4: East & Northeast India

Table 7.10: Market Share by Company

Table 7.10.1: Revenue Shares of Key Players

Table 7.10.2: Competitive Landscape Characteristics

Table 8.1: India Cyber Insurance Market Forecast (2026–2034) – By Value

Table 8.2: Market Forecast by Type

Table 8.3: Market Forecast by End-User

Table 8.4: Market Forecast by Industry

Table 8.5: Market Forecast by Coverage Type

Table 8.6: Market Forecast by Distribution Channel

Table 8.7: Market Forecast by Policy Duration

Table 8.8: Market Forecast by Premium Range

Table 8.9: Market Forecast by Region

Table 9.1: HDFC ERGO General Insurance – Key Metrics

Table 9.2: Bajaj Allianz General Insurance – Key Metrics

Table 9.3: ICICI Lombard General Insurance – Key Metrics

Table 9.4: SBI General Insurance – Key Metrics

Table 9.5: TATA AIG General Insurance – Key Metrics

Table 9.6: Zurich Kotak General Insurance – Key Metrics

Table 9.7: Go Digit General Insurance – Key Metrics

Table 9.8: Other Key Players – Key Metrics

Top Key Players & Market Share Outlook

- HDFC ERGO General Insurance

- Bajaj Allianz General Insurance

- ICICI Lombard General Insurance

- SBI General Insurance

- TATA AIG General Insurance

- Zurich Kotak General Insurance

- Go Digit General Insurance

- Others

Frequently Asked Questions