Understand The Key Trends Shaping This Market

Download Free SampleUAE Sugar-Free Ice Cream Market Overview: Market Size & Forecast (2026–2032)

What is the anticipated CAGR & size of the UAE Sugar-Free Ice Cream Market?

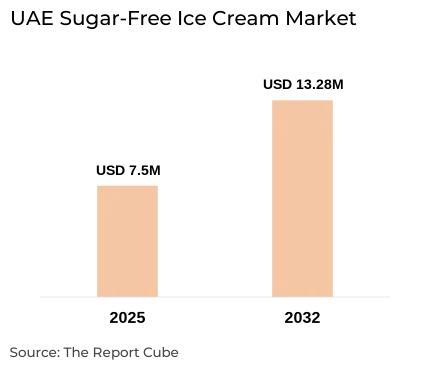

The UAE Sugar-Free Ice Cream Market is anticipated to register a CAGR of around 8.5% during 2026–2032. Also, the market size was valued at nearly USD 7.5 million in 2025 and is projected to reach USD 13.28 million by 2032.

Market Analysis & Insights (2025-32)

The industry growth is driven by rising health consciousness, growing diabetic-friendly consumption, and premiumization in frozen desserts. Natural sugar-free ice creams (utilizing erythritol, xylitol, monk fruit), vegan sugar-free ice creams (oat- or coconut-milk bases), and halal sugar-free ice creams are gaining traction across the UAE due to great halal supply chains & higher demand for plant-based & clean-label offerings. Furthermore, retail expansion is supported by supermarket & hotel demand for premium, healthier desserts, while online grocery & direct-to-consumer channels escalate market reach.

Moreover, producers & specialty brands are offering tub formats, bars, and novelty sticks intended for diabetic-concerned & calorie-conscious customers. Also, the UAE Sugar-Free Ice Cream Market observed innovation in texture & flavor to match full-sugar counterparts (e.g., premium sorbets, lactose-free frozen yogurts), and local distribution networks, large FMCG distributors & supermarket chains are quickly adopting sugar-free SKUs.

The UAE Sugar-Free Ice Cream Market is gaining robust momentum as health-conscious individuals incline toward low-calorie, diabetic-friendly, and plant-based frozen desserts. Further driven by surging lifestyle diseases, wellness-focused procurement, and premium indulgence trends, the industry is observing rapid innovation in vegan, halal, and natural sugar-free formulations. Also, key market companies, like The Brooklyn Creamery & Denada, are expanding their UAE presence with zero-added-sugar & keto-friendly launches, supported by modern retail expansion in hypermarkets, specialty stores, and convenience outlets, along with solid uptake in online grocery & direct-to-consumer (D2C) channels.

Additionally, the UAE Sugar-Free Ice Cream Market future outlook suggests tremendous expansion, driven by AI-enabled personalization, cold-chain optimization, and algorithmic promotions that adapt offerings for age groups, generally 21–30 & 31–40 years. Also, with strong backing from related sectors, including dairy, plant-based suppliers, hospitality, and retail, prospects remain positive. Further, the UAE Sugar-Free Ice Cream Industry is projected to continue expanding, with premium, plant-based, and diabetic-friendly forms, acting as the primary development market drivers through 2032.

UAE Sugar-Free Ice Cream Market Dynamics

What driving factor acts as a positive influencer for the UAE Sugar-Free Ice Cream Market?

- Healthy & Lifestyle Shift Toward Low/No-Sugar Indulgence to Elevate Market Demand: A sustained surge in lifestyle diseases & preventive health consciousness is the major driver for the UAE Sugar-Free Ice Cream Market. Also, customers increasingly look for indulgence without high glycemic load, which is robust among young adults (21–30) & middle-aged health seekers (31–40) who trade up to premium, low-calorie desserts. Moreover, the travel & hospitality industries (premium hotels, airport lounges, etc.) also demand diabetic-friendly & halal-certified sugar-free choices, generating B2B demand beyond retail.

What are the challenges that affect the UAE Sugar-Free Ice Cream Market?

- Taste & Texture Parity with Sugar Products & Items to Limit Growth: The texture, creaminess, and flavor release of sugar in frozen sweets are all challenging to replicate. Moreover, sugar alternatives may provide cooling effects, an aftertaste, or a less intense flavor, but attaining parity needs substantial R&D and increased ingredient requirements. Moreover, formulators are needed to make investments in stabilizers, fat blends, and processing (like micro-emulsification), owing to the high expectations of the UAE customers for luxury sensory experiences. Thus, this complicates mass adoption & raises price points across the national market.

How are the future opportunities transforming the market during 2026-32?

- Premiumization, Plant-Based & Niche Positioning to Create Prospects: There’s a solid premiumization opportunity, as customers would pay more for natural, vegan sugar-free ice creams or halal-certified premium tubs with exotic flavors (date-based, saffron, Arabic coffee). Also, private-label associations between supermarket chains & specialty producers could unlock scale, while co-branding with nutritionists & fitness platforms could increase trust among diabetic & weight-management cohorts. Further, an upsurge in online subscriptions & gifting (health-focused gift boxes) is an under-exploited route to improve market sales, generating prospects across the UAE Sugar-Free Ice Cream Market.

What market trends are affecting the UAE Sugar-Free Ice Cream Market Outlook?

- Increasing Digitalization & AI Deployment in Supply, Marketing & Product Personalization: Artificial intelligence (AI) is being employed to predict seasonal demand, optimize production schedules for perishable goods, and influence supermarket app recommendation engines, which increase the likelihood of impulsive purchases of sugar-free products. Moreover, targeted promotions & algorithmic costing are aggregating conversion. Also, on the manufacturing side, batch failure is reduced by automation & AI-driven quality control (texture imaging, viscosity sensors). Further, brands that leverage data for SKU rationalization & dynamic assortment see quicker retail adoption, thus elevating the industry growth.

How is the UAE Sugar-Free Ice Cream Market Defined as per Segments?

- Form: Pints, Bars/Sticks, Sandwiches, and Others

- Distribution Channels: Offline Sales Channel (Supermarkets & Hypermarkets, Convenience Stores, and Specialty Stores), and Online Sales Channel

By Form:

The Pint (tubs) form of ice creams leads the UAE Sugar-Free Ice Cream Market as they serve both retail households & premium hospitality requirements. Tubs allow for premium formulations (rich textures, inclusions), assortment (multi-serving), and enhanced profit packing for brands. They are prevalent among families & gift-buyers, and they are a great in-home treat for those between the ages of 31-40 and 41-50.

Moreover, the expansion of the UAE Sugar-Free Ice Cream Market & the premium drive for healthy ice creams is also elevating this segment’s demand, further translating into increased exposure in supermarket freezers & allowing for seasonal, limited flavors.

By Distribution Channels:

Offline Sales Channels (Supermarkets & Hypermarkets) remain the leading distribution channel for the Sugar-Free Ice Cream Market in the UAE by capturing the potential market share. Large retail chains offer national coverage, cold-chain display, and co-marketing prospects (end-aisle promotions, loyalty-programme features).

Also, supermarkets aid in introducing sugar-free SKUs to mainstream shoppers & to older age groups (41–50 & above 50), who favor in-store purchase. On the other hand, while the online grocery sector is also expanding at a faster pace, the refrigerated nature & impulse purchase behavior still positions offline channels foremost for market penetration & mass awareness across the UAE.

What are the Key Highlights of the UAE Sugar-Free Ice Cream Market (2026–32)?

- The UAE Sugar-Free Ice Cream Market is anticipated to expand at a strong CAGR, driven by health-conscious customers.

- Expanding the UAE Healthy Ice Cream Market with demand for diabetic-friendly, low-calorie, and plant-based options is also influencing this market’s growth.

- Premium & innovative flavors to improve the UAE Sugar-Free Ice Cream Market appeal.

- AI improves personalization, predictive demand, and smart retail distribution across the Sugar-Free Ice Cream Market in the UAE.

- Growing investments, evolving regulations, and digital innovation reshape the UAE Sugar-Free Ice Cream Industry landscape.

How does the Future Outlook of the UAE Sugar-Free Ice Cream Market (2032) Appears?

The UAE Sugar-Free Ice Cream Market is projected to expand gradually by 2032, owing to rising health awareness, demand for diabetic-friendly items, and innovation in the nation's frozen desserts industry. Also, AI-driven personalization, astute retail insights, and taste innovation would improve consumer experiences in the UAE Sugar-Free Ice Cream Industry, which is estimated to grow at a robust rate. In addition, as the years pass, the market would observe expansion opportunities in the premium & plant-based categories, which would further favor the market's future outlook & redefine customer desire for guilt-free delight.

What Does Our UAE Sugar-Free Ice Cream Market Research Study Entail?

- The UAE Sugar-Free Ice Cream Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The UAE Sugar-Free Ice Cream Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- UAE Sugar-Free Ice Cream Market Overview (2020-2032)

- Market Size, By Value (in USD Millions)

- Market Share, By Flavor

- Vanilla

- Chocolate

- Cookies and Cream

- Mint Chip

- Strawberry

- Peanut Butter

- Salted Caramel

- Coffee

- Market Share, By Form

- Pints

- Bars/Sticks

- Sandwiches

- Others

- Market Share, By Distribution Channels

- Offline Sales Channel

- Online Sales Channel

- Market Share, By Region

- North

- East

- West

- South

- Central

- Market Share, By Competitors

- Competition Characteristics

- Revenue Shares

- UAE Vanilla Sugar-Free Ice Cream Market Overview, 2020-2032F

- By Value (USD Million)

- By Form- Market Size & Forecast 2019-2030, USD Million

- By Distribution Channels- Market Size & Forecast 2019-2030, USD Million

- UAE Chocolate Sugar-Free Ice Cream Market Overview, 2020-2032F

- By Value (USD Million)

- By Form- Market Size & Forecast 2019-2030, USD Million

- By Distribution Channels- Market Size & Forecast 2019-2030, USD Million

- UAE Cookies and Cream Sugar-Free Ice Cream Market Overview, 2020-2032F

- By Value (USD Million)

- By Form- Market Size & Forecast 2019-2030, USD Million

- By Distribution Channels- Market Size & Forecast 2019-2030, USD Million

- UAE Mint Chip Sugar-Free Ice Cream Market Overview, 2020-2032F

- By Value (USD Million)

- By Form- Market Size & Forecast 2019-2030, USD Million

- By Distribution Channels- Market Size & Forecast 2019-2030, USD Million

- UAE Strawberry Sugar-Free Ice Cream Market Overview, 2020-2032F

- By Value (USD Million)

- By Form- Market Size & Forecast 2019-2030, USD Million

- By Distribution Channels- Market Size & Forecast 2019-2030, USD Million

- UAE Peanut Butter Sugar-Free Ice Cream Market Overview, 2020-2032F

- By Value (USD Million)

- By Form- Market Size & Forecast 2019-2030, USD Million

- By Distribution Channels- Market Size & Forecast 2019-2030, USD Million

- UAE Salted Caramel Sugar-Free Ice Cream Market Overview, 2020-2032F

- By Value (USD Million)

- By Form- Market Size & Forecast 2019-2030, USD Million

- By Distribution Channels- Market Size & Forecast 2019-2030, USD Million

- UAE Coffee Sugar-Free Ice Cream Market Overview, 2020-2032F

- By Value (USD Million)

- By Form- Market Size & Forecast 2019-2030, USD Million

- By Distribution Channels- Market Size & Forecast 2019-2030, USD Million

- Competitive Outlook (Company Profile - Partila List)

- Yolé

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- The Brooklyn Creamery

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Denada

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Dione

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Moishi

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- House of Pops

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- NOTO

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Artinci

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- London Dairy

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- My Govinda’s

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Yolé

- Contact Us & Disclaimer

List of Figure

Figure 1.1 – Study Objective Overview

Figure 1.2 – Product Definition and Characteristics

Figure 1.3 – Market Segmentation Framework

Figure 1.4 – Study Variables Considered

Figure 2.1 – Secondary Data Sources Overview

Figure 2.2 – Companies Interviewed for Secondary Research

Figure 2.3 – Primary Data Collection Process

Figure 2.4 – Breakdown of Primary Interviews by Stakeholder Type

Figure 3.1 – Executive Summary Key Insights

Figure 4.1 – Market Drivers of UAE Sugar-Free Ice Cream

Figure 4.2 – Market Challenges Overview

Figure 4.3 – Opportunity Assessment Matrix

Figure 5.1 – Recent Market Trends and Developments

Figure 6.1 – Policy & Regulatory Landscape – Key Policies and Impact

Figure 7.1 – UAE Sugar-Free Ice Cream Market Size (2020-2032) (USD Million)

Figure 7.2 – Market Share by Flavor (2023)

Figure 7.3 – Market Share by Form (Pints, Bars, Sandwiches, Others)

Figure 7.4 – Market Share by Distribution Channels (Online vs Offline)

Figure 7.5 – Market Share by Region (North, East, West, South, Central)

Figure 7.6 – Market Share by Competitors (Revenue Shares & Characteristics)

Figure 8.1 – Vanilla Sugar-Free Ice Cream Market Value (2020-2032)

Figure 8.2 – Vanilla Market Size by Form (2019-2030)

Figure 8.3 – Vanilla Market Size by Distribution Channel (2019-2030)

Figure 9.1 – Chocolate Sugar-Free Ice Cream Market Value (2020-2032)

Figure 9.2 – Chocolate Market Size by Form (2019-2030)

Figure 9.3 – Chocolate Market Size by Distribution Channel (2019-2030)

Figure 10.1 – Cookies & Cream Sugar-Free Ice Cream Market Value (2020-2032)

Figure 10.2 – Cookies & Cream Market Size by Form (2019-2030)

Figure 10.3 – Cookies & Cream Market Size by Distribution Channel (2019-2030)

Figure 11.1 – Mint Chip Sugar-Free Ice Cream Market Value (2020-2032)

Figure 11.2 – Mint Chip Market Size by Form (2019-2030)

Figure 11.3 – Mint Chip Market Size by Distribution Channel (2019-2030)

Figure 12.1 – Strawberry Sugar-Free Ice Cream Market Value (2020-2032)

Figure 12.2 – Strawberry Market Size by Form (2019-2030)

Figure 12.3 – Strawberry Market Size by Distribution Channel (2019-2030)

Figure 13.1 – Peanut Butter Sugar-Free Ice Cream Market Value (2020-2032)

Figure 13.2 – Peanut Butter Market Size by Form (2019-2030)

Figure 13.3 – Peanut Butter Market Size by Distribution Channel (2019-2030)

Figure 14.1 – Salted Caramel Sugar-Free Ice Cream Market Value (2020-2032)

Figure 14.2 – Salted Caramel Market Size by Form (2019-2030)

Figure 14.3 – Salted Caramel Market Size by Distribution Channel (2019-2030)

Figure 15.1 – Coffee Sugar-Free Ice Cream Market Value (2020-2032)

Figure 15.2 – Coffee Market Size by Form (2019-2030)

Figure 15.3 – Coffee Market Size by Distribution Channel (2019-2030)

Figure 16.1 – Competitive Landscape Overview

Figure 16.2 – Company Profiles: Yolé, Brooklyn Creamery, Denada, Dione, Moishi, House of Pops, NOTO, Artinci, London Dairy, My Govinda’s (Key Metrics and Developments)

List of Table

Table 1.1 – Study Objectives and Scope

Table 1.2 – Product Definition Details

Table 1.3 – Market Segmentation Parameters

Table 1.4 – Study Variables List

Table 2.1 – Secondary Data Sources

Table 2.2 – List of Companies Interviewed (Secondary Research)

Table 2.3 – Primary Data Collection Approach

Table 2.4 – Primary Interviews Breakdown (by Stakeholder Type)

Table 3.1 – Key Executive Summary Metrics

Table 4.1 – Market Drivers Summary

Table 4.2 – Market Challenges Summary

Table 4.3 – Opportunity Assessment Factors

Table 5.1 – Recent Trends and Developments List

Table 6.1 – Key Policy and Regulatory Framework

Table 7.1 – UAE Sugar-Free Ice Cream Market Size by Year (2020-2032), USD Million

Table 7.2 – Market Share by Flavor – Vanilla, Chocolate, Cookies & Cream, etc.

Table 7.3 – Market Share by Form – Pints, Bars, Sandwiches, Others

Table 7.4 – Market Share by Distribution Channel – Offline vs Online

Table 7.5 – Market Share by Region – North, East, West, South, Central

Table 7.6 – Competitor Revenue Shares and Characteristics

Table 8.1 – Vanilla Sugar-Free Ice Cream Market Size by Year (USD Million)

Table 8.2 – Vanilla Market Size by Form (2019-2030)

Table 8.3 – Vanilla Market Size by Distribution Channel (2019-2030)

Table 9.1 – Chocolate Sugar-Free Ice Cream Market Size by Year (USD Million)

Table 9.2 – Chocolate Market Size by Form (2019-2030)

Table 9.3 – Chocolate Market Size by Distribution Channel (2019-2030)

Table 10.1 – Cookies & Cream Sugar-Free Ice Cream Market Size by Year (USD Million)

Table 10.2 – Cookies & Cream Market Size by Form (2019-2030)

Table 10.3 – Cookies & Cream Market Size by Distribution Channel (2019-2030)

Table 11.1 – Mint Chip Sugar-Free Ice Cream Market Size by Year (USD Million)

Table 11.2 – Mint Chip Market Size by Form (2019-2030)

Table 11.3 – Mint Chip Market Size by Distribution Channel (2019-2030)

Table 12.1 – Strawberry Sugar-Free Ice Cream Market Size by Year (USD Million)

Table 12.2 – Strawberry Market Size by Form (2019-2030)

Table 12.3 – Strawberry Market Size by Distribution Channel (2019-2030)

Table 13.1 – Peanut Butter Sugar-Free Ice Cream Market Size by Year (USD Million)

Table 13.2 – Peanut Butter Market Size by Form (2019-2030)

Table 13.3 – Peanut Butter Market Size by Distribution Channel (2019-2030)

Table 14.1 – Salted Caramel Sugar-Free Ice Cream Market Size by Year (USD Million)

Table 14.2 – Salted Caramel Market Size by Form (2019-2030)

Table 14.3 – Salted Caramel Market Size by Distribution Channel (2019-2030)

Table 15.1 – Coffee Sugar-Free Ice Cream Market Size by Year (USD Million)

Table 15.2 – Coffee Market Size by Form (2019-2030)

Table 15.3 – Coffee Market Size by Distribution Channel (2019-2030)

Table 16.1 – Competitive Company Overview – Yolé, Brooklyn Creamery, Denada, Dione, Moishi, House of Pops, NOTO, Artinci, London Dairy, My Govinda’s (Key Metrics)

Top Key Players & Market Share Outlook

- Yolé

- The Brooklyn Creamery

- Denada

- Dione

- Moishi

- House of Pops

- NOTO

- Artinci

- London Dairy

- My Govinda’s

- Others

Frequently Asked Questions