UAE HR Outsourcing Market

Source: The Report Cube

Understand The Key Trends Shaping This Market

Download Free SampleThe UAE HR Outsourcing Market Insights & Analysis

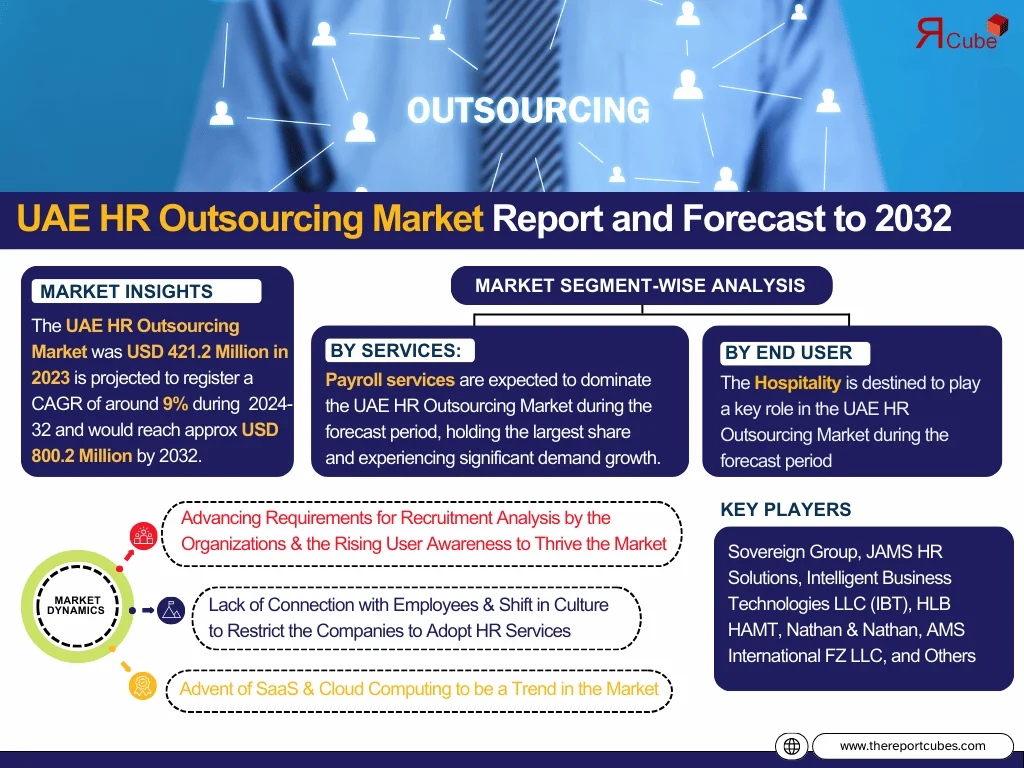

The UAE HR Outsourcing Market was USD 421.2 Million in 2023 is projected to register a CAGR of around 9% during the forecast period, i.e., 2024-32 and would reach approx USD 800.2 Million by 2032. Nowadays, as the government of the UAE is striving to lessen its reliance on the oil & gas sectors, therefore a substantial investment by the government across numerous other industries has been witnessed. This, in turn, is augmenting the need for HR outsourcing services, thus propelling the market in future years. Along with this, numerous factors, such as the growing need for recruitment analysis within businesses, rising awareness among users, and a swift transition of organizations toward harnessing intelligent technologies are also aiding in elevating the market’s demand graph.

Besides, as the internet and technology persist in their evolution, there are expected forthcoming developments that would have a beneficial effect on the UAE's industry, offering unexplored prospects for prominent entities in the coming years. Furthermore, organizations are progressively using digital platforms like social media for recruitment and resource identification, leading to a surge in the popularity of service providers who optimize & enhance resource management, thereby driving market growth.

Moreover, there is a growing awareness among businesses regarding the benefits of these services in enhancing overall operational efficiency. This awareness is prompting organizations to invest in human resource outsourcing services. Additionally, with the booming digitization of processes and the establishment of new companies in the country, there is a rising need for data optimization, further boosting the demand for these services and propelling the UAE HR Outsourcing Market forward.

The UAE HR Outsourcing Market Dynamics

- Advancing Requirements for Recruitment Analysis by the Organizations & the Rising User Awareness to Thrive the Market

The job industry of the country is favorably competitive, and organizations are constantly looking for top talents, who could add value to their companies. Therefore, to fulfill the needs of these organizations HR outsourcing services play a crucial role, as these services efficiently identify the right candidate & onboard them, further satisfying the requirements of the firms. HR outsourcing providers bring specialized skills in candidate assessment, skill matching, and market insights, assisting businesses in making more informed and strategic hiring decisions. This has created a significant demand for these services throughout the UAE.

Additionally, as more firms across the UAE recognize the positive aspects of HR outsourcing, there is a growing interest in using these services. Businesses are beginning to realize that outsourcing HR activities can lead to cost savings, increased productivity, and access to specialist HR knowledge. As a result, this awareness is encouraging organizations to explore these solutions as a way to improve their overall human resource operations, further enhancing the HR Outsourcing Market size in the UAE.

-

Lack of Connection with Employees & Shift in Culture to Restrict the Companies to Adopt HR Services

HR outsourcing presents a variety of challenges for investors, particularly, a disconnect with the workforce. Transferring these services off-site to computer software or third-party providers runs the risk of losing direct contact with employees, resulting in a possible lack of understanding.

Therefore, nobody understands the office culture better than the employees themselves. Furthermore, when services are outsourced to external entities or automated systems, team members may feel insecure, engage less, and occasionally perform less. As a result, several organizations hesitate to embrace HR outsourcing services, which impedes the growth of the UAE HR Outsourcing Market.

- Advent of SaaS & Cloud Computing to be a Trend in the Market

The rise of Software as a Service (SaaS) and cloud computing is transforming the HR outsourcing environment, providing a more efficient service delivery model and emerging as a major trend in the HR Outsourcing Market of the UAE. As a rising number of outsourcing service providers migrate to the cloud, it is projected to have a direct impact on the operational efficiency & the employee experience, resulting in a positive upgrade of employer branding.

Simultaneously, the availability of real-time data updates can greatly enhance decision-making effectiveness, enabling management to respond swiftly and accurately to evolving scenarios. This, in turn, contributes to a positive market outlook in the HR outsourcing sector.

The UAE HR Outsourcing Market Segment-wise Analysis

By Services:

- Payroll

- Benefits Administration

- Recruitment Process

- Learning Services

- Multi-process Human Resource

- Others

Payroll services are expected to dominate the UAE HR Outsourcing Market during the forecast period, holding the largest share and experiencing significant demand growth. This can be attributed mainly to the increasing awareness among businesses regarding the substantial benefits offered by these services. These benefits comprise legal, tax, and accounting support, which guarantee that employees get accurate and timely paychecks while reducing associated risks.

Moreover, these services are outsourced to third-party suppliers, permitting businesses to better manage their payroll operations & ease compliance with regulatory needs, relieving their teams of major administrative strain. Therefore, companies across the UAE are progressively turning to payroll HR outsourcing services.

By End Users:

- Oil & Gas

- Healthcare

- IT & ITES

- Hospitality

- Retail/Manufacturing

- Healthcare

- Others

The Hospitality is destined to play a key role in the UAE HR Outsourcing Market during the forecast period, mainly owing to the significant growth in the nation’s tourism sector. In this segment, the hospitality sector is witnessing an enormous influx of tourists, migrants, and pilgrims, resulting in the explosive growth of various hospitality establishments, like resorts, hotels, cafes, restaurants, and numerous other related services.

As a result, organizations in this industry are completely relying on HR outsourcing services to search and hire competent people for varied positions in hotels, resorts, catering compliances, and other settings. These talent acquisitions are critical for finding suitable workers or employees to manage a variety of tasks, like front office, back office, cleaning, culinary staff, etc. Thus, the demand for these services is fast increasing to satisfy the needs of the UAE’s expanding hospitality sector.

What Does Our UAE HR Outsourcing Market Research Study Entail?

- The UAE HR Outsourcing Market Research Report highlights the forecast growth rate or CAGR by anticipating the market size & share.

- The market analysis puts light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The UAE HR Outsourcing Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Key Factors Considered by Companies While Selecting a HR Outsourcing Management Vendor

- Smart Measures Takes by HR Outsourcing Management Vendors

- UAE HR Outsourcing Management Market Overview (2020-2032)

- Market Size (in USD Millions)

- Market Share, By Services

- Payroll (Payroll Management, Loans & Other Benefits Processing, Payroll Master Data Management, Pension Administration, etc.)

- Benefits (Health Insurance, Retirement Accounts, Vacations & Leaves, Employee Visa Processing Services, Employee Data Administration, etc.)

- Recruitment Process (Talent Acquisition, Recruiting, etc.)

- Learning Services (Talent Development & Management, Employee Collaboration & Engagement, etc.)

- Multi Process Human Resource (HR Tools, Workforce Planning & Analytics, Budgeting, Integrated HR Services, etc.)

- Others (Leave & Attendance Management Compliance, HR consultancy etc.)

- Market Share, By End User

- Oil & Gas

- Healthcare

- IT & ITES

- Hospitality

- Retail/Manufacturing

- Healthcare

- Others

- Market Size, By Region

- Dubai

- Abu Dhabi & Al Ain

- Sharjah & Northern Emirates

- Market Share, By Company

- Competition Characteristics

- Revenue Shares & Analysis

- UAE Man Power Supply Management Market Overview (2020-2032)

- Manpower Demand (in numbers)

- Manpower Supply (in numbers)

- Market Share, By Manpower Type

- Blue-Collar

- White Collar

- Market Share, By Region

- Market Share, By Company

- Competitive Outlook (Company Profiles – Partial List)

- HR Outsourcing Services Providers

- Sovereign Group

- JAMS HR Solutions

- Intelligent Business Technologies LLC (IBT)

- HLB HAMT

- Nathan & Nathan

- AMS International FZ LLC

- Transguard Group

- Dulsco

- TASC Outsourcing

- Ultimate HR Solutions

- Sundus Recruitment Services LLC

- Al Mansoor Enterprises LLC

- Axxon HR Solutions

- Others

- Manpower Providers

- World Star Manpower Solutions

- BCC Manpower Services

- Naithils General Contracting LLC

- Marmoom Manpower Solutions

- Abu Dhabi Manpower Supply (ADMS)

- Gulf Oasis Manpower Supply LLC

- Spectra Force

- Others

- HR Outsourcing Services Providers

- Contact Us & Disclaimer

List of Figure

Figure 1: UAE HR Outsourcing Management Market Size (USD Million), 2020–2032

Figure 2: UAE HR Outsourcing Management Market Share, By Services, 2024 (%)

Figure 3: Market Share of Payroll Services in HR Outsourcing, 2024 (%)

Figure 4: Market Share of Benefits Services in HR Outsourcing, 2024 (%)

Figure 5: Market Share of Recruitment Process Services in HR Outsourcing, 2024 (%)

Figure 6: Market Share of Learning Services in HR Outsourcing, 2024 (%)

Figure 7: Market Share of Multi-Process HR Services, 2024 (%)

Figure 8: Market Share of Other HR Services, 2024 (%)

Figure 9: UAE HR Outsourcing Management Market Share, By End User, 2024 (%)

Figure 10: End-User Breakdown: Oil & Gas, Healthcare, IT & ITES, Hospitality, Retail/Manufacturing, Others

Figure 11: UAE HR Outsourcing Management Market Size, By Region, 2020–2032

Figure 12: Regional Market Share: Dubai, Abu Dhabi & Al Ain, Sharjah & Northern Emirates, 2024 (%)

Figure 13: UAE HR Outsourcing Market Share, By Company, 2024 (%)

Figure 14: Competitive Landscape: Revenue Shares of Major HR Outsourcing Providers, 2024

Figure 15: UAE Manpower Supply Management Market Overview, 2020–2032

Figure 16: UAE Manpower Demand Forecast (in Numbers), 2020–2032

Figure 17: UAE Manpower Supply Forecast (in Numbers), 2020–2032

Figure 18: Market Share of Manpower Supply, By Type (Blue-Collar vs. White Collar), 2024 (%)

Figure 19: Regional Share in Manpower Supply Market, 2024 (%)

Figure 20: Market Share of Leading Manpower Supply Companies, 2024 (%)

Figure 21: Key Factors Considered by Companies When Selecting HR Outsourcing Vendors

Figure 22: Smart Measures Taken by Leading HR Outsourcing Vendors

List of Table

Table 1: Objectives of the Study

Table 2: Market Segmentation – HR Outsourcing Management Services

Table 3: Study Variables and Definitions

Table 4: Research Methodology Summary

Table 5: Secondary Data Sources Used

Table 6: Companies Interviewed – HR Outsourcing and Manpower Supply

Table 7: Primary Data Points and Method of Collection

Table 8: Break Down of Primary Interviews (By Designation, Company Type, Region)

Table 9: Market Drivers for HR Outsourcing Management in UAE

Table 10: Market Challenges for HR Outsourcing Vendors

Table 11: Opportunity Assessment Matrix – HR Outsourcing Management

Table 12: Recent Trends and Technological Developments in HR Outsourcing

Table 13: Key Factors Considered by Companies While Selecting HR Outsourcing Vendors

Table 14: Smart Measures Taken by Top Vendors in HR Outsourcing

Table 15: UAE HR Outsourcing Management Market Size, 2020–2032 (USD Million)

Table 16: Market Share, By Service Type, 2024 (%)

Table 17: Detailed Breakdown of Payroll Services in HR Outsourcing

Table 18: Detailed Breakdown of Benefits Services in HR Outsourcing

Table 19: Detailed Breakdown of Recruitment Process Services

Table 20: Detailed Breakdown of Learning Services

Table 21: Detailed Breakdown of Multi-Process HR Services

Table 22: Market Share, By End User Industry, 2024 (%)

Table 23: Market Size, By Region, 2020–2032 (USD Million)

Table 24: Regional Share of HR Outsourcing Services, 2024 (%)

Table 25: Company-Wise Market Share – HR Outsourcing Market, 2024 (%)

Table 26: UAE Manpower Demand, By Year (2020–2032)

Table 27: UAE Manpower Supply, By Year (2020–2032)

Table 28: Market Share, By Manpower Type (Blue-Collar vs. White Collar), 2024 (%)

Table 29: Market Share, By Region – Manpower Supply Market, 2024 (%)

Table 30: Market Share, By Company – Manpower Providers, 2024 (%)

Table 31: Competitive Overview – Key HR Outsourcing Service Providers

Table 32: Competitive Overview – Key Manpower Supply Providers

Top Key Players & Market Share Outlook

- HR Outsourcing Services Providers

- Sovereign Group

- JAMS HR Solutions

- Intelligent Business Technologies LLC (IBT)

- HLB HAMT

- Nathan & Nathan

- AMS International FZ LLC

- Transguard Group

- Dulsco

- TASC Outsourcing

- Ultimate HR Solutions

- Sundus Recruitment Services LLC

- Al Mansoor Enterprises LLC

- Axxon HR Solutions

- Others

- Manpower Providers

- World Star Manpower Solutions

- BCC Manpower Services

- Naithils General Contracting LLC

- Marmoom Manpower Solutions

- Abu Dhabi Manpower Supply (ADMS)

- Gulf Oasis Manpower Supply LLC

- Spectra Force

- Others

Frequently Asked Questions