Understand The Key Trends Shaping This Market

Download Free SampleUAE Potato Chips Market Overview: Market Size & Forecast (2026–2032)

What is the anticipated CAGR & size of the UAE Potato Chips Market?

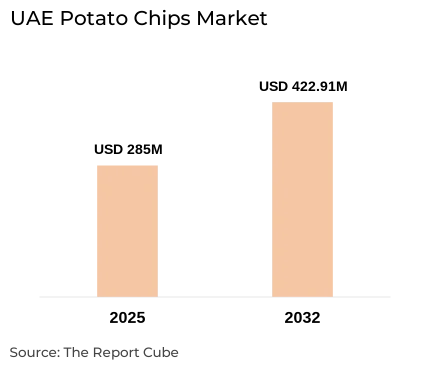

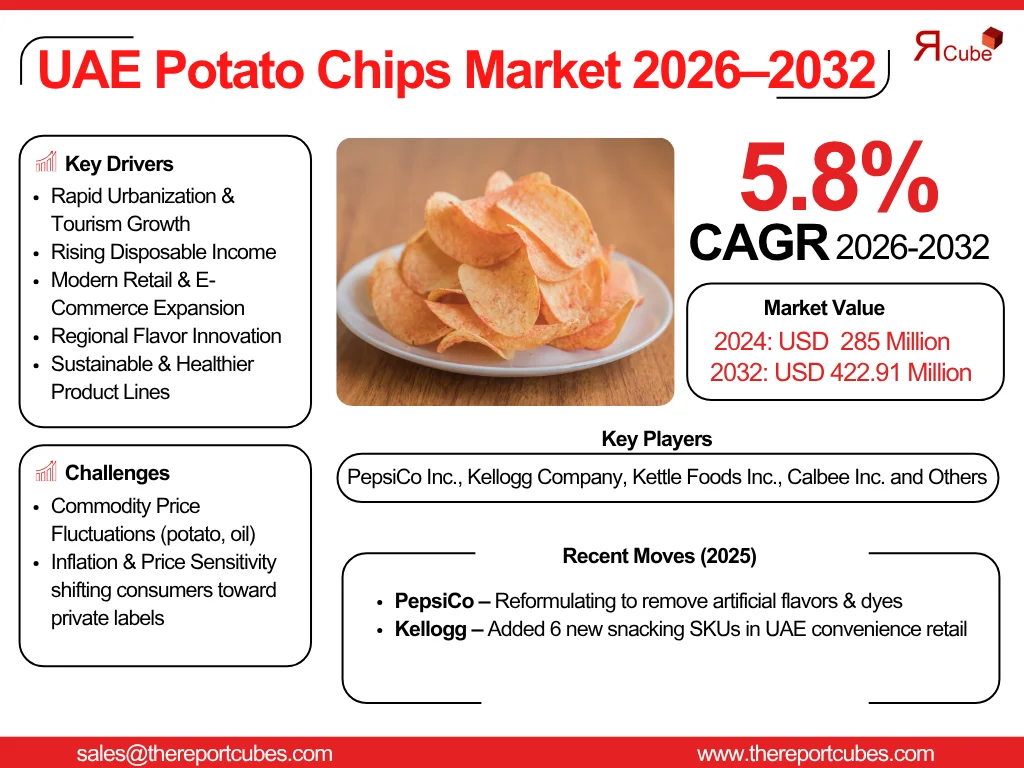

The UAE Potato Chips Market is anticipated to register a CAGR of around 5.8% during the forecast period, 2026-32. Additionally, the market size was valued at nearly USD 285 million in 2025 and is projected to reach nearly USD 422.91 million by 2032.

Market Analysis & Insights

The UAE Potato Chips Market expansion & increasing snacking occasions reinforce local demand. Urbanization, surging disposable income among expatriate & Emirati customers, and tourism-driven retail (airports, hotels, convenience stores) would drive consumption from 2026–2032. Also, major drivers, such as product innovation (premium & regional flavours), health-positioned SKUs (baked, reduced-oil), quick modern-retail growth in Dubai/Abu Dhabi, and solid foodservice/travel retail channels.

Moreover, related sectors like potato supply chains, contract prodiction, flavor development, packaging, and grocery retail form the backbone of the UAE Potato Chips Market’s ecosystem. Also, key market companies such as PepsiCo (Lay’s), Kellogg, Kettle Foods, Calbee, and Intersnack leverage distributor networks, supermarkets, convenience stores, and online platforms to expand their reach. Further, the Dubai Chips Market benefits from trade shows like ISM Middle East, which foster innovation & partnerships.

Additionally, retailers are adapting to emerging preferences via healthier & premium product lines, such as reduced-salt, baked, and ethnic flavors like za’atar & masala. Nevertheless, variations in potato & oil prices and inflationary pressures are affecting the UAE Potato Chips Market price & profit margins. Also, private-label products in supermarkets are also increasing competition & reshaping UAE Potato Chips Market. Further, moving forward, sustainability in packaging, AI-driven customer insights, and constant flavor innovation would also favour market growth in the forthcoming years.

UAE Potato Chips Market Dynamics

What driving factor acts as a positive influencer for the UAE Potato Chips Market?

- Premiumization & Flavour Diversification to Enhance Market Demand: The UAE customers are becoming more wealthy & seeking for high-end snack experiences that cater to a diversity of cultural preferences. Also, greater per-unit prices & new SKUs are driven by increasing demand for kettle-cooked textures, flavors with exotic & regional influences, and premium single-serve packaging. Moreover, social media culinary trends & tourist traffic (hotels, airport shops) pace up the testing of limited-edition flavors. In addition, market companies that adapt to local preferences while safeguarding international standards of excellence aids in gaining market share among both local & expatriate customers. Further, even while commodity pressures are still present, this premiumization assists branded players surge their margins.

What are the challenges that affect the UAE Potato Chips Market?

- Commodity Unpredictability & Price Sensitivity to Hinder Market Growth: Potato, vegetable oil, and seasoning input values alter with global markets & freight prices impacting the UAE Potato Chips Market & retail promotions. Also, inflationary pressures might compress mid-range SKU demand, shifting customers toward private label or smaller pack sizes. Additionally, producers who rely on imports to process potatoes & oils are vulnerable to logistical & currency shocks, effective hedging & procurement, as well as local contract farming, when practical, are indispensable mitigating measures.

How are the future opportunities transforming the market during 2026-32?

- Health-Oriented Lines & Snacking Occasions to Open New Avenues: A increasing health-conscious cohort is growing demand for baked chips, air-popped formats, and cleaner-label ingredients. Also, retailers are assigning shelf space to “better-for-you” snacks, enabling brands to segment & upscale. Further, travel retail & hospitality create occasions for single-serve premium SKUs & giftable formats. Moreover, brands that combine taste innovation with perceived health benefits can seize incremental share in a busy Dubai Chips Market.

What market trends are affecting the UAE Potato Chips Market Outlook?

- Omni-Channel Growth & Digital Trade Promotions: In the UAE, e-commerce, grocery apps & hypermarket click-and-collect programs are all expanding swiftly. Also, retailers are favoring supplier digital skills, as per data from regional snack trade fairs, companies that can carry out targeted promotions & quick restocking are given greater listings. Moreover, by transferring more volume via direct promotions & online channels, this development changes the economics of distribution & the size of the UAE Potato Chip Market.

How is the UAE Potato Chips Market Defined as per Segments?

The UAE Potato Chips Market Research Reports provide detailed market data & insights in accordance with market segmentation. Some of the segments are:

- Product: Baked & Fried

- Flavor: Plain/Salted & Flavored

By Product:

Fried potato chips govern the UAE Potato Chips Market, holing the potential market share, as consumers prefer their taste & crisp texture. Also, they are cheaper & easier to make than baked chips, making them prevalent across stores & supermarkets. Moreover, despite health trends, better-quality oils & smaller packs aid in maintaining robust demand, while baked & premium options continue to expand gradually.

By Flavor:

Flavoured potato chips (barbecue, sour cream & onion, regional spice blends) dominate the UAE Potato Chips Market, capturing the biggest market share. This is owing to solid customer preference for bold, diverse tastes among expatriate & Emirati populations. Also, international flavors & locally inspired spice blends drive trial & repeat buying, specifically in urban Dubai & Abu Dhabi markets where multicultural palates demand advances. Moreover, flavored SKUs command greater price per unit versus plain/salted chips & are key to promotional campaigns and limited-edition drops that enhance market visibility.

UAE Potato Chips Market: Recent Developments (2025)

- PepsiCo Inc. (Lay’s) declared global reformulation & rebranding plans to eliminate certain artificial dyes & flavors in Lay’s lines, supporting health-focused trends that would affect regional market portfolios.

- Kellogg Company extended its snacking portfolio with six new snacking SKUs (global rollouts), growing its presence in convenience & retail channels, further predicted to impact distributor assortments across the UAE snack sector.

What are the Key Highlights of the UAE Potato Chips Market (2026–32)?

- The UAE Potato Chips Market is envisioned to grow at a CAGR of around 5.8% during 2026-32, further valuing at about USD 422.91 million during 2032. This is owing to the surge in tourism, urban snacking, and modern retail expansion.

- Fried chips dominate by volume, and flavoured SKUs drive value & promotions.

- Health & premium trends drive baked & cleaner-label SKUs.

- AI to inspire dynamic costing, stimulate market demand, and offer targeted digital promotions for quick SKU testing.

- Commodity instability & private-label competition to shape the UAE Potato Chips Market.

How does the Future Outlook of the UAE Potato Chips Market (2032) Appears?

Through 2032, the UAE Potato Chips Market would experience swift growth led by premiumization, flavor improvement, and omni-channel retailing. Also, brands assimilating agile sourcing, ecological packaging, and health-positioned SKUs would seize greater margins. Also, AI would alter category management, enabling real-time demand sensing, dynamic promotions, and supply optimization, decreasing out-of-stocks & improving margin per SKU. Moreover, discount & private label classifications would continue to exist, but premium growth instigated by unique branded products & travel-retail exclusives would propel the UAE Potato Chip Market size upward.

What Does Our UAE Potato Chips Market Research Study Entail?

- The UAE Potato Chips Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The UAE Potato Chips Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- UAE Potato Chips Market Overview (2020-2032)

- Market Size, By Value (in USD Millions)

- Market Share, By Product

- Baked

- Fried

- Market Share, By Flavor

- Plain/Salted

- Flavored

- Market Share, By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Speciality Food Stores

- Online Stores

- Others

- Market Share, By Region

- North

- East

- West

- South

- Central

- Market Share, By Competitors

- Competition Characteristics

- Revenue Shares

- UAE Baked Potato Chips Market Overview, 2020-2032F

- By Value (USD Million)

- By Flavor- Market Size & Forecast 2019-2030, USD Million

- By Distribution Channel- Market Size & Forecast 2019-2030, USD Million

- UAE Fried Potato Chips Market Overview, 2020-2032F

- By Value (USD Million)

- By Flavor- Market Size & Forecast 2019-2030, USD Million

- By Distribution Channel- Market Size & Forecast 2019-2030, USD Million

- Competitive Outlook (Company Profile - Partila List)

- PepsiCo Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Kellogg Company

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Kettle Foods Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- The Campbell Soup Company

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Calbee Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Intersnack Group GmbH & Co. KG

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Others

- PepsiCo Inc.

- Contact Us & Disclaimer

List of Figure

Figure 1: UAE Potato Chips Market Size, By Value (2020-2032)

Figure 2: UAE Potato Chips Market Share, By Product (Baked vs. Fried)

Figure 3: UAE Potato Chips Market Share, By Flavor (Plain/Salted vs. Flavored)

Figure 4: UAE Potato Chips Market Share, By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Food Stores, Online Stores, Others)

Figure 5: UAE Potato Chips Market Share, By Region (North, East, West, South, Central)

Figure 6: UAE Potato Chips Market Share, By Competitors

Figure 7: Competitive Characteristics of Key Players in UAE Potato Chips Market

Figure 8: Revenue Shares of Key Players in UAE Potato Chips Market

Figure 9: UAE Baked Potato Chips Market Overview, 2020-2032F (By Value, USD Million)

Figure 10: UAE Baked Potato Chips Market by Flavor – Market Size & Forecast, 2019-2030 (USD Million)

Figure 11: UAE Baked Potato Chips Market by Distribution Channel – Market Size & Forecast, 2019-2030 (USD Million)

Figure 12: UAE Fried Potato Chips Market Overview, 2020-2032F (By Value, USD Million)

Figure 13: UAE Fried Potato Chips Market by Flavor – Market Size & Forecast, 2019-2030 (USD Million)

Figure 14: UAE Fried Potato Chips Market by Distribution Channel – Market Size & Forecast, 2019-2030 (USD Million)

Figure 15: Company Profile: PepsiCo Inc. – Business Segments and Strategic Alliances

Figure 16: Company Profile: Kellogg Company – Business Segments and Strategic Alliances

Figure 17: Company Profile: Kettle Foods Inc. – Business Segments and Strategic Alliances

Figure 18: Company Profile: The Campbell Soup Company – Business Segments and Strategic Alliances

Figure 19: Company Profile: Calbee Inc. – Business Segments and Strategic Alliances

Figure 20: Company Profile: Intersnack Group GmbH & Co. KG – Business Segments and Strategic Alliances

Figure 21: Others – Market Share and Competitive Overview

List of Table

Table 1: Objective of the Study

Table 2: Product Definition of Potato Chips

Table 3: Market Segmentation

Table 4: Study Variables

Table 5: Research Methodology

Table 6: Secondary Data Points

Table 7: Companies Interviewed

Table 8: Primary Data Points

Table 9: Breakdown of Primary Interviews

Table 10: Executive Summary – Key Highlights

Table 11: Market Dynamics – Drivers, Challenges, and Opportunities

Table 12: Recent Trends and Developments

Table 13: Policy and Regulatory Landscape

Table 14: UAE Potato Chips Market Overview (2020-2032)

Table 15: Market Size, By Value (USD Million)

Table 16: Market Share, By Product (Baked vs. Fried)

Table 17: Market Share, By Flavor (Plain/Salted vs. Flavored)

Table 18: Market Share, By Distribution Channel (Supermarkets, Convenience Stores, Specialty Food Stores, Online Stores, Others)

Table 19: Market Share, By Region (North, East, West, South, Central)

Table 20: Market Share, By Competitors

Table 21: UAE Baked Potato Chips Market Overview – By Value (USD Million)

Table 22: UAE Baked Potato Chips Market by Flavor – Size & Forecast (2019-2030, USD Million)

Table 23: UAE Baked Potato Chips Market by Distribution Channel – Size & Forecast (2019-2030, USD Million)

Table 24: UAE Fried Potato Chips Market Overview – By Value (USD Million)

Table 25: UAE Fried Potato Chips Market by Flavor – Size & Forecast (2019-2030, USD Million)

Table 26: UAE Fried Potato Chips Market by Distribution Channel – Size & Forecast (2019-2030, USD Million)

Table 27: Competitive Outlook – Key Metrics of PepsiCo Inc.

Table 28: Competitive Outlook – Key Metrics of Kellogg Company

Table 29: Competitive Outlook – Key Metrics of Kettle Foods Inc.

Table 30: Competitive Outlook – Key Metrics of The Campbell Soup Company

Table 31: Competitive Outlook – Key Metrics of Calbee Inc.

Table 32: Competitive Outlook – Key Metrics of Intersnack Group GmbH & Co. KG

Table 33: Others – Competitive Metrics and Market Overview

Top Key Players & Market Share Outlook

- PepsiCo Inc.

- Kellogg Company

- Kettle Foods Inc.

- the Campbell Soup Company

- Calbee Inc.

- Intersnack Group GmbH & Co. KG

- Others

Frequently Asked Questions