Understand The Key Trends Shaping This Market

Download Free SampleThe UAE Sunflower Oil Market Insights & Analysis

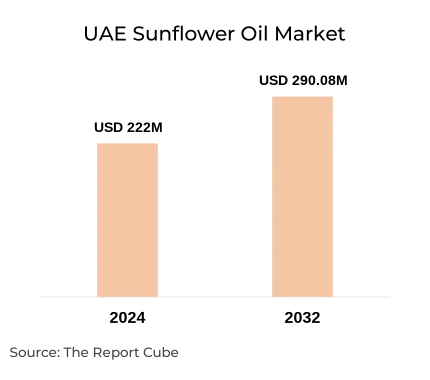

The UAE Sunflower Oil Market was USD 222 million in 2024 and is anticipated to register a CAGR of around 3.4% during the forecast period, i.e., 2024-32. As imports are a key source of supply to meet domestic demand, the United Arab Emirates is a net importer of edible vegetable oils, chiefly sunflower oil. Ukraine is the prime source of imports for the country. Turkey, Russia, Argentina, and Bulgaria are a few other significant importers of sunflower oil for the UAE. Further, not to be overlooked is the fact that the country is a significant supplier of food items, particularly edible oils, to other nations in the Middle East & North Africa. In light of this, the UAE Sunflower Oil Market is expected to grow in the next years as one of the top re-exporters.

It is utilized in food preparation, cooking, and in numerous industries, including the production of paint, varnish, and soap. It is naturally extracted from sunflower plant seeds. Low amounts of saturated fat are present, and it is specifically made up of mono- and polyunsaturated fats that are high in vitamin E. Refined, unrefined, and cold-pressed varieties are among the various kinds that are commonly accessible. Sunflower oil will therefore become more in demand in the upcoming years as more people turn to natural & nutritious food items these days.

Moreover, the government's efforts to achieve long-term food security & minimize import-related disruptions foster a favorable market environment. This has resulted in a surge in awareness & consumption of sunflower oil across the region. Similarly, the market benefits from a robust distribution network, with an extensive range of brands & packaging choices accessible to consumers. Furthermore, manufacturers employ various promotional activities, such as advertising & sponsoring events, to further enhance consumer perception, eventually driving the drive UAE Sunflower Oil Market growth in the future years.

The UAE Sunflower Oil Market Dynamics

- A Partial Ban On Trans-fats in Edible Oils by the Government Encourages the Adoption of Healthier Alternatives

The government's initiatives to diminish the amount of trans-fatty acids in edible oils are impelling market trends for sunflower oil in the UAE. The UAE government has taken steps to minimize trans-fat intake, raising the risk of heart disease, diabetes, obesity, and high blood pressure, conditions that hinder the average lifespan & are highly prevalent in the nation. For example, the National Nutrition Strategy 2022–2030 of the UAE government has produced application instructions to fundamentally eliminate trans-fats from the local food supply.

In addition, the government has started public awareness efforts to promote healthier eating practices and inform people about the dangers trans fats pose to their health. The government has also worked with food manufacturers to reduce the number of trans-fats in their products and promote healthier alternatives.

As a result, there is a growing demand for healthier edible oils such as sunflower oil, which contains lower levels of saturated fat and higher levels of Vitamin E, making it a good time for manufacturers & suppliers to capitalize on this trend, further enhancing the UAE Sunflower Oil Market size.

- Wide Availability of Alternatives to Hinder the Market Growth

Due to the accessibility of alternatives, including canola oil, rapeseed oil, coconut oil, and olive oil, the Sunflower Oil Market in the UAE is subject to fierce competition within the industry. Owing to its lower cost & higher nutritional content than sunflower oil, individuals are gravitating toward canola & coconut oils. As such, the accessibility of other substitutes and their relatively higher costs are making it difficult for the Sunflower Oil Market to generate a greater position in the UAE market.

- Rise in Healthy Eating Habits Due to Growing Diseases to Boost the Sunflower Oil Demand

The elevated income levels among UAE residents, coupled with the escalating expenses associated with fast food consumption, have significantly contributed to a range of health issues. The primary driver behind conditions such as obesity, diabetes, heart disease, and other chronic ailments is the excessive consumption of processed and fast foods.

Moreover, the predominant factor contributing to the nation's increasing incidence of lifestyle-related disorders is the widespread consumption of high-calorie packaged foods & beverages, often accompanied by minimal physical activity. Consequently, there is a growing inclination among consumers to adopt a healthier lifestyle, which includes the incorporation of nutritious oils like sunflower oil as a remedy for gastrointestinal ailments, obesity, and fatty liver disorders.

Hence, edible oils play a substantial role in the upsurge in obesity rates, therefore many consumers prefer to adopt sunflower oil to stay healthy & disease-free. This, in turn, would aid in transforming the growth graph of the UAE Sunflower Market in the forthcoming years.

The UAE Sunflower Oil Market Segment-wise Analysis

By Application:

- Food

- Feed

- Industrial

Owing to the vast adoption of sunflower oil by the food processing industry & their constant innovation & product expansion, the Food sector is anticipated to hold the maximum share of the UAE Sunflower Oil Market. High-oleic sunflower oil, in particular, is becoming increasingly popular in food formulations, such as coatings, spreads, fillings, and confectionery products, due to its high stability & long shelf life.

Moreover, the baking industry also favors oil as it creates various delicacies like cakes, muffins, cookies, and bread. As a key ingredient in many Middle Eastern dishes, such as hummus & falafel, sunflower oil remained popular as it infuses a mild nutty flavor.

Similarly, it is used as a salad dressing due to its light taste & consistency. It is also used in producing various food products, such as margarine & mayonnaise, and is a common ingredient in many packaged foods. Thus, backed by such growing adoption, the market is likely to be enthralled in the coming years.

Top Companies in UAE Sunflower Oil Market

UAE Sunflower Oil Market Companies,

Market Share (2026-2034)

Understand The Key Trends Shaping This Market

Download Free SampleWhat Does Our UAE Sunflower Oil Market Research Study Entail?

- The UAE Sunflower Oil Market Research Report highlights the forecast growth rate or CAGR by anticipating the market size & share.

- The market analysis puts light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The UAE Sunflower Oil Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Supply Chain Analysis (Distribution Channel)

- Margins at Each Level

- Export and Import Statistics

- Pricing Analysis

- Policies and Regulatory Landscape

- UAE Sunflower Oil Market Overview (2020-2032)

- Market Size, By Value (in USD Millions)

- Market Size, By Volume (Million Tons)

- UAE Sunflower Oil Market Share, By Application (USD Million)

- Food

- Feed

- Industrial

- UAE Sunflower Oil Market Share, By Region (USD Million)

- Dubai

- Abu Dhabi & Al Ain

- Sharjah & Northern Emirates

- UAE Sunflower Oil Market Share, By Company

- Revenue Shares

- Competition Characteristics

- Competitive Outlook (Company Profiles – Partial List)

- United Foods Company

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- The Savola Group

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- Rafael Salgado S.A

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- Abu Dhabi Vegetable Oil Company

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- Cargill Incorporated

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- IFFCO Group

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- Amira Nature Foods Ltd.

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- Archer-Daniels-Midland Company

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- Sime Darby Plantation Berhad

- Company Overview

- Business Segments

- Strategic Alliance/Partnerships

- Recent Developments

- Financials

- Others

- United Foods Company

- Contact Us & Disclaimer

List of Figure

-

Figure 1: UAE Sunflower Oil Market Size, By Value (USD Million), 2020–2032

-

Figure 2: UAE Sunflower Oil Market Size, By Volume (Million Tons), 2020–2032

-

Figure 3: UAE Sunflower Oil Market Share, By Application (USD Million), 2024

-

Figure 4: UAE Sunflower Oil Market Share, Food Segment (USD Million), 2020–2032

-

Figure 5: UAE Sunflower Oil Market Share, Feed Segment (USD Million), 2020–2032

-

Figure 6: UAE Sunflower Oil Market Share, Industrial Segment (USD Million), 2020–2032

-

Figure 7: UAE Sunflower Oil Market Share, By Region (USD Million), 2024

-

Figure 8: Regional Market Share – Dubai vs Abu Dhabi & Al Ain vs Sharjah & Northern Emirates, 2024

-

Figure 9: Supply Chain Structure of UAE Sunflower Oil Market

-

Figure 10: Margin Analysis Across Distribution Channels

-

Figure 11: Export Statistics of Sunflower Oil from UAE (USD Million), 2020–2024

-

Figure 12: Import Statistics of Sunflower Oil into UAE (USD Million), 2020–2024

-

Figure 13: Sunflower Oil Pricing Trends in UAE, 2020–2024

-

Figure 14: Impact of Regulatory Policies on UAE Sunflower Oil Market

-

Figure 15: Market Share of Leading Companies in UAE Sunflower Oil Market, 2024

-

Figure 16: Competitive Landscape – Revenue Share by Company, 2024

-

Figure 17: Strategic Partnerships and Alliances in the UAE Sunflower Oil Market

-

Figure 18: Investment and Expansion Activities by Key Players, 2020–2024

-

Figure 19: Opportunity Assessment Matrix – UAE Sunflower Oil Market

-

Figure 20: Trends and Developments Driving Market Growth (2024–2032)

List of Table

-

Table 1: Study Objectives and Scope

-

Table 2: Market Segmentation – By Application and Region

-

Table 3: Key Study Variables and Definitions

-

Table 4: Research Methodology Breakdown – Primary vs Secondary Sources

-

Table 5: List of Secondary Data Sources

-

Table 6: Companies Interviewed for Primary Research

-

Table 7: Demographics of Primary Respondents (By Designation, Region, Company Type)

-

Table 8: UAE Sunflower Oil Market Size, By Value (USD Million), 2020–2032

-

Table 9: UAE Sunflower Oil Market Size, By Volume (Million Tons), 2020–2032

-

Table 10: UAE Sunflower Oil Market Share, By Application (USD Million), 2020–2032

-

Table 11: UAE Sunflower Oil Market Share, By Region (USD Million), 2020–2032

-

Table 12: Key Market Drivers and Their Impact Analysis

-

Table 13: Key Market Challenges and Risk Factors

-

Table 14: Opportunity Assessment – Emerging Segments and Growth Areas

-

Table 15: Recent Trends and Innovations in the UAE Sunflower Oil Market

-

Table 16: Supply Chain Overview – Stakeholders and Functions

-

Table 17: Margin Breakdown at Each Level of the Supply Chain

-

Table 18: Export Volume and Value of Sunflower Oil from UAE, 2020–2024

-

Table 19: Import Volume and Value of Sunflower Oil into UAE, 2020–2024

-

Table 20: Sunflower Oil Average Prices (Retail & Wholesale), 2020–2024

-

Table 21: Regulatory Policies Governing Sunflower Oil Trade in UAE

-

Table 22: Company Market Share Analysis, 2024 (Top 8 Players)

-

Table 23: Competitive Characteristics – Distribution, Branding, Product Range

-

Table 24: Company Profile – United Foods Company

-

Table 25: Company Profile – The Savola Group

-

Table 26: Company Profile – Rafael Salgado S.A

-

Table 27: Company Profile – Abu Dhabi Vegetable Oil Company

-

Table 28: Company Profile – Cargill Incorporated

-

Table 29: Company Profile – IFFCO Group

-

Table 30: Company Profile – Amira Nature Foods Ltd.

-

Table 31: Company Profile – Archer-Daniels-Midland Company

-

Table 32: Company Profile – Sime Darby Plantation Berhad

-

Table 33: Strategic Partnerships and Alliances – Summary Table

-

Table 34: Summary of Financial Highlights (Select Companies)

-

Table 35: SWOT Analysis of Key Players

Top Key Players & Market Share Outlook

- United Foods Company

- The Savola Group

- Rafael Salgado S.A.

- Abu Dhabi Vegetable Oil Company

- Cargill Incorporated

- IFFCO Group

- Amira Nature Foods Ltd.

- Archer-Daniels-Midland Company

- Sime Darby Plantation Berhad

Frequently Asked Questions