AI in GCC Digital Healthcare Market

Source: The Report Cube

Understand The Key Trends Shaping This Market

Download Free SampleAI in GCC Digital Healthcare Market Overview: Market Size & Forecast (2026–2032)

What is the anticipated CAGR & size of the AI in GCC Digital Healthcare Market?

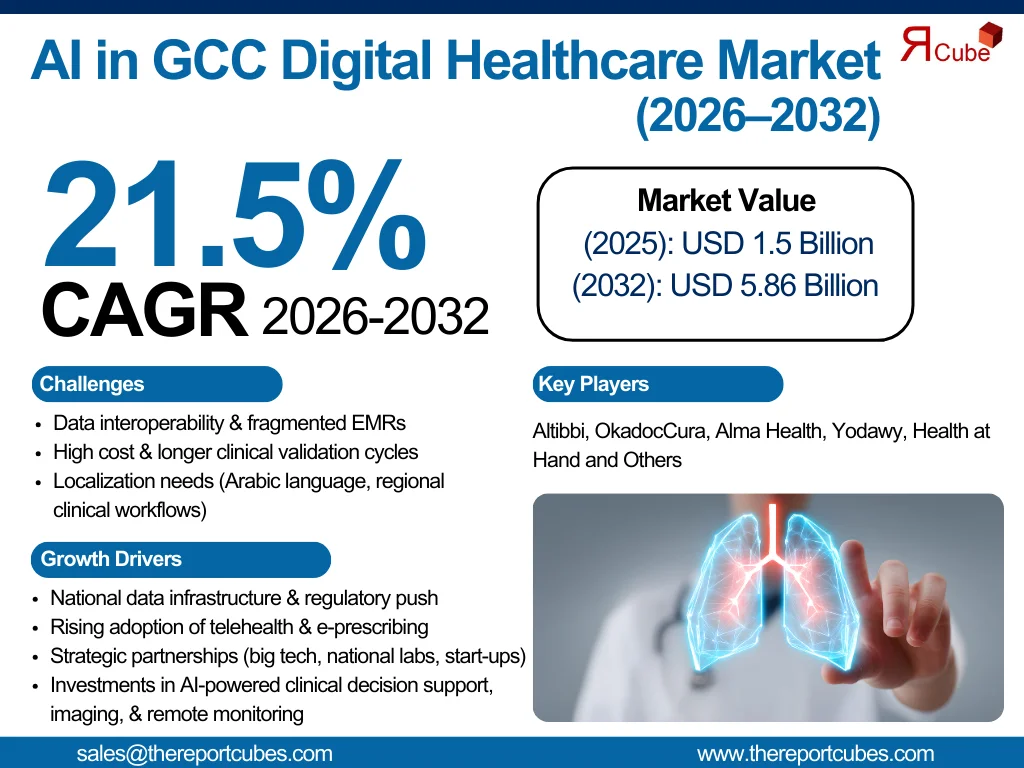

The AI in GCC Digital Healthcare Market is anticipated to register a CAGR of around 21.5% during the forecast period, 2026-32. Additionally, the market size was valued at nearly USD 1.5 billion in 2025 and is projected to reach nearly USD 5.86 billion by 2032.

Market Analysis & Insights

The AI in GCC Digital Healthcare Market is destined for rapid expansion between 2026 & 2032, compelled by government digital-health strategies, increasing telehealth uptake, and investments in data infrastructure. Moreover, major offerings in this industry include medical imaging analytics, remote patient monitoring devices, AI-powered telehealth platforms, clinical decision-support (CDS) tools, and SaaS for provider workflows, amalgamating software, particular hardware, and managed services exclusive to digital healthcare workflows.

Moreover, regional innovators, large tech groups, and health start-ups are employing population-scale AI solutions, for example, through strategic associations & local AI stacks that support clinical imaging, triage, and chronic-care management. Specialized digital-health integrations (e-prescribing, HIE linkage, lab-connectivity) distinguish digital health AI use-cases from wider healthcare AI, enabling quicker regulatory approvals & payer pilots.

Additionally, the AI in GCC Digital Healthcare Market prospects are appearing to be favourable, with constant national HIE rollouts, provider modernization, and private–public partnerships, further raising market scale & clinical efficacy by 2032.

AI in GCC Digital Healthcare Market Dynamics

What driving factor acts as a positive influencer for the AI in GCC Digital Healthcare Market?

- National Data Infrastructure & Regulatory Thrust to Elevate Market Growth: Numerous GCC governments are investing in health information exchanges, cloud & compute capacity, and AI governance frameworks that augment provider acceptance. These enable secure population-level analytics, federated learning, and clinical decision-support tools that range across hospitals & payer networks. Moreover, the existence of regional AI champions & cross-border partnerships curtails pilot cycles & intensifies trust in AI in healthcare solutions across the GCC region.

What are the challenges that affect the AI in GCC Digital Healthcare Market?

- Data Interoperability & Clinical Validation to Hinder Industry Expansion: The adoption of AI across the nations was sluggish & smooth despite infrastructure investments, fragmented EMR systems, and a lack of common clinical vocabulary among GCC countries, which affected the market expansion. Also, AI clinical decision support & AI medical imaging solutions have a longer time to market & cost more due to the resource-intensive clinical validation needs (trial-grade evidence for AI diagnostics & imaging). Furthermore, vendors must comply with local regulators while altering their products for Arabic language & regional clinical pathways.

How are the future opportunities transforming the market during 2026-32?

- Verticalized AI for Chronic Care & Remote Monitoring: With surging NCD prevalence, there is a high-yield opportunity for AI patient monitoring, Gulf & AI remote patient monitoring in Saudi Arabia, products that deploy wearables, telemedicine, and predictive analytics to minimize readmissions & enable value-based contracts. Further, payers & large employers are also piloting outcomes-based reimbursements that reward remote monitoring & AI-enabled care pathways.

What market trends are affecting the AI in GCC Digital Healthcare Market Outlook?

- Convergence of Big-Tech, National Labs, and Start-ups: In 2024–25, regional AI teams, cloud providers, and global health systems would collaborate to create operational platforms & localized models. The partnerships & AI infrastructure initiatives of G42, for instance, how enterprise-grade GCC digital health AI solutions to be developed & commercialized more quickly by national-scale compute & private partners. Moreover, start-ups (telehealth, diagnostics, provider SaaS) are co-developing features & embedding machine learning in healthcare GCC offerings into provider workflows, generating comfortable product-market fits.

How is the AI in GCC Digital Healthcare Market Defined as per Segments?

The AI in GCC Digital Healthcare Market Research Reports provide detailed market data & insights in accordance with market segmentation. Some of the segments are:

- Component: Software, Hardware, and Services

- End-User: Healthcare Providers, Healthcare Payers, and Others

By Component:

The Software segment dominates the AI in GCC Digital Healthcare Market by capturing the potential market share. Owing to SaaS delivery models for clinical decision support, imaging analytics, telemedicine, and remote-patient-management platforms, the segment is anticipated to witness an upscale. Software products allow constant model updates, easier regulatory traceability, and multi-tenant utilization across hospital groups & payers. Further, in the GCC, SaaS vendors combine Arabic-language interfaces, local compliance modules, and additions with national HIEs to capture scale rapidly. Thus, this portability & lower capital cost compared to medical hardware make software the fastest-adopted segment among healthcare AI companies in GCC, specifically for AI telemedicine UAE & AI-powered telehealth in Qatar.

By End-User:

Healthcare Providers (hospitals, clinics, specialist chains) lead acceptance as they directly benefit from AI in diagnostics, workflow automation, and telehealth that enhance throughput & quality metrics. Providers obtain clinical imaging AI, CDS, and remote monitoring assimilated into EMRs to decrease length of stay & enhance diagnostic yield. Moreover, huge hospital networks & government health systems, looking for efficiencies & national-scale analytics, drive procurement & pilot conversion, which, in turn, fascinates vendors & AI healthcare start-ups in Dubai & beyond. Also, providers’ willingness to test innovative payment models also aids in scaling digital health transformation & GCC initiatives quickly.

AI in GCC Digital Healthcare Market: Recent Developments (2025)

- G42, Oracle Health, and the Cleveland Clinic declared a strategic collaboration to build an AI-based healthcare delivery platform to support nation-scale analytics & clinical applications.

- The UAE-based Klaim (KLAIM.AI) raised substantial capital (reported USD 26M combined funding/debt) to enhance healthcare-fintech services & expand GCC operations, enabling better working capital for provider partners & supporting digital-health acceptance.

What are the Key Highlights of the AI in GCC Digital Healthcare Market (2026–32)?

- The rapid upgrade in CAGR 21.5% driven by national HIEs, telehealth growth, and private–public AI investment to elevate AI in GCC Digital Healthcare Market.

- Embracing software-first: AI solutions for digital health in the GCC, AI healthcare in the UAE, and AI in healthcare GCC scale the fastest.

- High-value verticals consist of CDS, remote monitoring, and clinical imaging.

- Partnerships between start-ups & large IT companies speed up commercialization & regulatory approval.

- AI's contribution to provider & payer workflows comprises triage, diagnostics, remote monitoring, and operational automation.

How does the Future Outlook of the AI in GCC Digital Healthcare Market (2032) Appears?

The GCC Digital Healthcare Market for AI would be well-known by sustainable payment methods, broader usage of AI diagnostics in Saudi Arabia & the Gulf, and interoperable AI platforms assimilated into care pathways by 2032. Also, the projected uptake & funding would transform pilots into expanded services, particularly in AI medical imaging GCC & AI telemedicine UAE, transforming care delivery, improving results, and facilitating predictive population health initiatives. Moreover, the AI in GCC Digital Healthcare Market would shift from proof-of-concept to production-grade, regulated AI that has demonstrated economic & clinical advantages.

What Does Our AI in GCC Digital Healthcare Market Research Study Entail?

- The AI in GCC Digital Healthcare Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The AI in GCC Digital Healthcare Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- GCC AI Digital Healthcare Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- Market Share, By Component

- Software

- Hardware

- Services

- Market Share, By End-User

- Healthcare Providers

- Healthcare Payers

- Others

- Market Share, By Application

- Diagnostics

- treatment planning

- patient engagement

- operations

- Market Share, By Technology

- Machine learning

- NLP

- Computer vision

- Robotics

- Market Share, By Country

- UAE

- Qatar

- Kuwait

- Oman

- Bahrain

- Saudi Arabia

- Market Share, By Company

- Revenue Shares

- Competition Characteristics

- UAE AI Digital Healthcare Market Overview, 2020-2032F

- Market Size, By Value (in USD Billions)

- By Component

- By End-User

- By Application

- By Technology

- Qatar AI Digital Healthcare Market Overview, 2020-2032F

- Market Size, By Value (in USD Billions)

- By Component

- By End-User

- By Application

- By Technology

- Kuwait AI Digital Healthcare Market Overview, 2020-2032F

- Market Size, By Value (in USD Billions)

- By Component

- By End-User

- By Application

- By Technology

- Oman AI Digital Healthcare Market Overview, 2020-2032F

- Market Size, By Value (in USD Billions)

- By Component

- By End-User

- By Application

- By Technology

- Bahrain AI Digital Healthcare Market Overview, 2020-2032F

- Market Size, By Value (in USD Billions)

- By Component

- By End-User

- By Application

- By Technology

- Competitive Outlook (Company Profile - Partila List)

- Altibbi

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- OkadocCura

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Alma Health

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Yodawy

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Health at Hand

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Vezeeta

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Clinicy

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Klaim

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- G42 Healthcare

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Others

- Altibbi

- Contact Us & Disclaimer

List of Figure

Figure 1. Study framework — objectives, scope and key research questions.

Figure 2. Product definition and taxonomy for AI Digital Healthcare (software, hardware, services).

Figure 3. Market segmentation tree (by component, end-user, application, technology, country).

Figure 4. Study variables and definitions (dependent, independent, control variables).

Figure 5. Research methodology flowchart (secondary vs primary research steps).

Figure 6. Secondary data points used (databases, reports, publications).

Figure 7. Companies interviewed — list and classification by type (vendor, provider, payer, regulator).

Figure 8. Primary data collection design (interview types, survey, sample size).

Figure 9. Break down of primary interviews — respondent role and sector (pie chart / table).

Figure 10. Executive summary — market snapshot infographic (key numbers & growth rate).

Figure 11. Market dynamics overview — drivers vs challenges (two-column infographic).

Figure 12. Top 5 market drivers (ranked bar chart).

Figure 13. Top 5 market challenges (ranked bar chart).

Figure 14. Opportunity assessment matrix (impact vs feasibility).

Figure 15. Recent trends & developments timeline (2020–2025 — major milestones).

Figure 16. Policy & regulatory landscape map — key regulations across GCC (table/map).

Figure 17. GCC AI Digital Healthcare market size, 2020–2032 (USD billions, historical & forecast line chart).

Figure 18. GCC market CAGR and year-on-year growth (bar + line overlay).

Figure 19. Market share by component — GCC (pie chart: software, hardware, services).

Figure 20. Component growth comparison, 2020–2032 (stacked area chart).

Figure 21. Market share by end-user — GCC (pie chart: providers, payers, others).

Figure 22. End-user adoption trends by year (stacked bar chart).

Figure 23. Market share by application — GCC (pie chart / donut: diagnostics, treatment planning, patient engagement, operations).

Figure 24. Application revenue growth trajectories (line series).

Figure 25. Market share by technology — GCC (pie: machine learning, NLP, computer vision, robotics).

Figure 26. Technology adoption curve and maturity map.

Figure 27. Market share by country — GCC (country comparison bar chart).

Figure 28. Market map of GCC showing country market sizes (thematic map).

Figure 29. Company revenue shares — top vendors in GCC (stacked bar / pie).

Figure 30. Competition characteristics matrix (product breadth vs regional presence).

Figure 31. UAE AI Digital Healthcare market size, 2020–2032 (line chart).

Figure 32. UAE — market by component (pie chart).

Figure 33. UAE — by end-user (pie chart).

Figure 34. UAE — by application (bar chart).

Figure 35. UAE — by technology (pie chart).

Figure 36. Qatar AI market size, 2020–2032 (line chart).

Figure 37. Qatar — component / end-user / application / technology (4 small charts or a multi-panel figure).

Figure 38. Kuwait AI market size, 2020–2032 (line chart).

Figure 39. Kuwait — component / end-user / application / technology (multi-panel).

Figure 40. Oman AI market size, 2020–2032 (line chart).

Figure 41. Oman — component / end-user / application / technology (multi-panel).

Figure 42. Bahrain AI market size, 2020–2032 (line chart).

Figure 43. Bahrain — component / end-user / application / technology (multi-panel).

Figure 44. Competitive outlook — vendor positioning map (market share vs product sophistication).

Figure 45. Altibbi — revenue trend & product map (company snapshot figure).

Figure 46. OkadocCura — revenue trend & product map.

Figure 47. Alma Health — revenue trend & product map.

Figure 48. Yodawy — revenue trend & product map.

Figure 49. Health at Hand — revenue trend & product map.

Figure 50. Vezeeta — revenue trend & product map.

Figure 51. Clinicy — revenue trend & product map.

Figure 52. Klaim — revenue trend & product map.

Figure 53. G42 Healthcare — revenue trend & product map.

Figure 54. Other vendors — aggregated revenue and feature heatmap.

Figure 55. Competitive benchmarking table — features, pricing model, regional coverage.

Figure 56. Data sources & research assumptions (table).

Figure 57. Forecast methodology and model diagram (inputs, modelling approach, sensitivity ranges).

Figure 58. Sensitivity analysis results (best / base / worst case scenarios).

Figure 59. Appendix — interview guide summary (key questions and respondent types).

Figure 60. Glossary of terms (visual list of key definitions).

List of Table

Table 1. Study objectives and scope of research.

Table 2. Product definition and classification of AI Digital Healthcare solutions.

Table 3. Market segmentation categories and subcategories (component, end-user, application, technology, country).

Table 4. Key study variables and definitions.

Table 5. Secondary data sources consulted (databases, reports, publications).

Table 6. List of companies interviewed — name, type, and role.

Table 7. Primary interviews — breakdown by respondent designation and geography.

Table 8. Summary of executive findings (market size, CAGR, opportunities).

Table 9. Market drivers with description and expected impact.

Table 10. Market challenges with description and expected impact.

Table 11. Opportunity assessment framework — potential areas of growth.

Table 12. Key recent trends and developments in GCC AI Digital Healthcare (2020–2025).

Table 13. Regulatory and policy landscape across GCC countries (UAE, Saudi, Qatar, etc.).

Table 14. GCC AI Digital Healthcare market size (USD billions), 2020–2032.

Table 15. GCC market share by component (software, hardware, services).

Table 16. GCC market share by end-user (providers, payers, others).

Table 17. GCC market share by application (diagnostics, treatment planning, patient engagement, operations).

Table 18. GCC market share by technology (machine learning, NLP, computer vision, robotics).

Table 19. GCC market share by country (UAE, Qatar, Kuwait, Oman, Bahrain, Saudi Arabia).

Table 20. GCC competitive landscape — revenue share by top companies.

Table 21. GCC competition characteristics — market concentration, entry barriers, differentiation.

Table 22. UAE AI Digital Healthcare market size (USD billions), 2020–2032.

Table 23. UAE market share by component.

Table 24. UAE market share by end-user.

Table 25. UAE market share by application.

Table 26. UAE market share by technology.

Table 27. Qatar AI Digital Healthcare market size, 2020–2032.

Table 28. Qatar market share by component, end-user, application, technology.

Table 29. Kuwait AI Digital Healthcare market size, 2020–2032.

Table 30. Kuwait market share by component, end-user, application, technology.

Table 31. Oman AI Digital Healthcare market size, 2020–2032.

Table 32. Oman market share by component, end-user, application, technology.

Table 33. Bahrain AI Digital Healthcare market size, 2020–2032.

Table 34. Bahrain market share by component, end-user, application, technology.

Table 35. Company profile summary — Altibbi (overview, business segments, partnerships, recent developments).

Table 36. Company profile summary — OkadocCura.

Table 37. Company profile summary — Alma Health.

Table 38. Company profile summary — Yodawy.

Table 39. Company profile summary — Health at Hand.

Table 40. Company profile summary — Vezeeta.

Table 41. Company profile summary — Clinicy.

Table 42. Company profile summary — Klaim.

Table 43. Company profile summary — G42 Healthcare.

Table 44. Other key companies operating in GCC AI Digital Healthcare.

Table 45. Competitive benchmarking — feature comparison across leading players.

Table 46. Research methodology assumptions and limitations.

Table 47. Forecast methodology inputs — drivers, constraints, variables.

Table 48. Sensitivity analysis — best, base, and worst-case market projections.

Table 49. Appendix — interview guide questions.

Table 50. Glossary of key terms and abbreviations.

Top Key Players & Market Share Outlook

- Altibbi

- OkadocCura

- Alma Health

- Yodawy

- Health at Hand

- Vezeeta

- Clinicy

- Klaim

- G42 Healthcare

- Others

Frequently Asked Questions