Bahrain Catering Market

Source: The Report Cube

Understand The Key Trends Shaping This Market

Download Free SampleBahrain Catering Market Insights & Analysis

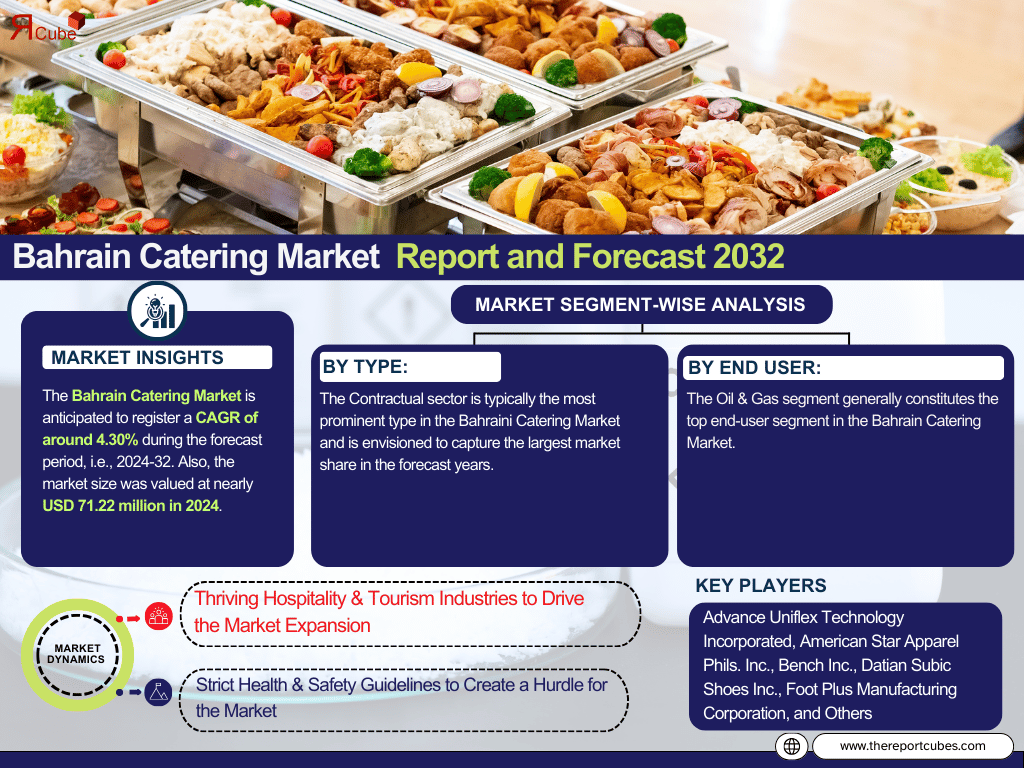

The Bahrain Catering Market is anticipated to register a CAGR of around 4.30% during the forecast period, i.e., 2024-32. Also, the market size was valued at nearly USD 71.22 million in 2024. The fast progress of corporate sectors, large-scale construction projects, the effects of international cuisine trends, and the increasing demand for high-quality catering services are all contributing variables to the market's steady expansion. The country has emerged as a primary location for business conferences, international events, & exhibitions, especially in Manama, and the country's regular hosting of corporate events, private functions, weddings, and public gatherings has heightened needs for catering services.

Moreover, hospital catering services are essential to the recovery of patients who are hospitalized for a brief or extended period of time. For patients to be healthy, their meals must be nourishing, clean, and provided on scheduled time. Most hospitals serve wholesome food that is tailored to the patients' requirements & conditions, and the significance of hygiene & nutrition has subsequently grown. Consequently, there is a great need for the hospital food catering service to oversee the patients' nutrition plans.

The sizeable expat population in Bahrain has resulted in a broad range of culinary preferences. Owing to the need to serve a diversified clientele, catering enterprises are being enforced to offer a broad range of menu choices, such as Middle Eastern, Asian, and Western cuisines. Furthermore, the catering industry in Bahrain is witnessing a push toward sustainable practices, which is constant with worldwide trends. Customers, mainly business clients, are favoring catering services that limit food waste, utilize eco-friendly packaging, and, whenever feasible, source materials locally.

The rising hospitality, tourism, and business sectors are projected to fuel the Bahraini Catering Market's further expansion. The market might experience amplified demand from sectors, such as public infrastructure, healthcare, and education as a result of Bahrain's government's efforts to expand its economy. The requirement for high-end & specialized catering services is foreseen to upscale as more foreign businesses open offices in Bahrain, which bodes well for the Bahrain Catering Industry in the years to come.

Bahrain Catering Market Dynamics

- Thriving Hospitality & Tourism Industries to Drive the Market Expansion

Bahrain is dynamically marketing itself as a travel destination, attracting tourists from all across the world with events like the Formula 1 Grand Prix, music festivals, and cultural gatherings. The requirement for catering services in hotels, resorts, and event spaces has upscaled as a result of the uptake in tourism, with an emphasis on offering a wide variety of high-quality food substitutes to suit the tastes of diverse countries. Professional catering services are also becoming more & more essential in these enterprises, both for everyday operations & special occasions, as classy hotels, resorts, and restaurants are built to suit the expanding number of tourists. As a result, this is driving the Bahrain Catering Market in the years to come.

- Strict Health & Safety Guidelines to Create a Hurdle for the Market

Bahrain's catering sector is subject to strict health & safety regulations, majorly those pertaining to the handling, making, and storing of food. Catering companies must make investments in regular employee training, top-notch kitchenware, and recurring inspections in order to conform with the government's stringent regulations for sanitation & hygiene. Further, particularly for smaller catering firms, regulatory compliance is a financial & operational problem as non-compliance can lead to penalties, legal action, or the suspension of operations.

Bahrain Catering Market Segment-wise Analysis

By Type:

- Contractual

- Non-Contractual

The Contractual sector is typically the most prominent type in the Bahraini Catering Market and is envisioned to capture the largest market share in the forecast years. Large industries, corporate offices, educational centers, healthcare facilities, and government initiatives that require constant & reliable catering services are the primary sources of this domination. Moreover, contract catering, which entails long-term agreements to offer regular meals & services that are often customized to the specific needs of the organization, gives catering businesses a consistent source of income. In contrast to non-contractual or one-time catering services, which are more irregular & unpredictable, the contractual segment is more noticeable due to its stability & reliability.

By End User:

- In-Flight

- Oil & Gas

- Hospitality

- Healthcare

- Education

- Corporate

- Others

The Oil & Gas segment generally constitutes the top end-user segment in the Bahrain Catering Market. The considerable need for catering services in distant & on-site locations where oil & gas businesses need to regularly provide meals for their employees deployed on rigs, refineries, and other operational sites is the cause for this domination. There is a constant need for high-quality catering services that combine dependability, convenience, and nutrition owing to the nature of the oil & gas sector, which employs a sizable & stable workforce in demanding settings. Also, the oil & gas category is the largest in the market as Bahraini catering firms frequently customize their offerings to match the unique requirements of this industry, such as 24-hour meal options and obedience to strict health & safety regulations.

What Does Our Bahrain Catering Market Research Study Entail?

- Bahrain Catering Market Research Report highlights the forecast growth rate or CAGR by anticipating the market size & share.

- The market analysis puts light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- Bahrain Catering Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- Bahrain Catering Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- Market Share, By Type

- Contractual

- Non-Contractual

- Market Share, By End User

- In-Flight

- Oil & Gas

- Hospitality

- Healthcare

- Education

- Corporate

- Others

- Others

- Market Share, By Operating Model

- In-House

- Outsourced

- Market Share, By Type

- Contractual

- Non-Contractual

- Market Share, By Enterprise Size

- Small (Less than 100 Employees)

- Medium (100 – 499 Employees)

- Large (More than 500 Employees)

- Market Share, By Region

- North

- South

- Central

- Capital

- Muharraq

- Market Share, By Competitors

- Competition Characteristics

- Revenue Shares

- Bahrain Contractual Catering Market Overview, 2020-2032F

- By Value (USD Million)

- Bahrain Non-Contractual Catering Market Overview, 2020-2032F

- By Value (USD Million)

- Competitive Outlook (Company Profile - Partila List)

- Promoseven Holdings

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- United Caterers and Contractors

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Mohammed Jalal Catering

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Foosco

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Food City

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Al Raya Catering

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Bahrain Airport Services (BAS) / BDC Catering

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Kazbah Catering (BFLC)

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Fine Foods Catering

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Al Raya Catering

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Promoseven Holdings

- Contact Us & Disclaimer

List of Figure

Figure 1: Bahrain Catering Market Segmentation Structure

Figure 2: Research Methodology Framework

Figure 3: Data Triangulation Approach

Figure 4: Breakdown of Primary Interviews by Company Type, Designation, and Region

Figure 5: Bahrain Catering Market Value (USD Billion), 2020–2032

Figure 6: Bahrain Catering Market Share, By Type (%), 2024

Figure 7: Bahrain Contractual Catering Market Share (%), 2024

Figure 8: Bahrain Non-Contractual Catering Market Share (%), 2024

Figure 9: Bahrain Catering Market Share, By End User (%), 2024

Figure 10: In-Flight Catering Market Share, 2024

Figure 11: Oil & Gas Catering Market Share, 2024

Figure 12: Hospitality Catering Market Share, 2024

Figure 13: Healthcare Catering Market Share, 2024

Figure 14: Education Sector Catering Market Share, 2024

Figure 15: Corporate Catering Market Share, 2024

Figure 16: Other End Users Catering Market Share, 2024

Figure 17: Competitive Landscape: Market Share by Major Companies, 2024

Figure 18: Revenue Comparison of Key Players (USD Million), 2024

Figure 19: Bahrain Contractual Catering Market Size (USD Million), 2020–2032

Figure 20: Bahrain Non-Contractual Catering Market Size (USD Million), 2020–2032

Figure 21: Strategic Alliances and Partnerships by Key Market Players

Figure 22: Recent Developments by Leading Companies (Timeline Format)

List of Table

Table 1: Study Variables and Their Definitions

Table 2: Secondary Data Sources Used in the Report

Table 3: Companies Interviewed During Primary Research

Table 4: Primary Interview Respondent Breakdown by Stakeholder Category

Table 5: Bahrain Catering Market Size, By Value (USD Billion), 2020–2032

Table 6: Bahrain Catering Market Share, By Type (%), 2024

Table 7: Bahrain Catering Market Share, By End User (%), 2024

Table 8: Bahrain Catering Market Share – In-Flight Segment, 2020–2032

Table 9: Bahrain Catering Market Share – Oil & Gas Segment, 2020–2032

Table 10: Bahrain Catering Market Share – Hospitality Segment, 2020–2032

Table 11: Bahrain Catering Market Share – Healthcare Segment, 2020–2032

Table 12: Bahrain Catering Market Share – Education Segment, 2020–2032

Table 13: Bahrain Catering Market Share – Corporate Segment, 2020–2032

Table 14: Bahrain Catering Market Share – Others Segment, 2020–2032

Table 15: Market Share of Key Competitors, 2024

Table 16: Bahrain Contractual Catering Market Size, By Value (USD Million), 2020–2032

Table 17: Bahrain Non-Contractual Catering Market Size, By Value (USD Million), 2020–2032

Table 18: Company Profile Summary – Promoseven Holdings

Table 19: Company Profile Summary – United Caterers and Contractors

Table 20: Company Profile Summary – Mohammed Jalal Catering

Table 21: Company Profile Summary – Foosco

Table 22: Company Profile Summary – Food City

Table 23: Company Profile Summary – Other Key Players

Table 24: Strategic Alliances and Partnerships – Key Players

Table 25: Recent Developments – Key Players (2020–2024)

Top Key Players & Market Share Outlook

- United Caterers & Contractors (UCC)

- Al Raya Catering

- Bahrain Airport Services (BAS) / BDC Catering

- Kazbah Catering (BFLC)

- Food City W.L.L

- Fine Foods Catering

- Promoseven Holdings

- Mohammed Jalal Catering

- Foesco

- Others

Frequently Asked Questions