Understand The Key Trends Shaping This Market

Download Free SampleUS Caustic Soda Market Overview: Market Size & Forecast (2026–2034)

What is the anticipated CAGR & size of the US Caustic Soda Market?

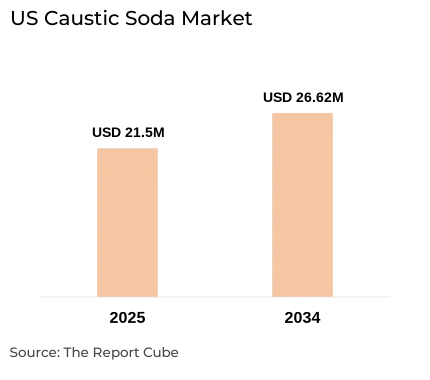

The US Caustic Soda Market is anticipated to register a CAGR of around 2.4% during the forecast period, 2026-34. Additionally, the market size was valued at nearly USD 21.5 million tons in 2025 and is projected to reach nearly USD 26.62 million tons by 2034.

Market Analysis & Insights

The US Caustic Soda (NaOH) Market is instigated by stable downstream demand from alumina refining, organic chemicals, pulp & paper, soaps & detergents, and water treatment sectors that support industrial consumption & procurement patterns. Also, production is concentrated among leading chlor-alkali operators (Olin, OxyChem/Occidental, Westlake, Dow), who supply via direct industrial contracts, chemical distributors, and export traders.

Furthermore, during 2024–25, various PVC industries witnessed slowdowns & plant maintenance activities, causing short-term supply tightness & cost fluctuations across the US Caustic Soda Market. Thus, this uncertainty motivated buyers to secure long-term contracts & maintain greater inventories. Further, as the chlor-alkali process is highly energy-intensive, manufacturers are upgrading to membrane-cell technology, electrified systems, and digital process controls to enhance energy efficiency & uptime to better advancement in the market.

Moreover, leading market companies, such as Olin Corporation and Dow advanced strategic & sustainability programs that enrich production flexibility & long-term competitiveness. Also, exceptionally, US producers’ vertical integration into chlorine-based products, like bleach & vinyls, assists in stabilizing market revenue against global demand fluctuation. Additionally, looking ahead, low-carbon production, stronger supply contracts, and continued digital & AI-enabled efficiency improvements are envisioned to transform the US Caustic Soda Market outlook through 2034, ensuring operational resilience & export strength.

What is the Impact of AI in the US Caustic Soda Market?

In the US Caustic Soda Market, the AI is playing a crucial role, as it aids in enhancing plant performance via predictive maintenance, processing model optimization, and energy-use forecasting, decreasing downtime & electricity consumption. Also, advanced analytics would support streamlining chemical procurement, inventory planning, and pricing strategies across the Caustic Soda Market supply chain in the US.

US Caustic Soda Market Dynamics

What driving factor acts as a positive influencer for the US Caustic Soda Market?

- Reshoring Manufacturing & Domestic Supply Security to Drive Market: Increasing nearshoring of chemical processing, pulp & paper mills, and water treatment facilities increases the demand graph of the US Caustic Soda Market through 2034. Trade policy favoring domestic sourcing & infrastructure reinvestment minimizes import reliance, while strong construction activity & pharmaceutical intermediate production generate stable geographical demand. Also, regional supply chain resilience priorities lock in multi-year purchase agreements, ensuring predictable cash flows for domestic producers & justifying brownfield expansions.

What are the challenges that affect the US Caustic Soda Market?

- Chlorine Co-Product Imbalance & Storage Restraints to Hamper Market Growth: Chlor-alkali economics rely on balanced caustic & chlorine offtake. If the chlorine demand is stumpy, production must be minimized or expensive venting must be done, leaving caustic capacity stranded. Also, inventory flexibility during seasonal variations is limited by severe safety rules & inadequate storage facilities. Further, the oversupply of chlorine from competing processes & PVC substitution in packaging interrupts the stoichiometric balance, eroding plant utilization rates & pressuring caustic pricing below variable cost recovery thresholds, thus hampering market growth.

How are the future opportunities transforming the market during 2026-34?

- Green Hydrogen Integration & Electrolyzer Synergies: Co-locating caustic production with evolving green hydrogen electrolyzers unlocks shared infrastructure, grid-scale renewable contracts, and oxygen by-product monetization. Also, caustic plants can supply ultra-pure water treatment chemicals to hydrogen facilities while retrieving off-peak renewable power, decreasing net electricity expenses. Further, strategic partnerships with hydrogen developers position producers as indispensable enablers of the energy transition, opening public funding channels & long-term hydrogen economy supply agreements.

What market trends are affecting the US Caustic Soda Market Outlook?

- Circular Economy Partnerships & Chemical Recycling Feedstock: Producers are falsifying alliances with plastics recyclers, battery reprocessors, and carbon capture operators who demand concentrated alkali. Along with this, chemical recycling of mixed plastics & lithium extraction from brines generates high-purity caustic demand with premium pricing, further elevating market demand. Moreover, real-time quality certification via blockchain & collaborative R&D on process-specific grades convert commodity transactions into co-development relationships, embedding suppliers deeper into developing circular value chains & stabilizing volumes against traditional cyclical end-markets.

How is the US Caustic Soda Market Defined as per Segments?

The US Caustic Soda Market Research Reports provide detailed market data & insights in accordance with market segmentation. Some of the segments are:

- Grade: Reagent Grade, Industrial Grade, Pharmaceutical Grade, Others

- Application: Alumina, Inorganic Chemicals, Organic Chemicals, Food, Pulp & Paper, Soap & Detergents, Textiles, Water Treatment, Steel/Metallurgy-Sintering, Others

By Grade:

Industrial Grade caustic soda governs the US Caustic Soda Market volumes by seizing the biggest market share. As the segment serves large-scale chemical, alumina, and pulp & paper operations that ingest NaOH in bulk, it is observed to have more prominence compared to other caustic soda grades. Also, industrial-grade scale, transportation by tanker, rail, or pipeline, making it the backbone of the US Caustic Soda Market size, supporting procurement contracts & spot logistics for constant-process manufacturers.

By Application:

The Alumina & Inorganic Chemicals segment grabs the prominent share of the US Caustic Soda Market. It is considered as one of the leading applications for NaOH across the US, utilizing caustic soda in alumina extraction, chlorine-based chemistry, and soap/detergent manufacture. These sectors necessitate continuous, large-volume supply, supporting long-term contracts & stable market demand. Also, the industrial-scale consumption by alumina & chemical producers reinforces the Caustic Soda Market stability in the US, and further validates investment in efficient, membrane-based production capacity.

US Caustic Soda Market: What Recent Innovations Are Affecting the Industry?

- 2025: Olin Corporation declared lifting force majeure & strategic plan milestones, enhancing supply reliability for caustic soda & related chlor-alkali products.

- 2025: Dow Chemical Company expanded sustainability & process-efficiency programs (digitalization & energy optimization pilots showcased during 2025 industry forums), augmenting low-carbon process trials that impact NaOH production economics.

What are the Key Highlights of the US Caustic Soda Market (2026–34)?

- The US Caustic Soda Market is projected to record a CAGR of around 2.4% during the forecast period, 2026-34, further anticipating a market size of about USD 26.62 million tons by 2034.

- The market demand is supported by sectors, such as alumina, inorganic chemicals, and detergents.

- Surging nearshoring of chemical processing, pulp & paper mills, and water treatment facilities raises the demand for the US Caustic Soda Market through 2034.

- AI to enhance maintenance & procurement, leading to manufacturers pursuing long-term contracts & vertical integration.

How does the Future Outlook of the US Caustic Soda Market (2034) Appears?

The US Caustic Soda Market is predicted to rise swiftly during 2026-2034, recording a market size of about USD 26.62 million tons during 2034. This is compelled by industrial demand, advancements in membrane-based efficiency, and the premiumization of low-carbon NaOH products. Furthermore, while contracting & vertical integration would stabilize market revenues & reward companies, who would engage in electrification & robust supply chains, artificial intelligence & digitalization would assist in reducing downtime & energy usage, further helping the market to function smoothly in the forecast years.

What Does Our US Caustic Soda Market Research Study Entail?

- The US Caustic Soda Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis & market scope sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The US Caustic Soda Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

List of Figure

List of Table

Top Key Players & Market Share Outlook

- Viridien

- Northland Power Inc

- Exelon Corp

- NRG Energy Inc

- Spirit AeroSystems Holdings Inc Class A

- Eaton Corp PLC

- Honeywell International Inc

- GE Aerospace

- Siemens AG

- ABB Ltd

- Others

Frequently Asked Questions