Understand The Key Trends Shaping This Market

Download Free SamplePhilippines Cold Brew Coffee Market Overview: Market Size & Forecast (2026–2034)

What is the anticipated CAGR & size of the Philippines Cold Brew Coffee Market?

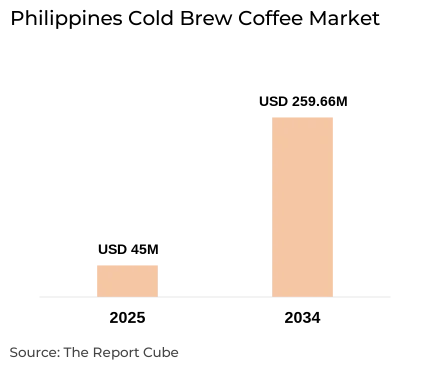

The Philippines Cold Brew Coffee Market is anticipated to register a CAGR of around 21.5% during the forecast period, 2026-34. Additionally, the market size was valued at nearly USD 45 million in 2025 and is projected to reach nearly USD 259.66 million by 2034.

Market Analysis & Insights

The Philippines Cold Brew Coffee Market is destined for considerable growth during 2026–34, instigated by the country’s rapidly emerging coffee culture, the increasing influence of specialty coffee shops, and the rising appeal of ready-to-drink (RTD) products. The industry reflects a swing from traditional instant coffee consumption toward premium, low-acidity, and high-flavor cold-brew choices. Also, in recent years, enhanced cold-chain infrastructure, development of convenience stores, and the prevalence of online retail have improved the accessibility & shelf presence of cold brew coffee in the archipelago.

Furthermore, key market companies, including Nestlé Philippines, Bo’s Coffee, and Figaro Coffee Company are instigating Philippines Cold Brew Coffee Market progression via RTD innovations, partnerships with local roasters or retailers, and growth of premium product lines. For example, Nestlé’s Nescafé RTD expansion in 2025 have increased awareness of cold-brew formats among young generation, further affecting market demand. Moreover, the ready-to-drink coffee segment is influenced by the Philippine Coffee Industry Roadmap (2021–2025), which encourages local sourcing, sustainability, and quality improvement in bean production, further benefiting both artisanal cafes & large brands.

Moving forward, the Philippines Cold Brew Coffee Market is projected to sustain tremendous growth as sensible customers look for healthier coffee options, convenient packaging, and locally sourced ingredients. Additionally, surging investments in Cold Brew Coffee Market across the Philippines, together with government support & robust retail networks, would continue to transform the market’s positive outlook through 2034.

What is the Impact of AI in the Philippines Cold Brew Coffee Market?

The optimization of AI in the Philippines Cold Brew Coffee Market demand forecasting, tailors promotions, and mines social sentiment for flavor trends. This technology assists cold-brew firms in the Philippines increase SKUs, control inventories within cold chain networks, and customize offers for customers who prefer a contemporary coffee experience.

Philippines Cold Brew Coffee Market Dynamics

What driving factor acts as a positive influencer for the Philippines Cold Brew Coffee Market?

- Expansion of Premiumization & Cafe Culture to Enhance Market Demand: Urban customers progressively trade up to specialty beverages. Therefore, specialty coffee shops & coffee chains are expanding cold-brew offerings (nitro, single-origin), stimulating average spend per visit & RTD adoption in the Philippines Cold Brew Coffee Market.

What are the challenges that affect the Philippines Cold Brew Coffee Market?

- Price Sensitivity & Scale Economics to Limit Market Growth: Cold-brew production & RTD processing incur greater production & cold-chain expenses versus instant coffee. Also, several Filipino cutomers remain price conscious, further restraining mass-uptake of the Philippines Cold Brew Coffee Market beyond urban pockets.

How are the future opportunities transforming the market during 2026-34?

- RTD Scaling & E-commerce/D2C: The Philippines Cold Brew Coffee Industry is now available to co-packers & smaller roasters due to the swift scale substitutes for bottled/canned cold brew & concentrates that supermarkets, convenience stores, and internet subscriptions provide.

What market trends are affecting the Philippines Cold Brew Coffee Market Outlook?

- Localization & Sustainability: As brands emphasize Filipino single-origin beans, farmer traceability, and eco-packaging, which is aligned with government roadmap goals & appealing conscious consumers, the market demand is destined to influence positively.

How is the Philippines Cold Brew Coffee Market Defined as per Segments?

- Type: Ready-to-Drink (RTD) Cold Brew Coffee, Concentrates, Cold Brew Coffee Pods

- Packaging: Bottles, Cans, Others (Cartons, Pouches)

By Type:

RTD Cold Brew Coffee dominates the Philippines Cold Brew Coffee Market, capturing the favourable market share. This is attributed to retail scalability & impulse market sales. Also, bottled and canned cold brews are quickly accepted in supermarkets & convenience stores, enabling brands to convert cafe fans into at-home & on-the-go buyers, further enhancing segment’s market value. Moreover, RTD formats also drive category visibility & are the most opted type across national distributors for cold-brew lines.

By Packaging:

The Bottles segment grabs the potential share of the Philippines Cold Brew Coffee Market. This is because niche brands & cafes are preferring the segment's premium positioning and resealability. Also, cans, which balance cost & cold-chain durability, are expanding rapidly for convenience channels & impulsive purchases, specifically in urban supermarket aisles & gas station locations.

Philippines Cold Brew Coffee Market: What Recent Innovations Are Affecting the Industry?

- 2025: Bo’s Coffee elevated emphasis on cold beverages & seasonal cold-brew promotions in (local campaigns, “Cold White Brew” promotions), augmenting customer exposure to home & in-store cold-brew formats.

What are the Key Highlights of the Philippines Cold Brew Coffee Market (2026–34)?

- The Philippines Cold Brew Coffee Market is foreseen to observe steady market growth by recording nearly 21.5% CAGR during 2026-2034, instigated by premiumization & increasing coffee culture.

- RTD cold brew coffee remains the foremost segment, with bottled formats leading market sales.

- Developing distribution channels, specifically convenience stores, coffee chains, and online retail are boosting accessibility.

- AI incorporation improves demand forecasting, supply-chain efficiency, and personalized marketing.

- Local sourcing & sustainability trends continue to enhance the Philippines Cold Brew Coffee Market outlook through 2034.

How does the Future Outlook of the Philippines Cold Brew Coffee Market (2034) Appears?

Through 2034, the Philippines Cold Brew Coffee Market would be a typical industry, with RTD penetration in urban retail & efficient D2C models. Moreover, market growth is also projected to be driven by premiumization, enhanced cold chain logistics, and AI-enabled customer insights, further making cold brew a standard coffee choice for Filipino population & solidifying the Philippines Cold Brew Coffee Market value in the forecast years.

What Does Our Philippines Cold Brew Coffee Market Research Study Entail?

- The Philippines Cold Brew Coffee Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis & market scope sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The Philippines Cold Brew Coffee Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the Study

- Product Definition

- Market Segmentation

- Study

- Research Methodology

- Secondary Data Points

- Sources of Secondary Research

- Companies Interviewed

- Primary Data Points

- Sources of Primary Research

- Breakdown of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- Philippines Cold Brew Coffee Market Overview

- Market Size, By Value (in USD Million)

- Market Size & Forecast, By Type (2026–2034)

- Ready-to-Drink (RTD) Cold Brew Coffee

- Concentrates

- Cold Brew Coffee Pods

- Market Size & Forecast, By Packaging (2026–2034)

- Bottles

- Cans

- Others (Cartons, Pouches)

- Market Size & Forecast, By Distribution Channel (2026–2034)

- Supermarkets and Hypermarkets

- Company-Owned Outlets

- Convenience Stores

- Online Stores

- Market Size & Forecast, By End User (2026–2034)

- Households

- Commercial Establishments

- Offices/Corporate Clients

- Market Share, By Competitors

- Competition Characteristics

- Revenue Shares

- Segment-wise Market Overviews (End User)

- Households Cold Brew Coffee Market Overview

- By Value (USD Million)

- By Source of Renewable Energy

- By Technology

- By Application

- By Distribution Channel

- Commercial Establishments Cold Brew Coffee Market Overview

- By Value (USD Million)

- By Source of Renewable Energy

- By Technology

- By Application

- By Distribution Channel

- Offices/Corporate Clients Cold Brew Coffee Market Overview

- By Value (USD Million)

- By Source of Renewable Energy

- By Technology

- By Application

- By Distribution Channel

- Households Cold Brew Coffee Market Overview

- Competitive Outlook (Company Profile - Partila List)

- Starbucks Coffee Company

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Nestlé S.A.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- UCC Ueshima Coffee Co., Ltd

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Figaro Coffee Company

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Bo's Coffee

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Silca Coffee Roasting Company, Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Philippine Coffee Company

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Homegrown Cold Brew Brands

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Others

- Starbucks Coffee Company

- Contact Us & Disclaimer

List of Figure

Figure 1: Research Methodology Flowchart

Figure 2: Data Triangulation Approach for Market Estimation

Figure 3: Philippines Cold Brew Coffee Market Overview (2024 Snapshot)

Figure 4: Market Size of Philippines Cold Brew Coffee, By Value (USD Million), 2026–2034

Figure 5: Market Share Analysis, By Type (2026–2034)

Figure 6: Market Size & Forecast, Ready-to-Drink (RTD) Cold Brew Coffee, By Value (USD Million), 2026–2034

Figure 7: Market Size & Forecast, Concentrates, By Value (USD Million), 2026–2034

Figure 8: Market Size & Forecast, Cold Brew Coffee Pods, By Value (USD Million), 2026–2034

Figure 9: Market Size & Forecast, By Packaging Type (2026–2034)

Figure 10: Market Share, By Bottles, Cans, and Others, 2026–2034

Figure 11: Market Size & Forecast, By Distribution Channel (2026–2034)

Figure 12: Market Share, By Distribution Channel (Supermarkets, Online, etc.)

Figure 13: Market Size & Forecast, By End User (2026–2034)

Figure 14: Market Share, By End User (Households, Commercial, Offices), 2026–2034

Figure 15: Porter’s Five Forces Analysis of the Philippines Cold Brew Coffee Market

Figure 16: Value Chain Analysis for the Cold Brew Coffee Industry

Figure 17: PESTLE Analysis of the Philippines Cold Brew Coffee Market

Figure 18: Key Drivers Impact Analysis

Figure 19: Key Challenges and Restraints Analysis

Figure 20: Opportunity Assessment Matrix (2026–2034)

Figure 21: Trends in Cold Brew Coffee Product Innovations (Global vs. Philippines)

Figure 22: Regulatory Landscape and Import Policies for Coffee Beverages in the Philippines

Figure 23: Market Attractiveness by Type and Distribution Channel, 2026–2034

Figure 24: Households Cold Brew Coffee Market, By Value (USD Million), 2026–2034

Figure 25: Households Segment, By Distribution Channel, 2026–2034

Figure 26: Commercial Establishments Cold Brew Coffee Market, By Value (USD Million), 2026–2034

Figure 27: Commercial Segment, By Distribution Channel, 2026–2034

Figure 28: Offices/Corporate Cold Brew Coffee Market, By Value (USD Million), 2026–2034

Figure 29: Offices Segment, By Distribution Channel, 2026–2034

Figure 30: Market Share of Key Players, 2024

Figure 31: Company Benchmarking by Revenue & Product Range

Figure 32: Strategic Developments among Key Competitors (2022–2025)

Figure 33: Competitive Landscape Mapping (Starbucks, Nestlé, UCC, Figaro, Bo’s Coffee, etc.)

Figure 34: SWOT Analysis Summary of Major Companies

Figure 35: Emerging Local Brands’ Market Penetration (2024–2026)

Figure 36: Forecasting Assumptions and Data Validation Framework

Figure 37: Analyst Viewpoint on Future Market Growth (2034 Outlook)

List of Table

Table 1: Objectives of the Study

Table 2: Product Definition and Classification

Table 3: Market Segmentation Overview

Table 4: Sources of Secondary Research

Table 5: Companies Interviewed for Primary Research

Table 6: Breakdown of Primary Interviews

Table 7: Philippines Cold Brew Coffee Market Size, By Value (USD Million), 2026–2034

Table 8: Market Size & Forecast, By Type (2026–2034)

Table 9: Ready-to-Drink (RTD) Cold Brew Coffee Market Size, By Value, 2026–2034

Table 10: Concentrates Market Size, By Value, 2026–2034

Table 11: Cold Brew Coffee Pods Market Size, By Value, 2026–2034

Table 12: Market Size & Forecast, By Packaging (2026–2034)

Table 13: Market Size & Forecast, By Distribution Channel (2026–2034)

Table 14: Market Size & Forecast, By End User (2026–2034)

Table 15: Market Share, By Competitors

Table 16: Segment-wise Market Overview – Households, By Value (USD Million)

Table 17: Segment-wise Market Overview – Commercial Establishments, By Value

Table 18: Segment-wise Market Overview – Offices/Corporate Clients, By Value

Table 19: Households Segment, By Distribution Channel

Table 20: Commercial Segment, By Distribution Channel

Table 21: Offices Segment, By Distribution Channel

Table 22: Competitive Outlook – Company Profiles Summary

Table 23: Starbucks Coffee Company – Revenue and Business Segments

Table 24: Nestlé S.A. – Revenue and Business Segments

Table 25: UCC Ueshima Coffee Co., Ltd – Revenue and Business Segments

Table 26: Figaro Coffee Company – Revenue and Business Segments

Table 27: Bo’s Coffee – Revenue and Business Segments

Table 28: Silca Coffee Roasting Company, Inc. – Revenue and Business Segments

Table 29: Philippine Coffee Company – Revenue and Business Segments

Table 30: Homegrown Cold Brew Brands – Revenue and Business Segments

Table 31: SWOT Analysis of Key Players

Table 32: Strategic Alliances and Partnerships of Key Players

Table 33: Recent Developments of Key Players (2025)

Top Key Players & Market Share Outlook

- Starbucks Coffee Company

- Nestlé S.A.

- UCC Ueshima Coffee Co., Ltd

- Figaro Coffee Company

- Bo's Coffee

- Silca Coffee Roasting Company, Inc.

- Philippine Coffee Company

- Homegrown Cold Brew Brands

- Others

Frequently Asked Questions