Understand The Key Trends Shaping This Market

Download Free SampleWhat Is the Southeast Asia Construction Market Size & Value?

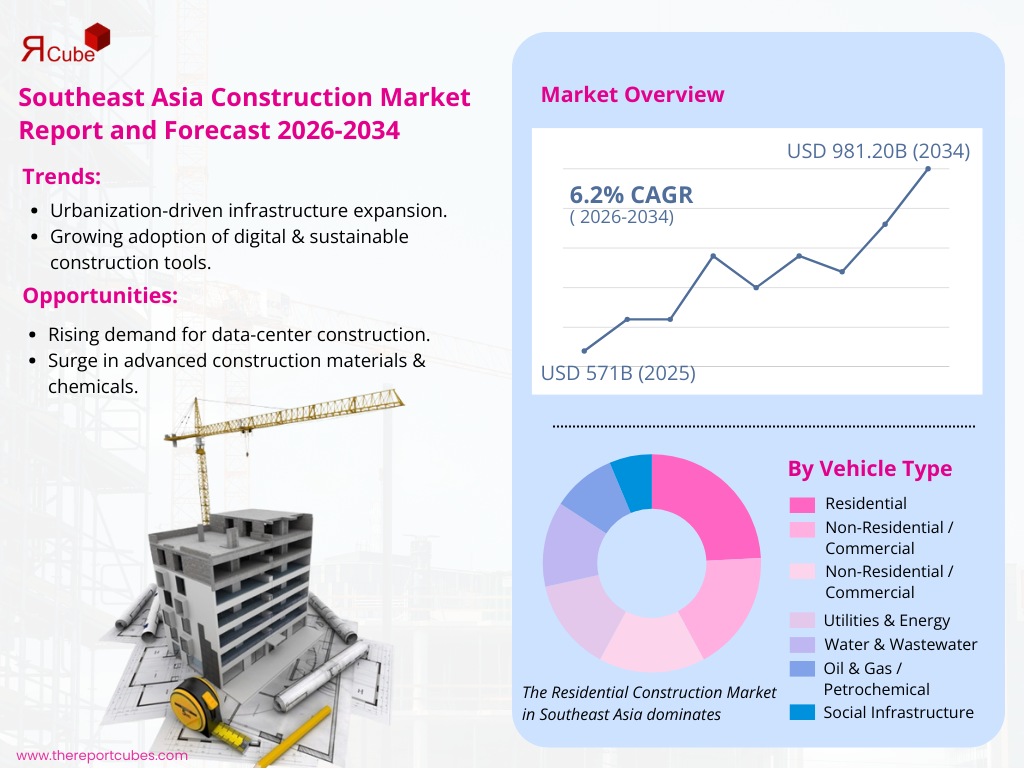

The Southeast Asia Construction Market is anticipated to register a CAGR of around 6.2% during the forecast period, 2026-34. Additionally, the market size was valued at nearly USD 571 billion in 2025 and is projected to reach almost USD 981.20 billion by 2034.

Southeast Asia Construction Market Key Highlights

- Strong demand for ASEAN building materials fuels growth amid expanded public-private partnerships & foreign direct investment across the construction sector.

- Increasing BIM adoption in Southeast Asia & AI deployment optimizes project schedules, costs, and safety, advancing construction technology acceptance.

- Green building certifications SEA (Southeast Asia) & sustainable materials respond to climate goals & urbanization, motivating eco-conscious construction trends regionally.

- Key market segments such as residential with affordable housing initiatives, commercial, industrial, logistics parks, and data center construction, to enhance SEA growth.

- Indonesia dominates regional market share, followed by Vietnam & Singapore.

- Smart city development & major infrastructure projects underpin industry growth.

Southeast Asia Construction Market Dynamics

What is the key driver of the Southeast Asia Construction Market?

Fast Expanding Urbanization Creating High Housing & Material Demand: A primary driver across the Southeast Asia Construction Market is penetrating urbanization that influences the residential construction, further generating market demand for building materials, specifically in Indonesia, Vietnam, and the Philippines. Also, governments deploy affordable housing initiatives & introduce major infrastructure projects SEA that expand transport & utilities, widening the regional industry, and strengthening the overall Southeast Asia Construction Market size. Also, expanding middle-class incomes further encourage commercial construction & diversified construction trends in Southeast Asia.

What are the major challenges that affect the Southeast Asia Construction Industry?

Structural Workforce Constraints & Execution Risk: A potential market challenge is persistent construction labor shortages across Asia, which increase wage costs & complicate timelines for major infrastructure projects and smart city development programs. Also, limited skilled labor restrains BIM adoption in Southeast Asia, decelerates the uptake of advanced approaches, and pressures contractors in construction technology clusters. Hence, these shortages also impede the delivery of affordable housing initiatives & the large residential construction market in Southeast Asia, especially in the Indonesia Construction Market.

What are the future opportunities in the Southeast Asia Construction Market during 2026-34?

Regional Industrial & Digital Infrastructure Expansion: Export-oriented production shifts that speed up logistics & industrial park construction in Thailand, Vietnam, and Indonesia present a lucrative market opportunity. Data center construction in Southeast Asia is furthered by expanding e-commerce & cloud services, which raises foreign direct investment (FDI) in the building industry & further enhances the Southeast Asia Construction Market. Also, these flows lift commercial development in Southeast Asia & sustain long-term SEA construction sector growth beyond traditional residential demand.

What trends are affecting the Southeast Asia Construction Market Outlook?

Sustainability & Governance Reforming Project Pipelines: The quick growth of SEA green building certifications is a new trend that has a potential impact on design, procurement, and the demand for building materials across ASEAN. In accordance with international sustainability regulations, governments set up Public-Private Partnerships (PPP) SEA to finance energy-efficient transportation, water, and social infrastructure. Hence, this forces developers to utilize low-carbon materials, assimilate lifecycle cost thinking, and adapt construction patterns across Southeast Asia to severer performance requirements, while stimulating Vietnam construction sector growth & construction technology across Singapore.

Southeast Asia Construction Industry Analysis (2026–2034)

The Southeast Asia Construction Market growth is anchored by quick urbanization, industrialization, and trade incorporation, with medium-term SEA construction sector expansion, supported by government-backed key infrastructure projects, port upgrades, metro systems, and smart city development. Further, strong foreign direct investment (FDI) in construction, manufacturing, warehouses, logistics, and industrial parks boosts export capacity across Indonesia, Vietnam, and Thailand.

Meanwhile, targeted affordable housing initiatives fuel growth in the residential construction market in Southeast Asia, supporting increasing ASEAN building materials demand & regional economic development. Moreover, upscaling e-commerce & cloud adoption drives data center construction & high-spec commercial construction, stimulating ASEAN building materials demand & enabling premium pricing for engineered products.

Nonetheless, the Southeast Asia Construction Market outlook appears to be hindered by construction labor shortages, growing financing costs, and stricter sustainability regulations that augment green building certifications in SEA & demand for efficient systems. Furthermore, the industry analysis highlights policy reforms, Public-Private Partnerships (PPP) SEA, and technology-enabled delivery shaping risk-adjusted returns & long-term competitiveness in the following years.

What is the Impact of AI in the Southeast Asia Construction Market?

AI fortifies BIM adoption across Southeast Asia, enabling real-time planning, quality control, and risk analytics that enhance productivity, margins, and the SEA Construction Industry growth. Also, leading construction technology contractors are deploying AI for progress tracking & safety analytics on major infrastructure projects, further boosting investor confidence.

How are the Southeast Asia Construction Market Segments Defined?

The Southeast Asia Construction Market Research Reports provide detailed market data & insights in accordance with market segmentation. Some of the segments are:

- End-Use: Residential, Non-Residential / Commercial, Industrial Infrastructure / Public Works, Utilities & Energy, Water & Wastewater, Oil & Gas / Petrochemical, Social Infrastructure

- Service Offering: Greenfield, Renovation, Refurbishment & Retrofitting, Repair & Maintenance, Engineering, Procurement & Construction (EPC) / Turnkey, Design & Architecture / Project Management, Construction Consulting & Testing Services

By End-Use:

The Residential Construction Market in Southeast Asia dominates, contributing for the largest market share. Booming urbanization & affordable housing initiatives in regional countries such as Indonesia & Vietnam are driving market demand. Also, this sector contributes in enhancing the overall Southeast Asia Construction Market revenue & demand, further shaping key construction trends by 2034.

By Service Offering:

Both Greenfield and Engineering, Procurement & Construction (EPC)/Turnkey services leads, capturing the potential share of the Southeast Asia Construction Market. These reflect key infrastructure projects, logistics, and industrial park construction, and data center construction in SEA. Moreover, rising foreign direct investment (FDI) in construction & Public-Private Partnerships (PPP), SEA support this expansion, while renovation advances with green building certifications, gains momentum.

Southeast Asia Construction Industry: Country Insights

The Southeast Asia Construction Market is geographically diversified, covering:

- Indonesia

- Malaysia

- Philippines

- Thailand

- Vietnam

- Singapore

- Myanmar

- Cambodia

- Rest of Southeast Asia

The Indonesia Construction Market governs across the regional landscape, followed by Vietnam & Singapore, by accounting for a substantial market share. The Indonesian construction sector includes mega projects, new capital developments, and infrastructure development, increasing ASEAN building materials demand & investment. Further, Vietnam & Singapore contribute through the rising construction sector & technology, progressing commercial construction in Southeast Asia & smart city development trends.

Southeast Asia Construction Market: What Recent Innovations Are Affecting the Industry?

- 2025: Gamuda Berhad steered a large-scale digital precast system, augmenting housing delivery & improving compliance with green building certifications SEA.

- 2025: Caterpillar Inc. introduced upgraded low-emission equipment in ASEAN, plummeting lifecycle costs & supporting sustainable construction trends.

How does the Southeast Asia Construction Market (2034) Future Outlook Appear?

Sustained Growth: By 2034, the Southeast Asia Construction Market size & value is expected to be significantly higher than the past period, as it is predicted nearly 6.2% CAGR, further attaining a market value of about USD 981.20 billion.

Technological Upgrade: Broader BIM acceptance in Southeast Asia & advanced construction technology in Singapore would diminish construction labor shortages, enhance quality, optimize resources, and amplify competitiveness across commercial, logistics, data center, and major infrastructure projects.

Future Opportunities: Growing FDI & climate policies drive transit, energy, water projects through PPP SEA, boosting ASEAN building materials demand & green certifications, increasing smart city development & export corridor opportunities after 2034.

What Does Our Southeast Asia Construction Market Research Study Entail?

- The Southeast Asia Construction Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis & market scope sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The Southeast Asia Construction Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the Study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Breakdown of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- Southeast Asia Construction Market Overview (2020-2034)

- Market Size, By Value (USD Billion)

- Market Share, By End-Use

- Residential

- Non-Residential / Commercial

- Industrial Infrastructure / Public Works

- Utilities & Energy

- Water & Wastewater

- Oil & Gas / Petrochemical

- Social Infrastructure

- Market Share, By Service Offering

- Greenfield

- Renovation

- Refurbishment & Retrofitting

- Repair & Maintenance

- Engineering

- Procurement & Construction (EPC) / Turnkey

- Design & Architecture / Project Management

- Construction Consulting & Testing Services

- Market Share, By Construction Method

- Traditional

- Smart / Sustainable / Green

- Market Share, By Material

- Cement & Concrete

- Aggregates

- Steel

- Bricks & Blocks

- Wood & Timber

- Others

- Market Share, By Equipment

- Earth-Moving Equipment

- Material Handling Equipment

- Concrete Equipment

- Road Construction Equipment

- Others

- Market Share, By Contract

- Lump-Sum / Fixed-Price Contracts

- Cost-Plus Contracts

- Unit-Price Contracts

- Time & Material (T&M) Contracts

- Design-Build (D&B) Contracts

- Others

- Market Share, By Country

- Indonesia

- Malaysia

- Philippines

- Thailand

- Vietnam

- Singapore

- Myanmar

- Cambodia

- Rest of Southeast Asia

- Market Share, By Company

- Revenue Shares

- Competition Characteristics

- Southeast Asia Construction Market Overview, By End-Use

- Residential Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Non-Residential / Commercial Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Industrial Infrastructure / Public Works Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Utilities & Energy Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Water & Wastewater Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Oil & Gas / Petrochemical Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Social Infrastructure Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Residential Market Overview

- Southeast Asia Construction Market Overview, By Service Offering

- Greenfield Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Renovation Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Refurbishment & Retrofitting Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Repair & Maintenance Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Engineering Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Procurement & Construction (EPC) / Turnkey Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Design & Architecture / Project Management Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Construction Consulting & Testing Services Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Greenfield Market Overview

- Southeast Asia Construction Market Overview, By Construction Method

- Traditional Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Smart / Sustainable / Green Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Traditional Market Overview

- Southeast Asia Construction Market Overview, By Material

- Cement & Concrete Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Aggregates Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Steel Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Bricks & Blocks Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Wood & Timber Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Others Material Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Cement & Concrete Market Overview

- Southeast Asia Construction Market Overview, By Equipment

- Earth-Moving Equipment Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Material Handling Equipment Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Concrete Equipment Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Road Construction Equipment Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Others Equipment Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Earth-Moving Equipment Market Overview

- Southeast Asia Construction Market Overview, By Contract

- Lump-Sum / Fixed-Price Contracts Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Cost-Plus Contracts Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Unit-Price Contracts Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Time & Material (T&M) Contracts Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Design-Build (D&B) Contracts Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Others Contract Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Lump-Sum / Fixed-Price Contracts Market Overview

- Southeast Asia Construction Market Overview, By Country

- Indonesia Construction Market Overview, 2020-2034F

- Market Share, By End-Use

- Market Share, By Service Offering

- Market Share, By Construction Method

- Market Share, By Material

- Market Share, By Equipment

- Market Share, By Contract

- Malaysia Construction Market Overview, 2020-2034F

- Market Size, By Value (USD Billion)

- Market Share, By End-Use

- Market Share, By Service Offering

- Market Share, By Construction Method

- Market Share, By Material

- Market Share, By Equipment

- Market Share, By Contract

- Philippines Construction Market Overview, 2020-2034F

- Market Size, By Value (USD Billion)

- Market Share, By End-Use

- Market Share, By Service Offering

- Market Share, By Construction Method

- Market Share, By Material

- Market Share, By Equipment

- Market Share, By Contract

- Thailand Construction Market Overview, 2020-2034F

- Market Size, By Value (USD Billion)

- Market Share, By End-Use

- Market Share, By Service Offering

- Market Share, By Construction Method

- Market Share, By Material

- Market Share, By Equipment

- Market Share, By Contract

- Vietnam Construction Market Overview, 2020-2034F

- Market Size, By Value (USD Billion)

- Market Share, By End-Use

- Market Share, By Service Offering

- Market Share, By Construction Method

- Market Share, By Material

- Market Share, By Equipment

- Market Share, By Contract

- Singapore Construction Market Overview, 2020-2034F

- Market Size, By Value (USD Billion)

- Market Share, By End-Use

- Market Share, By Service Offering

- Market Share, By Construction Method

- Market Share, By Material

- Market Share, By Equipment

- Market Share, By Contract

- Myanmar Construction Market Overview, 2020-2034F

- Market Size, By Value (USD Billion)

- Market Share, By End-Use

- Market Share, By Service Offering

- Market Share, By Construction Method

- Market Share, By Material

- Market Share, By Equipment

- Market Share, By Contract

- Cambodia Construction Market Overview, 2020-2034F

- Market Size, By Value (USD Billion)

- Market Share, By End-Use

- Market Share, By Service Offering

- Market Share, By Construction Method

- Market Share, By Material

- Market Share, By Equipment

- Market Share, By Contract

- Rest of Southeast Asia Construction Market Overview, 2020-2034F

- Market Size, By Value (USD Billion)

- Market Share, By End-Use

- Market Share, By Service Offering

- Market Share, By Construction Method

- Market Share, By Material

- Market Share, By Equipment

- Market Share, By Contract

- Indonesia Construction Market Overview, 2020-2034F

- Competitive Outlook (Company Profiles)

- Gamuda Berhad

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- IJM Corporation Berhad

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Sunway Construction Group Berhad

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- WCT Holdings Berhad

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Muhibbah Engineering

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- UEM Group Berhad

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Bina Puri Holdings

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Caterpillar Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Hitachi Construction Machinery

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Others

- Gamuda Berhad

- Contact Us & Disclaimer

List of Figure

List of Table

Top Key Players & Market Share Outlook

- Gamuda Berhad

- IJM Corporation Berhad

- Sunway Construction Group Berhad

- WCT Holdings Berhad

- Muhibbah Engineering

- UEM Group Berhad

- Bina Puri Holdings

- Caterpillar Inc.

- Hitachi Construction Machinery

- Others

Frequently Asked Questions