Understand The Key Trends Shaping This Market

Download Free SampleWhat Is the South America Directional Drilling Market Size & Value?

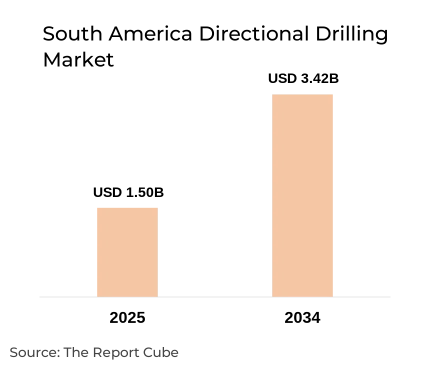

The South America Directional Drilling Market is anticipated to register a CAGR of around 9.59% during the forecast period, 2026-34. Additionally, the market size was valued at nearly USD 1.50 billion in 2025 and is projected to reach almost USD 3.42 billion by 2034.

South America Directional Drilling Market Key Highlights

- E&P investment in South America increases drilling efficacy metrics through Rotary Steerable Systems (RSS), Measurement While Drilling (MWD).

- The Brazil Directional Drilling Market dominates the regional market, followed by Argentina.

- Directional drilling trends in South America include deep directional drilling (DDD), trenchless technology.

- Oil & Gas Exploration to be one of the prominent applications across the South America Directional Drilling Market.

- Major market players are: OXY, Transocean, Halliburton, Equinor, Weatherford, Saipem, Precision Drilling, Nabors Industries, Schlumberger, Petrobras, National Oilwell Varco, etc.

- AI automates MWD, RSS, LWD workflows across South America drilling for real-time geosteering, efficiency.

South America Directional Drilling Market Dynamics

What is the key driver of the South America Directional Drilling Market?

Deep Pre‑Salt & DDD Push to Instigate Industry Growth: In Argentina's shale & Brazil's pre-salt, hostile ultra-deepwater and deep directional drilling (DDD) is a substantial factor influencing the market growth. To optimize recovery & drilling efficiency metrics, precise wellbore placement & cutting-edge downhole motors are observed to be crucial. Hence, this contributes to enhancing the South America Directional Drilling Market size & demand for high-spec rigs within the larger oil & gas drilling, by driving the adoption of integrated MWD, LWD, and RSS packages.

What are the major challenges that affect the South America Directional Drilling Industry?

High-End Tool Cost & Local Gaps to Hamper Market: The high lifecycle cost & limited local maintenance capacity of premium RSS, MWD, and LWD equipment are a less-discussed restraint that causes sophisticated projects in secondary basins to be delayed. Also, the adoption of drilling technology in South America is hindered by the fact that several E&P investments in the region still prioritize motor-and-MWD combos over full RSS, which minimizes the possibility for directional drilling services in South America.

What are the future opportunities in the South America Directional Drilling Market during 2026-34?

Trenchless Infrastructure Super-Cycle: The developing energy infrastructure & urban utilities are generating a structural market opportunity in South America, specifically in Brazil & Argentina. Also, underground pipeline construction in the regional nations, water networks, and telecommunications HDD for fiber‑to‑the‑home are augmenting trenchless technology deployment & lifting the South America Directional Drilling Market share for HDD contractors.

What trends are affecting the South America Directional Drilling Market Outlook?

Incorporation of Oilfield & HDD Know-How: The application of drilling efficiency measurements & wellbore placement skills to long river crossings & bundled ducts is an evolving trend in utility HDD. Directional drilling trends in South America are being shaped by this convergence, with the Brazil Directional Drilling Market & Argentina's directional drilling outlook demonstrating more bundled tenders that combine directional drilling services in South America with HDD for multi-commodity corridors & cross-border lines, benefiting key South America Directional Drilling Market companies.

South America Directional Drilling Industry Analysis (2026–2034)

Directional drilling refers to the utilization of controlled wellbore placement in South American onshore, offshore, and horizontal directional drilling industries to drill non-vertical oil, gas, and utility wells deploying Rotary Steerable Systems (RSS), Measurement While Drilling (MWD), Logging While Drilling (LWD), and downhole motors. Also, deep directional drilling (DDD) in Argentina's Vaca Muerta, offshore oil & gas, pre-salt projects in Brazil, and energy infrastructure development for pipeline construction in South America, as well as telecommunications HDD under trenchless utility upgrades, are the primary drivers influencing the South America Directional Drilling Market.

Furthermore, the South America Directional Drilling Market is progressing owing to high‑productivity, deepwater, and unconventional drilling. Nevertheless, profitability faces challenges from high capital expenditures, surfacing regulations, and uneven drilling technology adoption. Also, key market players in directional drilling services in South America navigate local content regulation & Brazilian expansion plans such as Novo PAC, alongside Petrobras’ 2025–2029 capex of about USD 97 billion. Further, Argentina’s liberalized hydrocarbon regime also impacts the industry, which grabs opportunities in advanced drilling efficiency metrics, integrated services, and strong sales channels spanning oilfield service majors, HDD contractors, and OEM tool suppliers.

Moreover, this dynamic environment transforms directional drilling trends across the region, further creating a positive South America Directional Drilling Market outlook through innovation & strategic investments in the forthcoming years.

What is the Impact of AI in the South America Directional Drilling Market?

With initiatives such as Petrobras' digital drilling optimization pilots in Brazilian pre-salt & international service majors' AI-driven bit & BHA design programs, artificial intelligence is enhancing drilling technology adoption in South America by optimizing wellbore placement & drilling efficiency metrics in offshore oil & gas and HDD. Also, these initiatives indirectly enhance the market size & the performance drilling services.

How are the South America Directional Drilling Market Segments Defined?

The South America Directional Drilling Market Research Reports provide detailed market data & insights in accordance with market segmentation. Some of the segments are:

- By Technology: Positive Displacement Motor (PDM), Rotary Steerable Systems (RSS), Measurement While Drilling (MWD), Logging While Drilling (LWD), Others (e.g., Integrated Drilling Services)

- By Application: Oil & Gas Exploration, Shale Gas Extraction, Coal Bed Methane (CBM), Geothermal, Others (e.g., Underground Storage or Drilling for Research)

By Technology:

Measurement While Drilling (MWD) dominates, commanding for potential share of the South America Directional Drilling Market, owing to real-time wellbore placement, trajectory control, and drilling efficacy. Also, it is often combined with Logging While Drilling (LWD), Rotary Steerable Systems (RSS), and downhole motors in integrated directional drilling services, meeting demands in deep directional drilling (DDD), eccentric drilling, and offshore oil & gas, while pushing South America drilling technology acceptance.

By Application:

Oil & Gas Exploration grabs the largest share of the South America Directional Drilling Market, focused on pre-salt, onshore oil, and gas wells applying high-performance MWD, LWD, RSS, and downhole motors. Moreover, shale gas & unconventional drilling add growth, aligning with the oil & gas drilling, as well as strengthening pipeline construction & energy infrastructure development across South America.

South America Directional Drilling Industry: Regional Insights

The South America Directional Drilling Market is geographically diversified, covering:

- Brazil

- Argentina

- Colombia

- Venezuela

- Peru

- Chile

- Rest of South America

Regionally, Brazil Directional Drilling Market dominates, accounting for the biggest market share across the region. This is attributed to the offshore & HDD projects that made the country market worth a million. Also, strong E&P investment in South America in pre-salt, gas pipelines, and trenchless technology contributes to the overall national market share.

South America Directional Drilling Market: What Recent Innovations Are Affecting the Industry?

- 2025: Petrobras extended its ultra-deepwater pre-salt drilling campaign with new FPSO capacity and high-spec Rotary Steerable Systems (RSS).

- 2025: SLB/Schlumberger deployed autonomous directional drilling & digital optimization workflows in Latin America, integrating Measurement While Drilling (MWD), Logging While Drilling (LWD), and AI to improve drilling efficiency metrics and wellbore placement.

How does the South America Directional Drilling Market (2034) Future Outlook Appear?

Sustained Growth: The South America Directional Drilling Market is destined to gain prominence in the future years, by recording an estimated CAGR of about 9.59% during 2026-34, and attaining a market value of nearly USD 1.50 billion by 2025.

Technological Upgrade: By 2034, broader deployment of Rotary Steerable Systems (RSS), high‑torque downhole motors, and real-time Logging While Drilling (LWD)/ Measurement While Drilling (MWD) analytics would push South America drilling technology adoption.

Future Opportunities: Gas-focused energy projects, cross-border pipelines, and urban fiber growth would lift South America’s trenchless & HDD demand, with Argentina, Guyana, and Colombia fascinating new drilling investments in the forecast years.

What Does Our South America Directional Drilling Market Research Study Entail?

- The South America Directional Drilling Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis & market scope sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The South America Directional Drilling Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the Study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Breakdown of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- South America Directional Drilling Market Overview (2020-2034)

- Market Size, By Value (USD Billion)

- Market Share, By Technology

- Positive Displacement Motor (PDM)

- Rotary Steerable Systems (RSS)

- Measurement While Drilling (MWD)

- Logging While Drilling (LWD)

- Others

- Market Share, By Application

- Oil & Gas Exploration

- Shale Gas Extraction

- Coal Bed Methane (CBM)

- Geothermal

- Others

- Market Share, By Service Type

- Rotary Steerable Systems

- Downhole Motors

- Market Share, By End-User

- Onshore

- Offshore

- Market Share, By Well Type

- Horizontal

- Extended reach

- Multilateral

- Market Share, By Country

- Brazil

- Argentina

- Colombia

- Venezuela

- Peru

- Chile

- Rest of South America

- Market Share, By Company

- Revenue Shares

- Competition Characteristics

- South America Directional Drilling Market Overview, By Technology

- Positive Displacement Motor (PDM) Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Rotary Steerable Systems (RSS) Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Measurement While Drilling (MWD) Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Logging While Drilling (LWD) Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Others Technology Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Positive Displacement Motor (PDM) Market Overview

- South America Directional Drilling Market Overview, By Application

- Oil & Gas Exploration Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Shale Gas Extraction Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Coal Bed Methane (CBM) Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Geothermal Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Others Application Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Oil & Gas Exploration Market Overview

- South America Directional Drilling Market Overview, By Service Type

- Rotary Steerable Systems Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Downhole Motors Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Rotary Steerable Systems Market Overview

- South America Directional Drilling Market Overview, By End-User

- Onshore Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Offshore Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Onshore Market Overview

- South America Directional Drilling Market Overview, By Well Type

- Horizontal Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Extended reach Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Multilateral Market Overview

- Market Size, By Value (USD Billion), 2026–2034

- Horizontal Market Overview

- South America Directional Drilling Market Overview, By Country

- Brazil Directional Drilling Market Overview, 2020-2034F

- Market Share, By Technology

- Market Share, By Application

- Market Share, By Service Type

- Market Share, By End-User

- Market Share, By Well Type

- Argentina Directional Drilling Market Overview, 2020-2034F

- Market Size, By Value (USD Billion)

- Market Share, By Technology

- Market Share, By Application

- Market Share, By Service Type

- Market Share, By End-User

- Market Share, By Well Type

- Colombia Directional Drilling Market Overview, 2020-2034F

- Market Size, By Value (USD Billion)

- Market Share, By Technology

- Market Share, By Application

- Market Share, By Service Type

- Market Share, By End-User

- Market Share, By Well Type

- Venezuela Directional Drilling Market Overview, 2020-2034F

- Market Size, By Value (USD Billion)

- Market Share, By Technology

- Market Share, By Application

- Market Share, By Service Type

- Market Share, By End-User

- Market Share, By Well Type

- Peru Directional Drilling Market Overview, 2020-2034F

- Market Size, By Value (USD Billion)

- Market Share, By Technology

- Market Share, By Application

- Market Share, By Service Type

- Market Share, By End-User

- Market Share, By Well Type

- Chile Directional Drilling Market Overview, 2020-2034F

- Market Size, By Value (USD Billion)

- Market Share, By Technology

- Market Share, By Application

- Market Share, By Service Type

- Market Share, By End-User

- Market Share, By Well Type

- Rest of South America Directional Drilling Market Overview, 2020-2034F

- Market Size, By Value (USD Billion)

- Market Share, By Technology

- Market Share, By Application

- Market Share, By Service Type

- Market Share, By End-User

- Market Share, By Well Type

- Brazil Directional Drilling Market Overview, 2020-2034F

- Competitive Outlook (Company Profiles)

- OXY

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Transocean

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Halliburton

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Equinor

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Weatherford

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Saipem

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Precision Drilling

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Nabors Industries

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Schlumberger

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Petrobras

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- National Oilwell Varco

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Baker Hughes

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Pioneer Natural Resources

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Eni

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Anadarko Petroleum

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Others

- OXY

- Contact Us & Disclaimer

List of Figure

List of Table

Top Key Players & Market Share Outlook

- OXY

- Transocean

- Halliburton

- Equinor

- Weatherford

- Saipem

- Precision Drilling

- Nabors Industries

- Schlumberger

- Petrobras

- National Oilwell Varco

- Baker Hughes

- Pioneer Natural Resources

- Eni

- Anadarko Petroleum

- Others

Frequently Asked Questions