Understand The Key Trends Shaping This Market

Download Free SampleIndia Green Hydrogen Market Overview: Market Size & Forecast (2026–2034)

What is the anticipated CAGR & size of the India Green Hydrogen Market?

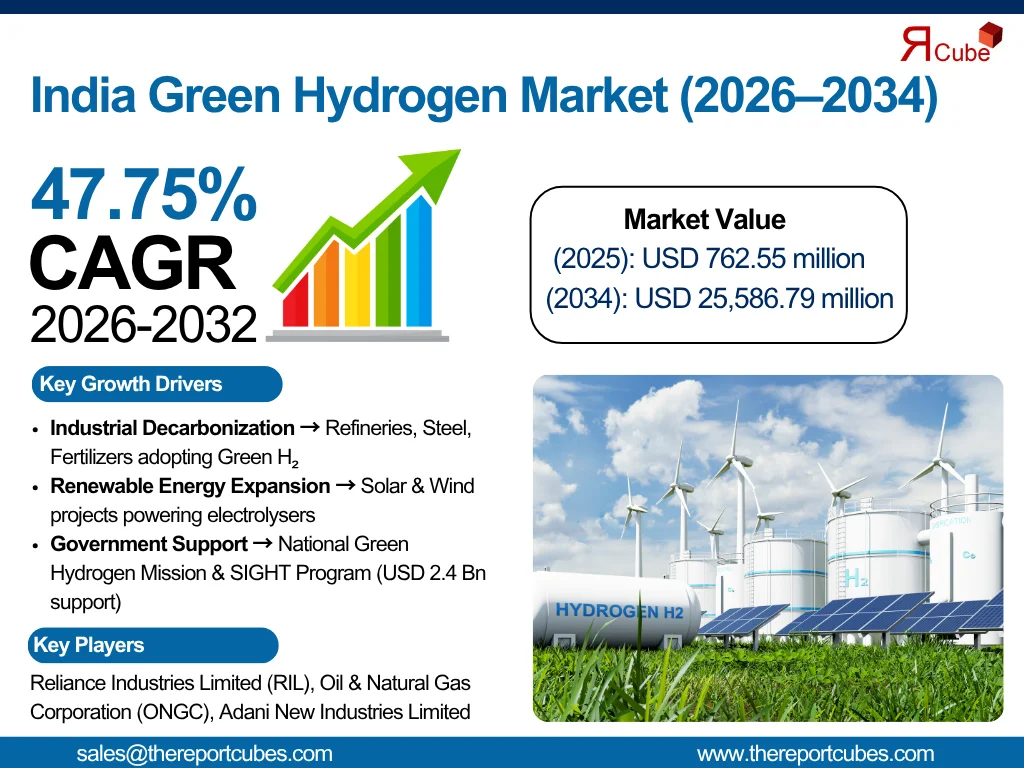

The India Green Hydrogen Market is anticipated to register a CAGR of around 47.75% during the forecast period, 2026-34. Additionally, the market size was valued at nearly USD 762.55 million in 2025 and is projected to reach nearly USD 25586.79 million by 2034.

Market Analysis & Insights

The India Green Hydrogen Market is augmenting as national policy, industrial decarbonization mandates, and huge private investments converge to scale capacity between 2026–2034. Also, the government's National Green Hydrogen Mission offers financial assistance, R&D financing, and pilot grants to de-risk early commercial facilities (with an initial spending of about USD 2.4 billion, including the SIGHT program).

Further, there is a robust market demand for locally produced green H₂ as leading industrial customers, such as refineries, fertilizer plants, steel producers, and chemical producers, are lining up offtake agreements & pilot conversions. Also, incorporated ecosystems are being swiftly implemented by private enterprises, which is contributing in enhancing the India Green Hydrogen Market share.

Moreover, the company, Reliance is building a multi-gigawatt green hydrogen & electrolyser ecosystem at Jamnagar. Along with this, the NTPC & state hubs (e.g., proposed 1,500 tpd NTPC hub) and IOCL’s refinery projects illustrate how tenders & cluster funding are catalyzing scale & logistics investment.

Additionally, renewable energy deployment, aggressive corporate targets, supportive hydrogen policy India, and green financing are the fundamental drivers placing the country to commercialize green hydrogen at scale, enabling exports (green ammonia), hard-to-abate industrial decarbonization, and a nascent H₂ supply chain throughout the forthcoming years, eventually creating a positive outlook for the India Green Hydrogen Market.

What is the Impact of AI in the India Green Hydrogen Market?

AI enhances electrolyzer uptime, predictive maintenance, and renewable dispatch optimization, decreasing the levelized prices of hydrogen. Also, ML (machine learning) augments site selection, optimizes grid-to-electrolyzer scheduling, and improves operational effectiveness in the India Green Hydrogen Market value chain.

India Green Hydrogen Market Dynamics

What driving factor acts as a positive influencer for the India Green Hydrogen Market?

- Increasing Industrial Decarbonization Demands to Instigate Market Growth: The country’s refineries, steel, and fertilizer industries are facing increasing emission-reduction mandates, which is creating market prospects. Government incentives & corporate net-zero goals are generating solid offtake demand for green hydrogen. Also, industrial conversion projects, backed by policy & financing support, are predicted to dominate early revenue streams & anchor large-scale usage through 2034.

What are the challenges that affect the India Green Hydrogen Market?

- Infrastructure & Regulatory Bottlenecks to Hinder Growth Graph: The India Green Hydrogen Market lacks strong pipelines, refueling stations, and export infrastructure for hydrogen & green ammonia. Moreover, unpredictable regulations around safety, certification, and blending percentages also hinders investor confidence. Further, these infrastructure & policy gaps suspend large-scale rollout, even as technology, funding, and developer interest continue to upscale, hence limiting industry expansion.

How are the future opportunities transforming the market during 2026-34?

- Domestic Gigafactories & Hydrogen Clusters: Integrated giga-projects like Reliance Jamnagar & NTPC green hubs could establish local electrolyser production & cluster-based economies. Also, supported by SIGHT subsidies, these initiatives reduce production expenses, reinforce supply chains, and position India as a competitive exporter of green hydrogen & green ammonia across the global landscape.

What market trends are affecting the India Green Hydrogen Market Outlook?

- Policy-Driven Investments & Global Partnerships: Government programs such as SIGHT & renewable PLI schemes are drawing global investments & joint ventures between oil & gas, power, and technology companies. Also, these partnerships, strengthened by green bonds & international hydrogen diplomacy, would quicken commercialization & support India’s leadership across the Green Hydrogen Market.

How is the India Green Hydrogen Market Defined as per Segments?

The India Green Hydrogen Market Research Reports provide detailed market data & insights in accordance with market segmentation. Some of the segments are:

- End User: Chemical Industry, Refinery, Power & Energy, Steel & Cement Industry, Transportation Sector, and Others (Export & Green Ammonia Producers)

- Source of Renewable Energy: Solar Energy, Wind Energy, Hybrid (Solar + Wind)

By End User:

The Refinery & Chemical sector captures the largest share of the India Green Hydrogen Market. As companies such as IOCL, IndianOil and BPCL convert existing hydrogen streams to green H₂ to meet emission goals, the sector is observed to become prominent across the national market. Also, refineries’ continuous on-site hydrogen demand & existing hydrogen networks make them economically captivating first movers.

By Source of Renewable Energy:

The Solar Energy segment to dominate the India Green Hydrogen Market, capturing the biggest market share. The leadership is owing to India’s high solar insolation & declining PV costs. Most declared green H₂ projects pair electrolysers with big solar parks (often hybridized with wind or storage) to secure low-cost, round-the-clock renewable supply.

India Green Hydrogen Market: What Recent Innovations Are Affecting the Industry?

- 2025: Adani New Industries Limited (ANIL) commissioned India’s first off-grid 5 MW green hydrogen pilot, demonstrating fully automated solar-to-electrolyser operations & providing learnings for off-grid industrial applications.

What are the Key Highlights of the India Green Hydrogen Market (2026–34)?

- India strives to become a major exporter with about 862,000 tons’/year production assigned to nearly 19 companies by 2030 under National Green Hydrogen Mission.

- The India Green Hydrogen Market size is predicted to expand from nearly USD 762.55 million in 2025 to USD 25586.79 billion by 2034, with CAGR of about 47.75% during 2026-34.

- Transportation is currently the biggest application segment in terms of revenue.

- Power Generation anticipated fastest-growing application.

- Under technology, electrolysis leads (specifically PEM & alkaline) the national market.

- PEM is favored for dynamic & high-purity usages.

- AI role-play: Smart optimization, forecasting of electrolyzer & plant operations, predictive maintenance, and efficacy improvements decreasing LCOH in the India Green Hydrogen Market.

How does the Future Outlook of the India Green Hydrogen Market (2034) Appears?

With multi-GW electrolyser capacity, assembled manufacturing, and downstream exports (green ammonia), India's H₂ economy would be largely commercial by 2034. Also, the prevalent industrial decarbonization & new value chains would be supported by cost reductions from domestic electrolyser gigafactories, mature renewable energy integration, and policy tools (SIGHT, PLI, green financing), further contributing in enhancing the future outlook of the India Green Hydrogen Market. Also, AI-enabled operations would further aid in minimizing costs & improve dependability in the forecast years.

What Does Our India Green Hydrogen Market Research Study Entail?

- The India Green Hydrogen Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis & market scope sheds light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The India Green Hydrogen Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the Study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Breakdown of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- India Green Hydrogen Market Overview

- Market Size, By Value (in USD Million)

- Market Share, By End User

- Chemical Industry

- Refinery

- Power & Energy

- Steel & Cement Industry

- Transportation Sector

- Others (Export & Green Ammonia Producers)

- Market Share, By Source of Renewable Energy

- Solar Energy

- Wind Energy

- Hybrid (Solar + Wind)

- Market Share, By Technology

- Alkaline Electrolyzer

- Polymer Electrolyte Membrane (PEM) Electrolyzer

- SOEC Electrolyzer

- Market Share, By Distribution

- Pipeline

- Cargo

- Market Share, By Competitors

- Competition Characteristics

- Revenue Shares

- Market Share, By Region

- North India

- South India

- East India

- West India

- End User Segment Overviews

- Chemical Industry Green Hydrogen Market Overview

- Market Size & Forecast (2026–2034), By Value (USD Million)

- Market Share & Forecast (2026–2034), By Source of Renewable Energy

- Market Share & Forecast (2026–2034), By Technology

- Market Share & Forecast (2026–2034), By Application

- Market Share & Forecast (2026–2034), By Distribution Channel

- Refinery Green Hydrogen Market Overview

- Market Size & Forecast (2026–2034), By Value (USD Million)

- Market Share & Forecast (2026–2034), By Source of Renewable Energy

- Market Share & Forecast (2026–2034), By Technology

- Market Share & Forecast (2026–2034), By Application

- Market Share & Forecast (2026–2034), By Distribution Channel

- Power & Energy Green Hydrogen Market Overview

- Market Size & Forecast (2026–2034), By Value (USD Million)

- Market Share & Forecast (2026–2034), By Source of Renewable Energy

- Market Share & Forecast (2026–2034), By Technology

- Market Share & Forecast (2026–2034), By Application

- Market Share & Forecast (2026–2034), By Distribution Channel

- Steel & Cement Industry Green Hydrogen Market Overview

- Market Size & Forecast (2026–2034), By Value (USD Million)

- Market Share & Forecast (2026–2034), By Source of Renewable Energy

- Market Share & Forecast (2026–2034), By Technology

- Market Share & Forecast (2026–2034), By Application

- Market Share & Forecast (2026–2034), By Distribution Channel

- Transportation Sector Green Hydrogen Market Overview

- Market Size & Forecast (2026–2034), By Value (USD Million)

- Market Share & Forecast (2026–2034), By Source of Renewable Energy

- Market Share & Forecast (2026–2034), By Technology

- Market Share & Forecast (2026–2034), By Application

- Market Share & Forecast (2026–2034), By Distribution Channel

- Others (Export & Green Ammonia Producers) Green Hydrogen Market Overview

- Market Size & Forecast (2026–2034), By Value (USD Million)

- Market Share & Forecast (2026–2034), By Source of Renewable Energy

- Market Share & Forecast (2026–2034), By Technology

- Market Share & Forecast (2026–2034), By Application

- Market Share & Forecast (2026–2034), By Distribution Channel

- Chemical Industry Green Hydrogen Market Overview

- Competitive Outlook

- Reliance Industries Limited (RIL)

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Oil & Natural Gas Corporation (ONGC)

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Adani New Industries Limited (ANIL)

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- GAIL India Limited

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- National Thermal Power Corporation Limited (NTPC)

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Indian Oil Corporation Limited (IOCL)

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Larsen and Toubro Limited (L&T)

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Bharat Petroleum Corporation Limited

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Hindustan Petroleum Corporation Limited (HPCL)

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Greenko Energies Private Limited (Group Greenko)

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Reliance Industries Limited (RIL)

- Contact Us & Disclaimer

List of Figure

Figure 1.1 — Flowchart: Research Scope & Objectives

Figure 1.2 — Product Definition Diagram: Green Hydrogen Value Chain

Figure 1.3 — Market Segmentation Tree (by Source, Technology, End-User, Distribution)

Figure 1.4 — Study Variables and Data Sources Matrix

Figure 2.1 — Research Methodology: Secondary & Primary Research Workflow

Figure 2.2 — Secondary Data Points: Sources and Data Types

Figure 2.3 — Primary Data Collection: Interviewee Profile Breakdown

Figure 3.1 — Executive Summary: India Green Hydrogen Market — Snapshot (2025 vs 2034 forecast)

Figure 4.1 — Market Dynamics: Drivers — Visual Summary

Figure 4.2 — Market Dynamics: Challenges — Visual Summary

Figure 4.3 — Market Dynamics: Opportunity Assessment Matrix

Figure 4.4 — Recent Trends & Developments Timeline (2019–2025)

Figure 4.5 — Policy & Regulatory Landscape: Key Policies and Incentives Map

Figure 5.1 — India Green Hydrogen Market: Historical Market Size (USD million, 2020–2025)

Figure 5.2 — India Green Hydrogen Market: Forecast Market Size (USD million, 2026–2034)

Figure 5.3 — Market Share — By End User (2025 pie chart)

Figure 5.4 — Market Share — By Source of Renewable Energy (2025 pie chart)

Figure 5.5 — Market Share — By Technology (2025 pie chart)

Figure 5.6 — Market Share — By Distribution Channel (2025 pie chart)

Figure 5.7 — Market Share — By Competitor (top players, 2025 bar chart)

Figure 5.8 — Competitive Characteristics Matrix (capabilities, scale, technology)

Figure 5.9 — Revenue Shares: Top Players (2023–2025 stacked bars)

Figure 5.10 — Market Share — By Region (North, South, East, West India map)

Figure 6.1 — End-User Segment Overview: Chemical Industry — Value Chain & Use Cases

Figure 6.2 — End-User Segment Overview: Refinery — Use Cases & Process Integration

Figure 6.3 — End-User Segment Overview: Power & Energy — Use Cases & Demand Drivers

Figure 6.4 — End-User Segment Overview: Steel & Cement — Use Cases & Decarbonization Pathways

Figure 6.5 — End-User Segment Overview: Transportation — Use Cases & Fuel Pathways

Figure 6.6 — End-User Segment Overview: Others (Export & Green Ammonia Producers) — Use Cases

Figure 7.1 — Chemical Industry: Market Size & Forecast (USD million, 2026–2034)

Figure 7.2 — Chemical Industry: Market Share & Forecast by Source of Renewable Energy (2026–2034)

Figure 7.3 — Chemical Industry: Market Share & Forecast by Technology (2026–2034)

Figure 7.4 — Chemical Industry: Market Share & Forecast by Application (2026–2034)

Figure 7.5 — Chemical Industry: Market Share & Forecast by Distribution Channel (2026–2034)

Figure 8.1 — Refinery: Market Size & Forecast (USD million, 2026–2034)

Figure 8.2 — Refinery: Market Share & Forecast by Source of Renewable Energy (2026–2034)

Figure 8.3 — Refinery: Market Share & Forecast by Technology (2026–2034)

Figure 8.4 — Refinery: Market Share & Forecast by Application (2026–2034)

Figure 8.5 — Refinery: Market Share & Forecast by Distribution Channel (2026–2034)

Figure 9.1 — Power & Energy: Market Size & Forecast (USD million, 2026–2034)

Figure 9.2 — Power & Energy: Market Share & Forecast by Source of Renewable Energy (2026–2034)

Figure 9.3 — Power & Energy: Market Share & Forecast by Technology (2026–2034)

Figure 9.4 — Power & Energy: Market Share & Forecast by Application (2026–2034)

Figure 9.5 — Power & Energy: Market Share & Forecast by Distribution Channel (2026–2034)

Figure 10.1 — Steel & Cement: Market Size & Forecast (USD million, 2026–2034)

Figure 10.2 — Steel & Cement: Market Share & Forecast by Source of Renewable Energy (2026–2034)

Figure 10.3 — Steel & Cement: Market Share & Forecast by Technology (2026–2034)

Figure 10.4 — Steel & Cement: Market Share & Forecast by Application (2026–2034)

Figure 10.5 — Steel & Cement: Market Share & Forecast by Distribution Channel (2026–2034)

Figure 11.1 — Transportation: Market Size & Forecast (USD million, 2026–2034)

Figure 11.2 — Transportation: Market Share & Forecast by Source of Renewable Energy (2026–2034)

Figure 11.3 — Transportation: Market Share & Forecast by Technology (2026–2034)

Figure 11.4 — Transportation: Market Share & Forecast by Application (2026–2034)

Figure 11.5 — Transportation: Market Share & Forecast by Distribution Channel (2026–2034)

Figure 12.1 — Others: Market Size & Forecast (USD million, 2026–2034)

Figure 12.2 — Others: Market Share & Forecast by Source of Renewable Energy (2026–2034)

Figure 12.3 — Others: Market Share & Forecast by Technology (2026–2034)

Figure 12.4 — Others: Market Share & Forecast by Application (2026–2034)

Figure 12.5 — Others: Market Share & Forecast by Distribution Channel (2026–2034)

Figure 13.1 — Competitive Landscape: Market Positioning Map (Scale vs. Technology Capability)

Figure 13.2 — Reliance Industries Ltd (RIL): Project Portfolio & Planned Capacity Map

Figure 13.3 — Oil & Natural Gas Corporation (ONGC): Project Portfolio & Strategic Focus

Figure 13.4 — Adani New Industries Ltd (ANIL): Project Pipeline & Partnerships

Figure 13.5 — GAIL India Ltd: Infrastructure & Offtake Agreements Overview

Figure 13.6 — NTPC: Green Hydrogen Projects and Power Integration Diagram

Figure 13.7 — Indian Oil Corporation Ltd (IOCL): Integration with Refinery Operations

Figure 13.8 — Larsen & Toubro (L&T): EPC Capabilities & Green Hydrogen Projects

Figure 13.9 — Bharat Petroleum Corp Ltd (BPCL): Project Map & Partnerships

Figure 13.10 — Hindustan Petroleum Corp Ltd (HPCL): Strategic Roadmap & Investments

Figure 13.11 — Greenko Energies: Renewable Integration & Electrolyzer Deployment

Figure 14.1 — Comparative Timeline: Key Announcements & Project Start-ups (2020–2025)

Figure 14.2 — SWOT Summary: India Green Hydrogen Market (visual)

Figure 14.3 — Appendix: List of Interviewed Companies & Respondent Types (table)

Figure 15.1 — Contact Us & Disclaimer Page Layout (graphic)

List of Table

Table 1.1 — Study Objectives and Research Scope

Table 1.2 — Market Segmentation Summary (By Source, Technology, End User, and Region)

Table 1.3 — Key Variables and Metrics Considered in the Study

Table 2.1 — Research Methodology Overview

Table 2.2 — Secondary Data Sources Used for Analysis

Table 2.3 — List of Companies Interviewed During Primary Research

Table 2.4 — Breakdown of Primary Respondents (by Designation and Region)

Table 3.1 — India Green Hydrogen Market Snapshot, 2025–2034

Table 4.1 — Key Market Drivers and Their Impact Assessment

Table 4.2 — Major Market Challenges and Risk Factors

Table 4.3 — Emerging Opportunities in the India Green Hydrogen Sector

Table 4.4 — Key Market Trends and Recent Developments

Table 4.5 — Policy & Regulatory Framework for Green Hydrogen in India

Table 5.1 — India Green Hydrogen Market Size, 2020–2034 (USD Million)

Table 5.2 — Market Share by End User, 2025–2034 (%)

Table 5.3 — Market Share by Source of Renewable Energy, 2025–2034 (%)

Table 5.4 — Market Share by Technology, 2025–2034 (%)

Table 5.5 — Market Share by Distribution Channel, 2025–2034 (%)

Table 5.6 — Market Share by Region, 2025–2034 (%)

Table 5.7 — Competitor Market Shares and Revenue (2023–2025)

Table 6.1 — End-User Segments and Key Applications of Green Hydrogen

Table 7.1 — Chemical Industry: Market Size & Forecast (USD Million, 2026–2034)

Table 7.2 — Chemical Industry: Market Share by Source of Renewable Energy (2026–2034)

Table 7.3 — Chemical Industry: Market Share by Technology (2026–2034)

Table 7.4 — Chemical Industry: Market Share by Application (2026–2034)

Table 7.5 — Chemical Industry: Market Share by Distribution Channel (2026–2034)

Table 8.1 — Refinery: Market Size & Forecast (USD Million, 2026–2034)

Table 8.2 — Refinery: Market Share by Source of Renewable Energy (2026–2034)

Table 8.3 — Refinery: Market Share by Technology (2026–2034)

Table 8.4 — Refinery: Market Share by Application (2026–2034)

Table 8.5 — Refinery: Market Share by Distribution Channel (2026–2034)

Table 9.1 — Power & Energy: Market Size & Forecast (USD Million, 2026–2034)

Table 9.2 — Power & Energy: Market Share by Source of Renewable Energy (2026–2034)

Table 9.3 — Power & Energy: Market Share by Technology (2026–2034)

Table 9.4 — Power & Energy: Market Share by Application (2026–2034)

Table 9.5 — Power & Energy: Market Share by Distribution Channel (2026–2034)

Table 10.1 — Steel & Cement: Market Size & Forecast (USD Million, 2026–2034)

Table 10.2 — Steel & Cement: Market Share by Source of Renewable Energy (2026–2034)

Table 10.3 — Steel & Cement: Market Share by Technology (2026–2034)

Table 10.4 — Steel & Cement: Market Share by Application (2026–2034)

Table 10.5 — Steel & Cement: Market Share by Distribution Channel (2026–2034)

Table 11.1 — Transportation: Market Size & Forecast (USD Million, 2026–2034)

Table 11.2 — Transportation: Market Share by Source of Renewable Energy (2026–2034)

Table 11.3 — Transportation: Market Share by Technology (2026–2034)

Table 11.4 — Transportation: Market Share by Application (2026–2034)

Table 11.5 — Transportation: Market Share by Distribution Channel (2026–2034)

Table 12.1 — Others (Export & Green Ammonia Producers): Market Size & Forecast (USD Million, 2026–2034)

Table 12.2 — Others: Market Share by Source of Renewable Energy (2026–2034)

Table 12.3 — Others: Market Share by Technology (2026–2034)

Table 12.4 — Others: Market Share by Application (2026–2034)

Table 12.5 — Others: Market Share by Distribution Channel (2026–2034)

Table 13.1 — Competitive Landscape Overview: Key Players and Strategic Focus

Table 13.2 — Reliance Industries Limited (RIL): Key Financials and Green Hydrogen Projects

Table 13.3 — Oil & Natural Gas Corporation (ONGC): Project Pipeline and Investments

Table 13.4 — Adani New Industries Limited (ANIL): Partnerships and Capacity Plans

Table 13.5 — GAIL India Limited: Project Overview and Strategic Initiatives

Table 13.6 — NTPC: Renewable Integration and Electrolyzer Capacity Plans

Table 13.7 — Indian Oil Corporation Limited (IOCL): Refinery Integration Projects

Table 13.8 — Larsen & Toubro Limited (L&T): Project Portfolio and EPC Capabilities

Table 13.9 — Bharat Petroleum Corporation Limited (BPCL): Green Hydrogen Initiatives

Table 13.10 — Hindustan Petroleum Corporation Limited (HPCL): Investment Plans

Table 13.11 — Greenko Energies: Renewable Asset Base and Green Hydrogen Strategy

Table 14.1 — Key Project Announcements and Commissioning Timeline (2020–2025)

Table 14.2 — SWOT Analysis: India Green Hydrogen Market

Table 14.3 — Summary of Primary Respondents and Interview Insights

Table 15.1 — Contact Information and Legal Disclaimer

Top Key Players & Market Share Outlook

- Reliance Industries Limited (RIL)

- Oil & Natural Gas Corporation (ONGC)

- Adani New Industries Limited (ANIL)

- GAIL India Limited

- National Thermal Power Corporation Limited (NTPC)

- Indian Oil Corporation Limited (IOCL)

- Larsen and Toubro Limited (L&T)

- Bharat Petroleum Corporation Limited

- Hindustan Petroleum Corporation Limited (HPCL)

- Greenko Energies Private Limited (Group Greenko)

- Others

Frequently Asked Questions