Understand The Key Trends Shaping This Market

Download Free SampleHigh-Density Polyethylene Market Insights & Analysis

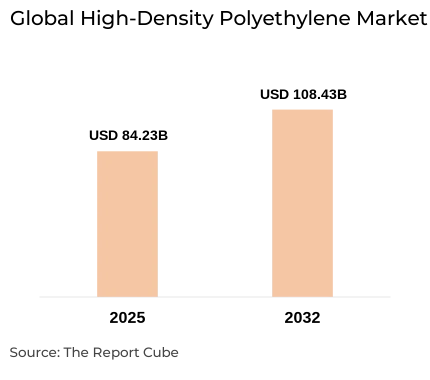

The Global High-Density Polyethylene Market reached a value of nearly USD 84.23 Billion in 2025. The market is assessed to grow at a CAGR of around 4.30%, during the forecast period of 2026-2032 to attain a value of around USD 108.43 Billion in 2032. High-density polyethylene is a petroleum-based thermoplastic polymer well-suited for usage in the automotive, construction, customer goods, and packaging sectors, owing to its strong suit, rigidity to chemicals, and moisture resistance.

Moreover, one of the key aspects driving the High-Density Polyethylene Market growth is the mounting requirement for lightweight & environmentally friendly packaging options. Industries are moving to recyclable plastics, such as HDPE, which have an inferior carbon footprint, as a result of stricter environmental limitations worldwide. For example, to accomplish their sustainability objectives, well-known FMCG corporations have guaranteed to shift from conventional plastics to HDPE-based alternates. Also, the deployment of HDPE pipes & sheets for drainage & water distribution systems is being compelled by the development of the building sector, specifically in evolving economies.

Furthermore, the progression of the e-commerce sector has elevated the demand for HDPE sheets & films for shipping & protective packaging. Also, government initiatives to encourage plastic recycling & infrastructure investments in nations such as China, Brazil, and India are impelling High-Density Polyethylene Market expansion.

Consequently, increasing environmental awareness, novel product usage, and expanding industrial infrastructure in developing countries are all anticipated to contribute to the High-Density Polyethylene Market’s robust growth. Additionally, HDPE would continue to progress in popularity globally as consumer preferences alter in favor of high-performance & environmentally friendly plastic alternatives.

High-Density Polyethylene Market: What Recent Innovation are Affecting the Industry?

2025:

- LyondellBasell declared a union with a regional Asian petrochemical company to extend its HDPE production capacity.

- Braskem S.A. introduced a line of bio-based HDPE products derived from sugarcane, solidifying its sustainable product portfolio.

2024:

- Dow introduced a new HDPE resin custom-made for flexible packaging to enhance recyclability & performance.

- INEOS joined forces with Plastic Energy to build an advanced recycling plant in the UK aiming at HDPE recovery.

- Borealis AG launched Borcycle™ M, an HDPE-based material targeting automotive & rigid packaging industries.

High-Density Polyethylene Market Dynamics

-

Driver: Growing Demand for Sustainable Packaging Solutions to Enhance Market Expansion

HDPE, identified for its outstanding recycling properties, is being accepted by industries exchanging single-use plastics. Also, this trend is primarily dominant in the food & beverage industry, where HDPE containers & bottles are favored, owing to their non-leaching & durable nature.

-

Challenge: Instability in Raw Material Costs to Hamper the Industry

The cost of ethylene, an essential raw material for the manufacturing of HDPE, is directly impacted by variations in crude oil prices, which also affect the sector. Also, this improbability casts doubt on factory planning & decreases profitability.

-

Opportunity: Progress in Infrastructure Projects Across Developing Economies

Developing countries are seeing a rise in urbanization & government-funded infrastructure projects. HDPE’s stability makes it perfect for pipes utilized in water distribution, gas supply, and sewage systems, offering huge expansion potential.

-

Trend: Acceptance of Bio-based HDPE Items

The usage of bio-based HDPE derived from sustainable resources, such as sugarcane, is increasing. Also, companies are investing in green technology to attain sustainability targets, which is motivating the growth of bio-based substitutes.

High-Density Polyethylene Market Segment-Wise Analysis

By Feedstock:

- Naphtha

- Natural Gas

- Others

Naphtha leads the High-Density Polyethylene Market owing to its prevalent availability & established infrastructure, specifically in regions including Europe & Asia. A wide variety of HDPE grades can be manufactured by producers due to the enhanced product output flexibility offered by naphtha-based production. Also, naphtha continues to be the most prevalent feedstock globally, owing to its compatibility with current refining systems & incorporation with large-scale petrochemical facilities, even if natural gas use in North America is rising. Moreover, long-term supply arrangements in the global supply chain & its cost-effectiveness in high-volume manufacturing settings further improve its significance.

By Application:

- Blow Molding

- Film and Sheet

- Injection Molding

- Pipe and Extrusion

- Others

Blow Molding upholds the prominent share of the High-Density Polyethylene Market. This is generally because it is broadly used in home, automobile, and packaging containers. Also, items made from blow-molded HDPE, such as milk jugs, detergent bottles, gasoline tanks, and drums, have a high degree of rigidity & impact resistance.

Moreover, blow-molding-grade HDPE is becoming more & more prevalent due to the increasing requirement for lightweight & strong packaging, predominantly in the FMCG & healthcare industries. Also, it is now more economical, efficient, and scalable, owing to growths in automation & molding technologies, which has reinforced its leading position across the global market.

Regional Projection of Global High-Density Polyethylene Industry

The Global High-Density Polyethylene Market is geographically diversified, covering:

- Asia-Pacific

- Europe

- North America

- Latin America

- The Middle East & Africa

Asia-Pacific grabs the largest share of the Global High-Density Polyethylene Market and is projected to maintain its leadership during the forecast period. The region's vast industrial base, rapid urbanization, and flourishing packaging & construction sectors significantly surge the demand for HDPE. Moreover, large investments are being made in production & infrastructure in countries such as South Korea, China, and India. Also, the rising middle class & elevated packaged goods consumption push the requirement for HDPE in domestic goods & customer packaging.

Furthermore, regional advancement is also assisted by strategic partnerships between private companies & municipal governments to enhance recycling facilities & domestic HDPE production. Asia-Pacific is also more competitive in international exports due to its proximity to raw material sources & lower labor costs.

What Does Our High-Density Polyethylene Market Research Study Entail?

- The High-Density Polyethylene Market Research Report highlights the forecast growth rate (CAGR) by anticipating market size and share.

- The market analysis puts light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The High-Density Polyethylene Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- Global High-Density Polyethylene Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- Market Share, By Feedstock

- Naphtha

- Natural Gas

- Others

- Market Share, By Application

- Blow Molding

- Film and Sheet

- Injection Molding

- Pipe and Extrusion

- Others

- Market Share, By Region

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

- Market Share, By Company

- Revenue Shares

- Competition Characteristics

- North America High-Density Polyethylene Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- Market Share, By Feedstock

- Market Share, By Application

- By Country

- The US

- Canada

- Mexico

- The US High-Density Polyethylene Market Overview (2020-2032)

- Market Share, By Feedstock

- Market Share, By Application

- Canada High-Density Polyethylene Market Overview (2020-2032)

- Market Share, By Feedstock

- Market Share, By Application

- Mexico High-Density Polyethylene Market Overview (2020-2032)

- Market Share, By Feedstock

- Market Share, By Application

- South America High-Density Polyethylene Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- Market Share, By Feedstock

- Market Share, By Application

- By Country

- Brazil

- Argentina

- Rest of South America

- Brazil High-Density Polyethylene Market Overview (2020-2032)

- Market Share, By Feedstock

- Market Share, By Application

- Argentina High-Density Polyethylene Market Overview (2020-2032)

- Market Share, By Feedstock

- Market Share, By Application

- Europe High-Density Polyethylene Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- By Feedstock

- By Application

- By Country

- Germany

- The UK

- France

- Spain

- Italy

- Rest of Europe

- Germany High-Density Polyethylene Market Overview (2020-2032)

- Market Share, By Feedstock

- Market Share, By Application

- France High-Density Polyethylene Market Overview (2020-2032)

- Market Share, By Feedstock

- Market Share, By Application

- The UK High-Density Polyethylene Market Overview (2020-2032)

- Market Share, By Feedstock

- Market Share, By Application

- Spain High-Density Polyethylene Market Overview (2020-2032)

- Market Share, By Feedstock

- Market Share, By Application

- Italy High-Density Polyethylene Market Overview (2020-2032)

- Market Share, By Feedstock

- Market Share, By Application

- The Middle East & Africa High-Density Polyethylene Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- By Feedstock

- By Application

- By Country

- The UAE

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- The UAE High-Density Polyethylene Market Overview (2020-2032)

- Market Share, By Feedstock

- Market Share, By Application

- Saudi Arabia High-Density Polyethylene Market Overview (2020-2032)

- Market Share, By Feedstock

- Market Share, By Application

- South Africa High-Density Polyethylene Market Overview (2020-2032)

- Market Share, By Feedstock

- Market Share, By Application

- Asia-Pacific High-Density Polyethylene Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- By Feedstock

- By Application

- By Country

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia-Pacific

- China High-Density Polyethylene Market Overview (2020-2032)

- Market Share, By Feedstock

- Market Share, By Application

- India High-Density Polyethylene Market Overview (2020-2032)

- Market Share, By Feedstock

- Market Share, By Application

- Japan High-Density Polyethylene Market Overview (2020-2032)

- Market Share, By Feedstock

- Market Share, By Application

- South Korea High-Density Polyethylene Market Overview (2020-2032)

- Market Share, By Feedstock

- Market Share, By Application

- Austraila High-Density Polyethylene Market Overview (2020-2032)

- Market Share, By Feedstock

- Market Share, By Application

- Competitive Outlook (Company Profile - Partila List)

- Dow

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Exxon Mobil Corporation

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- INEOS

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- SABIC

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- LyondellBasell Industries Holdings BV

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- LOTTE Chemical Corporation

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Borealis AG

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- PetroChina Company Limited

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Abu Dhabi Polymers Company Ltd.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Formosa Plastics Corp.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Braskem S.A

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Chevron Phillips Chemical Co.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Others

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Dow

- Disclaimer

List of Figure

-

Figure 1: Global HDPE Market Size, 2020-2032 (USD Billion)

-

Figure 2: Global HDPE Market Share, By Feedstock, 2024 (%)

-

Figure 3: Global HDPE Market Share, By Application, 2024 (%)

-

Figure 4: Global HDPE Market Share, By Region, 2024 (%)

-

Figure 5: Global HDPE Market Share, By Company, 2024 (%)

-

Figure 6: Competitive Landscape – Revenue Share of Key Players, 2024 (%)

-

Figure 7: HDPE Market Dynamics – Drivers, Challenges, Opportunities

-

Figure 8: HDPE Market Value Chain Analysis

-

Figure 9: Porter's Five Forces Analysis of the HDPE Market

-

Figure 10: SWOT Analysis – Major Market Participants

-

Figure 11: North America HDPE Market Size, 2020-2032 (USD Billion)

-

Figure 12: North America HDPE Market Share, By Feedstock, 2024 (%)

-

Figure 13: North America HDPE Market Share, By Application, 2024 (%)

-

Figure 14: South America HDPE Market Size, 2020-2032 (USD Billion)

-

Figure 15: Europe HDPE Market Size, 2020-2032 (USD Billion)

-

Figure 16: MEA HDPE Market Size, 2020-2032 (USD Billion)

-

Figure 17: Asia-Pacific HDPE Market Size, 2020-2032 (USD Billion)

-

Figure 18: Country-Level HDPE Market Shares (US, China, India, Brazil, etc.)

-

Figure 19: Application-Wise Growth Trends: Blow Molding vs. Film & Sheet

-

Figure 20: Company Strategic Developments – Timeline View

-

Figure 21: Mergers, Acquisitions, and Partnerships in HDPE Market (2020–2024)

-

Figure 22: Policy & Regulatory Impact on Global HDPE Trade Flows

-

Figure 23: Global HDPE Supply Chain Disruption Trends (Post-COVID)

-

Figure 24: Technological Innovations in HDPE Processing (Infographic)

-

Figure 25: Sustainability Initiatives by Leading HDPE Manufacturers

List of Table

-

Table 1: HDPE Market Segmentation – By Feedstock, Application, and Region

-

Table 2: Key Study Variables and Definitions

-

Table 3: Primary Interview Breakdown – By Designation, Region, and Company Type

-

Table 4: Global HDPE Market Size, 2020–2032 (USD Billion)

-

Table 5: Global HDPE Market Share, By Feedstock (Naphtha, Natural Gas, Others), 2024 (%)

-

Table 6: Global HDPE Market Share, By Application (Blow Molding, Film & Sheet, etc.), 2024 (%)

-

Table 7: Global HDPE Market Share, By Region, 2024 (%)

-

Table 8: Global HDPE Market Share, By Company – Revenue Breakdown, 2024 (%)

-

Table 9: Recent Trends and Developments in the Global HDPE Market (2022–2025)

-

Table 10: Regulatory Landscape Overview – Key Regional Policies

-

Table 11: North America HDPE Market Size, 2020–2032 (USD Billion)

-

Table 12: North America HDPE Market Share, By Feedstock & Application, 2024 (%)

-

Table 13: US HDPE Market Overview – By Feedstock & Application, 2020–2032

-

Table 14: Canada HDPE Market Overview – By Feedstock & Application, 2020–2032

-

Table 15: Mexico HDPE Market Overview – By Feedstock & Application, 2020–2032

-

Table 16: South America HDPE Market Size & Share, By Country & Application

-

Table 17: Brazil and Argentina HDPE Market Breakdown

-

Table 18: Europe HDPE Market Size, 2020–2032 (USD Billion)

-

Table 19: Europe HDPE Market Share, By Country and Segment, 2024 (%)

-

Table 20: Germany, UK, France, Spain, and Italy – Market Breakdown by Feedstock & Application

-

Table 21: MEA HDPE Market Size, 2020–2032 (USD Billion)

-

Table 22: MEA HDPE Market Share, By Country and Segment, 2024 (%)

-

Table 23: UAE, Saudi Arabia, South Africa – Market Breakdown by Feedstock & Application

-

Table 24: Asia-Pacific HDPE Market Size, 2020–2032 (USD Billion)

-

Table 25: Asia-Pacific HDPE Market Share, By Country and Segment, 2024 (%)

-

Table 26: China, India, Japan, South Korea, Australia – Market Breakdown

-

Table 27: Company Profile Comparison – Revenue, Products, and Strategic Focus

-

Table 28: Strategic Alliances, Partnerships, and M&A Activities (2020–2024)

-

Table 29: SWOT Analysis of Key Players

-

Table 30: Competitive Characteristics – Market Positioning Matrix

Top Key Players & Market Share Outlook

- Dow

- Exxon Mobil Corporation

- INEOS

- SABIC

- LyondellBasell Industries Holdings BV

- LOTTE Chemical Corporation

- Borealis AG

- PetroChina Company Limited

- Abu Dhabi Polymers Company Ltd.

- Formosa Plastics Corp.

- Braskem S.A

- Chevron Phillips Chemical Co.

- Others

Frequently Asked Questions